Market Brief 26/08/2021

VIETNAM STOCK MARKET

1,301.12

1D -0.64%

YTD 18.34%

1,412.45

1D -1.12%

YTD 33.45%

336.85

1D 0.25%

YTD 70.90%

91.55

1D 0.02%

YTD 24.00%

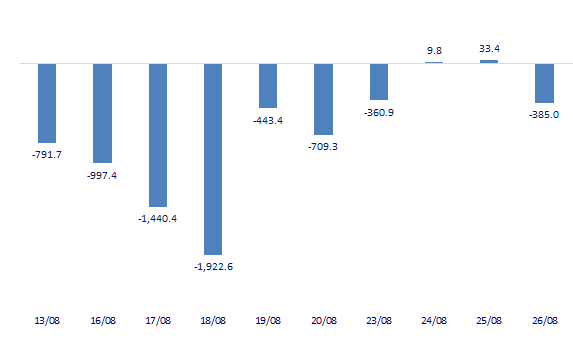

-385.04

1D 0.00%

YTD 0.00%

22,324.10

1D 8.10%

YTD 30.15%

- Session 26/8: After 2 sessions of net buying, foreign investors returned to a net selling of 385 billion dong, of which VHM today was under the strongest selling pressure with a value of nearly 206 billion dong.

ETF & DERIVATIVES

23,990

1D -0.25%

YTD 27.61%

16,710

1D -0.83%

YTD 33.36%

19,500

1D 9.49%

YTD 46.62%

21,000

1D -2.33%

YTD 32.91%

21,000

1D 1.45%

YTD 53.85%

24,880

1D 0.00%

YTD 44.65%

17,760

1D -0.50%

YTD 27.31%

1,406

1D -2.24%

YTD 0.00%

1,407

1D -1.67%

YTD 0.00%

1,406

1D -1.82%

YTD 0.00%

1,407

1D -1.73%

YTD 0.00%

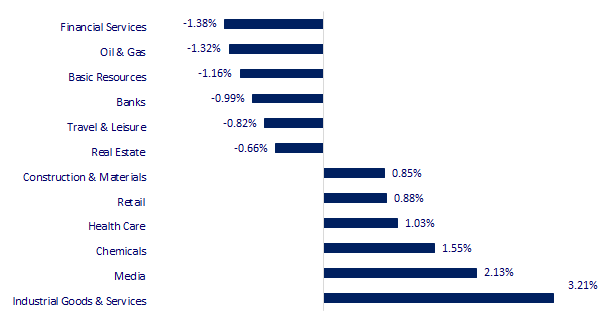

CHANGE IN PRICE BY SECTOR

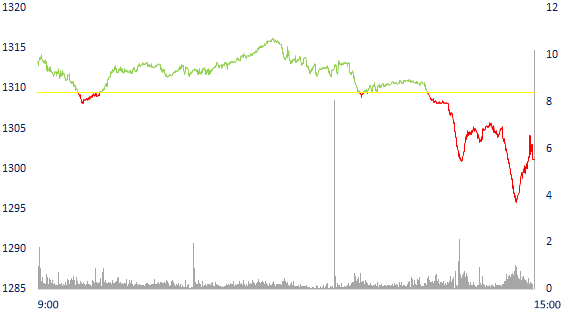

INTRADAY VNINDEX

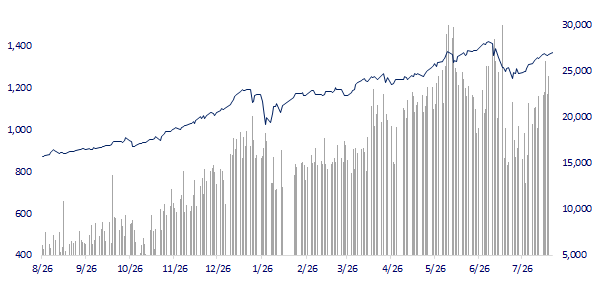

VNINDEX (12M)

GLOBAL MARKET

27,742.29

1D 0.05%

YTD 1.09%

3,501.66

1D -1.09%

YTD 2.55%

3,128.53

1D -0.58%

YTD 8.88%

25,415.69

1D -0.57%

YTD -6.38%

3,109.42

1D 0.06%

YTD 8.37%

1,601.91

1D 0.09%

YTD 10.53%

67.69

1D -0.28%

YTD 40.14%

1,790.05

1D -0.08%

YTD -5.97%

- South Korea raised interest rates, Asian stocks fell. In Japan, the Nikkei 225 gained 0.05%. The Chinese market fell with Shanghai Composite down 1.09%, Shenzhen Component down 1.92%. Hong Kong's Hang Seng fell 0.57%. South Korea's Kospi fell 0.58%

