Market Brief 04/08/2021

VIETNAM STOCK MARKET

1,334.74

1D 0.17%

YTD 21.40%

1,472.20

1D 0.16%

YTD 39.10%

320.02

1D 0.28%

YTD 62.36%

87.52

1D -0.08%

YTD 18.54%

807.66

1D 0.00%

YTD 0.00%

25,231.04

1D -0.82%

YTD 47.09%

- On HoSE, foreign investors net bought for the fourth consecutive session with a value 5 times higher than the previous session and at nearly 830 billion dong, equivalent to a net buying volume of 19.7 million shares. This is also the strongest net buying session of this capital flow since July 12.

ETF & DERIVATIVES

19,900

1D 0.45%

YTD 5.85%

13,970

1D -0.21%

YTD 11.49%

14,760

1D -17.13%

YTD 10.98%

17,300

1D 0.00%

YTD 9.49%

15,550

1D -0.32%

YTD 13.92%

19,600

1D -1.01%

YTD 13.95%

15,350

1D 0.46%

YTD 10.04%

1,464

1D -0.16%

YTD 0.00%

1,469

1D 0.17%

YTD 0.00%

1,469

1D 0.00%

YTD 0.00%

1,471

1D -0.28%

YTD 0.00%

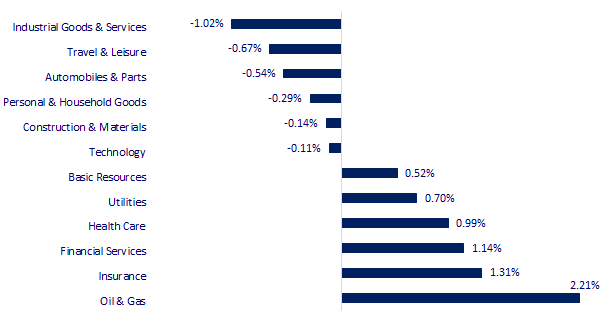

CHANGE IN PRICE BY SECTOR

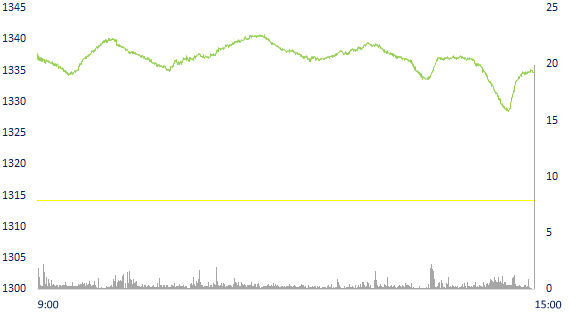

INTRADAY VNINDEX

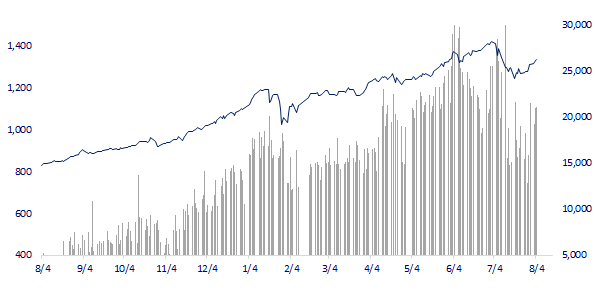

VNINDEX (12M)

GLOBAL MARKET

27,584.08

1D 0.09%

YTD 0.51%

3,477.22

1D 0.85%

YTD 1.84%

3,280.38

1D 1.34%

YTD 14.16%

26,426.55

1D 1.33%

YTD -2.65%

3,182.90

1D 1.07%

YTD 10.93%

1,545.86

1D 0.35%

YTD 6.66%

69.80

1D -2.40%

YTD 44.51%

1,818.95

1D 0.33%

YTD -4.45%

- China's service sector grows, Asian stocks rise. In Japan, the Nikkei 225 gained 0.09%. The Chinese market rose with the Shanghai Composite up 0.85% and the Shenzhen Component up 1.72%. Hong Kong's Hang Seng rose 1.33%. China's Caixin/Markit Purchasing Managers' Index (PMI) in July was 54.9 points, up from 50.3 points in June.

