Market brief 27/10/2021

VIETNAM STOCK MARKET

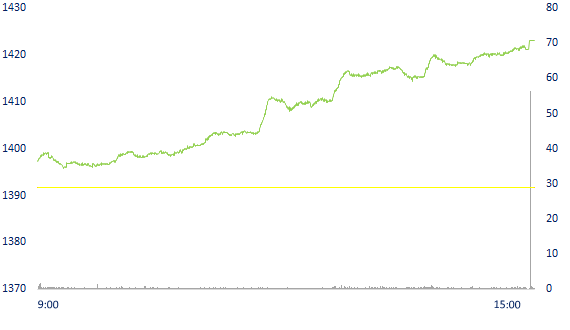

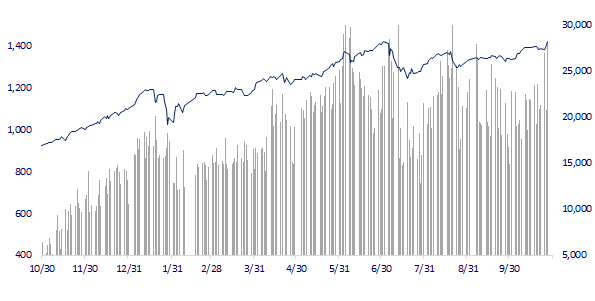

1,423.02

1D 2.26%

YTD 29.43%

1,516.46

1D 2.28%

YTD 43.28%

404.37

1D 1.65%

YTD 105.16%

102.67

1D 0.78%

YTD 39.06%

980.50

1D 0.00%

YTD 0.00%

35,124.78

1D 40.32%

YTD 104.77%

- Foreign investors saw a sudden net buying of nearly 1,000 billion dong in the session on October 27. HPG was the strongest net buying by foreign investors with 258 billion dong. KBC is behind with a net buying value of 210 billion dong. STB and GAS were also net bought over 100 billion dong. Meanwhile, NLG was sold the most with 179 billion dong.

ETF & DERIVATIVES

25,460

1D 0.32%

YTD 35.43%

17,870

1D 2.17%

YTD 42.62%

18,800

1D 5.56%

YTD 41.35%

22,000

1D 1.38%

YTD 39.24%

20,100

1D -0.99%

YTD 47.25%

27,320

1D 0.11%

YTD 58.84%

19,120

1D 3.24%

YTD 37.06%

1,489

1D 0.00%

YTD 0.00%

1,523

1D 2.30%

YTD 0.00%

1,522

1D 2.25%

YTD 0.00%

1,520

1D 2.33%

YTD 0.00%

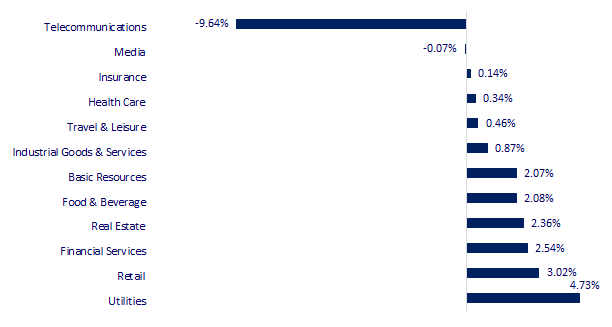

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

29,098.24

1D 0.59%

YTD 6.03%

3,562.31

1D -0.98%

YTD 4.33%

3,025.49

1D -0.77%

YTD 5.29%

25,628.74

1D -0.30%

YTD -5.59%

3,218.17

1D 0.42%

YTD 12.16%

1,627.61

1D -0.51%

YTD 12.30%

83.62

1D -0.58%

YTD 73.13%

1,791.60

1D -0.05%

YTD -5.89%

- China announced industrial profits, Asian stocks mixed. In Japan, the Nikkei 225 gained 0.59%. The Chinese market fell with the Shanghai Composite down 0.98% and the Shenzhen Component down 1.095%. Hong Kong's Hang Seng fell 0.3%. South Korea's Kospi index fell 0.77%.

