Market brief 29/10/2021

VIETNAM STOCK MARKET

1,444.27

1D 0.44%

YTD 31.36%

1,532.35

1D 0.20%

YTD 44.78%

412.12

1D 0.26%

YTD 109.09%

105.38

1D 0.96%

YTD 42.73%

26.33

1D 0.00%

YTD 0.00%

34,897.21

1D 8.19%

YTD 103.45%

- Foreign investors net bought slightly in the session on October 29. VHM was the strongest net buying by foreign investors with 158b dong. ETF certificates FUESSVFL were also net bought 149b dong. Following that, CTG and VCB were net buyers of 71b dong and 66b dong, respectively. On the other side, NLG was sold the most with 117b dong. PAN and VRE were net sold 87b dong and 68b dong respectively.

ETF & DERIVATIVES

25,710

1D -0.85%

YTD 36.76%

18,060

1D 0.17%

YTD 44.13%

18,900

1D 6.12%

YTD 42.11%

22,590

1D 0.85%

YTD 42.97%

20,400

1D 0.15%

YTD 49.45%

27,720

1D 0.07%

YTD 61.16%

19,330

1D 0.10%

YTD 38.57%

1,489

1D 0.00%

YTD 0.00%

1,534

1D 0.09%

YTD 0.00%

1,534

1D 0.21%

YTD 0.00%

1,529

1D -0.07%

YTD 0.00%

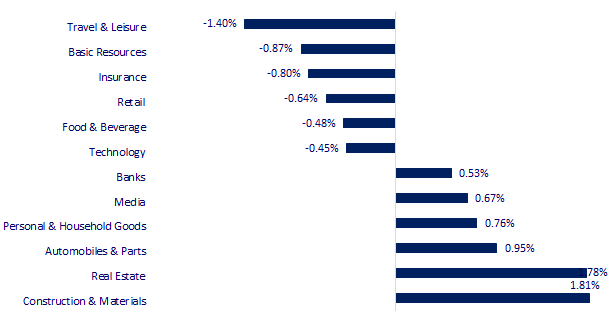

CHANGE IN PRICE BY SECTOR

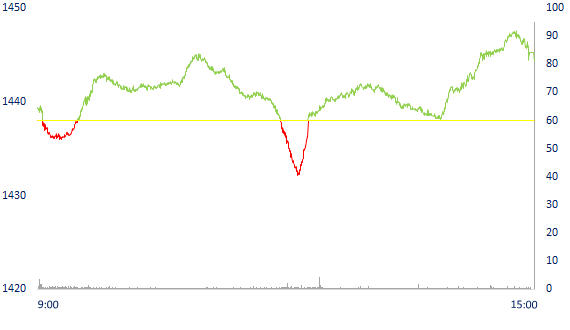

INTRADAY VNINDEX

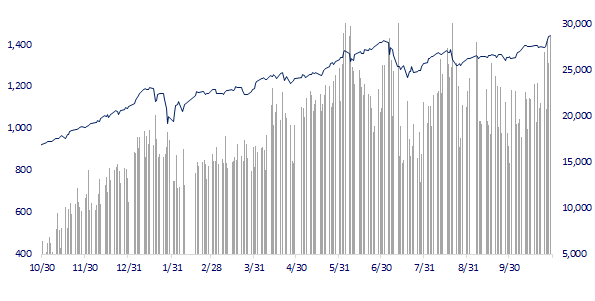

VNINDEX (12M)

GLOBAL MARKET

28,892.69

1D 0.64%

YTD 5.28%

3,547.34

1D 0.82%

YTD 3.89%

2,970.68

1D -1.29%

YTD 3.38%

25,377.24

1D 0.31%

YTD -6.52%

3,198.17

1D -0.18%

YTD 11.46%

1,623.43

1D -0.05%

YTD 12.01%

83.11

1D 0.47%

YTD 72.07%

1,797.15

1D -0.13%

YTD -5.59%

- Stock markets in Asia - Pacific were mixed in the session of October 29. In Japan, the Nikkei 225 gained 0.64%. The Chinese market rose with Shanghai Composite up 0.82%, Shenzhen Component up 1.45%. Hong Kong's Hang Seng rose 0.31%. South Korea's Kospi index fell 1.29%.

