Market Brief 17/09/2021

VIETNAM STOCK MARKET

1,352.64

1D 0.50%

YTD 23.02%

1,455.59

1D 0.46%

YTD 37.53%

357.97

1D 1.34%

YTD 81.62%

97.40

1D 1.19%

YTD 31.92%

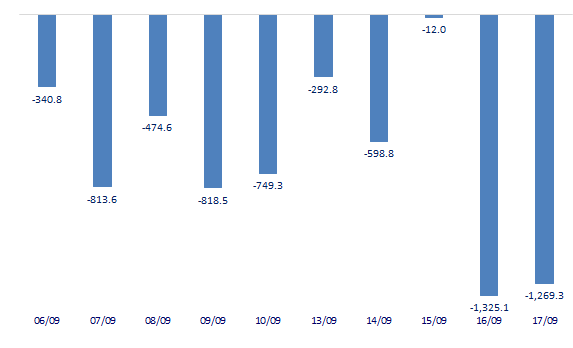

-1,269.25

1D 0.00%

YTD 0.00%

32,437.57

1D 37.86%

YTD 89.11%

- Foreign investors net sold on HoSE, bought a record on HNX on September 17. On HoSE, foreign investors had a sudden net selling of 1,703 billion dong, up 29% compared to the previous session, equivalent to a volume of 52 million shares. Thus, foreign investors on HoSE were net sellers for 16 consecutive sessions with a total value of 9,076 billion dong.

ETF & DERIVATIVES

24,560

1D 0.66%

YTD 30.64%

17,200

1D 0.58%

YTD 37.27%

18,150

1D 1.91%

YTD 36.47%

21,400

1D 0.47%

YTD 35.44%

20,390

1D 0.94%

YTD 49.38%

26,100

1D 3.98%

YTD 51.74%

18,350

1D 0.49%

YTD 31.54%

1,453

1D 1.23%

YTD 0.00%

1,453

1D 0.72%

YTD 0.00%

1,457

1D 1.12%

YTD 0.00%

1,450

1D 0.00%

YTD 0.00%

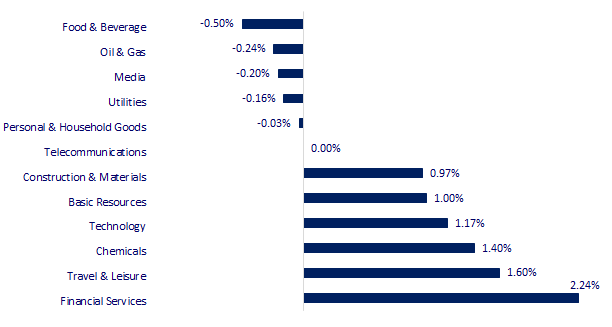

CHANGE IN PRICE BY SECTOR

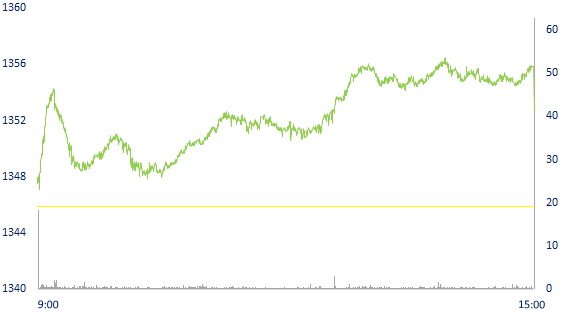

INTRADAY VNINDEX

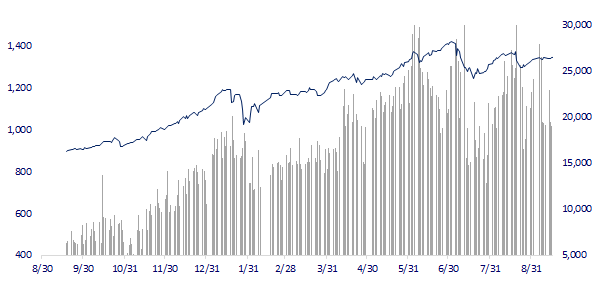

VNINDEX (12M)

GLOBAL MARKET

30,500.05

1D 0.10%

YTD 11.13%

3,613.97

1D 0.19%

YTD 5.84%

3,140.51

1D 0.33%

YTD 9.29%

24,920.76

1D 1.03%

YTD -8.20%

3,071.23

1D 0.22%

YTD 7.04%

1,625.65

1D -0.37%

YTD 12.16%

72.16

1D -0.43%

YTD 49.40%

1,763.45

1D 0.39%

YTD -7.36%

- Asian stocks mixed on Wall Street. In Japan, the Nikkei 225 gained 0.1%. The Chinese market rose with Shanghai Composite up 0.19%, Shenzhen Component up 0.71%. Hong Kong's Hang Seng rose 1.03%, after falling nearly 6% from the beginning of the week to the close of the session on September 16 due to concerns related to authorities tightening regulations on the technology and casino sectors. South Korea's Kospi index rose 0.33%.

