Market Brief 09/08/2021

VIETNAM STOCK MARKET

1,359.86

1D 1.37%

YTD 23.68%

1,497.83

1D 1.42%

YTD 41.52%

330.68

1D 1.60%

YTD 67.77%

89.38

1D 1.25%

YTD 21.06%

97.33

1D 0.00%

YTD 0.00%

28,449.50

1D 0.61%

YTD 65.86%

- On HoSE, foreign investors had the second net buying session in a row with the value nearly 3 times higher than last week's session and at 97 billion dong. Foreign investors concentrated on net buying of VHM with a value of 359 billion dong, far behind FUEVFVND with 72 billion dong.

ETF & DERIVATIVES

25,200

1D 1.12%

YTD 34.04%

17,720

1D 1.61%

YTD 41.42%

20,850

1D 17.07%

YTD 56.77%

22,000

1D 0.92%

YTD 39.24%

21,500

1D 0.00%

YTD 57.51%

26,070

1D 1.05%

YTD 51.57%

18,600

1D -0.59%

YTD 33.33%

1,499

1D 0.98%

YTD 0.00%

1,472

1D -0.09%

YTD 0.00%

1,499

1D 1.82%

YTD 0.00%

1,501

1D 1.87%

YTD 0.00%

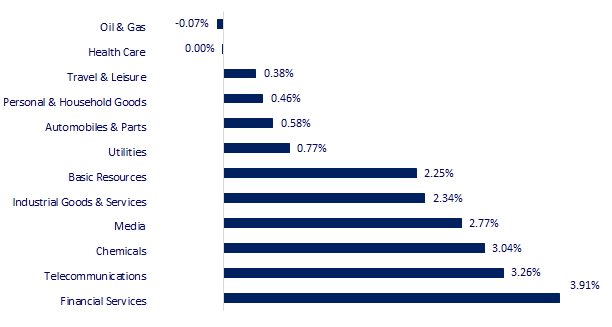

CHANGE IN PRICE BY SECTOR

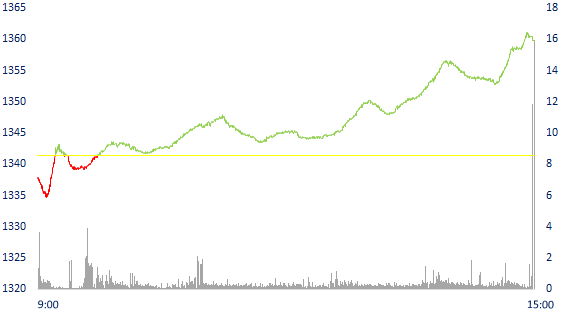

INTRADAY VNINDEX

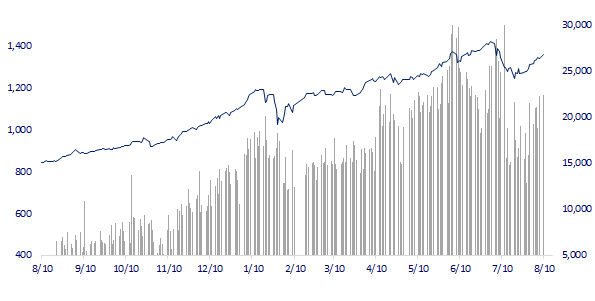

VNINDEX (12M)

GLOBAL MARKET

27,820.04

1D 0.00%

YTD 1.37%

3,494.63

1D 1.05%

YTD 2.35%

3,260.42

1D -0.30%

YTD 13.47%

26,283.40

1D 0.25%

YTD -3.18%

3,177.18

1D 0.00%

YTD 10.73%

1,540.19

1D 1.21%

YTD 6.27%

65.36

1D -2.29%

YTD 35.32%

1,744.00

1D 0.22%

YTD -8.39%

- Asian stocks mixed, oil prices plunged more than 3%. The Japanese market is on holiday today. The Chinese market rose with Shanghai Composite up 1.05%, Shenzhen Component up 0.77%. Hong Kong's Hang Seng rose 0.25%. South Korea's Kospi index fell 0.3%.