VIETNAM ECONOMY

0.61%

1D (bps) -4

YTD (bps) 48

5.60%

YTD (bps) -20

0.98%

1D (bps) -24

YTD (bps) -24

1.96%

1D (bps) 1

YTD (bps) -7

22,848

1D (%) -0.01%

YTD (%) -1.42%

26,948

1D (%) -0.20%

YTD (%) -7.40%

3,626

1D (%) -0.08%

YTD (%) 1.48%

- Realized investment capital from the State budget in October 2021 was estimated at VND 41.7 trillion, up 18.6% compared to September 2021 and down 17.4% over the same period last year. In the first 10 months of 2021, investment capital realized from the State budget reached 318.6 trillion VND, equaling 64.7% of the year plan and down 8.3% over the same period last year (the same period last year). 2020 by 67.8% and increasing by 31.6%).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Realized public investment capital in October is estimated at 41,700 billion VND, up 18.6%

- Travel service business is entitled to an 80% reduction in deposit until the end of 2023

- 10 months of 2021, CPI increased by 1.81% over the same period last year

- Global oil demand soars, refineries are benefiting

- US bans China's largest network operator

- WHO's $23 billion plan to combat Covid-19

VN30

BANK

98,000

1D 0.10%

5D 3.92%

Buy Vol. 2,765,900

Sell Vol. 2,313,200

41,500

1D 4.14%

5D 5.60%

Buy Vol. 5,519,100

Sell Vol. 5,720,300

31,500

1D 0.64%

5D 6.24%

Buy Vol. 22,610,700

Sell Vol. 24,059,300

51,600

1D -0.39%

5D -1.34%

Buy Vol. 20,795,200

Sell Vol. 24,420,300

38,050

1D -1.42%

5D 2.28%

Buy Vol. 11,895,300

Sell Vol. 18,909,200

28,500

1D 0.00%

5D 2.15%

Buy Vol. 19,128,500

Sell Vol. 22,397,700

25,250

1D -1.17%

5D 2.85%

Buy Vol. 4,414,000

Sell Vol. 6,302,900

44,850

1D 1.01%

5D 3.82%

Buy Vol. 6,127,300

Sell Vol. 8,772,900

26,600

1D -0.37%

5D 1.53%

Buy Vol. 33,654,400

Sell Vol. 22,444,500

33,000

1D 3.61%

5D 4.43%

Buy Vol. 20,470,800

Sell Vol. 22,794,700

- STB: Sacombank's profit before tax in the third quarter of 2021 decreased compared to the same period when it recorded a sharp decrease in profit from service activities. Specifically, the bank's profit from service activities in the third quarter of 2021 decreased by 53% over the same period, reaching only VND 589 billion. Profit from forex trading was also less positive, reaching only VND 150 billion, down 6% over the same period. Profit from other activities decreased by 89% to 39 billion.

REAL ESTATE

109,300

1D 1.39%

5D 5.81%

Buy Vol. 9,953,900

Sell Vol. 9,935,000

51,000

1D 3.03%

5D 11.96%

Buy Vol. 10,299,200

Sell Vol. 6,767,300

96,000

1D 0.73%

5D -3.03%

Buy Vol. 5,084,200

Sell Vol. 4,851,300

- NVL: In Q4.2021, NLG is expected to continue selling 4 projects, in which the most valuable project is the Izumi project, including 275 townhouses/villas worth about 2,000 billion VND in November.

OIL & GAS

124,500

1D -0.40%

5D 11.06%

Buy Vol. 2,315,200

Sell Vol. 2,357,400

12,650

1D -0.78%

5D 4.55%

Buy Vol. 26,628,900

Sell Vol. 42,932,700

54,100

1D -1.28%

5D 2.27%

Buy Vol. 3,492,200

Sell Vol. 3,617,200

- PLX: Petrolimex petrol price stabilization fund continues to be negative 262 billion VND compared to the previous time of petrol price adjustment (October 11).

VINGROUP

95,800

1D 0.84%

5D 4.36%

Buy Vol. 3,298,600

Sell Vol. 5,160,900

85,500

1D 5.56%

5D 9.62%

Buy Vol. 24,788,900

Sell Vol. 26,520,800

31,200

1D 0.65%

5D 1.79%

Buy Vol. 14,048,800

Sell Vol. 15,759,900

- VHM: Total consolidated profit before tax reached VND13,812b and consolidated profit after tax of the parent company reached VND11,167b, both increasing by 84% over the same period in 2020.

