Market Brief 01/07/2021

VIETNAM STOCK MARKET

1,417.08

1D 0.61%

YTD 28.89%

1,545.14

1D 1.06%

YTD 45.99%

325.72

1D 0.74%

YTD 65.26%

90.44

1D 0.21%

YTD 22.50%

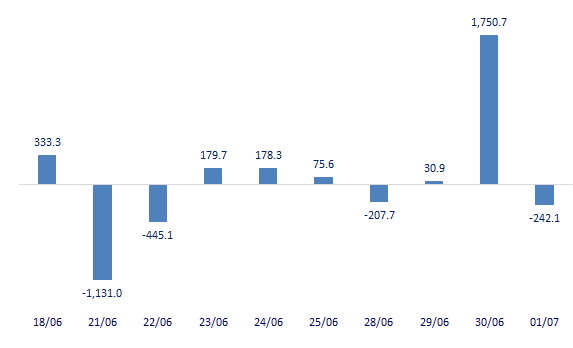

-242.08

1D 0.00%

YTD 0.00%

31,183.34

1D 27.53%

YTD 81.79%

- After the sudden surge the previous day, foreign investors were negative again when buying 34m shares, (1,516b dong), while selling out 36.3m shares, (1,762b dong). Total net selling volume was at 1.3m shares, equivalent to a net selling value of 242b dong. VPB and CTG sold the most by foreign investors with 338b dong and 298b dong, respectively.

ETF & DERIVATIVES

25,890

1D 0.19%

YTD 37.71%

18,130

1D 0.72%

YTD 44.69%

22,100

1D 0.00%

YTD 39.87%

23,090

1D 0.26%

YTD 69.16%

25,750

1D 0.19%

YTD 49.71%

19,280

1D -0.62%

YTD 38.21%

1,538

1D 1.02%

YTD 0.00%

1,540

1D 1.32%

YTD 0.00%

1,544

1D 1.38%

YTD 0.00%

1,549

1D 1.29%

YTD 0.00%

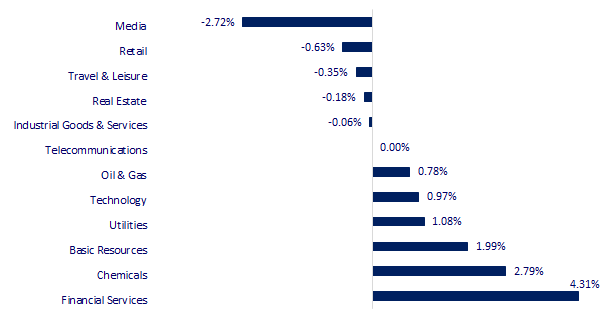

CHANGE IN PRICE BY SECTOR

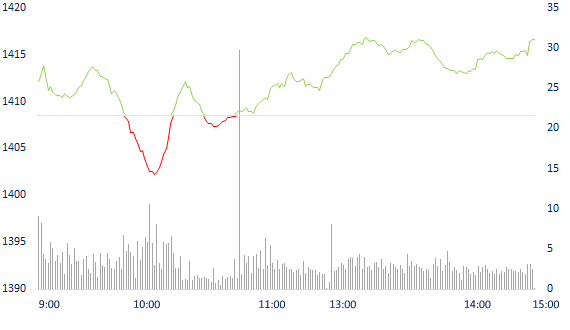

INTRADAY VNINDEX

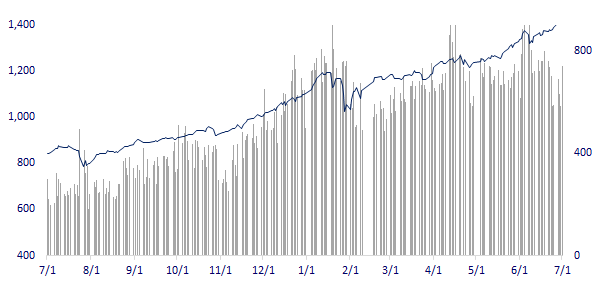

VNINDEX (12M)

GLOBAL MARKET

28,707.04

1D 0.21%

YTD 4.60%

3,588.78

1D -0.07%

YTD 5.11%

3,282.06

1D -0.44%

YTD 14.22%

28,827.95

1D 0.05%

YTD 6.19%

3,124.19

1D -0.20%

YTD 8.89%

1,593.75

1D 0.38%

YTD 9.96%

74.92

1D 1.93%

YTD 55.11%

1,775.25

1D 0.17%

YTD -6.74%

- China Caixin/Markit PMI in June fell, Asian stocks mixed. In Japan, the Nikkei 225 gained 0.21%. Mainland China markets were down from the start with the Shanghai Composite down 0.07% and the Shenzhen Component down 0.81%. The Hong Kong market rose 0.05%. South Korea's Kospi index fell 0.44%.

