Market Brief 13/07/2021

VIETNAM STOCK MARKET

1,297.54

1D 0.10%

YTD 18.01%

1,440.87

1D -0.15%

YTD 36.14%

296.70

1D 1.27%

YTD 50.53%

85.36

1D 1.75%

YTD 15.62%

-219.75

1D 0.00%

YTD 0.00%

19,460.46

1D -48.62%

YTD 13.45%

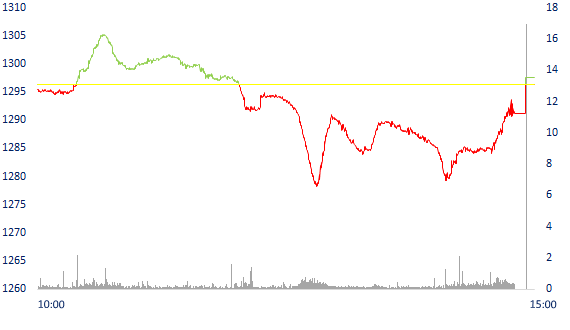

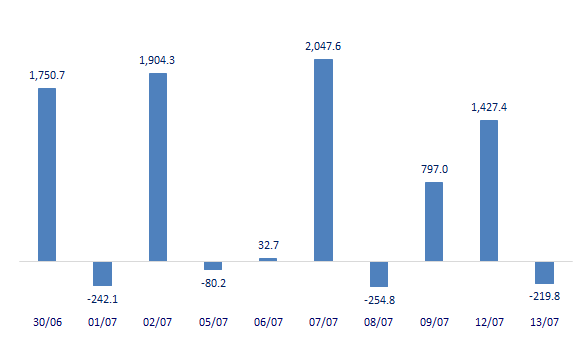

- Market liquidity today became much weaker, the total trading value of the whole floor was only approximately 19,400b dong. Regarding foreign transactions, after the previous 2 net buying sessions. They sold a net of approximately 220b dong in the whole market, focusing on strongly discharging stocks in the VN30 basket.

ETF & DERIVATIVES

24,950

1D 0.81%

YTD 32.71%

17,100

1D 0.71%

YTD 36.47%

20,600

1D 0.98%

YTD 30.38%

21,250

1D -0.65%

YTD 55.68%

25,220

1D -2.44%

YTD 46.63%

17,800

1D -0.84%

YTD 27.60%

1,442

1D -0.01%

YTD 0.00%

1,444

1D 0.03%

YTD 0.00%

1,445

1D 0.07%

YTD 0.00%

1,447

1D 0.21%

YTD 0.00%

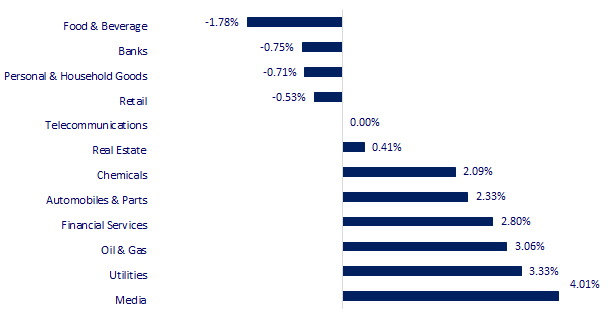

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,718.24

1D -0.17%

YTD 4.64%

3,566.52

1D 0.53%

YTD 4.45%

3,271.38

1D 0.77%

YTD 13.85%

27,885.62

1D 0.65%

YTD 2.72%

3,166.81

1D 0.63%

YTD 10.37%

1,570.99

1D 1.36%

YTD 8.39%

74.19

1D -0.15%

YTD 53.60%

1,808.85

1D -0.03%

YTD -4.98%

- China released trade data, Asian stocks mostly rose. In Japan, the Nikkei 225 alone fell 0.52%. The Chinese market rose from the start with the Shanghai Composite up 0.53%, the Shenzhen Component up 0.183%. Hong Kong's Hang Seng rose 0.65%, leading the region. South Korea's Kospi index rose 0.77%.

VIETNAM ECONOMY

0.92%

1D (bps) -3

YTD (bps) 79

5.60%

YTD (bps) -20

1.19%

1D (bps) 2

YTD (bps) -3

2.16%

1D (bps) 3

YTD (bps) 13

23,110

1D (%) -0.04%

YTD (%) -0.29%

28,049

1D (%) -0.23%

YTD (%) -3.62%

3,628

1D (%) 0.08%

YTD (%) 1.54%

- Despite the epidemic, the gross domestic product in Ho Chi Minh City in the first six months of 2021 is estimated to increase by 5.46% over the same period last year. This result mainly comes from the recovery of the global economy, which helps to resume production chains for key industry groups of the City.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Proposal to spend 40,500 billion VND to build metro line 3 from Hanoi station to Hoang Mai

- Ho Chi Minh City: Key industries have orders for the whole year

- Lowering loan interest rates for existing customers, the bank looks forward to opening the credit room soon

- Iron ore prices increase despite China importing a lot of scrap steel

- Bloomberg: The US has reached a digital trade deal to confront China in Asia

- Factors that brought the USD to a three-month high

VN30

BANK

103,400

1D -3.45%

5D -7.68%

Buy Vol. 3,255,500

Sell Vol. 3,446,300

42,400

1D 0.95%

5D -3.64%

Buy Vol. 3,900,700

Sell Vol. 3,517,700

34,600

1D -1.14%

5D -7.92%

Buy Vol. 29,539,500

Sell Vol. 22,872,100

53,900

1D 0.75%

5D -0.19%

Buy Vol. 42,603,000

Sell Vol. 35,722,300

64,000

1D 0.00%

5D -9.86%

Buy Vol. 25,893,400

Sell Vol. 27,370,800

29,800

1D 0.00%

5D 0.33%

Buy Vol. 22,384,300

Sell Vol. 26,847,700

33,950

1D 0.44%

5D -3.00%

Buy Vol. 5,634,100

Sell Vol. 5,223,000

34,800

1D -0.71%

5D -4.79%

Buy Vol. 6,594,100

Sell Vol. 5,432,500

28,700

1D 1.06%

5D -5.44%

Buy Vol. 38,813,100

Sell Vol. 36,876,500

- MBB: MBGroup's pre-tax profit reached nearly VND 8,000 billion, an increase of 56% over the same period, the parent bank's profit alone reached VND 7,038 billion, up 55% over the same period, the provision for covering bad debts exceeded 310%.