FOOD & BEVERAGE

90,700

1D 0.11%

5D 0.22%

Buy Vol. 8,251,300

Sell Vol. 7,248,400

150,900

1D -0.53%

5D 7.71%

Buy Vol. 2,290,700

Sell Vol. 2,887,400

160,500

1D -2.49%

5D 2.56%

Buy Vol. 393,900

Sell Vol. 406,900

- MSN: Q3/2021 with revenue of VND23,605b, up 17% QoQ. Deducting costs, the net profit of the third quarter of 2021 reached VND 1,147 billion, up 35% compared to the third quarter of 2020.

OTHERS

132,000

1D -1.12%

5D 0.15%

Buy Vol. 893,200

Sell Vol. 1,032,300

132,000

1D -1.12%

5D 0.15%

Buy Vol. 893,200

Sell Vol. 1,032,300

96,900

1D -1.12%

5D 0.73%

Buy Vol. 4,229,600

Sell Vol. 4,337,500

131,400

1D -0.45%

5D 2.98%

Buy Vol. 2,092,400

Sell Vol. 2,405,500

104,000

1D 2.36%

5D 5.05%

Buy Vol. 2,547,400

Sell Vol. 2,340,300

39,800

1D -0.62%

5D 3.92%

Buy Vol. 7,860,400

Sell Vol. 11,571,700

40,500

1D -0.74%

5D 3.32%

Buy Vol. 20,507,200

Sell Vol. 29,441,800

57,100

1D -1.55%

5D 0.71%

Buy Vol. 37,484,900

Sell Vol. 42,591,200

- MWG: just announced September business targets, recorded net revenue of VND 8,325 billion and EAT of nearly VND 333 billion, up 28% in revenue and 50% in profit respectively compared to August after stores are allowed to reopen in some provinces.

Market by numbers

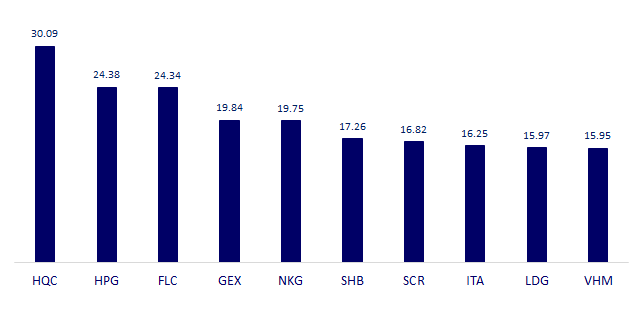

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

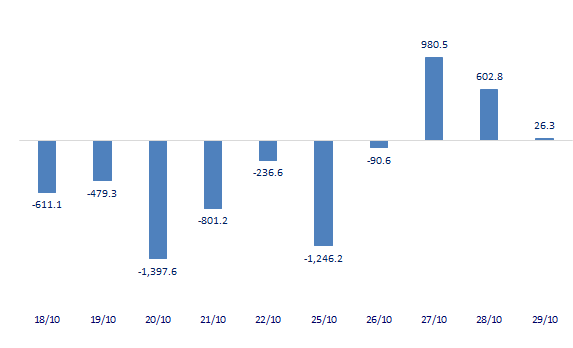

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

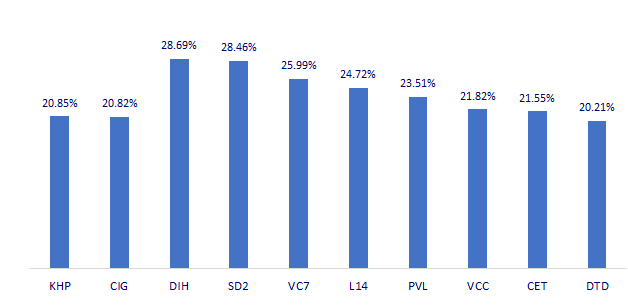

TOP INCREASES 3 CONSECUTIVE SESSIONS

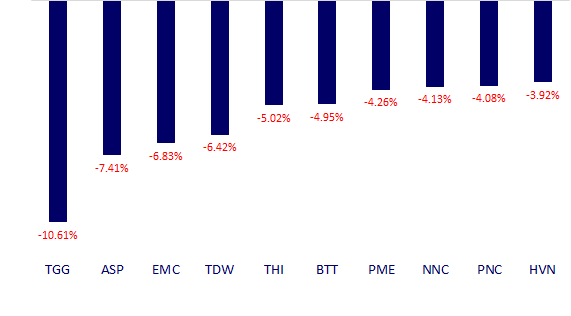

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.