Market Brief 01/09/2021

VIETNAM STOCK MARKET

1,334.65

1D 0.24%

YTD 21.39%

1,426.94

1D -0.12%

YTD 34.82%

343.42

1D 0.18%

YTD 74.24%

94.01

1D 0.26%

YTD 27.33%

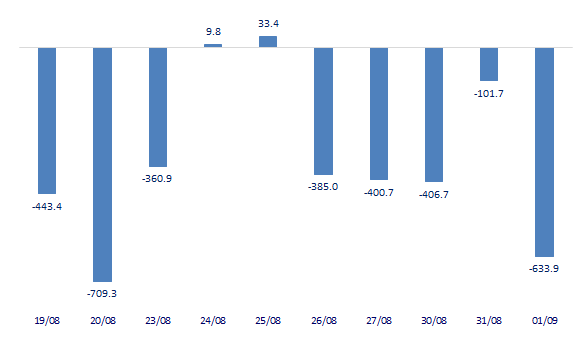

-633.93

1D 0.00%

YTD 0.00%

29,281.52

1D 3.78%

YTD 70.71%

- Continuing in the first session of September, foreign investors recorded a net selling of 634 billion dong on all 3 exchanges, of which MSN, VHM and fund certificates FUEVFVND were sold the most with a value of over 200 billion dong.

ETF & DERIVATIVES

24,050

1D -0.21%

YTD 27.93%

16,840

1D 0.06%

YTD 34.40%

18,000

1D 1.07%

YTD 35.34%

20,800

1D -0.95%

YTD 31.65%

20,550

1D 2.14%

YTD 50.55%

24,840

1D -0.72%

YTD 44.42%

18,150

1D 0.00%

YTD 30.11%

1,425

1D 0.12%

YTD 0.00%

1,429

1D 0.11%

YTD 0.00%

1,427

1D 0.00%

YTD 0.00%

1,429

1D 0.11%

YTD 0.00%

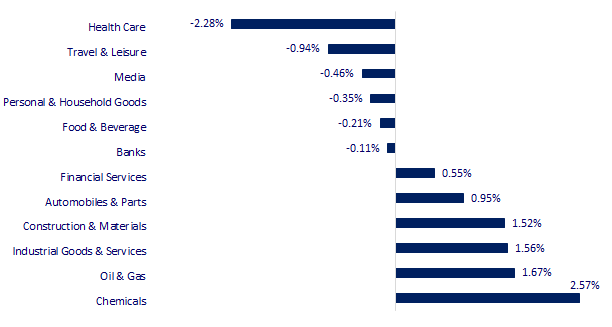

CHANGE IN PRICE BY SECTOR

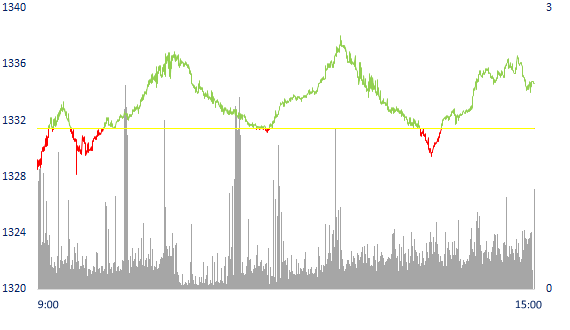

INTRADAY VNINDEX

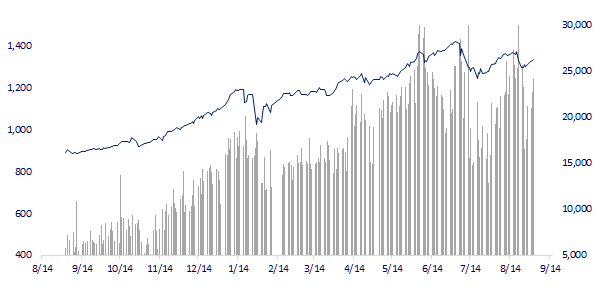

VNINDEX (12M)

GLOBAL MARKET

28,451.02

1D 0.56%

YTD 3.67%

3,567.10

1D 0.65%

YTD 4.47%

3,207.02

1D 0.24%

YTD 11.61%

26,028.29

1D 1.36%

YTD -4.12%

3,087.84

1D 1.07%

YTD 7.62%

1,634.48

1D -0.26%

YTD 12.77%

68.62

1D -0.16%

YTD 42.07%

1,815.80

1D 0.07%

YTD -4.61%

- More bad signals from the Chinese economy, Asian stocks mixed. In Japan, the Nikkei 225 gained 0.56%. The Chinese market was mixed with Shanghai Composite up 0.65%, Shenzhen Component down 0.1%. Hong Kong's Hang Seng rose 1.36%. South Korea's Kospi index rose 0.24%.