VIETNAM ECONOMY

0.64%

1D (bps) -2

YTD (bps) 51

5.60%

YTD (bps) -20

1.08%

1D (bps) 6

YTD (bps) -14

1.86%

1D (bps) 13

YTD (bps) -17

22,870

1D (%) 0.07%

YTD (%) -1.33%

27,458

1D (%) 0.25%

YTD (%) -5.65%

3,597

1D (%) 0.08%

YTD (%) 0.67%

- The report on industrial production and commercial activities of the Ministry of Industry and Trade has just been released, showing that industrial production in August was heavily affected when the COVID-19 epidemic continued to develop complicatedly, many Localities must practice social distancing. The figures show that the index of industrial production (IIP) fell 4.2% month-on-month and down 7.4% yoy.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The National Assembly approved a package of exemption and reduction taxes for businesses worth 21,000 billion VND

- The Ministry of Finance spoke out about the information "the state budget is almost no longer available"

- Exports wobble because of supply chain interruption

- China faces a winter without electricity

- Copper prices fell when China announced to 'discharge' further national reserves

- Singapore sets up more than 1 billion USD fund to promote stock market

VN30

BANK

97,200

1D -0.92%

5D -2.02%

Buy Vol. 2,178,100

Sell Vol. 1,875,200

40,000

1D 1.52%

5D 0.88%

Buy Vol. 3,086,000

Sell Vol. 3,963,400

31,800

1D 0.47%

5D -1.55%

Buy Vol. 10,697,100

Sell Vol. 14,428,500

49,750

1D 1.32%

5D 0.91%

Buy Vol. 13,290,700

Sell Vol. 15,335,700

67,000

1D 3.08%

5D 3.72%

Buy Vol. 21,282,700

Sell Vol. 22,741,100

27,850

1D 0.18%

5D -1.24%

Buy Vol. 16,366,200

Sell Vol. 19,532,400

25,450

1D 1.39%

5D -1.74%

Buy Vol. 3,914,600

Sell Vol. 3,732,600

40,800

1D 5.56%

5D 9.09%

Buy Vol. 19,362,600

Sell Vol. 17,970,900

26,800

1D 0.19%

5D -1.47%

Buy Vol. 31,886,600

Sell Vol. 25,530,500

31,600

1D 0.96%

5D -2.17%

Buy Vol. 8,690,700

Sell Vol. 8,268,300

- TPB: Tien Phong Commercial Joint Stock Bank (TPBank) has successfully implemented the 24/7 port infrastructure fee collection feature and became one of the first banks in Vietnam to provide this service.

REAL ESTATE

103,200

1D 0.10%

5D -0.10%

Buy Vol. 4,564,700

Sell Vol. 4,041,000

42,000

1D -1.64%

5D 3.58%

Buy Vol. 11,552,200

Sell Vol. 13,484,800

80,000

1D -2.20%

5D -2.79%

Buy Vol. 7,707,500

Sell Vol. 5,676,200

- NVL: Gia Phu Real Estate Company Limited, a subsidiary of Novaland, has just issued VND200 billion of bonds.

OIL & GAS

91,900

1D -0.76%

5D 3.72%

Buy Vol. 1,250,600

Sell Vol. 1,655,800

11,750

1D -0.42%

5D -2.89%

Buy Vol. 35,328,400

Sell Vol. 31,727,300

50,700

1D -0.59%

5D 0.40%

Buy Vol. 2,024,500

Sell Vol. 2,075,100

- GAS: 8 months EAT reaches VND5,700 billion, forecast to continue to face difficulties until the fourth quarter of 2021 due to Covid-19 pressure

VINGROUP

86,800

1D -1.14%

5D -4.93%

Buy Vol. 8,947,000

Sell Vol. 8,341,400

81,200

1D 1.37%

5D -0.40%

Buy Vol. 11,945,300

Sell Vol. 12,352,700

29,200

1D -2.67%

5D 4.29%

Buy Vol. 20,761,800

Sell Vol. 20,611,100

- VIC: On September 15, Vinpearl successfully offered $425m international bonds with the option to receive VIC shares. The bond matures in 2026, the interest rate is 3.25%/year.

