Market Brief 30/07/2021

VIETNAM STOCK MARKET

1,310.05

1D 1.27%

YTD 19.15%

1,447.23

1D 1.38%

YTD 36.74%

314.85

1D 1.25%

YTD 59.74%

86.93

1D 0.92%

YTD 17.74%

478.89

1D 0.00%

YTD 0.00%

25,811.63

1D 35.88%

YTD 50.48%

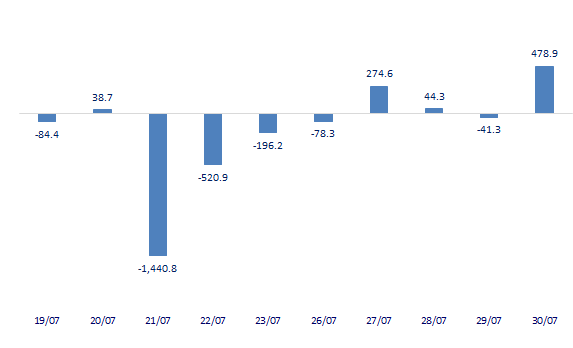

- Session 30/7: Foreign investors returned to a net buying of nearly 480 billion dong the day VN-Index surpassed 1,300 points. SSI, STB and MSN were three stocks that were bought by foreign investors with a net purchase of over 100 billion dong.

ETF & DERIVATIVES

24,600

1D 2.29%

YTD 30.85%

17,000

1D 1.19%

YTD 35.67%

18,200

1D 2.19%

YTD 36.84%

21,000

1D 1.94%

YTD 32.91%

21,100

1D 2.93%

YTD 54.58%

25,500

1D 2.82%

YTD 48.26%

18,110

1D 2.03%

YTD 29.82%

1,440

1D 0.79%

YTD 0.00%

1,428

1D 0.05%

YTD 0.00%

1,444

1D 1.09%

YTD 0.00%

1,445

1D 0.97%

YTD 0.00%

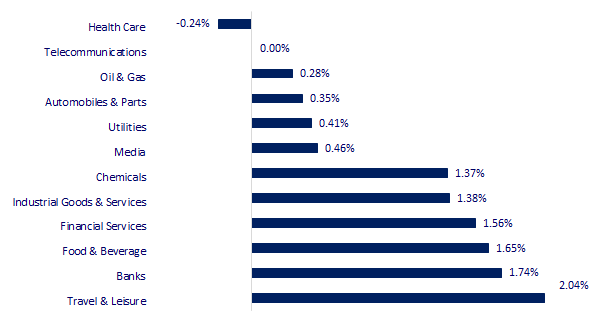

CHANGE IN PRICE BY SECTOR

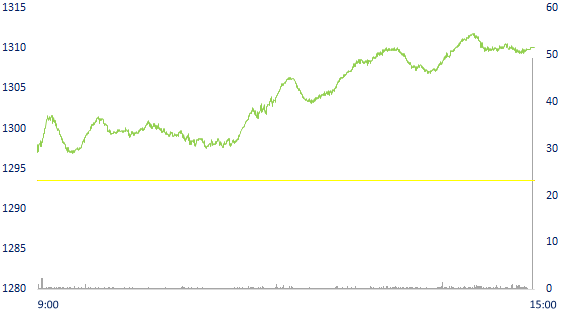

INTRADAY VNINDEX

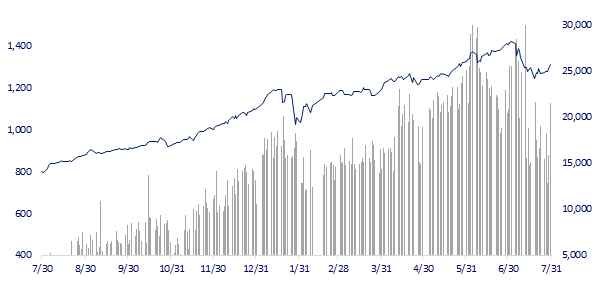

VNINDEX (12M)

GLOBAL MARKET

27,283.59

1D -0.26%

YTD -0.59%

3,397.36

1D -0.42%

YTD -0.50%

3,202.32

1D -1.24%

YTD 11.44%

25,908.00

1D -0.58%

YTD -4.56%

3,166.94

1D -0.43%

YTD 10.38%

1,521.92

1D -1.03%

YTD 5.01%

73.33

1D 0.11%

YTD 51.82%

1,827.55

1D -0.12%

YTD -4.00%

- Asian stocks fell, China market was sold strongly. In Japan, Nikkei fell 0.26%. The Chinese market fell with Shanghai Composite down 0.42%, Shenzhen Component down 0.29%. Hong Kong's Hang Seng fell 0.58%. South Korea's Kospi index fell 1.24%.

