Market Brief 29/07/2021

VIETNAM STOCK MARKET

1,293.60

1D 1.29%

YTD 17.65%

1,427.55

1D 1.42%

YTD 34.88%

310.97

1D 1.54%

YTD 57.77%

86.14

1D 1.39%

YTD 16.67%

-41.28

1D 0.00%

YTD 0.00%

18,995.42

1D 20.65%

YTD 10.74%

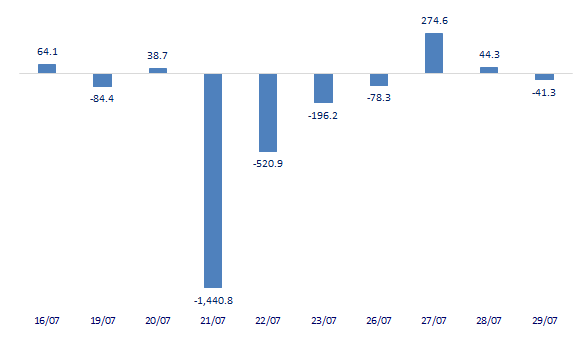

- Session 29/7: Foreign investors returned to be net sellers on HoSE. In which, HPG and FUEVFVND certificates saw a strong net withdrawal right after the foreign investors focused on net buying yesterday. Generally, on all 3 exchanges, foreign investors net sold 41 billion dong.

ETF & DERIVATIVES

24,050

1D 1.05%

YTD 27.93%

16,800

1D 1.20%

YTD 34.08%

17,740

1D -0.39%

YTD 33.38%

20,600

1D 0.73%

YTD 30.38%

20,500

1D 1.69%

YTD 50.18%

24,800

1D 1.64%

YTD 44.19%

17,750

1D 0.57%

YTD 27.24%

1,429

1D 1.64%

YTD 0.00%

1,427

1D 1.32%

YTD 0.00%

1,428

1D 1.49%

YTD 0.00%

1,431

1D 1.66%

YTD 0.00%

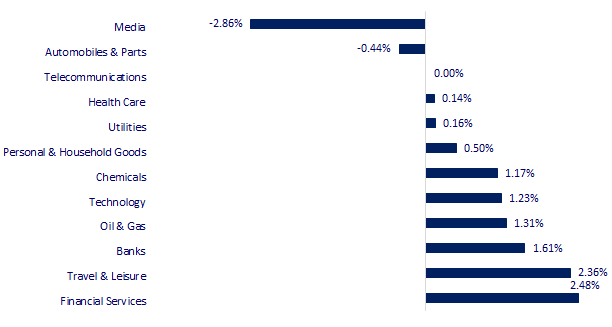

CHANGE IN PRICE BY SECTOR

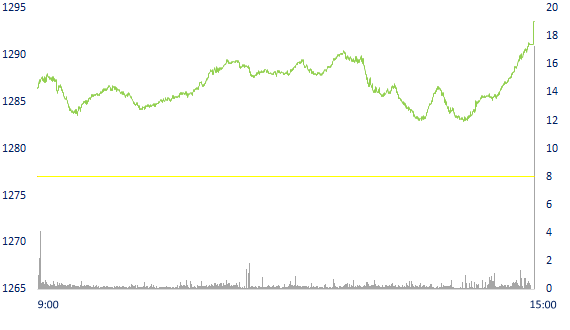

INTRADAY VNINDEX

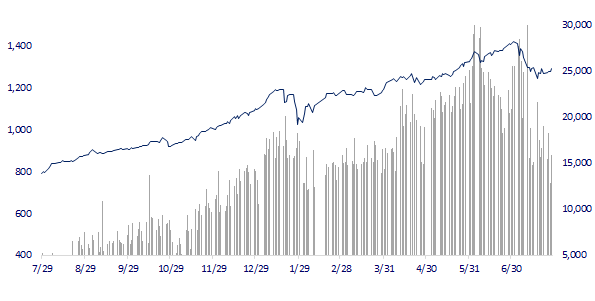

VNINDEX (12M)

GLOBAL MARKET

27,782.42

1D 0.30%

YTD 1.23%

3,411.72

1D 1.49%

YTD -0.08%

3,242.65

1D 0.18%

YTD 12.85%

26,243.62

1D 1.34%

YTD -3.33%

3,180.61

1D 1.24%

YTD 10.85%

1,537.78

1D 0.01%

YTD 6.10%

72.58

1D 0.61%

YTD 50.27%

1,822.20

1D 1.43%

YTD -4.28%

- Fed keeps interest rates unchanged, Asian stocks rise. In Japan, the Nikkei 225 gained 0.3%. The Chinese market went up with Shanghai Composite up 1.49%, Shenzhen Component up 3.045%. Hong Kong's Hang Seng gained 1.34%, continuing to recover after falling more than 8% in the first two sessions of the week. South Korea's Kospi index rose 0.18%.

