Market brief 25/08/2021

VIETNAM STOCK MARKET

1,309.55

1D 0.83%

YTD 19.11%

1,428.51

1D 0.72%

YTD 34.97%

336.01

1D 1.27%

YTD 70.48%

91.53

1D 0.44%

YTD 23.97%

33.44

1D 0.00%

YTD 0.00%

20,650.65

1D -30.36%

YTD 20.39%

- Session 25/8: Foreign investors continued to be net buyers. SSI and MBB continued to be net suckers with a trading value of over 100 billion dong while VHM was turned to be a net seller of over 152 billion dong.

ETF & DERIVATIVES

24,050

1D 0.42%

YTD 27.93%

16,850

1D 0.60%

YTD 34.48%

19,000

1D 6.68%

YTD 42.86%

21,500

1D 1.90%

YTD 36.08%

20,700

1D 1.47%

YTD 51.65%

24,880

1D -0.88%

YTD 44.65%

17,850

1D 0.00%

YTD 27.96%

1,438

1D 1.40%

YTD 0.00%

1,431

1D 0.87%

YTD 0.00%

1,432

1D 1.23%

YTD 0.00%

1,432

1D 1.16%

YTD 0.00%

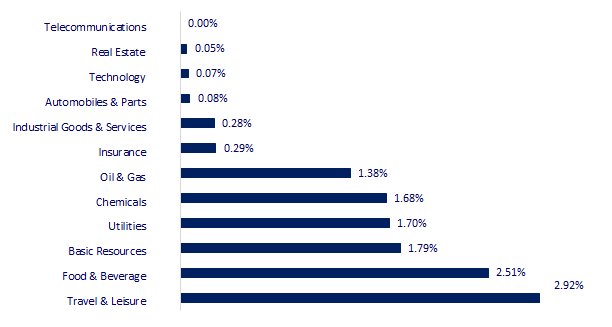

CHANGE IN PRICE BY SECTOR

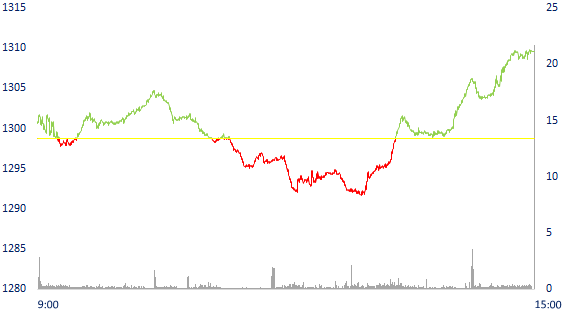

INTRADAY VNINDEX

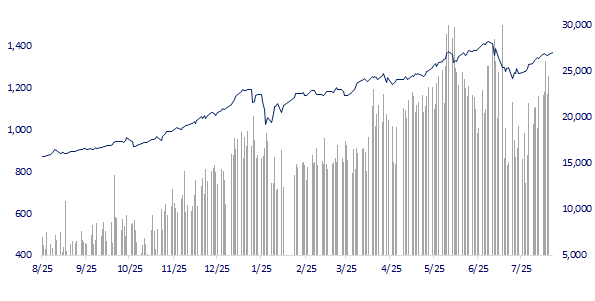

VNINDEX (12M)

GLOBAL MARKET

27,724.80

1D -0.29%

YTD 1.02%

3,540.38

1D 0.74%

YTD 3.69%

3,146.81

1D 0.27%

YTD 9.51%

25,693.95

1D -0.13%

YTD -5.35%

3,107.49

1D 0.00%

YTD 8.30%

1,600.49

1D 0.85%

YTD 10.43%

67.61

1D 0.34%

YTD 39.98%

1,795.95

1D -0.14%

YTD -5.66%

- Wall Street continued to be positive, Asian stocks mixed. In Japan, the Nikkei 225 fell 0.29%. The Chinese market rose with Shanghai Composite up 0.74%, Shenzhen Component up 0.23%. Hong Kong's Hang Seng fell 0.13%. South Korea's Kospi index rose 0.27%.

