Market Brief 02/11/2021

VIETNAM STOCK MARKET

1,452.46

1D 0.94%

YTD 32.10%

1,521.35

1D 0.30%

YTD 43.74%

424.11

1D 2.06%

YTD 115.18%

106.93

1D 0.92%

YTD 44.83%

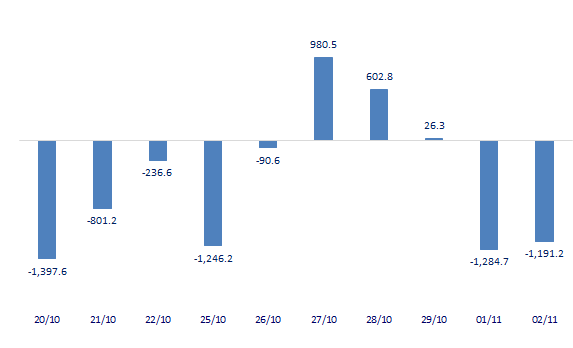

-1,191.17

1D 0.00%

YTD 0.00%

36,340.59

1D -10.01%

YTD 111.86%

- Foreign investors continued to net sell more than 1,191 billion dong on November 2. NVL was sold the most by foreign investors with a value of up to 614 billion dong, of which 611 billion dong came from put through transactions. NLG was behind and continued to be net sold 143 billion dong. Meanwhile, VHC was bought the most with 24.5 billion dong. GMD was also net bought 23 billion dong.

ETF & DERIVATIVES

25,690

1D 0.00%

YTD 36.65%

17,920

1D 0.11%

YTD 43.02%

18,840

1D 5.78%

YTD 41.65%

22,600

1D 0.44%

YTD 43.04%

20,400

1D -0.49%

YTD 49.45%

27,500

1D 0.00%

YTD 59.88%

19,300

1D 0.52%

YTD 38.35%

1,489

1D 0.00%

YTD 0.00%

1,524

1D 0.09%

YTD 0.00%

1,523

1D 0.14%

YTD 0.00%

1,521

1D 0.07%

YTD 0.00%

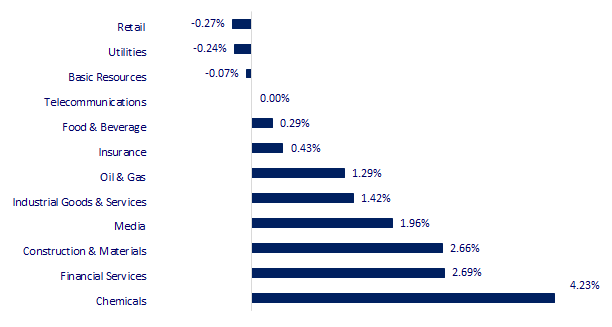

CHANGE IN PRICE BY SECTOR

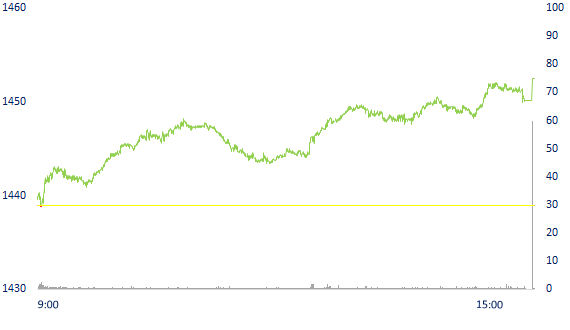

INTRADAY VNINDEX

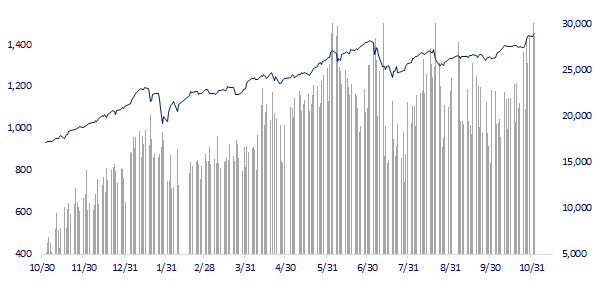

VNINDEX (12M)

GLOBAL MARKET

29,520.90

1D -0.08%

YTD 7.57%

3,505.63

1D -1.10%

YTD 2.67%

3,013.49

1D 1.16%

YTD 4.87%

25,099.67

1D -1.82%

YTD -7.54%

3,232.37

1D 0.41%

YTD 12.66%

1,617.89

1D 0.25%

YTD 11.63%

83.39

1D -1.00%

YTD 72.65%

1,793.45

1D 0.09%

YTD -5.79%

- Asian stocks mixed, Chinese real estate stocks fell deeply. In Japan, the Nikkei 225 fell 0.08%. The Chinese market fell with the Shanghai Composite down 1.1% and the Shenzhen Component down 0.686%. Hong Kong's Hang Seng fell 1.82%. Chinese real estate stocks listed in Hong Kong fell deeply, such as Evergrande losing 2.9%, China Vanke down 4%, Sunac China Holdings down 9.6%.