VIETNAM ECONOMY

0.65%

YTD (bps) 52

5.60%

YTD (bps) -20

1.01%

YTD (bps) -21

1.98%

1D (bps) -1

YTD (bps) -5

22,853

1D (%) -0.01%

YTD (%) -1.40%

26,820

1D (%) -0.09%

YTD (%) -7.84%

3,629

1D (%) -0.17%

YTD (%) 1.57%

- According to a report by the Japan Center for Economic Research (JCER), COVID-19 has cost the gross domestic product (GDP) of 15 economies in Asia in 2020 by nearly $1.7 trillion. Vietnam belongs to the group with the least damage

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- COVID-19 "blows away" nearly $ 1.7 trillion of 15 Asian economies, Vietnam is in the group with the least damage

- In 2021 inflation is under control, but the pressure in 2022 is great

- 80% of enterprises in Long An have resumed operation

- The energy crisis makes a rich country richer

- Commodity prices skyrocket, the risk of inflation is high

- Japan extends stock trading hours to attract investors

VN30

BANK

96,100

1D 2.23%

5D 1.16%

Buy Vol. 4,242,500

Sell Vol. 2,395,600

39,900

1D 1.79%

5D 0.38%

Buy Vol. 3,047,200

Sell Vol. 2,977,800

31,100

1D 4.01%

5D 3.67%

Buy Vol. 30,843,200

Sell Vol. 31,517,000

51,500

1D 0.98%

5D -3.20%

Buy Vol. 26,102,500

Sell Vol. 24,102,600

37,950

1D 2.43%

5D -0.91%

Buy Vol. 10,589,900

Sell Vol. 13,548,400

28,400

1D 1.61%

5D 0.71%

Buy Vol. 16,271,300

Sell Vol. 20,064,900

25,200

1D 2.02%

5D 0.60%

Buy Vol. 5,212,700

Sell Vol. 5,731,900

43,300

1D 1.88%

5D -1.81%

Buy Vol. 3,588,700

Sell Vol. 2,942,700

26,500

1D 3.52%

5D 0.76%

Buy Vol. 57,702,100

Sell Vol. 30,335,100

31,400

1D 0.96%

5D -2.79%

Buy Vol. 8,890,700

Sell Vol. 9,405,500

- ACB: Although the main business segments still grew by nearly 25%, due to strong provisioning, ACB's third quarter profit increased slightly by 0.9% compared to the same period last year. However, after subtracting, the bank's pre-tax profit is still VND 8,968 billion, up 40%. As of September 30, 2021, ACB's total assets reached VND 479,309 billion, up 7.8% compared to the beginning of the year. ACB's bad debt in the first 9 months of the year increased mainly in the group of sub-standard debts (up 201%) and doubtful debts (up 76.1%).

REAL ESTATE

103,900

1D 0.58%

5D 1.56%

Buy Vol. 2,620,100

Sell Vol. 3,858,500

48,000

1D 4.23%

5D 8.35%

Buy Vol. 7,986,000

Sell Vol. 6,584,500

97,100

1D 0.83%

5D 0.73%

Buy Vol. 5,027,300

Sell Vol. 4,567,700

- Bac Giang has a new urban area with a planned area of about 99.84 ha. The population size is about 12,300 people.

OIL & GAS

121,700

1D 6.94%

5D 6.29%

Buy Vol. 7,239,800

Sell Vol. 5,929,600

12,400

1D 0.40%

5D 0.81%

Buy Vol. 25,723,700

Sell Vol. 39,143,200

55,300

1D 1.28%

5D 2.60%

Buy Vol. 2,820,300

Sell Vol. 4,028,300

- GAS: was in the top 4 stocks that were suddenly bought by foreign investors in today's session with a value of nearly 105 billion dong.

VINGROUP

95,000

1D 3.04%

5D 2.93%

Buy Vol. 6,456,000

Sell Vol. 6,144,000

81,000

1D 2.92%

5D 2.79%

Buy Vol. 13,657,800

Sell Vol. 15,149,800

31,200

1D 1.96%

5D 0.81%

Buy Vol. 12,415,400

Sell Vol. 14,875,200

- Vingroup has risen to the top position in the ranking of the most favorite domestic brands, according to the results of the consumer survey "Top 1,000 Asia's Top Brands".

FOOD & BEVERAGE

90,400

1D 0.89%

5D 0.44%

Buy Vol. 6,499,500

Sell Vol. 6,556,700

146,800

1D 5.16%

5D 2.59%

Buy Vol. 2,888,600

Sell Vol. 3,741,200

159,900

1D 2.90%

5D 3.03%

Buy Vol. 222,800

Sell Vol. 243,000

- MSN: Hoa Huong Duong Construction bought 441,100 MSN shares, raising MSN's ownership rate to 13.29%.

