Market Brief 10/08/2021

VIETNAM STOCK MARKET

1,362.43

1D 0.19%

YTD 23.91%

1,494.41

1D -0.23%

YTD 41.20%

335.08

1D 1.33%

YTD 70.01%

90.53

1D 1.29%

YTD 22.62%

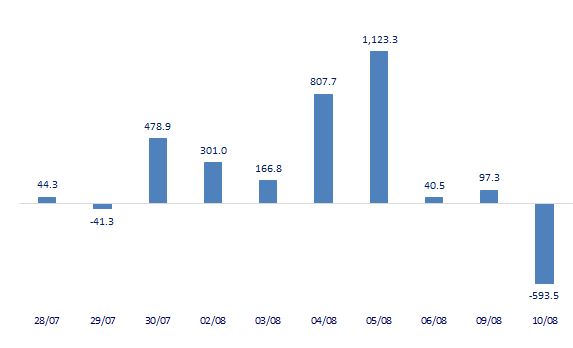

-593.50

1D 0.00%

YTD 0.00%

28,630.88

1D 0.64%

YTD 66.91%

- Foreign investors ended the series of 7 consecutive net buying sessions on HoSE, net selling back to 593b dong. Foreign investors on this floor continued to be a strong net buyer of VHM with more than 409b dong, far behind PLX with only 69b dong. Meanwhile, HPG was sold the most with 159b dong. SSI and VIC were net sold 86b dong and 70b dong respectively.

ETF & DERIVATIVES

25,190

1D -0.04%

YTD 33.99%

17,740

1D 0.11%

YTD 41.58%

19,500

1D 9.49%

YTD 46.62%

22,200

1D 0.91%

YTD 40.51%

21,520

1D 0.09%

YTD 57.66%

26,070

1D 0.00%

YTD 51.57%

18,800

1D 1.08%

YTD 34.77%

1,500

1D 0.07%

YTD 0.00%

1,492

1D 1.36%

YTD 0.00%

1,492

1D -0.45%

YTD 0.00%

1,494

1D -0.43%

YTD 0.00%

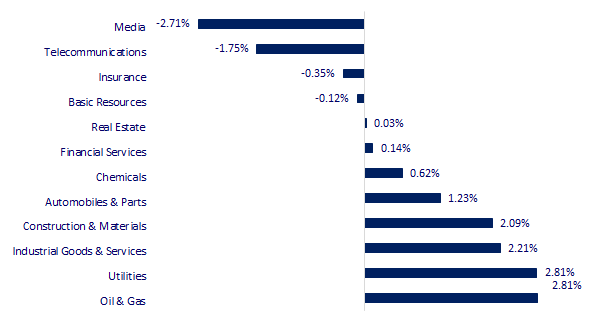

CHANGE IN PRICE BY SECTOR

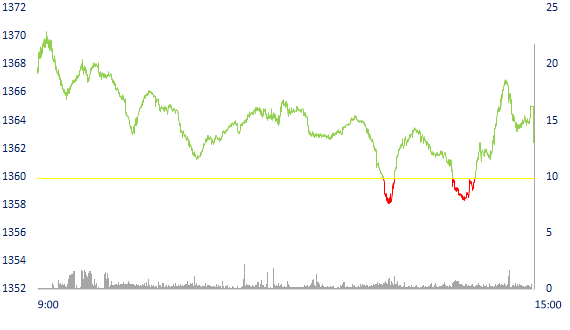

INTRADAY VNINDEX

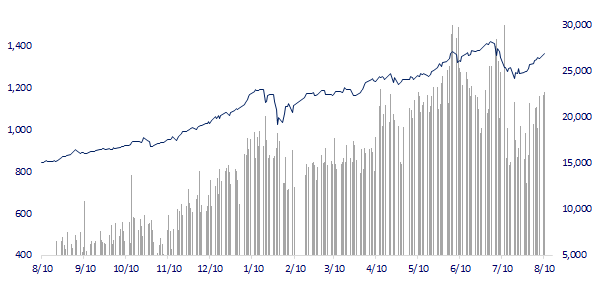

VNINDEX (12M)

GLOBAL MARKET

27,888.15

1D 0.24%

YTD 1.62%

3,529.93

1D 2.07%

YTD 3.38%

3,243.19

1D -0.83%

YTD 12.87%

26,605.62

1D 1.48%

YTD -1.99%

3,207.36

1D 0.95%

YTD 11.79%

1,542.62

1D 1.37%

YTD 6.44%

67.78

1D 1.33%

YTD 40.33%

1,731.45

1D -0.50%

YTD -9.05%

- Asian stocks mixed, investors worried about Covid-19. In Japan, the Nikkei 225 gained 0.24%. The Chinese market rose with the Shanghai Composite up 2.07%. Hong Kong's Hang Seng rose 1.48%. South Korea's Kospi index fell 0.83%.