VIETNAM ECONOMY

0.94%

1D (bps) -4

YTD (bps) 81

5.60%

YTD (bps) -20

1.28%

1D (bps) 1

YTD (bps) 6

2.08%

1D (bps) 1

YTD (bps) 5

23,055

1D (%) 0.00%

YTD (%) -0.53%

27,913

1D (%) 0.05%

YTD (%) -4.09%

3,620

1D (%) -0.14%

YTD (%) 1.32%

- Food prices increased in some localities implementing social distancing to prevent the Covid-19 epidemic; Petrol prices, gas prices increasing according to world fuel prices and electricity prices increasing according to demand in the hot season are the main reasons for the increase in consumer price index (CPI) in July 2021 by 0.62% compared to that of the hot season. with the previous month and increased by 2.64% compared to July 2020.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In 7 months, the Ministry of Transport disbursed over VND 19,000 billion, reaching 45% of the plan

- CPI in July 2021 increased sharply because food and gasoline prices both increased

- Enterprises leaving the market increased by more than 30% in 7 months

- China's steel output in the second half of the year tends to decrease, iron ore prices go down

- WTO warns inequality in access to vaccines could hinder economic recovery

- South Korea, China recorded more new cases of Covid-19

VN30

BANK

98,000

1D 0.10%

5D 1.03%

Buy Vol. 2,694,900

Sell Vol. 2,375,600

41,100

1D 0.24%

5D 2.24%

Buy Vol. 3,453,700

Sell Vol. 3,846,700

34,400

1D 1.47%

5D 5.85%

Buy Vol. 37,030,000

Sell Vol. 36,424,200

51,100

1D 0.99%

5D 3.23%

Buy Vol. 28,059,800

Sell Vol. 33,457,800

61,000

1D 5.72%

5D 4.27%

Buy Vol. 28,289,700

Sell Vol. 23,207,100

28,900

1D 1.76%

5D 4.14%

Buy Vol. 33,937,600

Sell Vol. 31,726,700

33,700

1D 0.90%

5D 4.17%

Buy Vol. 5,860,300

Sell Vol. 7,514,600

35,000

1D 0.86%

5D 6.06%

Buy Vol. 7,614,500

Sell Vol. 8,750,900

29,900

1D 2.05%

5D 4.18%

Buy Vol. 55,315,200

Sell Vol. 68,471,400

- VCB: Consolidated financial statements of the second quarter, VCB recorded net interest income of 10,937 billion dong, up 37% over the same period in 2020. Net profit from service activities decreased by 73% to nearly 300 billion dong. Net foreign exchange gain increased by 20% to VND 985 billion, while net profit from other activities also increased by 26% to VND 357 billion. - SBT: Sacombank plans to divest all capital from SBS. Since 2011, Sacombank is no longer the parent company of SBS.

REAL ESTATE

104,000

1D 0.00%

5D 0.97%

Buy Vol. 3,148,400

Sell Vol. 2,735,900

19,150

1D 1.32%

5D 3.51%

Buy Vol. 36,742,300

Sell Vol. 23,270,600

40,700

1D 2.26%

5D 5.99%

Buy Vol. 11,739,200

Sell Vol. 12,556,300

92,500

1D 1.76%

5D 4.40%

Buy Vol. 5,045,900

Sell Vol. 4,595,400

- KDH: recorded a net profit of the first 6 months of 470 billion dong, up 15% over the same period. However, the Company's net cash flow from operating activities was negative over VND 841 billion.

OIL & GAS

89,600

1D 0.11%

5D 1.82%

Buy Vol. 905,800

Sell Vol. 1,042,600

10,700

1D 0.47%

5D 1.90%

Buy Vol. 22,091,600

Sell Vol. 17,695,800

51,300

1D 0.59%

5D 2.19%

Buy Vol. 2,118,900

Sell Vol. 2,306,100

- In this morning's trading session, the price of Brent crude oil for October delivery fell 0.36% to $74.61/barrel. The price of US WTI crude oil rose 1.7% to $73.62 a barrel.