REAL ESTATE

104,700

1D -0.38%

5D -10.51%

Buy Vol. 3,334,600

Sell Vol. 3,745,400

19,650

1D 4.80%

5D -4.61%

Buy Vol. 10,947,700

Sell Vol. 9,052,500

36,300

1D 0.28%

5D 0.55%

Buy Vol. 2,240,400

Sell Vol. 3,486,300

87,000

1D -4.29%

5D -7.84%

Buy Vol. 3,149,800

Sell Vol. 3,849,900

- NVL: issued 300 million USD of international convertible bonds listed in Singapore (SGX). Funds raised from this issuance will focus on developing key projects and increasing land bank.

OIL & GAS

91,500

1D 3.98%

5D 6.64%

Buy Vol. 1,170,600

Sell Vol. 1,279,700

10,550

1D 3.94%

5D -7.86%

Buy Vol. 20,670,000

Sell Vol. 16,665,200

51,000

1D 2.72%

5D -1.35%

Buy Vol. 2,498,200

Sell Vol. 2,007,600

- GAS: 1 MMTPA LNG storage project in Thi Vai is ahead of schedule. Total disbursement value for construction investment in the first 6 months of GAS reached VND3,327.8b

VINGROUP

103,000

1D -0.96%

5D -8.04%

Buy Vol. 4,206,400

Sell Vol. 3,775,200

109,500

1D 1.39%

5D -0.73%

Buy Vol. 5,190,800

Sell Vol. 4,697,600

27,850

1D 3.15%

5D -5.59%

Buy Vol. 6,118,100

Sell Vol. 4,499,200

- VIC: On July 13, 2021, Vingroup officially announced the launch of Shop VinWonders Phu Quoc project at the Phu Quoc United Center resort - shopping - entertainment complex.

FOOD & BEVERAGE

84,300

1D -2.32%

5D -3.10%

Buy Vol. 4,785,200

Sell Vol. 4,724,800

115,000

1D -4.09%

5D 5.50%

Buy Vol. 2,818,300

Sell Vol. 2,716,500

18,000

1D 6.82%

5D -6.25%

Buy Vol. 12,059,800

Sell Vol. 5,983,900

- MSN: Ho Chi Minh City closes traditional markets, Bach Hoa Xanh chains, WinMart/WinMart+ benefit from short-term stockpiling of necessities.

OTHERS

119,900

1D -0.08%

5D 0.50%

Buy Vol. 724,600

Sell Vol. 848,000

119,900

1D -0.08%

5D 0.50%

Buy Vol. 724,600

Sell Vol. 848,000

87,000

1D 1.05%

5D 0.00%

Buy Vol. 4,815,800

Sell Vol. 4,188,000

175,000

1D -0.91%

5D 12.90%

Buy Vol. 1,579,300

Sell Vol. 1,414,700

99,200

1D -2.84%

5D -0.40%

Buy Vol. 1,159,900

Sell Vol. 1,199,600

51,900

1D -0.76%

5D -1.14%

Buy Vol. 964,200

Sell Vol. 703,500

51,800

1D 4.65%

5D -1.52%

Buy Vol. 25,482,700

Sell Vol. 20,080,800

45,500

1D 1.22%

5D -5.21%

Buy Vol. 53,146,400

Sell Vol. 45,215,700

- VJC: Deputy General Director To Viet Thang sold 70,000 shares. Accordingly, reducing the number of share ownership to 206,000 shares. Transaction time: June 17, 2021 - FPT: Additional listing of 118,354,395 shares due to the issue of shares to pay dividends. Official transaction date: July 21, 2021

Market by numbers

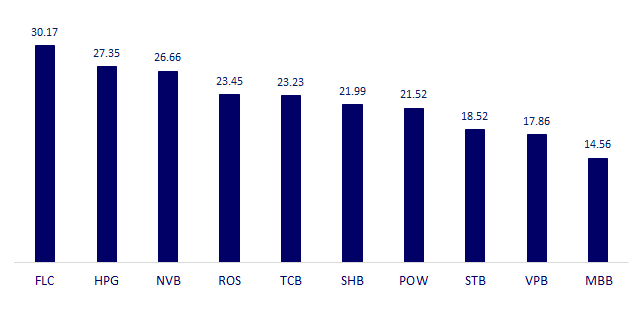

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

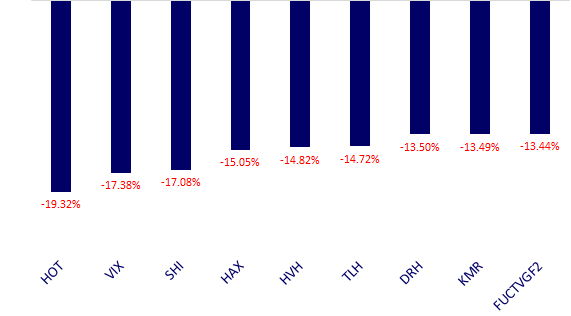

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.