Market Brief 16/07/2021

VIETNAM STOCK MARKET

1,299.31

1D 0.42%

YTD 18.17%

1,438.05

1D 0.54%

YTD 35.87%

307.76

1D 0.48%

YTD 56.14%

85.33

1D 0.41%

YTD 15.58%

64.05

1D 0.00%

YTD 0.00%

18,810.80

1D 3.51%

YTD 9.66%

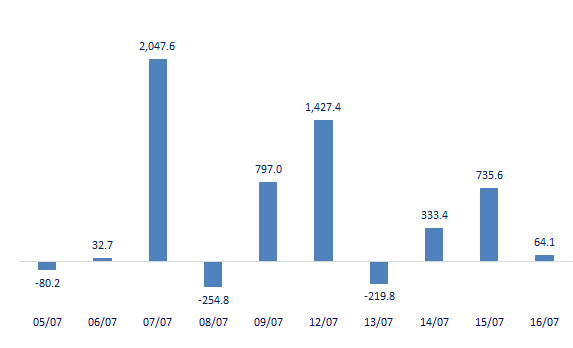

- Session 16/7: Foreign investors continued to net buy 64 billion dong, focusing on "collecting" NVL and VIC. On the opposite side, foreign investors' discharge continued to be strong in banking such as CTG (64.4 billion dong), VCB (39.3 billion dong), STB (19 billion dong), HDB (17, 1 billion).

ETF & DERIVATIVES

24,500

1D 1.03%

YTD 30.32%

16,920

1D 0.00%

YTD 35.04%

20,800

1D 0.97%

YTD 31.65%

21,150

1D -0.09%

YTD 54.95%

24,700

1D -0.80%

YTD 43.60%

17,950

1D 0.28%

YTD 28.67%

1,438

1D -0.07%

YTD 0.00%

1,441

1D 0.08%

YTD 0.00%

1,439

1D 0.16%

YTD 0.00%

1,440

1D 0.57%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

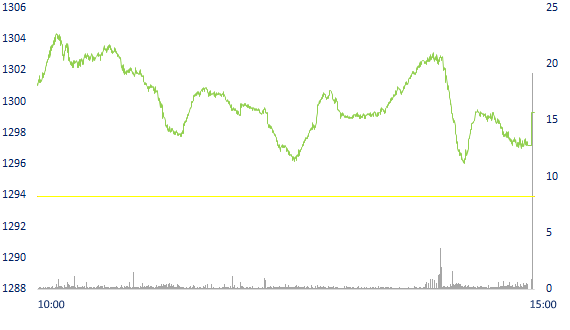

INTRADAY VNINDEX

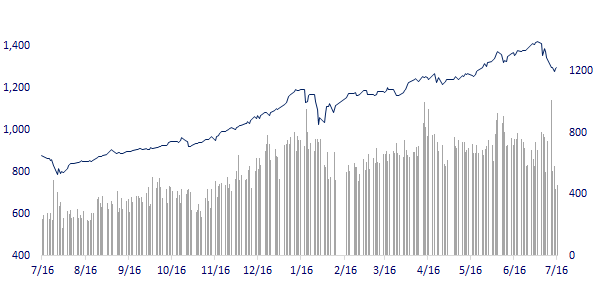

VNINDEX (12M)

GLOBAL MARKET

28,003.08

1D -0.12%

YTD 2.04%

3,539.30

1D -0.71%

YTD 3.66%

3,276.91

1D -0.28%

YTD 14.04%

28,082.00

1D 0.54%

YTD 3.44%

3,152.30

1D 0.39%

YTD 9.87%

1,574.37

1D 0.15%

YTD 8.63%

71.83

1D 0.24%

YTD 48.72%

1,822.85

1D -0.27%

YTD -4.24%

- Asian stocks mostly fell, waiting for Japan to make a monetary decision. In Japan, the Nikkei 225 fell 0.12%. The Chinese market fell with the Shanghai Composite down 0.71% and the Shenzhen Component down 1.299%. Hong Kong's Hang Seng rose 0.54%. South Korea's Kospi index fell 0.28%.