VINGROUP

107,200

1D 2.00%

5D 3.08%

Buy Vol. 3,368,100

Sell Vol. 4,945,000

108,300

1D 0.37%

5D 0.65%

Buy Vol. 7,601,500

Sell Vol. 7,278,500

27,650

1D 1.10%

5D 2.41%

Buy Vol. 7,632,300

Sell Vol. 8,282,800

- VIC: Vingroup reported a profit of more than VND 3,600 billion, net revenue of nearly VND 38,500 billion. Most business areas saw revenue growth.

FOOD & BEVERAGE

86,100

1D -0.81%

5D -1.71%

Buy Vol. 8,801,400

Sell Vol. 6,518,600

134,000

1D 4.93%

5D 12.61%

Buy Vol. 4,245,000

Sell Vol. 4,494,600

18,550

1D 1.09%

5D 2.20%

Buy Vol. 6,962,300

Sell Vol. 5,694,300

- MSN: recorded a 19% increase in revenue to VND21,219b; parent company's profit after tax reached VND791b, more than 4 times higher than the same period last year

OTHERS

113,000

1D -1.22%

5D -0.35%

Buy Vol. 792,700

Sell Vol. 708,900

113,000

1D -1.22%

5D -0.35%

Buy Vol. 792,700

Sell Vol. 708,900

94,000

1D 0.64%

5D 3.87%

Buy Vol. 9,106,800

Sell Vol. 8,251,400

164,100

1D 0.80%

5D 1.48%

Buy Vol. 3,765,300

Sell Vol. 2,916,800

95,800

1D 3.01%

5D 5.27%

Buy Vol. 1,462,400

Sell Vol. 1,929,100

55,000

1D 4.96%

5D 6.80%

Buy Vol. 5,652,000

Sell Vol. 2,403,500

54,600

1D 1.11%

5D 7.91%

Buy Vol. 25,591,800

Sell Vol. 29,762,600

47,300

1D 0.42%

5D 3.28%

Buy Vol. 37,873,800

Sell Vol. 45,208,900

- REE: In the second quarter of 2021 alone, REE's net revenue reached more than VND 1,636 billion, up 27% over the same period last year. While revenue from refrigeration and mechanical engineering dropped significantly, revenue from electricity and water infrastructure was a bright spot in Q2 when it tripled in the same period last year. Gross profit was nearly 664 billion dong, up 69%.

Market by numbers

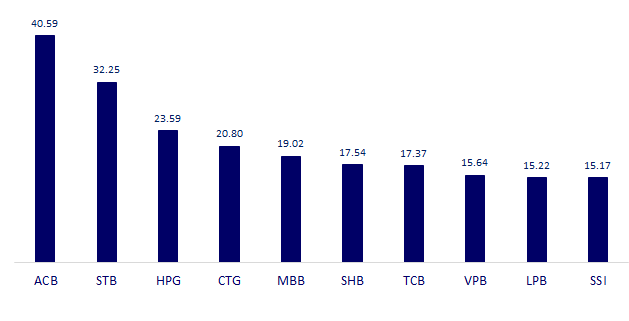

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

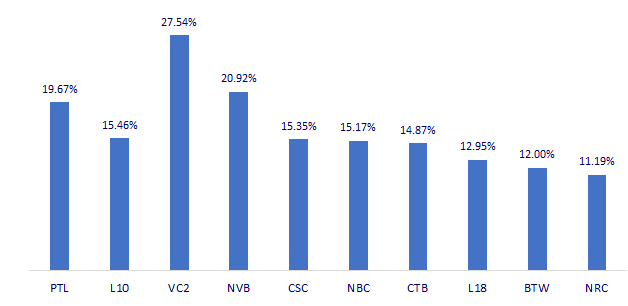

TOP INCREASES 3 CONSECUTIVE SESSIONS

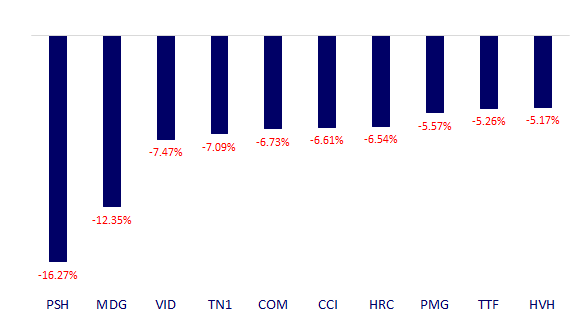

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.