VIETNAM ECONOMY

0.63%

1D (bps) -6

YTD (bps) 50

5.60%

YTD (bps) -20

1.16%

YTD (bps) -6

1.89%

1D (bps) -1

YTD (bps) -14

22,870

1D (%) 0.00%

YTD (%) -1.33%

27,535

1D (%) 0.16%

YTD (%) -5.39%

3,591

1D (%) -0.08%

YTD (%) 0.50%

- According to the Hanoi Statistics Office, in August 2021, Hanoi has 12 newly licensed FDI projects with a total registered capital of 17.6 million USD. Besides, there are 2 projects adjusted to increase investment capital with the registered investment capital reaching 47 thousand USD; Foreign investors contributed capital and bought shares 7 times, reaching 1.1 million USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In 8 months, Hanoi city attracted more than 840 million USD of FDI capital

- WB Group cooperates Australian Gov. to support development of Vietnam's capital market, focus on attracting foreign investors

- Worried about a sudden increase in bad debts, proposing a separate resolution to remove difficulties for the bank

- A series of Asian 'factories' reduced production due to Covid-19

- US investors lower margin for the first time since the outbreak of Covid-19

- WHO monitors new variant of SARS-CoV-2 that is resistant to vaccines

VN30

BANK

99,400

1D 0.00%

5D 1.95%

Buy Vol. 1,853,100

Sell Vol. 1,944,700

39,000

1D 0.13%

5D -1.14%

Buy Vol. 2,904,200

Sell Vol. 2,505,600

32,050

1D 0.79%

5D -0.31%

Buy Vol. 24,282,200

Sell Vol. 26,558,700

48,300

1D -0.41%

5D -1.73%

Buy Vol. 15,490,700

Sell Vol. 15,954,100

61,500

1D -0.16%

5D 0.16%

Buy Vol. 12,184,000

Sell Vol. 11,395,800

27,900

1D 0.00%

5D -2.45%

Buy Vol. 23,900,300

Sell Vol. 24,155,300

25,650

1D -1.16%

5D -5.14%

Buy Vol. 5,942,500

Sell Vol. 5,434,600

34,200

1D 0.29%

5D -2.01%

Buy Vol. 3,706,600

Sell Vol. 4,859,800

27,200

1D -0.55%

5D -0.55%

Buy Vol. 25,646,100

Sell Vol. 18,163,600

32,000

1D 0.00%

5D -1.39%

Buy Vol. 16,591,000

Sell Vol. 15,915,300

- According to the provisions of Circular 11/2021/TT-NHNN issued by the State Bank of Vietnam on July 30, 2021, stipulating the method of setting up risk provisions, the general provision amount must be equal to 0.75 % of total outstanding loans from group 1 to group 4, Vietcombank is the bank with the highest bad debt coverage ratio of 366%. Followed by Techcombank (259%), MB (237%) and ACB (208%). Some other banks have a bad debt coverage ratio of over 100% such as TPBank (145%), BAB (137%), BIDV (131%).

REAL ESTATE

104,700

1D 0.29%

5D -0.76%

Buy Vol. 3,431,800

Sell Vol. 3,648,900

39,300

1D -1.13%

5D 2.34%

Buy Vol. 2,795,300

Sell Vol. 2,527,800

85,700

1D -2.50%

5D -1.27%

Buy Vol. 3,744,500

Sell Vol. 4,434,500

- TCH: Will sell 199,587,872 shares to existing shareholders and issue 19,958,787 shares to pay dividends.

OIL & GAS

88,600

1D -0.89%

5D 1.49%

Buy Vol. 777,500

Sell Vol. 1,109,500

12,450

1D 5.06%

5D 10.67%

Buy Vol. 56,335,800

Sell Vol. 52,836,700

50,800

1D 2.21%

5D 2.52%

Buy Vol. 2,224,100

Sell Vol. 2,860,900

- POW: NPAT in the first 6 months of 2021 increased by VND 144b over the same period mainly thank to an increase in profit from financial activities to VND 502b.