VIETNAM ECONOMY

0.65%

1D (bps) 1

YTD (bps) 52

5.60%

YTD (bps) -20

1.16%

1D (bps) 1

YTD (bps) -6

1.93%

1D (bps) 8

YTD (bps) -10

22,880

1D (%) -0.04%

YTD (%) -1.29%

27,438

1D (%) 0.03%

YTD (%) -5.72%

3,584

1D (%) -0.14%

YTD (%) 0.31%

- The Trade Remedies Administration said that, the Department received information about the Mexican Ministry of Economy receiving an application from the domestic industry to request an anti-dumping investigation for galvanized steel products from Vietnam. Accordingly, the Mexican investigative agency will consider the initiation of an investigation into the case within a maximum of 30 days from the date receipt a complete complaint.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- World Bank: Vietnam's remittances in 2021 will not decline

- Furniture enterprises are still "sitting on fire"

- China's central bank increases cash injection

- Korea becomes the first developed economy to raise interest rates

- The US re-evaluates its trade policy with China

- Reuters: World stocks lose their upward momentum, may be corrected at the end of the year

VN30

BANK

96,800

1D -0.72%

5D -5.84%

Buy Vol. 1,532,700

Sell Vol. 1,786,100

38,600

1D -2.15%

5D -9.18%

Buy Vol. 3,673,300

Sell Vol. 3,322,600

31,200

1D -2.95%

5D -9.04%

Buy Vol. 33,002,800

Sell Vol. 39,268,800

48,300

1D -1.73%

5D -8.87%

Buy Vol. 15,819,300

Sell Vol. 17,706,500

60,800

1D -0.98%

5D -5.88%

Buy Vol. 7,451,500

Sell Vol. 7,609,500

28,100

1D -1.75%

5D -9.65%

Buy Vol. 22,377,000

Sell Vol. 22,155,200

26,850

1D -0.70%

5D -6.77%

Buy Vol. 4,541,700

Sell Vol. 6,478,300

34,100

1D -2.29%

5D -7.08%

Buy Vol. 4,707,300

Sell Vol. 7,068,100

27,100

1D -0.91%

5D -9.52%

Buy Vol. 22,965,700

Sell Vol. 23,250,200

31,950

1D -1.54%

5D -9.49%

Buy Vol. 9,964,100

Sell Vol. 11,085,200

- STB: Recently, EY Vietnam Consulting Joint Stock Company assessed and concluded that Sacombank fully complied with the contents of the Basel II in accordance with Circular 41 and Circular 13 of the State Bank. Thus, Sacombank has officially completed the implementation and application of the Basel II.

REAL ESTATE

103,700

1D -1.71%

5D -1.14%

Buy Vol. 3,772,000

Sell Vol. 4,185,700

38,150

1D -0.65%

5D -8.18%

Buy Vol. 3,165,900

Sell Vol. 3,283,600

83,500

1D -3.80%

5D -5.44%

Buy Vol. 3,632,900

Sell Vol. 4,555,600

- KDH: may be added to the list of 2 VNM ETF and FTSE ETF in the portfolio restructuring period in early September because it has met the liquidity factor in the last 3 quarters

OIL & GAS

86,300

1D -1.15%

5D -5.06%

Buy Vol. 1,264,700

Sell Vol. 1,271,800

11,350

1D 0.89%

5D 0.00%

Buy Vol. 24,661,300

Sell Vol. 32,111,500

48,700

1D -1.72%

5D -5.44%

Buy Vol. 1,365,100

Sell Vol. 1,569,500

- Gas prices today, natural gas prices in this morning's delivery increased again after the previous drop thanks to the recovery in demand.

VINGROUP

93,100

1D -1.59%

5D -10.48%

Buy Vol. 3,312,500

Sell Vol. 2,934,000

106,600

1D -0.37%

5D -3.96%

Buy Vol. 17,162,000

Sell Vol. 19,237,300

26,450

1D 0.57%

5D -5.37%

Buy Vol. 5,215,300

Sell Vol. 4,512,800

- VHM: 1H2021, VHM ranked 2nd in EAT on the stock exchange (after HPG) and brought in VND41,711b in revenue and VND15.629b in net profit, up 82% and 52% HoH.

