Market Brief 16/08/2021

VIETNAM STOCK MARKET

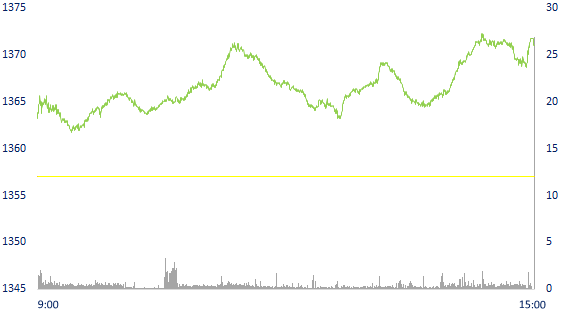

1,370.96

1D 1.03%

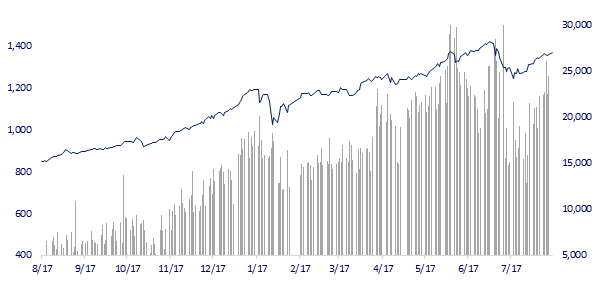

YTD 24.69%

1,500.77

1D 1.11%

YTD 41.80%

343.53

1D 1.95%

YTD 74.29%

94.04

1D 2.03%

YTD 27.37%

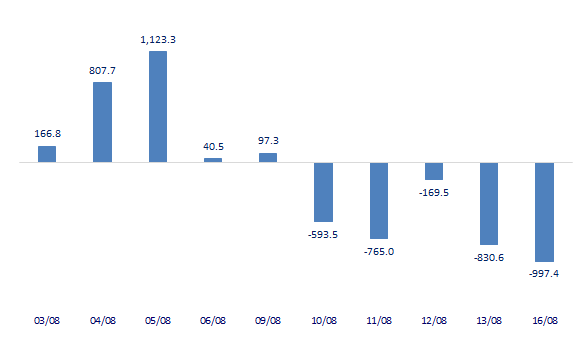

-997.36

1D 0.00%

YTD 0.00%

34,211.48

1D 11.73%

YTD 99.45%

- Contrary to the excitement of the market, foreign investors maintained the 5th consecutive net selling session with a value of more than 997 billion dong on all 3 exchanges. Pressure to "discharge" concentrated goods of blue-chips such as VHM, VIC, HPG, SSI...

ETF & DERIVATIVES

25,300

1D 1.93%

YTD 34.57%

17,770

1D 2.13%

YTD 41.82%

19,580

1D 9.94%

YTD 47.22%

21,900

1D 1.86%

YTD 38.61%

21,550

1D -0.14%

YTD 57.88%

26,200

1D 1.71%

YTD 52.33%

18,750

1D 2.40%

YTD 34.41%

1,480

1D 0.04%

YTD 0.00%

1,499

1D 1.28%

YTD 0.00%

1,498

1D 1.15%

YTD 0.00%

1,503

1D 1.21%

YTD 0.00%

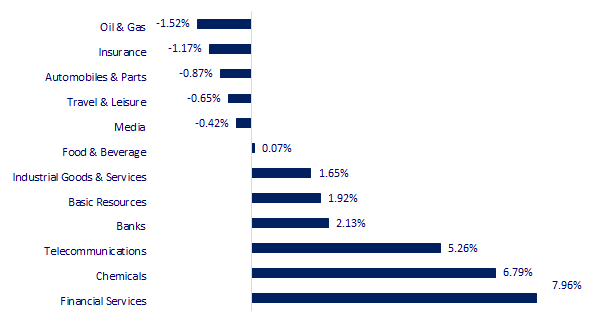

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,523.19

1D -0.23%

YTD 0.29%

3,517.34

1D 0.03%

YTD 3.01%

3,171.29

1D 0.00%

YTD 10.36%

26,181.46

1D -0.37%

YTD -3.56%

3,145.52

1D -0.63%

YTD 9.63%

1,531.24

1D 0.19%

YTD 5.65%

67.30

1D 0.10%

YTD 39.34%

1,777.25

1D -0.29%

YTD -6.64%

- Chinese economic data disappoint, Asian stocks mixed. In Japan, Nikkei fell 0.23%. The Chinese market was mixed with Shanghai Composite up 0.03% and Shenzhen Component down 0.712%. Hong Kong's Hang Seng fell 0.37%. The Korean market is on holiday.