VIETNAM ECONOMY

0.64%

1D (bps) -1

YTD (bps) 51

5.60%

YTD (bps) -20

1.15%

1D (bps) 14

YTD (bps) -7

1.85%

1D (bps) -11

YTD (bps) -18

22,892

1D (%) -0.10%

YTD (%) -1.23%

27,399

1D (%) -0.03%

YTD (%) -5.86%

3,590

1D (%) -0.17%

YTD (%) 0.48%

- Deputy Prime Minister Le Minh Khai suggested closely monitoring the world economic developments, the general inflation situation to propose comprehensive and long-term measures in the management and administration of prices, stabilizing the macro-economy.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Keeping the price level stable, supporting economic growth

- The journey to reduce interest rates to support customers has not stopped

- From today, August 25, all passenger trains on all railway lines will be temporarily suspended

- The US president's spending plan of nearly 5 trillion USD has reached a new step in the House of Representatives

- The US re-evaluates its trade policy with China

- Fed receives criticism in China

VN30

BANK

97,500

1D 0.52%

5D -3.47%

Buy Vol. 2,119,800

Sell Vol. 2,078,800

39,450

1D 0.13%

5D -7.50%

Buy Vol. 2,581,300

Sell Vol. 2,066,200

32,150

1D -1.83%

5D -6.81%

Buy Vol. 35,302,600

Sell Vol. 32,641,600

49,150

1D 0.31%

5D -6.91%

Buy Vol. 17,848,300

Sell Vol. 14,997,500

61,400

1D 0.66%

5D -4.06%

Buy Vol. 7,922,100

Sell Vol. 6,639,900

28,600

1D 0.18%

5D -8.04%

Buy Vol. 34,620,300

Sell Vol. 26,724,900

33,800

1D 0.30%

5D -5.06%

Buy Vol. 5,148,300

Sell Vol. 7,769,700

34,900

1D 2.50%

5D -6.31%

Buy Vol. 5,858,100

Sell Vol. 3,962,400

27,350

1D 0.37%

5D -8.68%

Buy Vol. 26,235,200

Sell Vol. 17,016,200

32,450

1D 0.46%

5D -8.72%

Buy Vol. 10,576,900

Sell Vol. 9,719,500

- According to statistics from the FS of 29 domestic banks, the total risk provision expense in 1H2021 reached VND 68,577b, up 38% over the same period last year. TOP 10 banks with the largest risk provisions include BID, Agribank, VPBank, CTG, VCB, MBB, SHB, HDB, ACB and STB. The total provision expense of these banks reached VND62,680b, accounting for more than 91% of the total provision of the 29 listed banks. BID was still the bank that made the largest provision for risks in 1H2021 with VND 15,424b, an increase of 49% over the same period.

REAL ESTATE

105,500

1D 0.00%

5D 2.43%

Buy Vol. 3,999,100

Sell Vol. 5,323,100

38,400

1D 1.05%

5D -7.47%

Buy Vol. 2,476,500

Sell Vol. 2,141,900

86,800

1D 0.93%

5D -2.47%

Buy Vol. 4,455,800

Sell Vol. 4,425,500

- KDH: has just approved to sell all 20 million treasury shares to supplement working capital for the Company.

OIL & GAS

87,300

1D 1.51%

5D -5.72%

Buy Vol. 1,318,400

Sell Vol. 1,094,500

11,250

1D 6.64%

5D -1.32%

Buy Vol. 32,985,800

Sell Vol. 18,132,200

49,550

1D 1.54%

5D -3.97%

Buy Vol. 5,455,400

Sell Vol. 1,765,700

- Gas prices in this morning dropped nearly 1% due to concerns about demand in the market. Nymex contract for September delivery was down 4.9cents a day at $3,896.

VINGROUP

94,600

1D -0.84%

5D -3.37%

Buy Vol. 3,906,600

Sell Vol. 3,678,600

107,000

1D -0.28%

5D -2.73%

Buy Vol. 20,060,300

Sell Vol. 20,643,600

26,300

1D 0.57%

5D -5.40%

Buy Vol. 5,303,300

Sell Vol. 3,921,900

- VHM: was the focus of foreign investors' net selling in today's session with a value of 152 billion dong.

