Market Brief 19/07/2021

VIETNAM STOCK MARKET

1,243.51

1D -4.29%

YTD 13.10%

1,374.15

1D -4.44%

YTD 29.83%

292.06

1D -5.10%

YTD 48.18%

82.59

1D -3.21%

YTD 11.87%

-84.44

25,810.69

1D 39.08%

YTD 50.47%

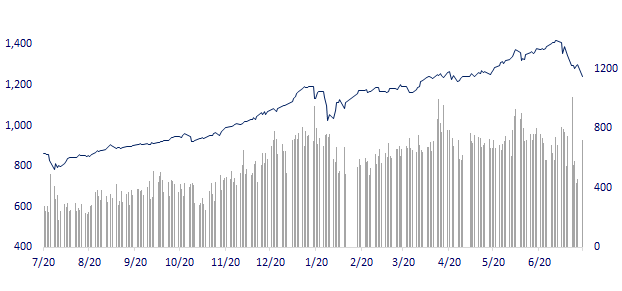

- Under the negative impact of key stocks, VN-Index continued to plunge and fell more than 30 points from the ATO session. Although bottom-fishing appeared after strong dips, the supply was so large that the main index in the whole session kept its downward momentum and continuously broke through the bottoms, sometimes losing 60 points before recovering slightly recovered.

ETF & DERIVATIVES

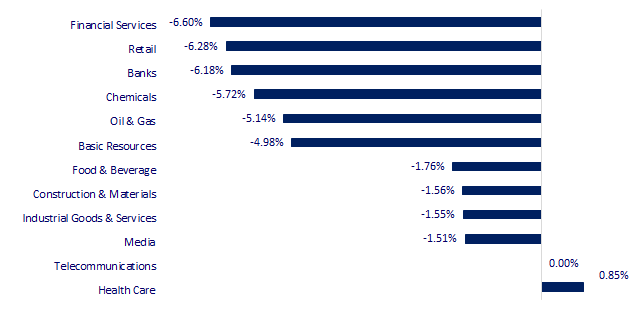

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,652.74

1D 0.29%

YTD 0.76%

3,539.12

1D -0.01%

YTD 3.65%

3,244.04

1D -1.00%

YTD 12.90%

27,456.62

1D -0.05%

YTD 1.14%

3,111.20

1D -1.30%

YTD 8.43%

1,556.01

1D -1.17%

YTD 7.36%

69.58

1D -1.19%

YTD 44.06%

1,803.95

1D -0.52%

YTD -5.24%

- Asian stocks mostly fell, oil prices fell after OPEC + agreed to increase production. Except in Japan, Nikkei 225 gained 0.29%. The Chinese market fell with the Shanghai Composite down 0.01%. Hong Kong's Hang Seng fell 0.05%. South Korea's Kospi index fell 1%.

VIETNAM ECONOMY

0.93%

YTD (bps) 80

5.60%

YTD (bps) -20

1.24%

1D (bps) 1

YTD (bps) 2

2.00%

1D (bps) 2

YTD (bps) -3

23,120

1D (%) 0.04%

YTD (%) -0.25%

27,659

1D (%) -0.20%

YTD (%) -4.96%

3,619

1D (%) -0.03%

YTD (%) 1.29%

- The Ministry of Finance said that the preferential import and export tax rates for a number of items that have increased sharply in the past time are expected to be revised to contribute to stabilizing the macro economy and reducing difficulties for businesses.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Residential deposit growth is low in "statistical history"

- Prime Minister establishes a special working group to promote investment activities

- Proposal to amend preferential import and export tax for some items

- OPEC+ will increase production from August 2021

- US Treasury Secretary doubts the effectiveness of a trade deal with China

- New fault lines of the world economy

VN30

BANK

97,000

1D -5.37%

5D -9.43%

Buy Vol. 4,066,200

Sell Vol. 3,567,800

39,650

1D -6.71%

5D -5.60%

Buy Vol. 5,141,400

Sell Vol. 5,062,000

32,250

1D -6.93%

5D -7.86%

Buy Vol. 35,786,500

Sell Vol. 34,181,200

48,000

1D -6.98%

5D -10.28%

Buy Vol. 68,407,000

Sell Vol. 62,831,700

60,000

1D -6.98%

5D -6.25%

Buy Vol. 25,167,100

Sell Vol. 26,544,500

27,150

1D -6.70%

5D -8.89%

Buy Vol. 36,745,900

Sell Vol. 38,249,700

31,900

1D -4.63%

5D -5.62%

Buy Vol. 5,061,500

Sell Vol. 6,005,400

31,550

1D -6.93%

5D -9.99%

Buy Vol. 7,380,100

Sell Vol. 8,164,300

27,500

1D -3.34%

5D -3.17%

Buy Vol. 63,519,000

Sell Vol. 56,703,500

- MBB's consolidated profit was nearly 8,000b dong in the first 6 months, an increase of 56% over the same period and completed more than 60% of the whole year target (13,200b dong). VCB estimated pre-tax profit of more than 14,500 dong, up 36% over the same period last year. This year, the bank set a profit target of VND 25,580b, thus completing more than 56% after 6 months. CTG sets a profit target of 16,800b dong this year. Meanwhile, in the first 6 months of the year, the bank estimated pre-tax profit of about 13tr dong, completing 3/4 of the whole year's journey.