VIETNAM ECONOMY

0.77%

1D (bps) -2

YTD (bps) 64

5.60%

YTD (bps) -20

1.00%

1D (bps) -16

YTD (bps) -22

1.92%

1D (bps) 5

YTD (bps) -11

22,930

1D (%) 0.02%

YTD (%) -1.07%

27,519

1D (%) -0.10%

YTD (%) -5.44%

3,596

1D (%) 0.06%

YTD (%) 0.64%

- According to new data updated by the State Bank, by the end of June 2021, total customer deposits at credit institutions have reached more than 10.4 million billion VND, up 3.84% compared to the previous year. In which, deposits of economic organizations increased sharply to over 5.11 million billion dong, nearly equal to the deposit of the population (more than 5.29 million billion dong).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Finance proposes to increase the debt ceiling by 30% compared to other localities for Da Nang

- Business is difficult, businesses put deposits in banks to earn interest

- Draft Resolution on tax exemption and reduction has been submitted to the National Assembly Standing Committee

- China's production and consumption decelerate more than expected

- World's third busiest container port partially closed for 6 consecutive days

- Malaysian Prime Minister and Cabinet resign

VN30

BANK

100,600

1D 1.00%

5D 2.34%

Buy Vol. 3,069,000

Sell Vol. 2,906,600

43,300

1D 1.76%

5D 0.35%

Buy Vol. 6,189,500

Sell Vol. 5,646,100

35,100

1D 2.33%

5D 1.59%

Buy Vol. 39,320,000

Sell Vol. 37,425,700

54,000

1D 3.45%

5D 2.86%

Buy Vol. 48,975,100

Sell Vol. 46,003,500

65,600

1D 3.14%

5D 7.54%

Buy Vol. 31,810,600

Sell Vol. 22,297,200

31,000

1D 4.73%

5D 3.68%

Buy Vol. 55,239,200

Sell Vol. 49,989,200

35,750

1D 2.88%

5D 0.70%

Buy Vol. 6,609,100

Sell Vol. 5,397,400

37,100

1D 1.92%

5D 3.34%

Buy Vol. 12,040,600

Sell Vol. 11,354,500

30,300

1D 2.02%

5D -1.30%

Buy Vol. 49,135,200

Sell Vol. 43,881,600

35,700

1D 0.99%

5D -2.19%

Buy Vol. 21,859,600

Sell Vol. 22,833,800

- STB: As of June 30, 2021, STB's consolidated equity capital structure reached nearly VND 39,193 billion, of which Tier 1 capital reached VND 30,372 billion and Tier 2 capital reached VND 11,346 billion.

REAL ESTATE

103,800

1D 148.33%

5D 145.10%

Buy Vol. 5,256,900

Sell Vol. 6,318,500

91,700

1D 119.38%

5D 116.53%

Buy Vol. 5,256,900

Sell Vol. 6,318,500

91,700

1D 0.11%

5D -2.03%

Buy Vol. 3,859,100

Sell Vol. 3,734,900

- KDH: Q2.2021, Operating cash flow is -841b dong while HoH is +455 billion dong. This is due to a decrease in payables and an increase in paid corporate income tax.

OIL & GAS

94,200

1D 1.29%

5D 1.29%

Buy Vol. 2,028,100

Sell Vol. 1,718,000

11,450

1D 1.33%

5D 2.69%

Buy Vol. 19,589,900

Sell Vol. 24,932,300

52,100

1D -1.51%

5D -1.51%

Buy Vol. 2,484,000

Sell Vol. 2,656,600

- Domestic individual investors net bought back 5,625 billion dong in the week from 9-13 August on HoSE.PLX was the focus of net selling with the value of 238 billion dong.

