Market Brief 01/10/2021

VIETNAM STOCK MARKET

1,334.89

1D -0.53%

YTD 21.41%

1,441.83

1D -0.82%

YTD 36.23%

356.49

1D -0.24%

YTD 80.87%

95.98

1D -0.60%

YTD 30.00%

-543.28

1D 0.00%

YTD 0.00%

28,108.49

1D 49.67%

YTD 63.87%

- Session 1/10: Foreign investors boosted a net selling of 539 billion dong in the whole market, in which MSN, VCB and the "trio" of VHM, VIC, VRE were under the strongest net selling pressure with a value of 50 billion dong or more.

ETF & DERIVATIVES

24,570

1D 0.08%

YTD 30.69%

17,010

1D -0.76%

YTD 35.75%

18,430

1D 3.48%

YTD 38.57%

21,000

1D -1.41%

YTD 32.91%

20,300

1D 0.00%

YTD 48.72%

25,600

1D -2.48%

YTD 48.84%

18,170

1D -0.98%

YTD 30.25%

1,432

1D -0.89%

YTD 0.00%

1,437

1D -0.73%

YTD 0.00%

1,440

1D -0.79%

YTD 0.00%

1,441

1D -0.77%

YTD 0.00%

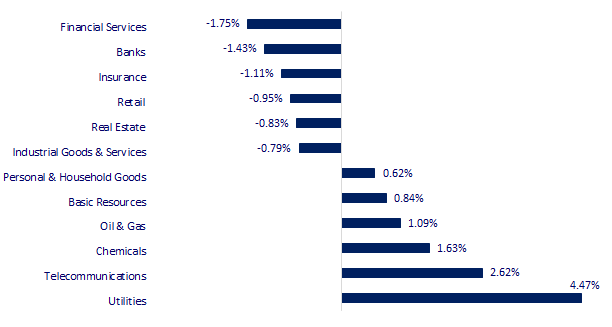

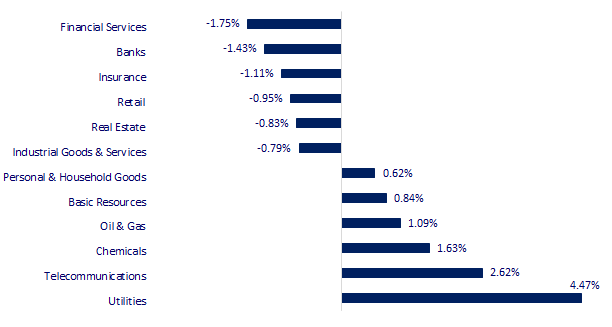

CHANGE IN PRICE BY SECTOR

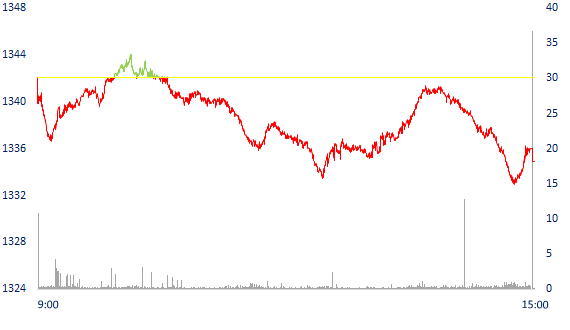

INTRADAY VNINDEX

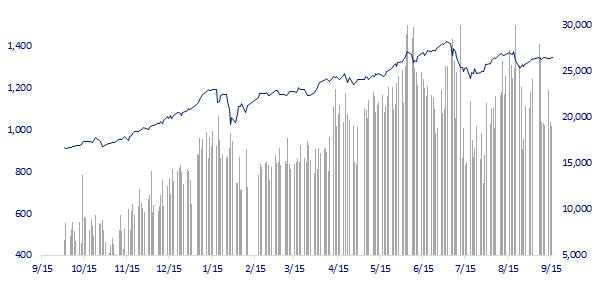

VNINDEX (12M)

GLOBAL MARKET

28,771.07

1D -0.45%

YTD 4.83%

3,568.17

1D 0.00%

YTD 4.50%

3,019.18

1D -1.62%

YTD 5.07%

24,575.64

1D 0.00%

YTD -9.47%

3,051.11

1D -1.15%

YTD 6.34%

1,605.17

1D -0.03%

YTD 10.75%

74.52

1D -0.61%

YTD 54.29%

1,755.30

1D 0.01%

YTD -7.79%

- Asian stocks fall, China markets into Golden Week. In Japan, the Nikkei 225 fell 0.45%. The Chinese market is closed for Golden Week from October 1 to 7. The Hong Kong market is also closed for a holiday today. South Korea's Kospi index fell 1.62%.

