Market brief 01/11/2021

VIETNAM STOCK MARKET

1,438.97

1D -0.37%

YTD 30.88%

1,516.75

1D -1.02%

YTD 43.31%

415.54

1D 0.83%

YTD 110.83%

105.95

1D 0.54%

YTD 43.51%

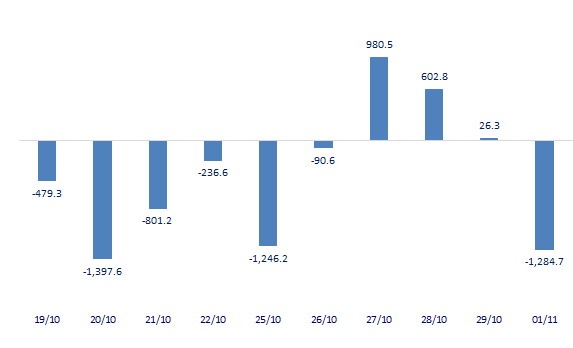

-1,284.74

1D 0.00%

YTD 0.00%

40,384.52

1D 15.82%

YTD 135.44%

- After 3 consecutive sessions, foreign investors turned to be net buyers on HoSE and turned to be net sellers today, with a net selling value of billion dong. Accordingly, selling pressure returned to HPG, besides NLG, SSI, MSN or VNM, they were also sold strongly at over 100 billion dong. On the contrary, three banking tickers, CTG, STB and VCB, saw the most net pouring of foreign investors in the session.

ETF & DERIVATIVES

25,690

1D -0.08%

YTD 36.65%

17,900

1D -0.89%

YTD 42.86%

18,810

1D 5.61%

YTD 41.43%

22,500

1D -0.40%

YTD 42.41%

20,500

1D 0.49%

YTD 50.18%

27,500

1D -0.79%

YTD 59.88%

19,200

1D -0.67%

YTD 37.63%

1,489

1D 0.00%

YTD 0.00%

1,523

1D -0.72%

YTD 0.00%

1,521

1D -0.86%

YTD 0.00%

1,520

1D -0.60%

YTD 0.00%

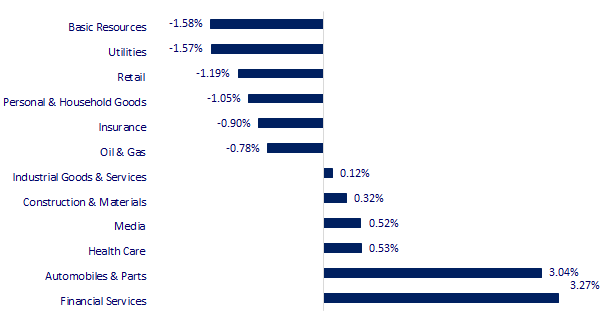

CHANGE IN PRICE BY SECTOR

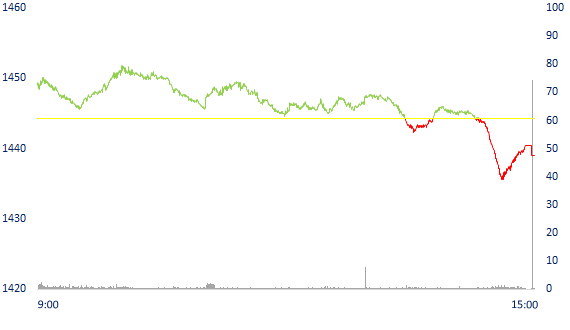

INTRADAY VNINDEX

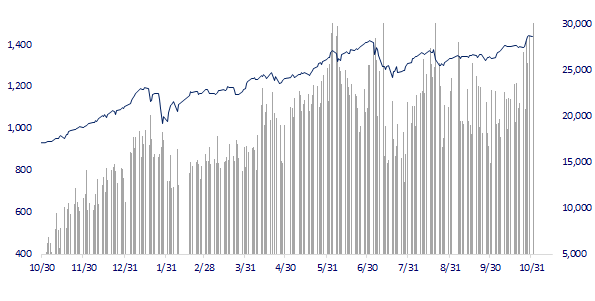

VNINDEX (12M)

GLOBAL MARKET

29,647.08

1D 0.35%

YTD 8.03%

3,544.48

1D -0.08%

YTD 3.81%

2,978.94

1D 0.28%

YTD 3.67%

25,154.32

1D 0.26%

YTD -7.34%

3,219.05

1D 0.65%

YTD 12.19%

1,613.78

1D -0.59%

YTD 11.35%

83.92

1D 0.78%

YTD 73.75%

1,787.75

1D 0.15%

YTD -6.09%

- China releases PMI, Asian stocks mixed. In Japan, the Nikkei 225 gained 0.35%. The Chinese market was mixed with Shanghai Composite down 0.08%, Shenzhen Component up 0.174%. Hong Kong's Hang Seng rose 0.26%. The official Purchasing Managers' Index (PMI) of China's manufacturing sector in October reached 49.2 points. This is the second consecutive month that China's production has declined, after the official PMI in September reached 49.6 points.