VIETNAM ECONOMY

0.93%

1D (bps) 1

YTD (bps) 80

5.60%

YTD (bps) -20

1.23%

1D (bps) 12

YTD (bps) 1

1.98%

1D (bps) -11

YTD (bps) -5

23,110

1D (%) 0.02%

YTD (%) -0.29%

27,727

1D (%) -0.01%

YTD (%) -4.73%

3,628

1D (%) -0.08%

YTD (%) 1.54%

- According to data from the Ministry of Finance, in the first 6 months of the year, the State budget revenue has reached VND 781,000 billion, equaling 58.2% of the estimate and increasing by 16.3% over the same period in 2020. If compared with the same period of the same period of 2019 (no outbreak of Covid-19 yet), this year's revenue is 4.5% higher.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- After steel, the Ministry of Finance wants to increase the export tax on raw materials for cement production to 10%.

- Budget revenue is still at a record high despite the epidemic

- Trade balance deficit due to production cycle but still need to be cautious

- It is the turn of Asia - America sea freight to reach a record, close to 10,000 USD

- Japan, Australia agree to promote CPTPP and RCEP

- Goldman Sachs: Delta mutation threatens Southeast Asia's economy

VN30

BANK

102,500

1D 0.00%

5D -6.65%

Buy Vol. 2,858,700

Sell Vol. 2,223,600

42,500

1D -0.47%

5D -5.35%

Buy Vol. 2,604,700

Sell Vol. 3,509,100

34,650

1D -1.00%

5D -7.85%

Buy Vol. 22,448,300

Sell Vol. 23,350,100

51,600

1D -0.96%

5D -8.83%

Buy Vol. 36,515,200

Sell Vol. 29,850,500

64,500

1D 0.78%

5D -6.25%

Buy Vol. 23,298,200

Sell Vol. 24,471,000

29,100

1D -0.68%

5D -6.12%

Buy Vol. 21,485,000

Sell Vol. 25,870,000

33,450

1D 0.75%

5D -4.43%

Buy Vol. 4,820,800

Sell Vol. 5,225,500

33,900

1D 0.59%

5D -8.38%

Buy Vol. 3,522,100

Sell Vol. 3,771,300

28,450

1D -1.22%

5D -2.23%

Buy Vol. 50,014,700

Sell Vol. 37,488,400

- MBB, TPB and BIDV are the first banks to continue to sharply reduce lending rates until the end of 2021

REAL ESTATE

104,600

1D 0.58%

5D 1.06%

Buy Vol. 6,026,100

Sell Vol. 5,019,000

19,200

1D 0.26%

5D -4.00%

Buy Vol. 6,861,700

Sell Vol. 10,370,600

36,950

1D 1.65%

5D 0.96%

Buy Vol. 2,467,100

Sell Vol. 2,809,400

90,200

1D 3.44%

5D -4.45%

Buy Vol. 8,427,800

Sell Vol. 7,496,700

- TCH: TCH wil issue nearly 200 million shares, priced at 12,800 VND/share. Expected mobilized capital is more than 2,550 billion VND for 2 housing projects in Hai Phong.

OIL & GAS

90,000

1D -0.55%

5D -1.85%

Buy Vol. 722,900

Sell Vol. 722,100

10,600

1D -0.93%

5D -1.85%

Buy Vol. 13,801,700

Sell Vol. 12,956,500

51,100

1D 0.39%

5D 0.59%

Buy Vol. 1,891,900

Sell Vol. 1,848,500

- Oil prices continued dropping on Thursday's (15/07) as investors forecast increased supply following a deal between OPEC producers.

