Market Brief 20/08/2021

VIETNAM STOCK MARKET

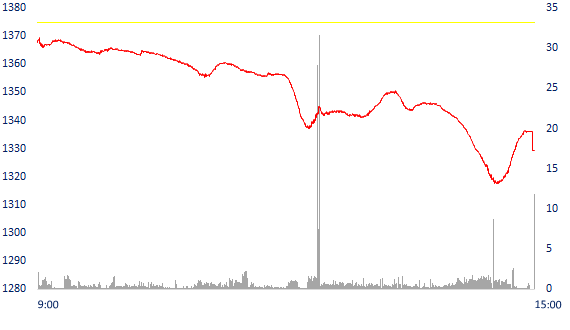

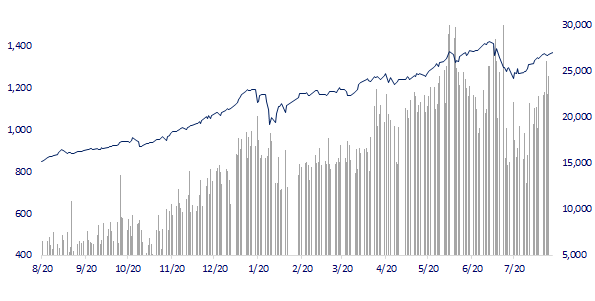

1,329.43

1D -3.30%

YTD 20.91%

1,450.45

1D -3.63%

YTD 37.04%

338.93

1D -2.06%

YTD 71.96%

92.47

1D -2.37%

YTD 25.25%

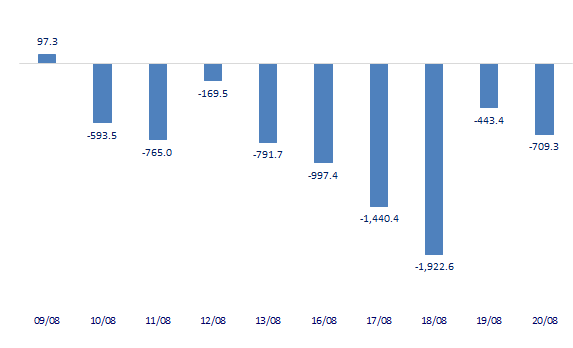

-709.25

1D 0.00%

YTD 0.00%

48,493.23

1D 53.16%

YTD 182.71%

- Session 20/8: Foreign investors continued to net sell more than 709 billion dong in the day VN-Index dropped more than 45 points. The focus of the "discharge" force because foreign investors focused on blue-chips such as HPG, VJC, VIC, CTG, HCM…

ETF & DERIVATIVES

24,100

1D -3.64%

YTD 28.19%

17,200

1D -2.99%

YTD 37.27%

18,670

1D 4.83%

YTD 40.38%

21,100

1D -5.38%

YTD 33.54%

20,950

1D -3.01%

YTD 53.48%

25,210

1D -3.04%

YTD 46.57%

18,170

1D -2.68%

YTD 30.25%

1,443

1D -2.57%

YTD 0.00%

1,443

1D -2.87%

YTD 0.00%

1,445

1D -2.82%

YTD 0.00%

1,445

1D -3.67%

YTD 0.00%

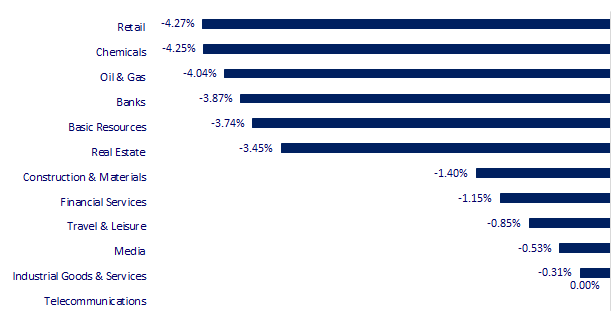

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,013.25

1D -0.31%

YTD -1.57%

3,427.33

1D -1.10%

YTD 0.38%

3,060.51

1D -1.20%

YTD 6.51%

24,849.72

1D -1.08%

YTD -8.46%

3,102.75

1D 0.51%

YTD 8.14%

1,553.18

1D 0.58%

YTD 7.16%

63.01

1D -0.97%

YTD 30.46%

1,787.40

1D 0.06%

YTD -6.11%

- China kept interest rates unchanged, Asian stocks fell. In Japan, Nikkei fell 0.31%. The Chinese market fell with Shanghai Composite down 1.1%, Shenzhen Component down 1.832%. Hong Kong's Hang Seng fell 1.08%. South Korea's Kospi index fell 1.2%.