VIETNAM ECONOMY

0.61%

YTD (bps) 48

5.60%

YTD (bps) -20

0.98%

YTD (bps) -24

1.98%

1D (bps) 2

YTD (bps) -5

22,845

1D (%) -0.02%

YTD (%) -1.44%

26,755

1D (%) 0.08%

YTD (%) -8.07%

3,626

1D (%) 0.11%

YTD (%) 1.48%

- PMI in October reached 52.1 points, business conditions improved. The easing of restrictions due to Covid-19 helped some companies restart production in October, while others increased output to meet increased new orders. As a result, output increased for the first time in five months.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ready to open international flight

- Imported sugar flooded into Vietnam

- October PMI reached 52.1 points, business conditions improved

- Manufacturing activity in Asia recovered in October

- The 'dilemma' of the European central bank

- The US and other oil consuming countries increase pressure for OPEC + to increase production

VN30

BANK

97,000

1D -1.02%

5D 3.08%

Buy Vol. 4,896,100

Sell Vol. 1,884,100

41,800

1D 0.72%

5D 6.63%

Buy Vol. 4,655,000

Sell Vol. 5,812,900

32,200

1D 2.22%

5D 7.69%

Buy Vol. 29,211,700

Sell Vol. 29,495,200

51,600

1D 0.00%

5D 1.38%

Buy Vol. 37,944,300

Sell Vol. 39,605,400

37,550

1D -1.31%

5D 1.49%

Buy Vol. 8,936,800

Sell Vol. 12,893,700

28,400

1D -0.35%

5D 2.90%

Buy Vol. 17,187,300

Sell Vol. 23,049,800

25,300

1D 0.20%

5D 3.27%

Buy Vol. 5,230,900

Sell Vol. 6,092,700

43,400

1D -3.23%

5D 3.33%

Buy Vol. 4,159,600

Sell Vol. 6,128,400

26,600

1D 0.00%

5D 3.91%

Buy Vol. 35,816,500

Sell Vol. 30,945,200

32,700

1D -0.91%

5D 4.64%

Buy Vol. 8,551,500

Sell Vol. 11,268,900

- BID: recorded net interest income of 12,204 billion dong, up 33.5%, mainly because the bank reduced interest expense by 11.5%. Net profit from service activities reached VND 1,594 billion, up nearly 17%. Net profit from foreign exchange business reached VND 457 billion, up 4% over the same period. In the opposite direction, trading in securities lost 2.4 billion dong while the same period gained 58 billion dong. Net profit from trading investment securities also decreased by 50% to 151 billion dong. Net profit from other activities was 20% lower, at VND 794 billion, compared to the same period last year.

REAL ESTATE

109,600

1D 0.27%

5D 5.59%

Buy Vol. 5,043,800

Sell Vol. 5,020,100

49,000

1D -3.92%

5D 5.15%

Buy Vol. 7,997,600

Sell Vol. 8,922,900

93,100

1D -3.02%

5D -5.00%

Buy Vol. 4,340,800

Sell Vol. 4,990,700

- NVL: total consolidated revenue of 9 months reached nearly VND 10,362 billion, an increase of nearly 159% over the same period in 2020.

OIL & GAS

121,300

1D -2.57%

5D 8.30%

Buy Vol. 3,029,000

Sell Vol. 3,145,100

13,100

1D 3.56%

5D 6.94%

Buy Vol. 53,985,200

Sell Vol. 60,142,200

53,900

1D -0.37%

5D -0.37%

Buy Vol. 3,223,600

Sell Vol. 3,090,500

- POW: Effective market offer of electricity brought high gross profit, Q3/2021 NPAT was 4 times higher than the same period last year with 630 billion dong

VINGROUP

95,800

1D 0.00%

5D 4.02%

Buy Vol. 3,038,100

Sell Vol. 3,692,500

84,300

1D -1.40%

5D 7.39%

Buy Vol. 16,337,900

Sell Vol. 18,084,500

31,150

1D -0.16%

5D 2.47%

Buy Vol. 13,659,400

Sell Vol. 16,208,700

- VIC: Q3 consolidated financial statements with pre-tax profit of nearly VND3,315 billion, down 8% over the same period. Net profit reached nearly 3,193 billion dong, down 21%.

