Market Brief 09/07/2021

VIETNAM STOCK MARKET

1,347.14

1D -2.00%

YTD 22.52%

1,494.43

1D -1.76%

YTD 41.20%

306.73

1D -2.93%

YTD 55.62%

87.08

1D -1.59%

YTD 17.95%

797.03

1D 0.00%

YTD 0.00%

29,244.78

1D 21.10%

YTD 70.49%

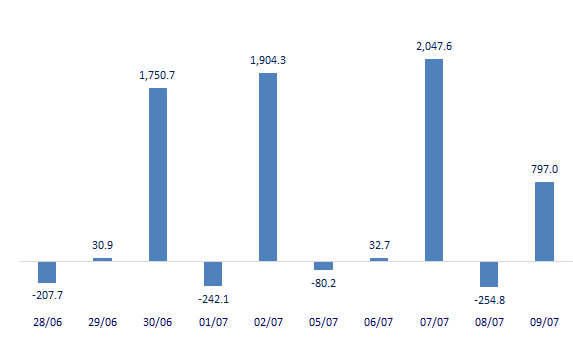

- Foreign investors' trade was more positive when buying 54.8m shares, worth 2,788b dong, while selling 36m shares, worth 1,992b dong. Total net buying volume reached 18.8m shares, equivalent to a net buying value of nearly 797b dong. The strongest buying force of foreign investors occurred with the code of MBB bank, the net buying value was nearly 358b dong.

ETF & DERIVATIVES

25,490

1D 0.75%

YTD 35.59%

17,810

1D -2.68%

YTD 42.14%

21,000

1D -2.78%

YTD 32.91%

23,000

1D 0.00%

YTD 68.50%

26,150

1D 0.58%

YTD 52.03%

18,660

1D -1.11%

YTD 33.76%

1,482

1D -1.52%

YTD 0.00%

1,482

1D -3.07%

YTD 0.00%

1,494

1D -0.97%

YTD 0.00%

1,497

1D -1.06%

YTD 0.00%

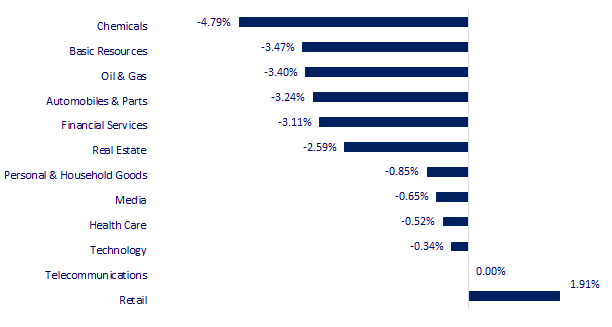

CHANGE IN PRICE BY SECTOR

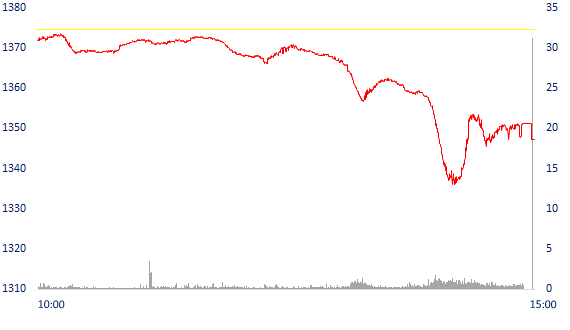

INTRADAY VNINDEX

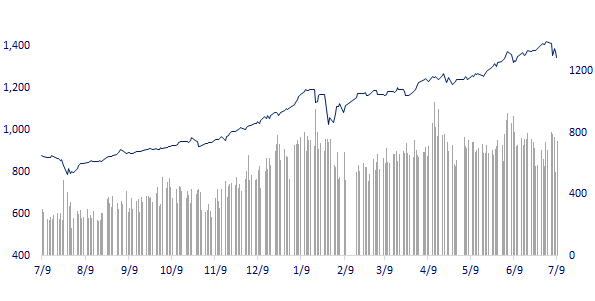

VNINDEX (12M)

GLOBAL MARKET

27,940.42

1D 1.41%

YTD 1.81%

3,524.09

1D -0.04%

YTD 3.21%

3,217.95

1D -1.07%

YTD 11.99%

27,274.12

1D 0.46%

YTD 0.47%

3,131.40

1D 0.77%

YTD 9.14%

1,552.09

1D 0.55%

YTD 7.09%

73.86

1D 1.30%

YTD 52.92%

1,801.15

1D -0.27%

YTD -5.38%

- China announced June inflation, Asian stocks mixed. In Japan, the Nikkei 225 gained 1.41%. Mainland China markets were down from the start with the Shanghai Composite down 0.04% and the Shenzhen Component down 0.259%. Hong Kong's Hang Seng rose 0.46%.