VIETNAM ECONOMY

0.92%

1D (bps) -1

YTD (bps) 79

5.60%

YTD (bps) -20

1.05%

1D (bps) -13

YTD (bps) -17

1.97%

1D (bps) 4

YTD (bps) -6

23,020

1D (%) -0.02%

YTD (%) -0.68%

27,566

1D (%) -0.03%

YTD (%) -5.28%

3,608

1D (%) 0.00%

YTD (%) 0.98%

- In the face of complicated developments of the Covid-19 epidemic, the export of computers, components and electronic products in Vietnam in 2021 can still reach about 50 billion USD, up 12.5% compared to 2020. In which, The US, China, EU, ASEAN, Japan, Korea, Hong Kong (China), Taiwan (China), India are the top 9 export markets, accounting for more than 52.4% of total export turnover.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Export of computers and electronic accessories can reach 50 billion USD this year thanks to "big guys" like LG, Fukang or Samsung

- Hanoi SMEs propose the State Bank to direct the reduction of interest rates by 3-5%/year

- Be careful to buy high-yield corporate bonds

- Saudi Arabia will lead the world in oil and gas production growth this decade

- Iran ready to resume talks to restore nuclear deal

- The double crisis caused Myanmar to be engulfed in the "tsunami" of Covid-19

VN30

BANK

98,300

1D 0.20%

5D 1.34%

Buy Vol. 2,618,600

Sell Vol. 2,097,000

43,150

1D 0.58%

5D 1.41%

Buy Vol. 3,205,500

Sell Vol. 3,536,800

34,550

1D 1.17%

5D 2.37%

Buy Vol. 31,004,600

Sell Vol. 26,461,400

52,500

1D 1.35%

5D 3.35%

Buy Vol. 28,128,500

Sell Vol. 26,132,900

61,000

1D 0.66%

5D 0.99%

Buy Vol. 15,661,300

Sell Vol. 12,527,900

29,900

1D 0.84%

5D 3.82%

Buy Vol. 28,159,000

Sell Vol. 22,860,600

35,500

1D 1.43%

5D 3.80%

Buy Vol. 4,947,800

Sell Vol. 4,544,400

35,900

1D 1.13%

5D 4.21%

Buy Vol. 6,092,500

Sell Vol. 6,363,000

30,700

1D 1.32%

5D 4.78%

Buy Vol. 42,013,300

Sell Vol. 45,837,300

- According to statistics from the financial statements of the second quarter of 2021 of 29 banks, the total balance of bad debts of banks as of June 30, 2021 has increased by 4.5% compared to the end of the previous year with nearly 124,898 billion VND. In terms of scale, the top 10 banks with the most bad debts by the end of the second quarter of 2021 include Agribank, BIDV, VietinBank, VPBank, Vietcombank, SHB, Sacombank, SCB, VIB and LienVietPostBank.

REAL ESTATE

36,500

1D 2.67%

5D 2.67%

Buy Vol. 32,336,100

Sell Vol. 30,006,000

106,000

1D 156.04%

5D 163.03%

Buy Vol. 6,142,600

Sell Vol. 5,891,200

93,600

1D 126.09%

5D 132.26%

Buy Vol. 6,142,600

Sell Vol. 5,891,200

93,600

1D 0.11%

5D 0.00%

Buy Vol. 3,859,400

Sell Vol. 3,852,800

- NVL: In Da Lat NVL is building a super project of NovaWorld Da Lat resort, in Don Duong district with a scale of 650 hectares and 183 hectares of lake surface area.

OIL & GAS

93,000

1D 0.65%

5D -0.53%

Buy Vol. 2,003,800

Sell Vol. 1,468,600

11,150

1D 1.36%

5D 3.72%

Buy Vol. 15,813,900

Sell Vol. 15,998,000

52,900

1D 0.00%

5D 2.72%

Buy Vol. 3,103,800

Sell Vol. 3,673,800

- POW: PV Power revenue in July decreased by 10%. Most power plants have not fulfilled their output plans, except for Dakđrinh hydropower plant and Vung Ang 1 power plant.

VINGROUP

113,100

1D -0.18%

5D 5.21%

Buy Vol. 5,341,000

Sell Vol. 4,911,700

117,400

1D 3.07%

5D 8.60%

Buy Vol. 14,488,700

Sell Vol. 9,669,000

28,600

1D 2.33%

5D 4.00%

Buy Vol. 11,742,000

Sell Vol. 10,943,100

- VIC: Quang Ninh will hand over 924 ha of land for Vingroup's Ha Long Xanh project by the end of this year. Specifically, Ha Long City has handed over 568 ha (60%).