VIETNAM ECONOMY

0.98%

1D (bps) -2

YTD (bps) 85

5.60%

YTD (bps) -20

1.27%

1D (bps) 6

YTD (bps) 5

2.07%

1D (bps) 15

YTD (bps) 4

23,055

1D (%) -0.09%

YTD (%) -0.53%

27,883

1D (%) 0.17%

YTD (%) -4.19%

3,624

1D (%) 0.39%

YTD (%) 1.43%

- In the first five months of 2021, goods exports to France reached more than 2.21 billion euros, up 14.8% over the same period in 2020 with the growth of traditional groups such as footwear, textiles, and furniture. , furniture, household appliances.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Exports to France regain growth momentum thanks to traditional commodity groups

- In the first seven months of the year, Hanoi disbursed nearly 24 trillion VND

- The bank is still stuck with a data channel

- Fearing strong market volatility, the Central Bank of China rushed to inject 30 billion CNY into the financial system

- The picture of world per capita income in 2021

- Thailand's economy faces the first double recession since the Asian financial crisis

VN30

BANK

97,900

1D 0.93%

5D -2.39%

Buy Vol. 2,003,200

Sell Vol. 1,720,700

41,000

1D 1.23%

5D 0.00%

Buy Vol. 1,876,400

Sell Vol. 2,500,900

33,900

1D 3.04%

5D 1.19%

Buy Vol. 35,057,100

Sell Vol. 30,659,100

50,600

1D 1.81%

5D -0.98%

Buy Vol. 20,435,600

Sell Vol. 23,673,600

57,700

1D 2.49%

5D -5.10%

Buy Vol. 15,426,800

Sell Vol. 13,634,100

28,400

1D 2.90%

5D 0.18%

Buy Vol. 28,364,800

Sell Vol. 25,396,300

33,400

1D 1.52%

5D 3.09%

Buy Vol. 3,892,600

Sell Vol. 5,033,800

34,700

1D 1.46%

5D 2.51%

Buy Vol. 9,491,400

Sell Vol. 10,959,400

29,300

1D 1.38%

5D 4.64%

Buy Vol. 30,082,200

Sell Vol. 34,164,400

- VPB: VPBank shareholders approved the dividend and stock bonus plan. VPBank will issue a maximum of nearly 1.98 billion shares to shareholders, the issuance rate will account for 80% of the total number of outstanding shares at the time of closing. The total value of issuance at the maximum par value is nearly VND 19,758 billion.

REAL ESTATE

104,000

1D -0.10%

5D -0.86%

Buy Vol. 1,990,000

Sell Vol. 2,462,200

18,900

1D -1.31%

5D -1.31%

Buy Vol. 5,182,400

Sell Vol. 8,292,800

39,800

1D 2.71%

5D 1.53%

Buy Vol. 9,035,700

Sell Vol. 7,524,400

90,900

1D 0.00%

5D 0.89%

Buy Vol. 3,129,500

Sell Vol. 3,421,100

- NVL: The General Meeting approved the plan to issue shares to increase share capital from equity in the second phase in 2021, (expected ratio 1:0.29) and the plan to issue shares to pay dividends ( expected ratio 1:0.31)

OIL & GAS

89,500

1D 0.45%

5D 0.11%

Buy Vol. 754,100

Sell Vol. 907,100

10,650

1D 0.47%

5D 2.90%

Buy Vol. 13,201,400

Sell Vol. 13,719,200

51,000

1D 0.99%

5D 0.20%

Buy Vol. 2,720,300

Sell Vol. 2,570,500

- PLX: announced that it will sell 8m treasury shares from August 6 to September 3, 2021. Transactions will be order matching through the exchange.