VINGROUP

94,100

1D 0.00%

5D -0.53%

Buy Vol. 2,042,000

Sell Vol. 2,808,100

107,000

1D 0.56%

5D 0.00%

Buy Vol. 29,719,300

Sell Vol. 30,277,500

27,900

1D 2.20%

5D 6.08%

Buy Vol. 6,665,500

Sell Vol. 7,463,000

- VHM: will pay a cash dividend (rate 15%) on October 1, the amount expected to be spent is VND 5.024b. At the same time, VHM will issue 1b shares (rate 30%) to pay dividends

FOOD & BEVERAGE

88,100

1D 0.80%

5D 1.38%

Buy Vol. 5,916,400

Sell Vol. 6,365,700

133,300

1D -1.26%

5D -1.26%

Buy Vol. 1,927,000

Sell Vol. 2,076,500

148,700

1D -0.87%

5D 1.02%

Buy Vol. 158,000

Sell Vol. 277,100

- MSN: The investment fund group GIC wants to sell 19.5m MSN. At the beginning of the year, this group also sold about 20m MSN, earning 1,700 billion dong.

OTHERS

125,500

1D -0.79%

5D -1.18%

Buy Vol. 999,600

Sell Vol. 1,171,900

125,500

1D -0.79%

5D -1.18%

Buy Vol. 999,600

Sell Vol. 1,171,900

92,400

1D 0.00%

5D 0.54%

Buy Vol. 2,903,300

Sell Vol. 2,987,800

110,200

1D -0.72%

5D 2.67%

Buy Vol. 1,148,300

Sell Vol. 1,145,700

85,300

1D -0.81%

5D -4.16%

Buy Vol. 1,636,000

Sell Vol. 1,419,600

40,100

1D 3.48%

5D 13.92%

Buy Vol. 14,812,100

Sell Vol. 16,432,800

61,200

1D -0.97%

5D -1.29%

Buy Vol. 19,472,600

Sell Vol. 20,555,500

49,200

1D -0.20%

5D 1.65%

Buy Vol. 24,177,500

Sell Vol. 34,204,500

- BVH: Head of Supervisory Board Tien Hung registered to sell all 57,239 shares by order matching method from September 7 to October 6. - VJC: approved by the State Securities Commission to postpone the publication of the reviewed semi-annual financial statements for 2021

Market by numbers

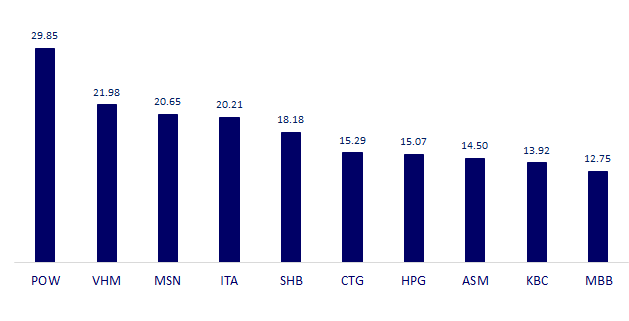

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

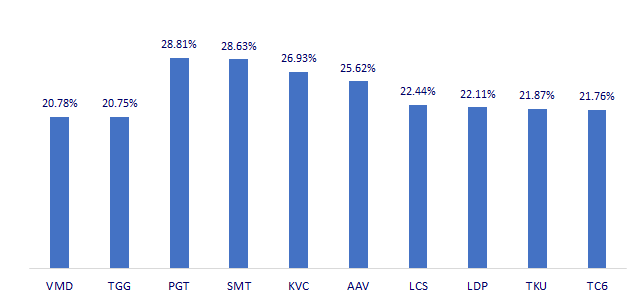

TOP INCREASES 3 CONSECUTIVE SESSIONS

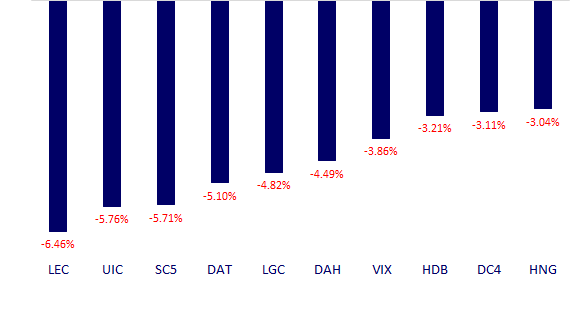

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.