VIETNAM ECONOMY

0.69%

1D (bps) -2

YTD (bps) 56

5.60%

YTD (bps) -20

1.21%

1D (bps) 5

YTD (bps) -1

1.95%

1D (bps) 8

YTD (bps) -8

22,922

1D (%) -0.01%

YTD (%) -1.10%

27,275

1D (%) -0.03%

YTD (%) -6.28%

3,582

1D (%) -0.06%

YTD (%) 0.25%

- Loan package of 7,500 billion VND to pay employees' salaries, after more than 1 month of implementation, the Bank for Social Policies has only disbursed 170 billion VND, equivalent to 2.2% of the amount of money that can be used for loans to pay employees' salaries.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Excess liquidity, both transactions and interest rates on the interbank dropped sharply

- Importance of Cat Lai port: accounted for 86% of Ho Chi Minh City's import and export container volume

- Loan package of 7,500 billion VND to pay employees' salaries: Only 170 billion VND has been disbursed

- EU solar power output reaches a record high

- The number of deaths from Covid-19 in 42 US states, the worst since December 2020

- Nearly 100 million USD has just been stolen from Japan's largest cryptocurrency exchange

VN30

BANK

100,100

1D -2.63%

5D 0.50%

Buy Vol. 2,844,000

Sell Vol. 3,088,000

40,500

1D -4.71%

5D -4.82%

Buy Vol. 6,342,000

Sell Vol. 6,593,300

32,700

1D -4.66%

5D -4.66%

Buy Vol. 38,926,500

Sell Vol. 42,609,900

50,500

1D -4.72%

5D -3.26%

Buy Vol. 44,576,100

Sell Vol. 49,591,000

62,500

1D -3.25%

5D -1.73%

Buy Vol. 23,859,100

Sell Vol. 24,708,900

29,900

1D -3.86%

5D 1.01%

Buy Vol. 46,901,200

Sell Vol. 52,792,000

34,500

1D -4.17%

5D -0.72%

Buy Vol. 5,678,700

Sell Vol. 7,567,700

35,000

1D -4.63%

5D -3.85%

Buy Vol. 9,149,500

Sell Vol. 10,299,700

28,300

1D -5.51%

5D -4.71%

Buy Vol. 64,971,100

Sell Vol. 66,523,100

33,600

1D -4.82%

5D -4.95%

Buy Vol. 32,774,600

Sell Vol. 33,397,500

- VPB: Share dividend and private placement plans will help VPBank become the private bank with the largest charter capital. The bank will also improve the capital adequacy ratio after increasing equity and charter capital.

REAL ESTATE

103,700

1D 149.58%

5D 148.09%

Buy Vol. 6,437,100

Sell Vol. 7,767,700

85,100

1D 104.81%

5D 103.59%

Buy Vol. 6,437,100

Sell Vol. 7,767,700

85,100

1D -3.62%

5D -7.10%

Buy Vol. 3,964,800

Sell Vol. 4,641,800

- HoREA has pointed out series of inadequacies arising from inconsistent regulations of Housing Law 2014, causing thousands of billions of dong in losses in State enterprises

OIL & GAS

87,500

1D -3.74%

5D -5.91%

Buy Vol. 4,201,500

Sell Vol. 4,004,900

10,900

1D -3.96%

5D -3.54%

Buy Vol. 25,269,400

Sell Vol. 35,139,800

49,600

1D -3.69%

5D -6.24%

Buy Vol. 6,342,700

Sell Vol. 4,006,800

- Gas prices today, natural gas prices in the morning session increased slightly again after yesterday's decline thanks to forecasts of demand recovery.