VIETNAM ECONOMY

0.94%

1D (bps) 4

YTD (bps) 81

5.60%

YTD (bps) -20

1.20%

1D (bps) -1

YTD (bps) -2

2.13%

1D (bps) 14

YTD (bps) 10

23,105

1D (%) -0.02%

YTD (%) -0.31%

28,084

1D (%) 0.11%

YTD (%) -3.50%

3,619

1D (%) 0.11%

YTD (%) 1.29%

- Near the end of the second quarter, the central exchange rate suddenly rebounded after a long series of deep declines. This development is similar to that happened at the end of Q1. In the first 6 months of 2021, the USD/VND exchange rate continued to remain stable when the central exchange rate increased only 0.2% compared to the beginning of the year, equivalent to an increase. another 47 dong, to 23,178 dong/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- USD/VND exchange rate remained stable in the first 6 months of the year

- Vietnam's cement was investigated to impose a safeguard tax in the Philippines

- Vietnamese businesses are miserable because foreign shipping companies manipulate prices

- US hot-rolled coil surpasses USD 1,700/ton, forecast to continue to increase

- EU asks UK to pay more than 47 billion euros for post-Brexit financial settlement

- China's producer price inflation peaked in June

VN30

BANK

109,800

1D -1.08%

5D -4.44%

Buy Vol. 4,727,100

Sell Vol. 4,145,100

44,900

1D -1.97%

5D -4.57%

Buy Vol. 5,626,400

Sell Vol. 6,590,100

37,600

1D -2.59%

5D -7.92%

Buy Vol. 31,081,700

Sell Vol. 30,624,500

56,600

1D 0.00%

5D 4.24%

Buy Vol. 67,645,600

Sell Vol. 65,310,400

68,800

1D -0.72%

5D -4.58%

Buy Vol. 37,545,600

Sell Vol. 34,324,500

41,850

1D -0.59%

5D -3.68%

Buy Vol. 57,112,600

Sell Vol. 75,588,400

35,000

1D -2.64%

5D -5.91%

Buy Vol. 5,990,800

Sell Vol. 6,746,000

37,000

1D -1.99%

5D -1.99%

Buy Vol. 8,325,300

Sell Vol. 9,624,300

29,100

1D -3.64%

5D -7.62%

Buy Vol. 60,730,100

Sell Vol. 57,535,400

- TCB: The daughter of Chairman of the Board of Directors, Mr. Ho Hung Anh registered to buy 22,474,840 shares of TCB from July 12, 2021 to August 4, 2021, by order matching or put through method.

REAL ESTATE

103,500

1D -6.59%

5D -13.03%

Buy Vol. 7,616,300

Sell Vol. 7,331,600

20,000

1D -4.99%

5D -8.47%

Buy Vol. 7,365,600

Sell Vol. 13,703,400

36,600

1D -0.41%

5D -2.66%

Buy Vol. 4,814,700

Sell Vol. 5,080,700

94,400

1D -0.32%

5D -1.56%

Buy Vol. 3,489,300

Sell Vol. 3,212,400

- NVL: Nearly 390 million bonus shares of Novaland were traded since July 16. The number of securities after changing the listing of the enterprise increased to 1.47 billion shares.

OIL & GAS

91,700

1D -1.40%

5D -5.07%

Buy Vol. 1,882,100

Sell Vol. 2,196,700

10,800

1D -4.85%

5D -10.00%

Buy Vol. 20,055,400

Sell Vol. 22,419,800

50,800

1D -2.87%

5D -8.30%

Buy Vol. 3,874,900

Sell Vol. 4,641,900

- GAS: The 1 MMTPA LNG storage project in Thi Vai is ahead of schedule. Total disbursed value for construction in the first 6 months of the year reached 3,327.8 billion VND.