FOOD & BEVERAGE

86,500

1D 0.12%

5D 0.00%

Buy Vol. 10,593,300

Sell Vol. 9,533,700

146,000

1D -2.54%

5D 12.31%

Buy Vol. 4,376,000

Sell Vol. 3,844,400

161,000

1D 0.00%

5D 6.34%

Buy Vol. 1,529,400

Sell Vol. 1,032,300

- VNM: SCIC members will not divest, Platinum Victory Pte. Ltd continues to register to buy more shares

OTHERS

124,900

1D -0.87%

5D -3.78%

Buy Vol. 1,456,200

Sell Vol. 1,586,200

124,900

1D -0.87%

5D -3.78%

Buy Vol. 1,456,200

Sell Vol. 1,586,200

95,700

1D 1.06%

5D 2.35%

Buy Vol. 5,457,800

Sell Vol. 7,528,700

123,000

1D -0.49%

5D 3.45%

Buy Vol. 1,469,800

Sell Vol. 1,531,600

92,500

1D -0.54%

5D -1.60%

Buy Vol. 664,900

Sell Vol. 919,800

38,550

1D 0.39%

5D -1.91%

Buy Vol. 6,590,500

Sell Vol. 7,226,800

43,000

1D 1.18%

5D -1.83%

Buy Vol. 28,570,700

Sell Vol. 21,866,600

51,800

1D 0.97%

5D 0.58%

Buy Vol. 36,138,900

Sell Vol. 52,337,100

- FPT: announced business results for the first 8 months of the year with revenue and pre-tax profit of VND 21,842 billion and VND 4,005 billion, up 19.2% and 19.8% over the same period. Pre-tax profit margin increased from 18.2% to 18.3%. Profit after tax for shareholders of the parent company and EPS reached VND 2,629 billion and VND 2,904 respectively, up 17.0% and 16.4% respectively.

Market by numbers

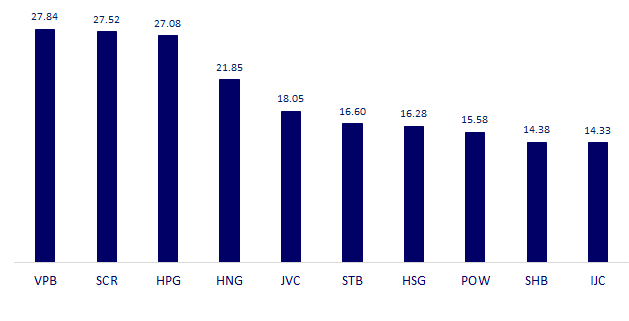

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

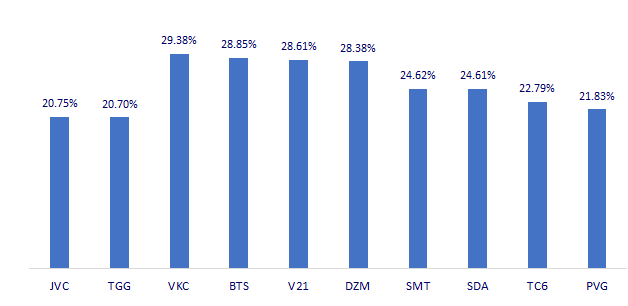

TOP INCREASES 3 CONSECUTIVE SESSIONS

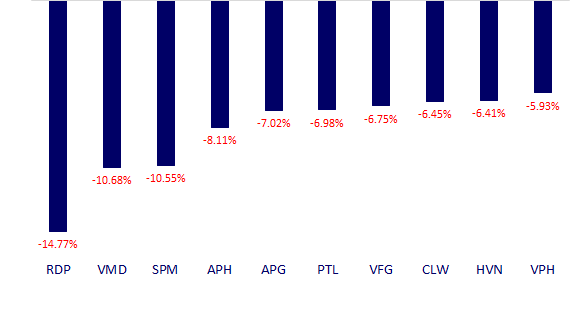

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.