VINGROUP

110,600

1D -0.27%

5D -2.21%

Buy Vol. 4,581,200

Sell Vol. 5,605,700

116,000

1D -3.33%

5D -1.19%

Buy Vol. 29,472,100

Sell Vol. 30,073,600

28,500

1D 1.79%

5D -0.35%

Buy Vol. 10,188,900

Sell Vol. 11,536,500

- VIC: registered to sell 100.48m VHM shares (3% of charter capital). Trading time from August 19 to September 17 to increase operating capital and invest in subsidiaries.

FOOD & BEVERAGE

89,500

1D -0.44%

5D 2.05%

Buy Vol. 6,178,500

Sell Vol. 5,685,400

133,500

1D 0.00%

5D -5.32%

Buy Vol. 1,680,400

Sell Vol. 1,752,300

151,600

1D -0.13%

5D -2.26%

Buy Vol. 342,900

Sell Vol. 270,600

- VNM: PLATINUM VICTORY PTE. LTD. haven't bought any shares out of nearly 21 million registered shares. Trading time from July 14, 2021 to August 12, 2021

OTHERS

117,300

1D -0.59%

5D -1.84%

Buy Vol. 662,900

Sell Vol. 733,700

117,300

1D -0.59%

5D -1.84%

Buy Vol. 662,900

Sell Vol. 733,700

94,600

1D 0.64%

5D -1.94%

Buy Vol. 3,106,200

Sell Vol. 3,855,500

170,100

1D -0.53%

5D -2.13%

Buy Vol. 1,936,200

Sell Vol. 1,851,000

94,500

1D 0.00%

5D -2.07%

Buy Vol. 771,900

Sell Vol. 827,300

37,200

1D 6.90%

5D 5.68%

Buy Vol. 20,809,400

Sell Vol. 13,162,500

62,100

1D 5.25%

5D 4.72%

Buy Vol. 30,774,700

Sell Vol. 29,993,900

49,450

1D 1.64%

5D -0.50%

Buy Vol. 33,430,600

Sell Vol. 40,192,900

- MWG: reduce 2020 cash dividend to 5% to ensure business cash flow. Accordingly, with more than 475m shares, MWG will pay more than 237b dong to pay dividends to shareholders. - HPG: Mr. Tran Vu Minh, son of the Chairman, registered to buy 5m shares, increasing the holding amount to 69.8m units (1.56% of capital. The transaction was carried out by agreement method from August 18 to September 16.

Market by numbers

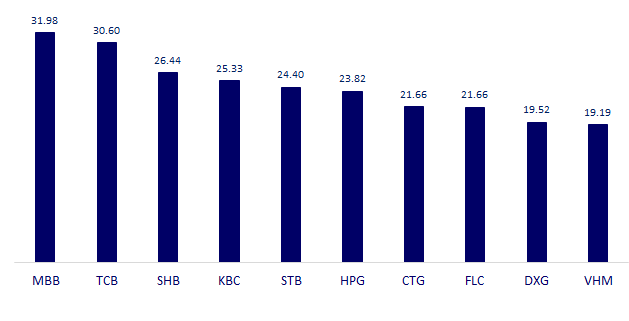

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

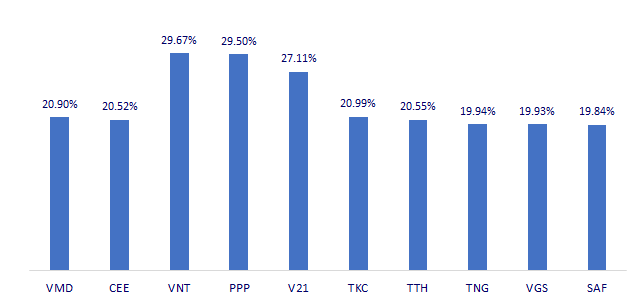

TOP INCREASES 3 CONSECUTIVE SESSIONS

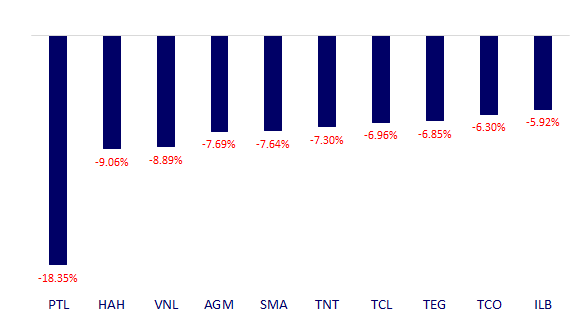

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.