VIETNAM ECONOMY

1.13%

1D (bps) 3

YTD (bps) 100

5.60%

YTD (bps) -20

1.25%

1D (bps) 10

YTD (bps) 3

2.01%

1D (bps) -11

YTD (bps) -2

23,108

1D (%) -0.01%

YTD (%) -0.30%

28,077

1D (%) -0.01%

YTD (%) -3.53%

3,627

1D (%) -0.17%

YTD (%) 1.51%

- Deputy Prime Minister Le Van Thanh assigned the Ministry of Finance to assume the prime responsibility for, and coordinate with relevant agencies in, reviewing the implementation of the tax incentive program for automobile manufacturing and assembly, and to study and propose contents to be amended, supplement, consider the possibility of continuing to extend the Tax Incentive Program for the next period (after 2022).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Profits of many banks soared in the first half of 2021

- Production declines, the sugar industry is increasingly struggling

- Deputy Prime Minister asked to consider the possibility to extend tax incentives for automobile production and assembly

- The price of iron ore on the Chinese exchange increased for 7 consecutive quarters

- The global economy could lose 2.4 trillion dollars because of the collapse of the tourism industry

- WB adds 8 billion USD to Covid-19 vaccine fund for developing countries

VN30

BANK

116,400

1D 0.00%

5D 5.15%

Buy Vol. 2,412,700

Sell Vol. 3,186,500

47,300

1D 0.11%

5D 4.65%

Buy Vol. 6,549,100

Sell Vol. 7,677,900

52,400

1D -0.57%

5D -1.87%

Buy Vol. 48,499,600

Sell Vol. 44,069,400

53,300

1D 1.14%

5D 4.72%

Buy Vol. 33,388,900

Sell Vol. 30,082,800

70,400

1D 3.99%

5D 2.62%

Buy Vol. 48,038,900

Sell Vol. 43,742,300

43,450

1D 0.23%

5D 3.45%

Buy Vol. 42,903,600

Sell Vol. 43,345,200

36,450

1D 2.68%

5D 6.42%

Buy Vol. 9,234,300

Sell Vol. 9,368,600

37,200

1D 1.22%

5D 4.35%

Buy Vol. 8,459,900

Sell Vol. 8,168,400

31,000

1D 1.31%

5D 6.90%

Buy Vol. 49,836,100

Sell Vol. 53,542,500

- HDB: The Asian Development Bank (ADB) has just announced an increase in trade financing limits for HDB from $75 million to $125 million, raising the revolving credit limit from $10 million to $25 million.

REAL ESTATE

120,000

1D -0.83%

5D 4.35%

Buy Vol. 5,438,700

Sell Vol. 8,778,100

21,900

1D 0.23%

5D -1.13%

Buy Vol. 7,232,300

Sell Vol. 7,278,400

37,700

1D 0.40%

5D 4.14%

Buy Vol. 3,411,300

Sell Vol. 3,737,000

95,900

1D 2.68%

5D 7.75%

Buy Vol. 6,379,000

Sell Vol. 5,580,500

- NVL: This time NVL's content of collecting written opinions from shareholders is to supplement the company's business and amend the company's charter.

OIL & GAS

94,200

1D 1.29%

5D 1.43%

Buy Vol. 1,584,900

Sell Vol. 1,667,800

12,100

1D 0.41%

5D -0.41%

Buy Vol. 16,391,500

Sell Vol. 18,586,900

55,500

1D 1.28%

5D -0.89%

Buy Vol. 13,578,700

Sell Vol. 3,843,000

- U.S. inventories fell, oil prices rose. Brent oil price for August delivery, due on June 30, increased 37 cents, or 0.5%, to 75.13 USD/barrel.