REAL ESTATE

103,000

1D -1.53%

5D -2.00%

Buy Vol. 5,403,200

Sell Vol. 4,767,000

18,050

1D -5.99%

5D -3.73%

Buy Vol. 23,403,800

Sell Vol. 14,754,800

37,300

1D 0.95%

5D 3.04%

Buy Vol. 14,122,900

Sell Vol. 14,779,700

87,800

1D -2.66%

5D -3.41%

Buy Vol. 3,142,300

Sell Vol. 3,589,100

- PDR: As of July 10, 2021, PDR's short-term loans are at VND 350.95 billion. Specifically, in the second quarter of 2021, PDR has paid off 1,283.55 billion dong of short-term loans.

OIL & GAS

86,700

1D -3.67%

5D -1.48%

Buy Vol. 1,289,100

Sell Vol. 1,029,700

10,100

1D -4.72%

5D -0.49%

Buy Vol. 20,508,000

Sell Vol. 19,340,800

49,000

1D -4.11%

5D -1.31%

Buy Vol. 2,350,300

Sell Vol. 2,648,300

- POW: just announced business results for the first 6 months with total revenue estimated at VND 16,456b and profit after tax estimated at VND 1,393b, up 4% and 2% respectively

VINGROUP

102,900

1D -2.74%

5D -1.06%

Buy Vol. 3,205,600

Sell Vol. 3,366,200

104,300

1D -4.31%

5D -3.43%

Buy Vol. 7,341,100

Sell Vol. 5,429,300

26,800

1D -3.25%

5D -0.74%

Buy Vol. 8,747,400

Sell Vol. 9,486,100

- VHM was suddenly net bought by foreign investors in today's session with a value of more than 36 billion dong.

FOOD & BEVERAGE

85,000

1D -1.05%

5D -1.51%

Buy Vol. 5,860,900

Sell Vol. 6,006,800

119,400

1D -0.91%

5D -0.42%

Buy Vol. 2,563,600

Sell Vol. 2,788,000

18,000

1D -5.26%

5D 6.82%

Buy Vol. 4,126,000

Sell Vol. 4,734,400

- SBT: Collecting shareholders' written opinions on the payment of 5% stock dividend. The expected number of shares to be issued is 30,857,907 shares

OTHERS

114,000

1D -1.21%

5D -5.00%

Buy Vol. 688,700

Sell Vol. 958,800

48,000

1D -5.88%

5D -4.57%

Buy Vol. 1,602,600

Sell Vol. 1,740,600

84,700

1D -2.42%

5D -1.63%

Buy Vol. 5,994,600

Sell Vol. 5,198,600

156,500

1D -6.90%

5D -11.38%

Buy Vol. 2,784,600

Sell Vol. 3,082,600

91,600

1D -4.58%

5D -10.28%

Buy Vol. 1,321,500

Sell Vol. 1,383,400

50,800

1D -2.12%

5D -2.87%

Buy Vol. 1,133,600

Sell Vol. 993,500

49,300

1D -6.63%

5D -0.40%

Buy Vol. 27,993,300

Sell Vol. 27,193,000

44,300

1D -5.24%

5D -1.45%

Buy Vol. 72,775,300

Sell Vol. 67,688,300

- PNJ: Hanoi Investments Holdings Limited announced that it had sold 115,200 PNJ shares to reduce the holding of Dragon Capital group to 22.6 million units, equivalent to 9.9% of charter capital.

Market by numbers

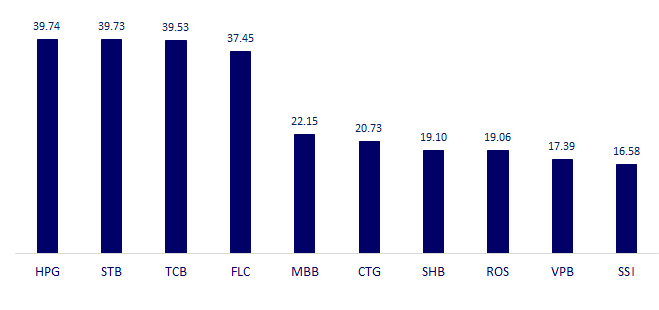

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

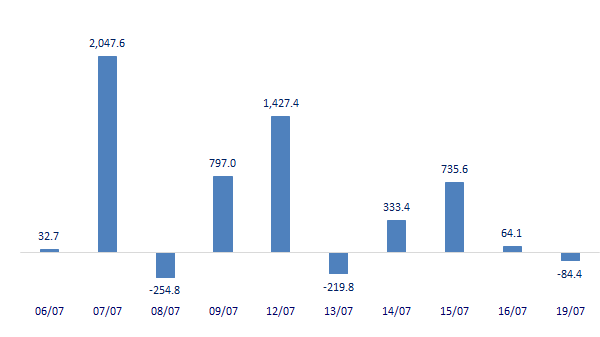

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

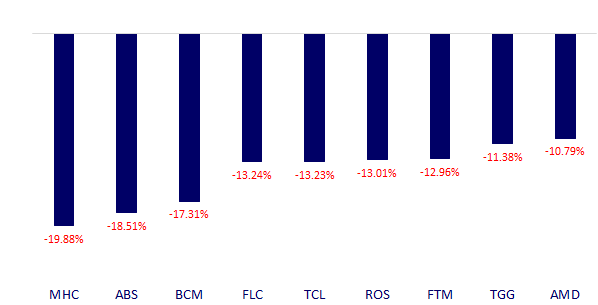

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.