VINGROUP

108,600

1D -2.16%

5D -7.57%

Buy Vol. 2,672,800

Sell Vol. 2,994,700

112,500

1D -2.17%

5D -4.66%

Buy Vol. 6,670,500

Sell Vol. 6,395,900

28,000

1D -6.35%

5D -11.67%

Buy Vol. 7,249,400

Sell Vol. 7,626,200

- VHM: Vinhomes wants to sell 60 million treasury shares. The number of treasury shares Vinhomes bought at the end of 2019 with a value of VND 5,550 billion.

FOOD & BEVERAGE

87,000

1D -1.58%

5D -3.44%

Buy Vol. 4,657,300

Sell Vol. 5,300,600

116,900

1D -2.42%

5D 2.63%

Buy Vol. 3,450,700

Sell Vol. 3,808,100

18,100

1D -6.22%

5D -13.81%

Buy Vol. 5,881,700

Sell Vol. 5,891,600

- VNM: Platinum Victory PTE.LTD did not buy any of the nearly 21 million shares registered to buy from June 9, 2021-July 8, 2021

OTHERS

118,900

1D -1.16%

5D -1.41%

Buy Vol. 828,300

Sell Vol. 956,600

118,900

1D -1.16%

5D -1.41%

Buy Vol. 828,300

Sell Vol. 956,600

89,700

1D -0.11%

5D -2.39%

Buy Vol. 5,253,600

Sell Vol. 6,215,300

176,500

1D 2.32%

5D 12.56%

Buy Vol. 2,036,000

Sell Vol. 1,783,400

105,500

1D -0.09%

5D 6.03%

Buy Vol. 2,129,300

Sell Vol. 1,910,700

52,900

1D -0.19%

5D -6.70%

Buy Vol. 1,251,400

Sell Vol. 1,407,400

52,600

1D -3.31%

5D -9.15%

Buy Vol. 24,857,100

Sell Vol. 25,180,700

47,300

1D -3.47%

5D -9.56%

Buy Vol. 71,350,400

Sell Vol. 79,973,300

-HPG: Hoa Phat Dung Quat proposed to invest in a project of more than VND 371 billion in Quang Ngai and the Quang Ngai Department of Finance assessed that the enterprise has enough basis to invest in the project with its own capital.

Market by numbers

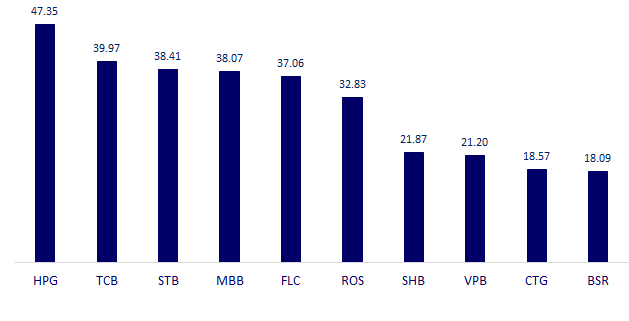

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

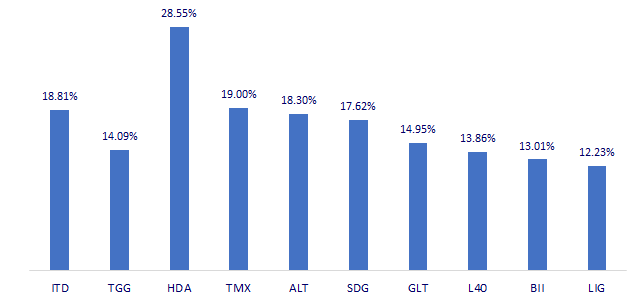

TOP INCREASES 3 CONSECUTIVE SESSIONS

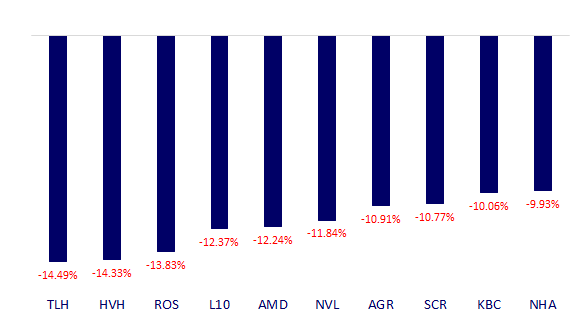

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.