VINGROUP

105,100

1D -0.10%

5D -1.04%

Buy Vol. 2,017,800

Sell Vol. 2,087,800

107,900

1D 1.31%

5D -2.79%

Buy Vol. 7,089,600

Sell Vol. 6,493,000

27,350

1D 0.55%

5D -3.01%

Buy Vol. 7,424,900

Sell Vol. 7,866,500

- VHM: In Q2. 2021, VHM achieved revenue of VND 28.725b, up 75% over the same period. In which, revenue from real estate transfer accounted for VND26,018b

FOOD & BEVERAGE

86,800

1D -0.12%

5D 0.00%

Buy Vol. 4,335,700

Sell Vol. 4,400,700

127,700

1D 2.57%

5D 3.91%

Buy Vol. 2,042,800

Sell Vol. 2,229,400

18,350

1D 0.55%

5D -0.54%

Buy Vol. 3,075,000

Sell Vol. 2,880,800

- MSN: Paid over 68 billion dong of bond interest with a total par value of 1,500 billion dong for the first 6 months of 2021

OTHERS

114,400

1D 0.00%

5D 0.35%

Buy Vol. 709,500

Sell Vol. 675,300

114,400

1D 0.00%

5D 0.35%

Buy Vol. 709,500

Sell Vol. 675,300

93,400

1D 1.52%

5D 4.47%

Buy Vol. 6,957,300

Sell Vol. 6,655,800

162,800

1D 3.63%

5D -1.45%

Buy Vol. 2,669,000

Sell Vol. 1,732,200

93,000

1D 3.22%

5D -0.11%

Buy Vol. 1,436,000

Sell Vol. 1,783,700

52,400

1D 0.00%

5D -0.76%

Buy Vol. 786,100

Sell Vol. 663,900

54,000

1D 3.05%

5D 3.45%

Buy Vol. 21,490,600

Sell Vol. 24,323,700

47,100

1D 0.86%

5D -0.21%

Buy Vol. 54,862,400

Sell Vol. 57,470,800

- HPG: announced Q2 revenue of VND 35,400 billion, up 71%; profit after tax was 9,745 billion dong, 3.6 times higher than the same period last year and set a new profit record. Accumulated in the first 6 months, revenue reached nearly 66,900 billion dong, up 67%; profit after tax is 16,751 billion dong, 3.3 times higher than the same period last year. The Group fulfilled 56% of the revenue plan and 93% of the year profit plan.

Market by numbers

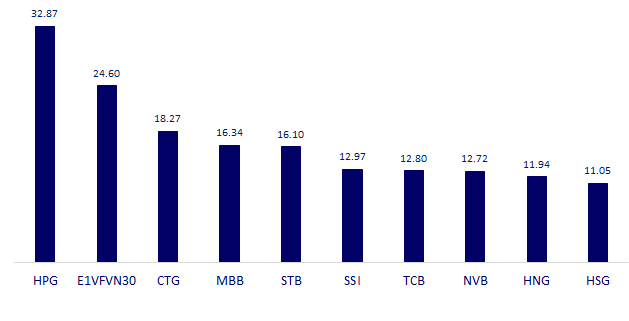

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

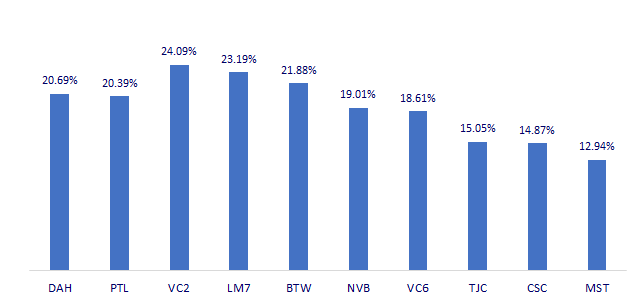

TOP INCREASES 3 CONSECUTIVE SESSIONS

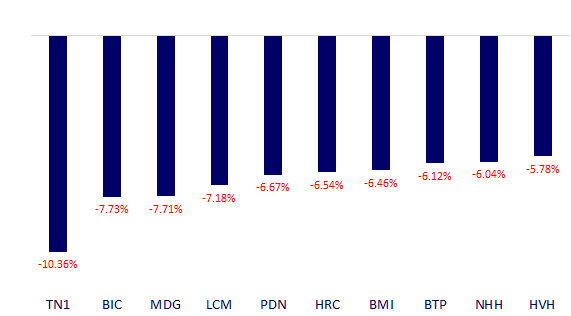

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.