VIETNAM ECONOMY

0.96%

YTD (bps) 83

5.60%

YTD (bps) -20

1.20%

1D (bps) -1

YTD (bps) -2

1.93%

1D (bps) -3

YTD (bps) -10

23,045

1D (%) 0.02%

YTD (%) -0.57%

27,829

1D (%) -0.01%

YTD (%) -4.38%

3,621

1D (%) 0.17%

YTD (%) 1.34%

- According to the Ministry of Industry and Trade, the export activities in 7 months achieved positive growth. However, this growth momentum is somewhat slowing down because the Covid-19 epidemic is negatively affecting production and business activities. In the coming time, the growth of import and export will depend greatly on the situation of disease control as well as the acceleration of the vaccination process in the country.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ministry of Industry and Trade: External demand for Vietnamese goods will increase in the coming months

- The US Vice President will come to Vietnam on August 24, focusing on supply chain issues

- Proposing to reduce many corporate taxes

- US businesses' profit in the second quarter of 2021 was better than COVID-19 expectations

- The world is in a shipping crisis again

- China tightens import, copper price drops sharply

VN30

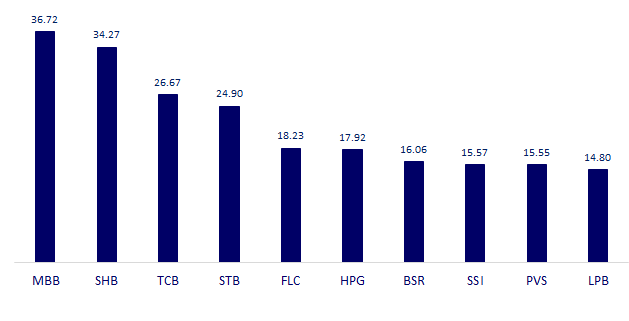

BANK

100,000

1D -0.60%

5D 2.88%

Buy Vol. 2,333,900

Sell Vol. 2,311,500

44,000

1D 0.57%

5D 7.84%

Buy Vol. 2,872,000

Sell Vol. 2,988,500

37,050

1D 0.14%

5D 4.66%

Buy Vol. 14,642,600

Sell Vol. 17,000,100

39,800

1D 3.11%

5D 10.56%

Buy Vol. 44,632,700

Sell Vol. 43,372,200

40,500

1D -1.10%

5D 5.19%

Buy Vol. 12,540,100

Sell Vol. 13,137,500

27,400

1D 2.62%

5D 10.71%

Buy Vol. 57,097,200

Sell Vol. 52,509,400

25,950

1D 0.58%

5D 7.68%

Buy Vol. 8,142,800

Sell Vol. 10,669,000

27,950

1D 0.18%

5D 4.10%

Buy Vol. 5,035,300

Sell Vol. 7,112,900

18,800

1D 1.08%

5D 3.58%

Buy Vol. 52,308,700

Sell Vol. 51,333,300

- VPB: reported profit before tax in the second quarter increased by 37% over the same period, reaching more than 5,031 billion dong. Notably, the profit from trading securities investment was 14.6 times higher, earning more than 1,390 billion dong. In the second quarter, most of VPBank's business activities showed better results than the same period last year. The main source of revenue brought in nearly 9,232 billion dong of net interest income, up 20%

REAL ESTATE

31,700

1D 0.32%

5D 11.03%

Buy Vol. 23,473,300

Sell Vol. 27,396,800

80,800

1D 138.35%

5D 153.29%

Buy Vol. 2,106,100

Sell Vol. 2,236,600

64,000

1D 88.79%

5D 100.63%

Buy Vol. 2,106,100

Sell Vol. 2,236,600

64,000

1D -0.78%

5D 1.91%

Buy Vol. 4,538,600

Sell Vol. 4,100,900

OIL & GAS

89,400

1D 1.36%

5D 9.96%

Buy Vol. 2,829,800

Sell Vol. 3,035,900

12,850

1D -0.39%

5D 4.05%

Buy Vol. 17,558,300

Sell Vol. 19,301,700

56,800

1D -0.70%

5D 7.17%

Buy Vol. 1,984,900

Sell Vol. 2,594,600

- PLX: ENEOS Corporation has just announced registration to buy another 8 million shares of PLX. The transaction is expected to take place from August 6 to September 3, 2021.