VIETNAM ECONOMY

0.61%

YTD (bps) 48

5.60%

YTD (bps) -20

1.22%

1D (bps) 24

1.95%

1D (bps) -3

YTD (bps) -8

22,845

1D (%) 0.00%

YTD (%) -1.44%

26,837

1D (%) 0.07%

YTD (%) -7.79%

3,625

1D (%) 0.00%

YTD (%) 1.46%

- According to the Ministry of Planning and Investment, in the 10 months of the year, there were more than 23.7 billion USD of foreign investment in Vietnam, an increase of 1.1% over the same period last year, of which, many projects have large scale. Large scale investment was quickly disbursed.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Two large corporations of Vietnam and Germany cooperate to produce 500 MW of wind power

- Vietnam, Australia strive to double investment, two-way trade will soon reach 15 billion USD

- FDI attraction in the 10 months of the year increased

- OPEC+ is under pressure to pump more oil to the market

- China's economy is at risk of an inflationary recession

- Inflation in Korea highest in nearly a decade

VN30

BANK

97,900

1D 0.93%

5D 4.15%

Buy Vol. 2,935,700

Sell Vol. 1,616,500

41,950

1D 0.36%

5D 7.02%

Buy Vol. 2,716,100

Sell Vol. 3,885,400

32,400

1D 0.62%

5D 8.36%

Buy Vol. 20,907,400

Sell Vol. 22,234,800

51,600

1D 0.00%

5D 1.18%

Buy Vol. 25,260,400

Sell Vol. 28,127,500

37,550

1D 0.00%

5D 1.35%

Buy Vol. 11,657,600

Sell Vol. 10,338,600

28,400

1D 0.00%

5D 1.61%

Buy Vol. 14,583,500

Sell Vol. 19,994,100

25,600

1D 1.19%

5D 3.64%

Buy Vol. 7,914,500

Sell Vol. 7,573,700

43,800

1D 0.92%

5D 3.06%

Buy Vol. 6,427,400

Sell Vol. 6,734,700

26,650

1D 0.19%

5D 4.10%

Buy Vol. 31,583,800

Sell Vol. 22,958,500

33,150

1D 1.38%

5D 6.59%

Buy Vol. 11,082,600

Sell Vol. 12,608,600

- HDB: On October 31, 2021, HDBank and Affinity International Investment Fund signed a cooperation agreement on supporting and raising capital for HDBank for Vietnamese businesses worth 300 million USD to finance programs process to meet ESG criteria, sustainable development.

REAL ESTATE

108,100

1D -1.37%

5D 4.65%

Buy Vol. 5,287,300

Sell Vol. 5,276,000

50,400

1D 2.86%

5D 9.45%

Buy Vol. 6,425,900

Sell Vol. 5,619,500

95,300

1D 2.36%

5D -1.04%

Buy Vol. 5,617,400

Sell Vol. 5,267,100

- KDH: In 9 months of the year, buyers who paid in advance reduced VND 1,737.55 billion to only VND 433.15 billion

OIL & GAS

121,600

1D 0.25%

5D 6.85%

Buy Vol. 2,584,500

Sell Vol. 2,625,800

12,850

1D -1.91%

5D 4.05%

Buy Vol. 34,131,700

Sell Vol. 39,190,700

54,300

1D 0.74%

5D -0.55%

Buy Vol. 3,084,000

Sell Vol. 3,275,500

- PLX: net revenue in Q3.2021 reached VND34,625b, up 26% QoQ. COGS increased faster than revenue, causing gross profit to decrease by 35% QoQ, bringing in VND2,036b

VINGROUP

95,800

1D 0.00%

5D 3.90%

Buy Vol. 2,459,900

Sell Vol. 3,213,800

85,000

1D 0.83%

5D 8.01%

Buy Vol. 9,649,300

Sell Vol. 10,446,400

30,850

1D -0.96%

5D 0.82%

Buy Vol. 10,687,800

Sell Vol. 12,925,400

- VHM: In the third quarter, despite social distancing, sales on Vinhomes' online platform were still guaranteed, bringing in an after-tax profit of nearly VND 11,200 billion.