VINGROUP

105,800

1D 3.73%

5D -2.58%

Buy Vol. 4,283,300

Sell Vol. 3,715,200

109,000

1D -1.18%

5D -3.11%

Buy Vol. 4,049,400

Sell Vol. 4,356,500

27,700

1D -1.07%

5D -1.07%

Buy Vol. 4,983,500

Sell Vol. 6,330,900

- VHM: registered to sell all 60m treasury shares (1.79%) from July 26 to August 24. This is the amount of treasury shares that Vinhomes has bought back since the end of 2019

FOOD & BEVERAGE

85,900

1D 0.82%

5D -1.26%

Buy Vol. 2,693,600

Sell Vol. 3,558,000

120,500

1D 4.78%

5D 3.08%

Buy Vol. 4,515,000

Sell Vol. 3,779,700

19,000

1D 1.60%

5D 4.97%

Buy Vol. 6,999,600

Sell Vol. 5,977,600

- MSN and VNM were both in the top stocks that were net bought by foreign investors in today's session with the value of 59 billion dong and 45 billion dong, respectively.

OTHERS

115,400

1D 0.52%

5D -2.94%

Buy Vol. 942,900

Sell Vol. 883,800

115,400

1D 0.52%

5D -2.94%

Buy Vol. 942,900

Sell Vol. 883,800

86,800

1D 1.64%

5D -3.23%

Buy Vol. 5,296,700

Sell Vol. 4,446,200

168,100

1D 0.60%

5D -4.76%

Buy Vol. 1,290,000

Sell Vol. 1,201,900

96,000

1D 0.95%

5D -9.00%

Buy Vol. 1,360,600

Sell Vol. 1,087,000

51,900

1D 1.37%

5D -1.89%

Buy Vol. 1,065,200

Sell Vol. 730,000

52,800

1D -1.68%

5D 0.38%

Buy Vol. 21,275,200

Sell Vol. 22,348,300

46,750

1D 0.54%

5D -1.16%

Buy Vol. 41,267,700

Sell Vol. 45,917,700

- HPG: The Fubon FTSE Vietnam ETF saw its total assets increase to more than 11 trillion dong, mainly thanks to the amount of new capital raised this week. With the newly raised capital, the big fund Fubon bought about 3.3 million shares of HPG, 3.1 million shares of CTG and 1.5 million shares of SSI.

Market by numbers

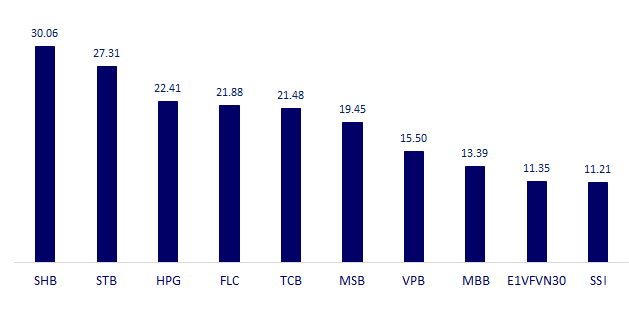

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

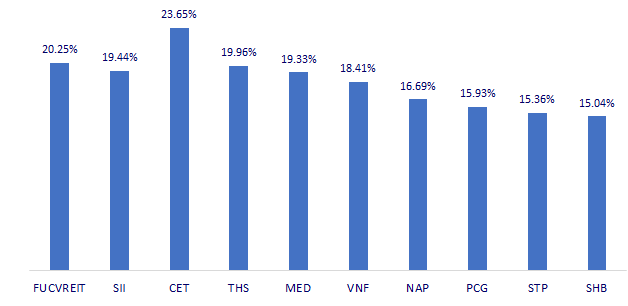

TOP INCREASES 3 CONSECUTIVE SESSIONS

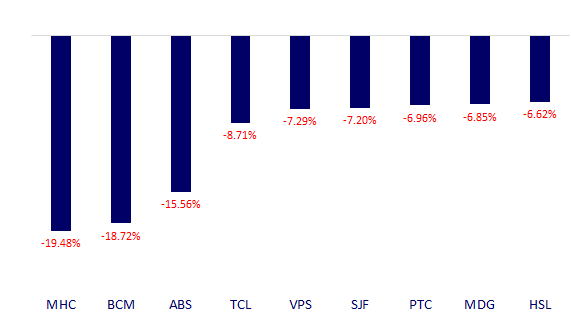

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.