VIETNAM ECONOMY

0.90%

1D (bps) -3

YTD (bps) 77

5.60%

YTD (bps) -20

1.10%

1D (bps) -8

YTD (bps) -12

2.05%

1D (bps) 12

YTD (bps) 2

22,980

1D (%) -0.20%

YTD (%) -0.85%

27,437

1D (%) -0.50%

YTD (%) -5.72%

3,599

1D (%) -0.25%

YTD (%) 0.73%

- Credit institutions have committed to support interest rates with the amount of VND20,300b from now until the end of the year, taken from the source of profit reduction, depending on the size of the bank. Notably, SBV will closely supervise and ensure that banks properly implement their support commitments in the spirit of the Prime Minister's direction on supporting the economy in the context of economic growth current difficulty.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- SBV supervises credit institutions continuing to reduce interest rates to support people and businesses

- Proposal to reduce registration fee by 50% for electric cars

- New FDI projects in Binh Duong decreased by more than 53% compared to the same period in 2020

- The Delta variant pulled a cloud over the Asian financial market, China had the first month of net withdrawal since Q1.2021

- US: Democrats announce $3.5 trillion spending plan

- Two Fed officials say that will tighten support policy, prompting discussion about raising interest rates

VN30

BANK

99,000

1D 0.71%

5D 0.20%

Buy Vol. 2,880,300

Sell Vol. 2,447,400

43,300

1D 0.35%

5D -0.12%

Buy Vol. 3,316,700

Sell Vol. 4,105,900

34,650

1D 0.29%

5D 1.61%

Buy Vol. 24,425,200

Sell Vol. 23,282,900

52,300

1D -0.38%

5D 0.97%

Buy Vol. 21,948,600

Sell Vol. 26,521,500

60,500

1D -0.82%

5D -0.49%

Buy Vol. 11,195,600

Sell Vol. 11,081,100

29,650

1D -0.84%

5D 1.19%

Buy Vol. 27,032,000

Sell Vol. 28,000,000

35,550

1D 0.14%

5D 1.86%

Buy Vol. 5,030,500

Sell Vol. 7,254,800

36,000

1D 0.28%

5D 4.20%

Buy Vol. 5,579,800

Sell Vol. 6,377,400

30,600

1D -0.33%

5D 2.68%

Buy Vol. 43,786,100

Sell Vol. 59,960,600

36,500

1D 0.00%

5D 1.96%

Buy Vol. 18,878,900

Sell Vol. 23,035,900

- VPB: Approved the plan to issue 15,000,000 ESOP shares from treasury shares (75,219,600 shares). - STB: Has sold 81,562,287 treasury shares, bringing the total number of outstanding shares to 1,803,653,429 shares.

REAL ESTATE

104,600

1D 146.99%

5D 155.43%

Buy Vol. 7,681,400

Sell Vol. 7,722,700

92,900

1D 119.36%

5D 126.86%

Buy Vol. 7,681,400

Sell Vol. 7,722,700

92,900

1D -0.75%

5D -1.06%

Buy Vol. 3,554,600

Sell Vol. 3,828,200

- NVL was among the top stocks that were net sold by foreign investors in today's session with a value of nearly 47 billion dong.

OIL & GAS

96,000

1D 3.23%

5D 3.23%

Buy Vol. 3,359,300

Sell Vol. 3,765,900

11,250

1D 0.90%

5D 4.17%

Buy Vol. 17,393,500

Sell Vol. 20,722,400

53,800

1D 1.70%

5D 5.08%

Buy Vol. 5,884,600

Sell Vol. 6,004,500

- POW: Load demand on the system continues to be low due to Covid-19, July revenue decreased by 10% to VND 2,302 billion

VINGROUP

113,000

1D -0.09%

5D -1.31%

Buy Vol. 4,199,800

Sell Vol. 4,754,000

117,000

1D -0.34%

5D 5.50%

Buy Vol. 13,968,600

Sell Vol. 13,277,000

28,350

1D -0.87%

5D 0.18%

Buy Vol. 7,056,300

Sell Vol. 8,708,100

- VIC: contributed more than VND934b to establish VinES and VinAI.VinES has a charter capital of VND1,000b, mainly engaged in the production of batteries and accumulators.