VINGROUP

110,000

1D 0.27%

5D 3.58%

Buy Vol. 2,262,800

Sell Vol. 2,382,900

105,300

1D -0.47%

5D 8.78%

Buy Vol. 3,570,700

Sell Vol. 4,197,900

34,400

1D 0.73%

5D 9.03%

Buy Vol. 7,487,000

Sell Vol. 8,541,000

- VHM: Vinhomes wants to finance the planning of a heavy industry zone to build a car factory project in Vung Ang

FOOD & BEVERAGE

107,000

1D -0.47%

5D -0.93%

Buy Vol. 5,317,900

Sell Vol. 5,053,100

92,700

1D -2.01%

5D 4.51%

Buy Vol. 2,605,700

Sell Vol. 2,826,300

186,000

1D -2.11%

5D 3.22%

Buy Vol. 416,100

Sell Vol. 373,900

- SAB: Q2.2021 net revenue reached more than VND7.2tr, up slightly compared to the same period last year. Gross profit increased slightly by 3% to more than 2.2 trillion dong.

OTHERS

134,000

1D 1.82%

5D 3.88%

Buy Vol. 1,743,100

Sell Vol. 1,380,100

134,000

1D 1.82%

5D 3.88%

Buy Vol. 1,743,100

Sell Vol. 1,380,100

75,500

1D -1.69%

5D 1.21%

Buy Vol. 5,102,000

Sell Vol. 4,878,300

136,200

1D -0.58%

5D 5.17%

Buy Vol. 2,892,200

Sell Vol. 2,687,100

83,500

1D -1.88%

5D -0.12%

Buy Vol. 1,649,300

Sell Vol. 1,707,300

29,900

1D 6.98%

5D 24.32%

Buy Vol. 15,007,400

Sell Vol. 12,781,800

33,600

1D 2.28%

5D 5.83%

Buy Vol. 27,053,400

Sell Vol. 27,940,700

43,300

1D -0.23%

5D 3.59%

Buy Vol. 32,695,400

Sell Vol. 30,915,200

- GVR: In Q2.2021, GVR's net revenue reached nearly VND5,688b, up 72% QoQ. Thanks to the higher selling price compared to the same period last year, revenue from core business of the Company from rubber latex production and trading increased by more than 88%, to nearly 3,294b dong. GVR's gross profit recorded nearly 1,629b dong, 2.3 times higher than the same period last year. Accordingly, gross profit margin increased from 21.4% to 28.6%.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

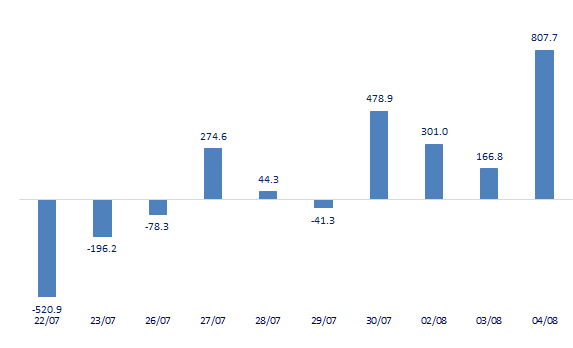

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

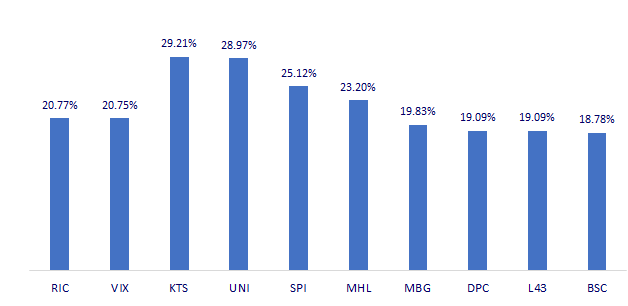

TOP INCREASES 3 CONSECUTIVE SESSIONS

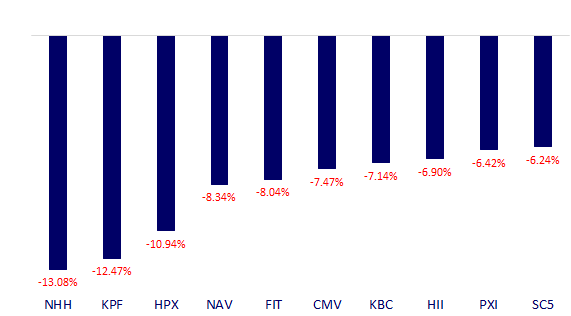

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.