FOOD & BEVERAGE

89,200

1D -0.89%

5D -0.45%

Buy Vol. 7,720,900

Sell Vol. 7,569,200

145,500

1D 0.00%

5D 4.23%

Buy Vol. 1,596,300

Sell Vol. 1,951,000

165,200

1D 1.98%

5D 6.31%

Buy Vol. 227,900

Sell Vol. 226,500

- VNM: Vinamilk usually maintains a gross profit margin of over 45% for many years, starting from the first quarter of this year, it dropped to 43%.

OTHERS

132,000

1D 1.54%

5D -0.38%

Buy Vol. 1,051,600

Sell Vol. 1,064,800

132,000

1D 1.54%

5D -0.38%

Buy Vol. 1,051,600

Sell Vol. 1,064,800

96,100

1D 0.31%

5D -0.83%

Buy Vol. 8,450,800

Sell Vol. 3,632,200

128,900

1D -0.85%

5D 0.70%

Buy Vol. 1,493,500

Sell Vol. 1,512,000

105,000

1D 3.86%

5D 6.82%

Buy Vol. 752,500

Sell Vol. 810,000

42,100

1D 6.99%

5D 6.72%

Buy Vol. 15,005,700

Sell Vol. 12,244,500

42,350

1D 2.29%

5D 9.15%

Buy Vol. 28,304,900

Sell Vol. 32,266,700

55,500

1D -0.36%

5D -1.42%

Buy Vol. 46,762,900

Sell Vol. 43,712,000

- HPG: announced the consolidated financial statements of the third quarter with revenue of VND 38,674 billion, up 56.7%. COGS increased lower, so gross profit reached 11,861 billion dong, up 129%. Profit margin increased sharply from 20.9% to 30.7%. In the revenue structure, steel segment contributed 36,497 billion VND in revenue, up 74%; agriculture 1,568 billion dong, down 43%; real estate 609 billion, 3 times higher.

Market by numbers

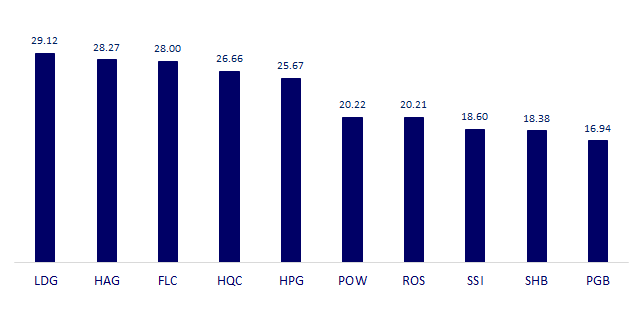

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

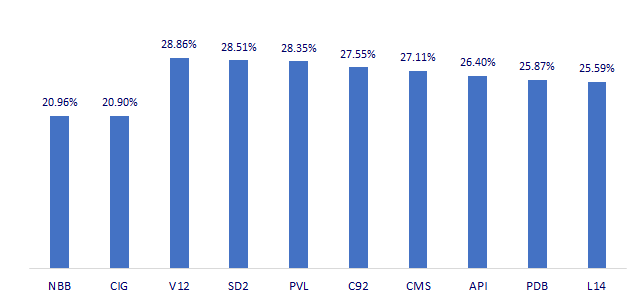

TOP INCREASES 3 CONSECUTIVE SESSIONS

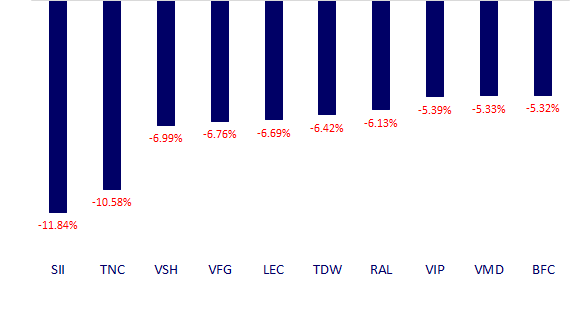

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.