VIETNAM ECONOMY

0.65%

1D (bps) -2

YTD (bps) 52

5.60%

YTD (bps) -20

1.09%

1D (bps) 10

YTD (bps) -13

2.01%

1D (bps) 11

YTD (bps) -2

22,857

1D (%) -0.01%

YTD (%) -1.38%

26,967

1D (%) 0.03%

YTD (%) -7.34%

3,600

1D (%) -0.03%

YTD (%) 0.76%

- Cement exports in 9 months increased by 19%, while consumption of cement products in the domestic market since the beginning of the year has remained stable compared to the same period in 2020, cement exports have grown strongly, reaching nearly 32 million tons and up to 19%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The scale of Vietnam's Covid-19 support packages is about 10.45 billion USD

- September PMI continues to be the lowest since April 2020, employment declines unseen in 10 years

- Cement exports in 9 months increased by 19%

- Global supply disruptions could get worse

- Europe faces the risk of energy crisis in the winter

- Production in a series of Asian economies declines

VN30

BANK

95,900

1D -1.34%

5D -3.62%

Buy Vol. 2,414,600

Sell Vol. 2,224,700

38,800

1D -1.65%

5D -2.27%

Buy Vol. 3,195,800

Sell Vol. 2,571,800

29,750

1D -2.14%

5D -6.15%

Buy Vol. 19,624,600

Sell Vol. 19,201,700

49,000

1D -1.21%

5D -3.16%

Buy Vol. 9,660,300

Sell Vol. 11,124,600

63,900

1D -3.03%

5D -4.63%

Buy Vol. 11,904,900

Sell Vol. 14,730,700

27,450

1D -1.44%

5D -4.36%

Buy Vol. 20,740,000

Sell Vol. 22,872,400

24,850

1D -2.17%

5D -2.55%

Buy Vol. 2,965,900

Sell Vol. 3,672,700

42,600

1D 2.40%

5D 2.40%

Buy Vol. 22,202,300

Sell Vol. 22,571,700

24,700

1D -3.89%

5D -7.66%

Buy Vol. 41,540,100

Sell Vol. 40,952,400

31,500

1D -0.16%

5D -1.56%

Buy Vol. 9,335,500

Sell Vol. 10,504,600

- In the first morning trading session of October, banking stocks still haven't escaped the downtrend. Many codes found new bottoms of 5-6 months ago due to strong selling. During the session, up to 25/27 bank codes dropped, only TPBank of TPBank and NVB of the National Bank escaped the fire. TPB was supported by the news that foreign investors wanted to collect 28 million shares ahead of the bank's 2nd capital increase plan and NVB had a 2nd consecutive increase after falling the most in banking in the previous session.

REAL ESTATE

102,000

1D 0.00%

5D -0.97%

Buy Vol. 2,125,500

Sell Vol. 2,787,600

41,300

1D -0.72%

5D -1.67%

Buy Vol. 1,538,200

Sell Vol. 2,169,000

84,000

1D 2.69%

5D 4.61%

Buy Vol. 6,668,300

Sell Vol. 5,468,500

- KDH announced that it has sold all over 19.8m treasury shares as registered with the average selling price of 40,866 dong/share. The company is estimated to have collected more than 811b dong.

OIL & GAS

103,500

1D 6.70%

5D 13.74%

Buy Vol. 7,090,800

Sell Vol. 5,888,500

12,200

1D 2.09%

5D 6.93%

Buy Vol. 37,183,200

Sell Vol. 40,643,600

51,900

1D 0.58%

5D 3.80%

Buy Vol. 3,727,000

Sell Vol. 3,980,200

- POW: submitted a document to the Ministry of Industry and Trade to implement contract power output, bid and operate according to gas consumption requirements in 2021.