VINGROUP

118,600

1D -0.34%

5D 0.94%

Buy Vol. 3,025,500

Sell Vol. 3,726,600

117,200

1D -0.68%

5D 4.55%

Buy Vol. 6,485,700

Sell Vol. 5,960,600

31,800

1D 0.16%

5D -0.63%

Buy Vol. 4,961,500

Sell Vol. 7,788,300

- VIC: Vinpearl transferred more than 57.6 million VIC shares to Deutsche Bank and Credit Suisse

FOOD & BEVERAGE

90,900

1D 0.55%

5D 2.48%

Buy Vol. 5,313,000

Sell Vol. 7,913,300

113,500

1D 2.76%

5D 7.49%

Buy Vol. 2,915,700

Sell Vol. 2,977,600

21,350

1D 1.67%

5D -0.23%

Buy Vol. 6,085,200

Sell Vol. 6,197,100

- MSN: spends hundreds of millions USD to increase ownership of The CrownX to nearly 85%, continuing the plan to raise 300-400 million USD in the second half of the year

OTHERS

120,700

1D -0.66%

5D 4.50%

Buy Vol. 681,900

Sell Vol. 824,700

120,700

1D -0.66%

5D 4.50%

Buy Vol. 681,900

Sell Vol. 824,700

88,900

1D 1.02%

5D 4.96%

Buy Vol. 2,853,600

Sell Vol. 3,053,100

151,100

1D -0.59%

5D 4.93%

Buy Vol. 1,089,300

Sell Vol. 1,356,000

100,200

1D 0.10%

5D 2.14%

Buy Vol. 637,700

Sell Vol. 751,500

57,600

1D -0.17%

5D 2.13%

Buy Vol. 802,800

Sell Vol. 1,138,300

57,500

1D 4.55%

5D 14.54%

Buy Vol. 27,430,900

Sell Vol. 21,485,100

52,800

1D 2.52%

5D 4.35%

Buy Vol. 68,693,100

Sell Vol. 64,578,800

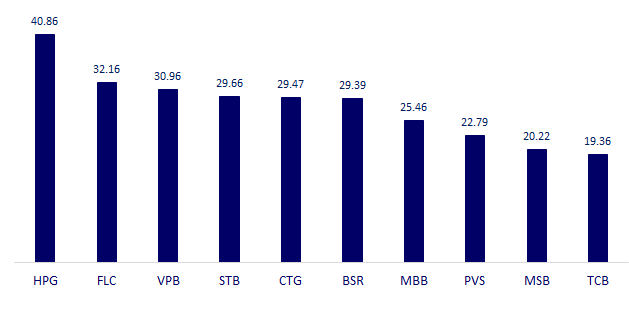

- HPG: Leading among stocks with the strongest net withdrawal by foreign investors in the first half of 2021 was HPG, with a recorded value of more than 12,970 billion dong.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

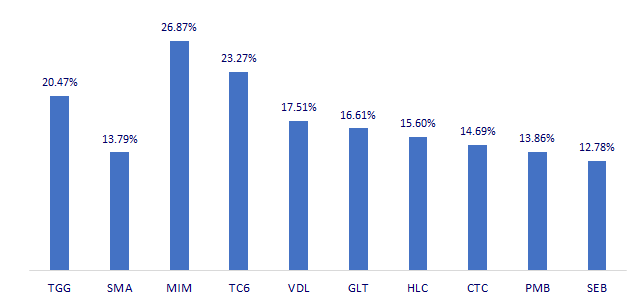

TOP INCREASES 3 CONSECUTIVE SESSIONS

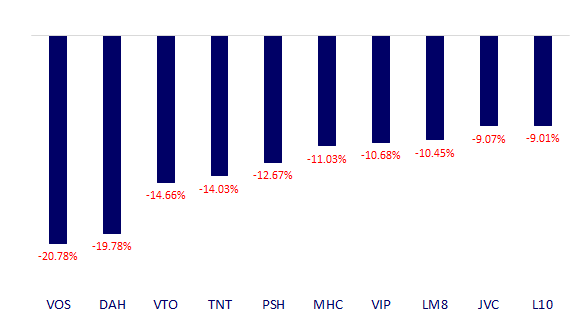

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.