FOOD & BEVERAGE

89,400

1D 1.94%

5D 2.64%

Buy Vol. 10,571,800

Sell Vol. 10,889,800

138,500

1D -1.77%

5D 0.51%

Buy Vol. 1,637,500

Sell Vol. 1,660,200

154,100

1D -0.64%

5D -0.77%

Buy Vol. 525,700

Sell Vol. 525,500

- MSN: As of August 6, the proportion of MSN shares in the VNM ETF portfolio has risen to the top with 8.1%.

OTHERS

118,700

1D -0.67%

5D 2.33%

Buy Vol. 794,000

Sell Vol. 741,200

118,700

1D -0.67%

5D 2.33%

Buy Vol. 794,000

Sell Vol. 741,200

97,800

1D 0.31%

5D 2.09%

Buy Vol. 4,583,300

Sell Vol. 5,364,600

173,900

1D 0.06%

5D 2.35%

Buy Vol. 1,503,000

Sell Vol. 1,656,500

95,800

1D -0.73%

5D -0.73%

Buy Vol. 785,400

Sell Vol. 793,600

35,000

1D -0.57%

5D 3.86%

Buy Vol. 9,859,200

Sell Vol. 11,880,300

59,400

1D 0.17%

5D 5.13%

Buy Vol. 20,731,400

Sell Vol. 23,230,000

49,400

1D -0.60%

5D 4.55%

Buy Vol. 39,638,400

Sell Vol. 48,255,400

- HPG: Hoa Phat construction steel consumption increased again thanks to public investment works still being carried out. Hoa Phat construction steel consumption volume in July increased by 58% over the previous month and 21% over the same period last year. Sales of businesses in the North and Central regions grew.

Market by numbers

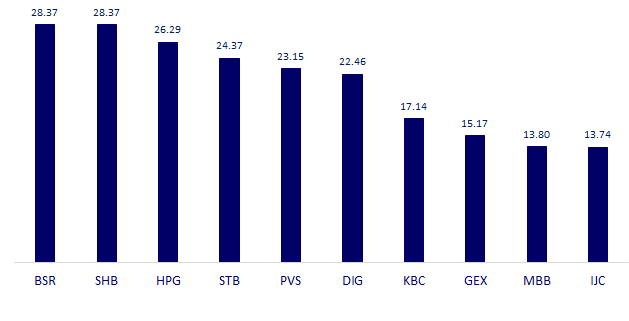

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

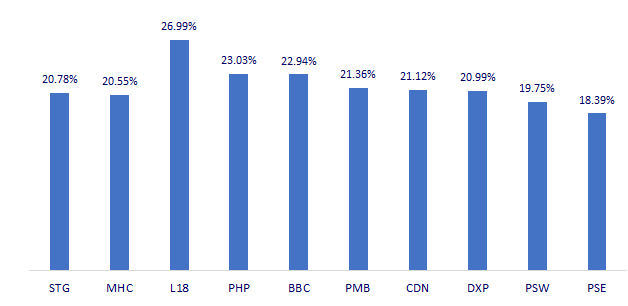

TOP INCREASES 3 CONSECUTIVE SESSIONS

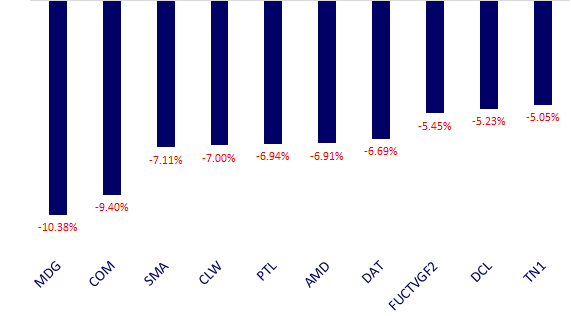

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.