FOOD & BEVERAGE

86,900

1D 0.70%

5D -3.44%

Buy Vol. 3,404,400

Sell Vol. 2,612,000

135,000

1D 5.06%

5D 0.37%

Buy Vol. 1,915,400

Sell Vol. 1,661,200

147,200

1D 3.37%

5D 0.82%

Buy Vol. 561,700

Sell Vol. 413,600

- MSN: Masan Group commits to Alibaba to IPO company worth 7 billion USD CrownX before June 2026

OTHERS

127,000

1D 3.42%

5D 7.63%

Buy Vol. 1,864,000

Sell Vol. 1,565,900

127,000

1D 3.42%

5D 7.63%

Buy Vol. 1,864,000

Sell Vol. 1,565,900

91,900

1D 0.00%

5D -2.23%

Buy Vol. 3,127,200

Sell Vol. 2,827,500

161,500

1D 0.62%

5D -6.38%

Buy Vol. 1,142,500

Sell Vol. 1,185,000

89,000

1D 0.79%

5D -6.02%

Buy Vol. 709,900

Sell Vol. 555,300

35,200

1D 3.53%

5D -6.26%

Buy Vol. 7,234,900

Sell Vol. 6,519,200

62,000

1D 1.31%

5D 2.99%

Buy Vol. 24,920,900

Sell Vol. 20,483,500

48,400

1D 1.36%

5D -3.97%

Buy Vol. 33,421,900

Sell Vol. 28,776,400

- HPG: HPG said that public investment projects using Hoa Phat steel for construction such as Vinh Tuy bridge phase 2 (Hanoi) started in January, component items on the North-South expressway, My Thuan 2 bridge (Tien Giang - Vinh Long), project to renovate and upgrade Tan Son Nhat International Airport, project K Hospital 2 (Hanoi), Binh Thuan Provincial General Hospital, Hospital General Hospital in Hoc Mon and Cu Chi (HCMC)…

Market by numbers

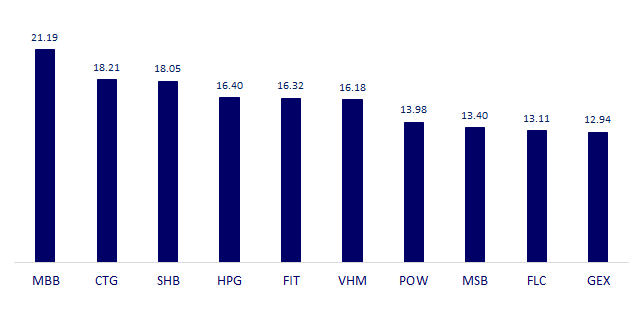

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

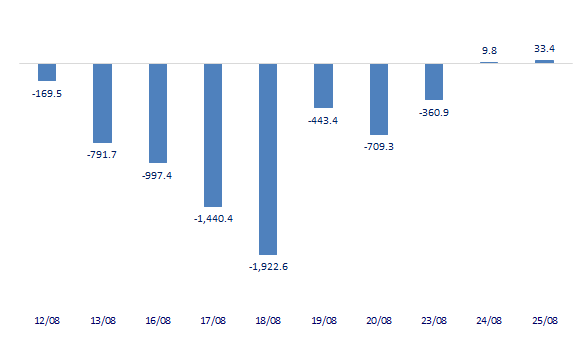

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

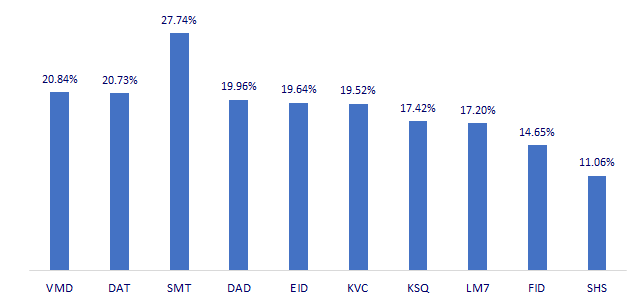

TOP INCREASES 3 CONSECUTIVE SESSIONS

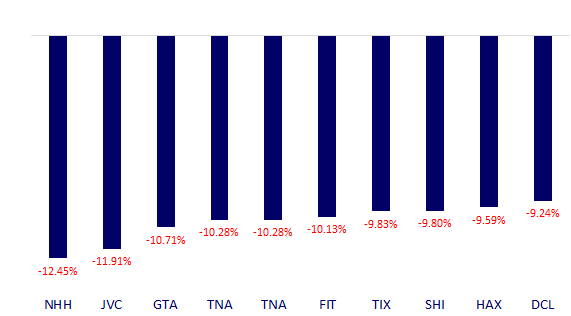

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.