FOOD & BEVERAGE

87,700

1D 0.57%

5D 1.39%

Buy Vol. 6,783,200

Sell Vol. 4,788,600

141,000

1D 4.83%

5D 3.52%

Buy Vol. 2,799,500

Sell Vol. 2,035,100

155,100

1D -0.06%

5D 0.00%

Buy Vol. 551,900

Sell Vol. 251,700

- VNM continued to be net sold by foreign investors in today's session with a value of up to 73 billion dong.

OTHERS

119,500

1D 1.79%

5D 3.46%

Buy Vol. 896,400

Sell Vol. 701,400

119,500

1D 1.79%

5D 3.46%

Buy Vol. 896,400

Sell Vol. 701,400

97,500

1D 0.93%

5D 1.99%

Buy Vol. 5,045,800

Sell Vol. 5,528,500

173,800

1D 1.34%

5D 2.30%

Buy Vol. 1,353,300

Sell Vol. 1,485,100

96,500

1D 0.31%

5D 0.94%

Buy Vol. 771,500

Sell Vol. 949,000

35,200

1D 2.92%

5D 5.07%

Buy Vol. 10,326,500

Sell Vol. 10,310,900

59,300

1D 5.14%

5D 7.82%

Buy Vol. 38,513,800

Sell Vol. 38,353,200

49,700

1D 2.69%

5D 5.19%

Buy Vol. 52,835,700

Sell Vol. 47,393,200

- HPG: announced crude steel production in July reached 700,000 tons, up 70% over the same period last year. Sales volume of steel products reached 600,000 tons, up 28% year-on-year and 5% month-on-month. In which, construction steel reached 363,000 tons, up 58% compared to June and 21% over the same period last year; hot rolled coil is 160,000 tons, the rest is steel pipe and galvanized sheet.

Market by numbers

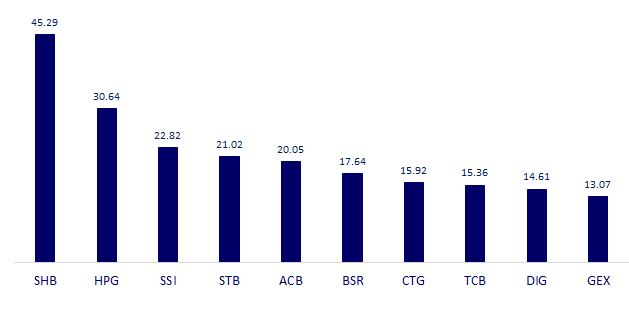

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

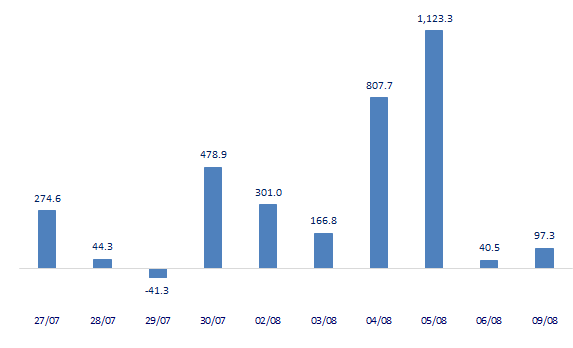

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

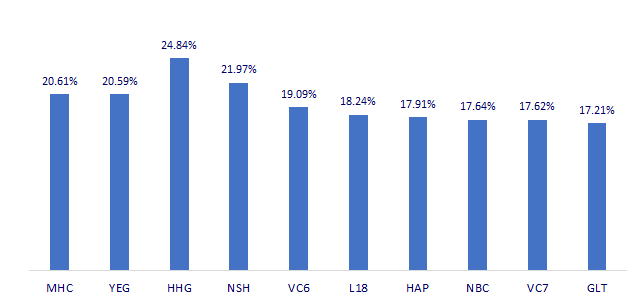

TOP INCREASES 3 CONSECUTIVE SESSIONS

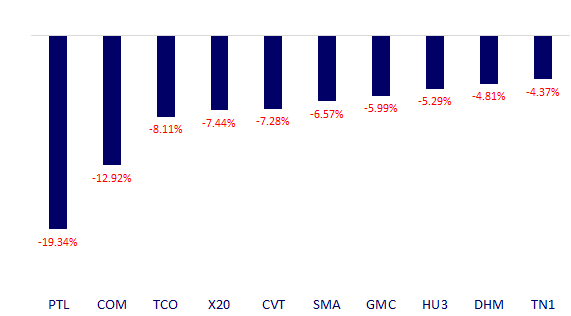

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.