FOOD & BEVERAGE

87,000

1D 0.12%

5D -3.65%

Buy Vol. 3,565,600

Sell Vol. 3,463,300

134,000

1D -0.74%

5D -1.69%

Buy Vol. 1,596,900

Sell Vol. 2,129,000

147,600

1D 0.27%

5D -0.27%

Buy Vol. 228,000

Sell Vol. 369,700

- MSN: A subsidiary of BoD, Hoa Huong Duong Construction JSC. registered to buy 1m MSN shares, bringing the total ownership to more than 157.7 million shares (13.36%).

OTHERS

125,800

1D -0.94%

5D 4.83%

Buy Vol. 1,219,900

Sell Vol. 1,468,500

125,800

1D -0.94%

5D 4.83%

Buy Vol. 1,219,900

Sell Vol. 1,468,500

91,400

1D -0.54%

5D -3.28%

Buy Vol. 3,164,900

Sell Vol. 3,476,300

162,000

1D 0.31%

5D -6.09%

Buy Vol. 1,064,200

Sell Vol. 1,382,100

86,200

1D -3.15%

5D -8.30%

Buy Vol. 846,400

Sell Vol. 1,003,700

35,500

1D 0.85%

5D -8.51%

Buy Vol. 7,815,500

Sell Vol. 8,912,400

61,100

1D -1.45%

5D -2.55%

Buy Vol. 25,087,600

Sell Vol. 25,127,500

47,700

1D -1.45%

5D -6.29%

Buy Vol. 24,531,500

Sell Vol. 27,868,100

- HPG: produced more than 4m tons of crude steel in 6 months, up 55% HoH. Sales volume of steel products reached nearly 4.3m tons, up more than 60%. Construction steel reached 1.8m tons, up 22%, leading the market share in Vietnam with 34.6%. Output of hot rolled coil reached 1.3m tons, steel pipe 375,000 tons. Galvanized steel production was recorded at nearly 160,000 tons, 2.8 times higher than the same period last year.

Market by numbers

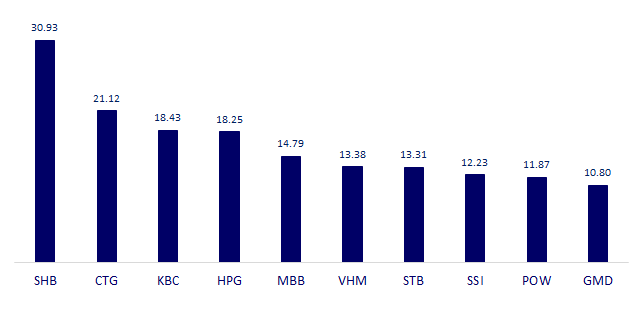

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

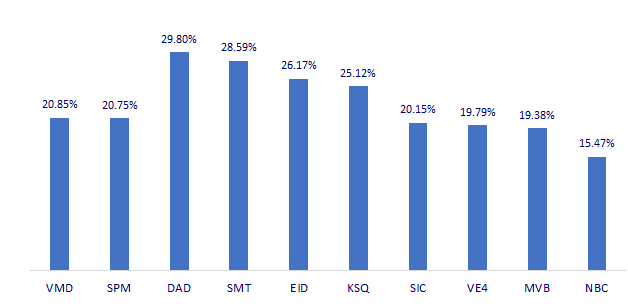

TOP INCREASES 3 CONSECUTIVE SESSIONS

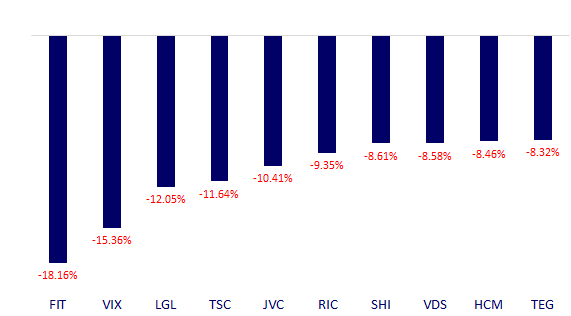

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.