VINGROUP

87,700

1D -0.34%

5D 0.80%

Buy Vol. 2,434,100

Sell Vol. 3,866,200

77,000

1D -1.66%

5D -3.27%

Buy Vol. 8,588,500

Sell Vol. 7,224,500

28,200

1D -3.09%

5D -1.05%

Buy Vol. 8,562,600

Sell Vol. 9,468,800

- In the third quarter of 2021, VIC was the stock that was sold the most by foreign investors with a value of VND 6,322 billion

FOOD & BEVERAGE

89,800

1D 0.22%

5D -0.99%

Buy Vol. 7,198,400

Sell Vol. 6,291,700

140,000

1D -1.82%

5D -1.69%

Buy Vol. 1,540,800

Sell Vol. 1,337,900

154,200

1D -1.41%

5D -3.63%

Buy Vol. 285,200

Sell Vol. 304,900

- VNM: Management, technology, and human resources are the three spearheads of VNM "dual goals" strategy to both stabilize production and business and effectively prevent the epidemic.

OTHERS

128,800

1D 0.70%

5D 3.04%

Buy Vol. 987,400

Sell Vol. 913,000

128,800

1D 0.70%

5D 3.04%

Buy Vol. 987,400

Sell Vol. 913,000

92,900

1D -0.11%

5D 0.22%

Buy Vol. 2,694,100

Sell Vol. 2,093,000

126,200

1D -1.25%

5D -3.30%

Buy Vol. 1,786,000

Sell Vol. 2,401,500

99,000

1D 0.30%

5D 7.61%

Buy Vol. 970,900

Sell Vol. 1,354,700

36,100

1D 0.56%

5D -2.43%

Buy Vol. 5,812,200

Sell Vol. 5,345,700

39,200

1D -3.57%

5D -6.22%

Buy Vol. 17,170,600

Sell Vol. 18,196,400

53,400

1D 0.95%

5D 5.12%

Buy Vol. 62,648,300

Sell Vol. 54,489,600

- HPG: Fubon FTSE Vietnam ETF portfolio fluctuated strongly in September. This fund sold more than 6 million units of HPG, reducing its weight from 12% to 10.2%. Thereby, HPG dropped to second place with an investment value of NT$1.35 billion (more than VND 1,100 billion), behind MSN (VND 1,176 billion).

Market by numbers

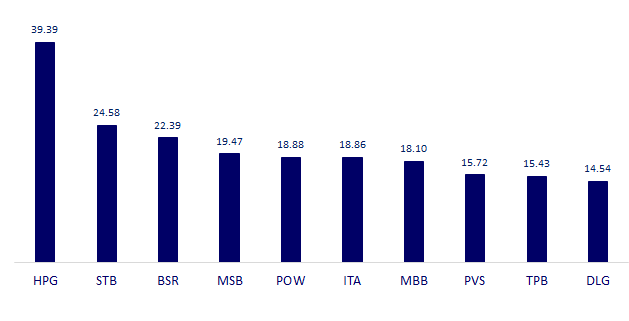

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

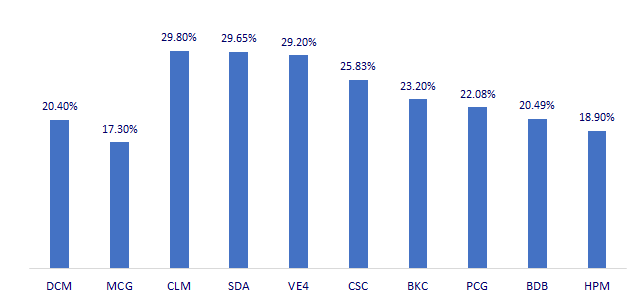

TOP INCREASES 3 CONSECUTIVE SESSIONS

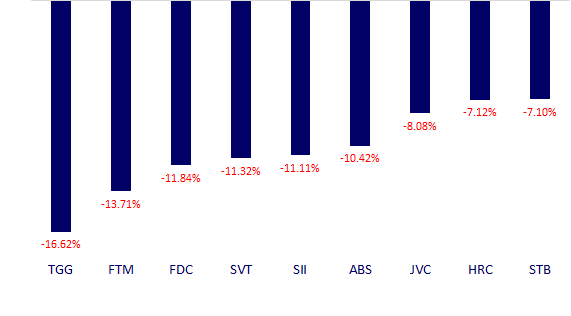

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.