OTHERS

134,000

1D 1.13%

5D -1.40%

Buy Vol. 1,021,700

Sell Vol. 1,106,800

134,000

1D 1.13%

5D -1.40%

Buy Vol. 1,021,700

Sell Vol. 1,106,800

98,200

1D 1.34%

5D 0.61%

Buy Vol. 3,773,000

Sell Vol. 4,660,800

132,000

1D 3.13%

5D 2.17%

Buy Vol. 2,918,700

Sell Vol. 3,701,300

101,900

1D 3.66%

5D 2.93%

Buy Vol. 1,186,300

Sell Vol. 1,235,000

40,000

1D 1.39%

5D 6.67%

Buy Vol. 9,515,300

Sell Vol. 14,255,000

40,400

1D 4.12%

5D 0.25%

Buy Vol. 19,908,100

Sell Vol. 20,340,200

57,900

1D 2.84%

5D 1.76%

Buy Vol. 42,949,400

Sell Vol. 44,911,000

- BVH: approved the plan to pay dividend in 2020 in cash, rate 8.985%. The group will spend nearly 667 billion VND to implement on November 30. The last registration date to enjoy the right to receive dividends is 9/11. After the distribution, the total amount of dividends paid to shareholders of Bao Viet Group from the equitization in 2007 to this year will increase to nearly 9,500 billion dong.

Market by numbers

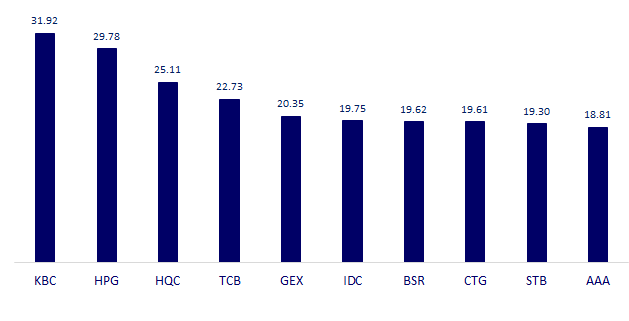

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

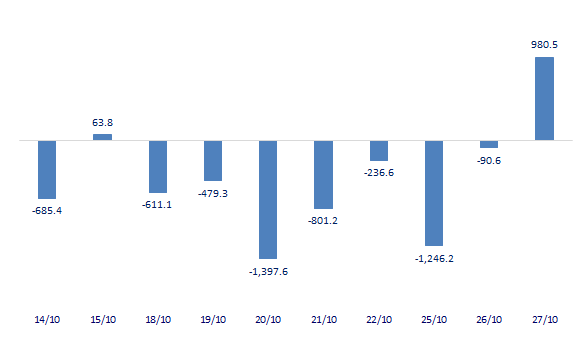

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

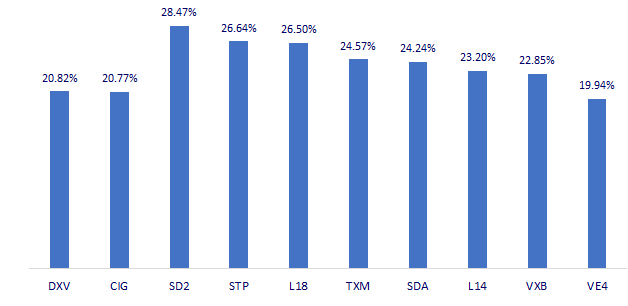

TOP INCREASES 3 CONSECUTIVE SESSIONS

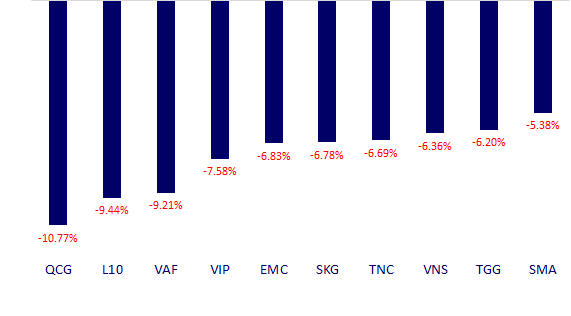

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.