VINGROUP

97,700

1D -6.06%

5D -0.89%

Buy Vol. 8,794,500

Sell Vol. 10,863,700

108,100

1D -2.61%

5D -9.92%

Buy Vol. 26,670,900

Sell Vol. 27,246,200

27,050

1D -3.22%

5D -3.39%

Buy Vol. 9,847,600

Sell Vol. 11,048,300

- VHM was under pressure to sell 132.42 million shares from Vingroup and KKR recorded a drop of more than 11% from its peak for 3 consecutive sessions.

FOOD & BEVERAGE

87,800

1D -2.77%

5D -2.34%

Buy Vol. 6,420,700

Sell Vol. 7,602,200

133,800

1D -1.83%

5D 0.22%

Buy Vol. 1,770,700

Sell Vol. 1,924,200

143,000

1D -3.38%

5D -5.80%

Buy Vol. 515,600

Sell Vol. 559,000

- SAB may be added to MVIS Vietnam Index due to improved liquidity in the next restructuring

OTHERS

119,800

1D -0.17%

5D 1.53%

Buy Vol. 1,855,400

Sell Vol. 1,913,600

119,800

1D -0.17%

5D 1.53%

Buy Vol. 1,855,400

Sell Vol. 1,913,600

92,800

1D -1.80%

5D -1.28%

Buy Vol. 6,828,900

Sell Vol. 7,082,500

164,000

1D -4.93%

5D -4.09%

Buy Vol. 2,897,100

Sell Vol. 3,453,600

91,500

1D -2.66%

5D -3.17%

Buy Vol. 674,200

Sell Vol. 872,900

36,350

1D -6.31%

5D 4.45%

Buy Vol. 19,070,500

Sell Vol. 20,097,800

62,500

1D -0.32%

5D 5.93%

Buy Vol. 44,889,200

Sell Vol. 41,142,000

49,000

1D -3.73%

5D 0.72%

Buy Vol. 73,180,900

Sell Vol. 82,293,900

- SSI: The largest shareholder of SSI - Daiwa Securities Group Inc. on August 18-19 successfully sold 15.3 million SSI shares (2.33%) registered previously. After the transaction, Daiwa Securities Group Inc's ownership rate in SSI decreased to 15.67%, equivalent to nearly 103 million shares.

Market by numbers

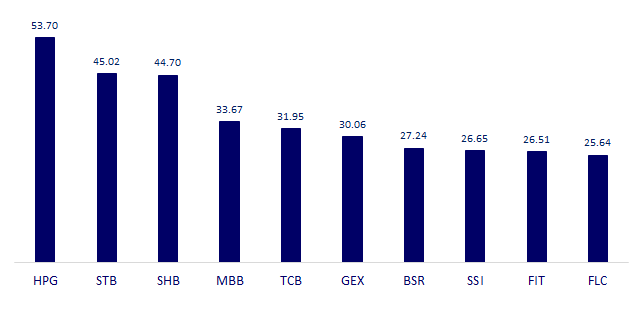

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

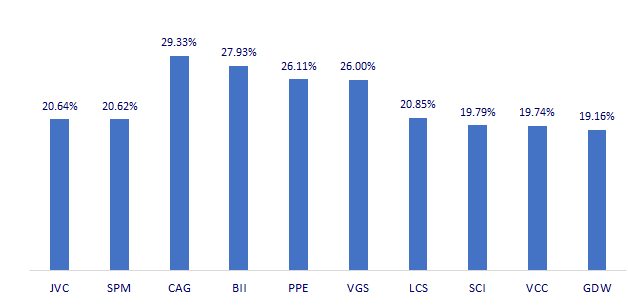

TOP INCREASES 3 CONSECUTIVE SESSIONS

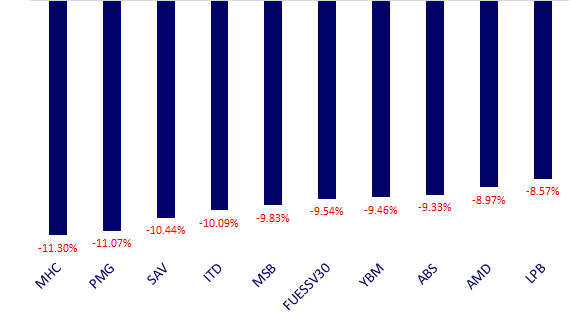

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.