FOOD & BEVERAGE

90,000

1D -0.77%

5D -0.11%

Buy Vol. 10,583,500

Sell Vol. 8,435,400

145,500

1D -3.58%

5D 3.63%

Buy Vol. 2,675,100

Sell Vol. 2,713,000

162,000

1D 0.93%

5D 3.38%

Buy Vol. 308,900

Sell Vol. 325,700

- VNM: Revenue in Q3.2021 increased and many expenses were reduced, but profit continued to decrease over to the same period last year. Q3 profit margin reached 42.9% - the lowest level in 4y.

OTHERS

130,000

1D -1.52%

5D -1.37%

Buy Vol. 1,081,500

Sell Vol. 1,491,700

130,000

1D -1.52%

5D -1.37%

Buy Vol. 1,081,500

Sell Vol. 1,491,700

95,800

1D -1.14%

5D 0.95%

Buy Vol. 4,860,900

Sell Vol. 4,762,400

130,000

1D -1.07%

5D 1.25%

Buy Vol. 1,820,100

Sell Vol. 2,021,400

101,100

1D -2.79%

5D 2.02%

Buy Vol. 866,000

Sell Vol. 1,152,000

39,350

1D -1.13%

5D 0.13%

Buy Vol. 8,323,600

Sell Vol. 9,639,600

41,400

1D 2.22%

5D 8.09%

Buy Vol. 35,201,600

Sell Vol. 41,129,700

55,700

1D -2.45%

5D 1.09%

Buy Vol. 66,122,200

Sell Vol. 63,979,800

- GVR reported a 26% increase in Q3 net profit even though revenue was mostly flat. In the context of higher selling price of rubber in the same period last year, revenue from this business segment of GVR in the third quarter increased by more than 6%. In contrast, the second largest revenue contributor is wood processing, which decreased by more than 34% in revenue. As a result, GVR's net revenue was almost flat compared to the third quarter of the previous year, at more than VND 6,151 billion.

Market by numbers

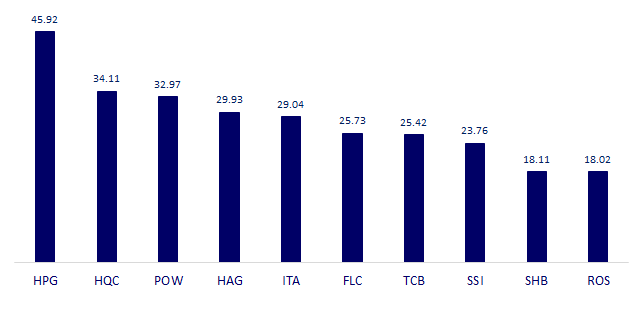

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

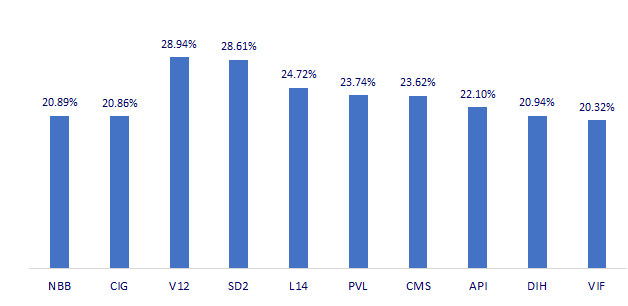

TOP INCREASES 3 CONSECUTIVE SESSIONS

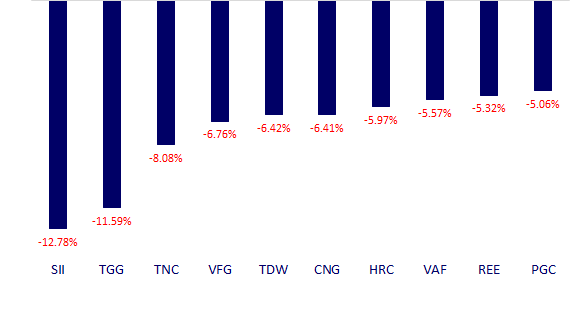

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.