Market Brief 03/11/2021

VIETNAM STOCK MARKET

1,444.30

1D -0.56%

YTD 31.36%

1,530.65

1D 0.61%

YTD 44.62%

415.71

1D -1.98%

YTD 110.91%

106.98

1D 0.05%

YTD 44.90%

267.20

1D 0.00%

YTD 0.00%

51,928.02

1D 42.89%

YTD 202.73%

- Foreign investors net bought back 267 billion dong in the market session that set a record in terms of liquidity. HPG was the strongest net buying by foreign investors today with a value of 266 billion dong, far behind GEX with 85 billion dong. Meanwhile, HSG was sold the most with 84 billion dong. MSN and VNM were net sold 44 billion dong and 41 billion dong respectively.

ETF & DERIVATIVES

25,700

1D 0.04%

YTD 36.70%

18,080

1D 0.89%

YTD 44.29%

18,770

1D 5.39%

YTD 41.13%

22,600

1D 0.00%

YTD 43.04%

21,000

1D 2.94%

YTD 53.85%

27,800

1D 1.09%

YTD 61.63%

19,480

1D 0.93%

YTD 39.64%

1,489

1D 0.00%

YTD 0.00%

1,529

1D 0.29%

YTD 0.00%

1,527

1D 0.29%

YTD 0.00%

1,525

1D 0.25%

YTD 0.00%

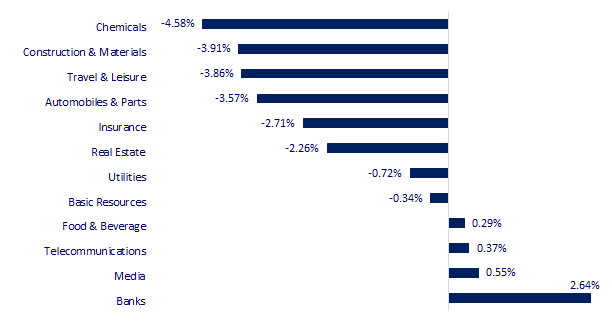

CHANGE IN PRICE BY SECTOR

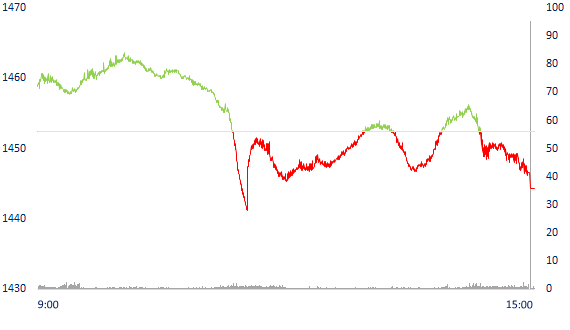

INTRADAY VNINDEX

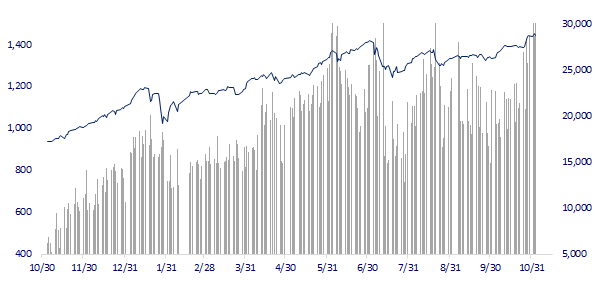

VNINDEX (12M)

GLOBAL MARKET

29,520.90

1D 0.00%

YTD 7.57%

3,498.54

1D -0.20%

YTD 2.46%

2,975.71

1D -1.25%

YTD 3.56%

25,024.75

1D -0.17%

YTD -7.82%

3,219.69

1D -0.39%

YTD 12.21%

1,611.92

1D -0.37%

YTD 11.22%

82.12

1D -0.69%

YTD 70.02%

1,783.70

1D -0.09%

YTD -6.30%

- China announced services PMI, Asian stocks fell. The Chinese market fell with the Shanghai Composite down 0.2%. Hong Kong's Hang Seng fell 0.17%. The Caixin/Markit Services Purchasing Managers' Index (PMI) in October was 53.8 points, up from 53.4 points in September. The October non-manufacturing PMI released last week was 52.4. points, down from 53.2 in September. Korea's Kospi index fell 1.25%. Japanese market holiday.

VIETNAM ECONOMY

0.60%

1D (bps) -1

YTD (bps) 47

5.60%

YTD (bps) -20

1.16%

1D (bps) -6

YTD (bps) -6

1.87%

1D (bps) -8

YTD (bps) -16

22,815

1D (%) -0.13%

YTD (%) -1.57%

26,761

1D (%) -0.07%

YTD (%) -8.05%

3,622

1D (%) -0.06%

YTD (%) 1.37%

- 26 cooperation agreements, worth billions of USD, have been signed between Vietnamese and British businesses. One of them is the signing of a Memorandum of Understanding between SOVICO Group and Oxford University, funding investment in research and education development with a total value of £155 million. Meanwhile, Vietjet Air and Rolls-Royce Group signed an agreement to provide engines and engine services for the wide-body fleet with a total value of 400 million USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- TThe Ministry of Transport and Communications has approved the planning of Van Ninh general port to receive ships of 20,000 tons

- Officially promulgate the National List of projects calling for foreign investment

- Waiting for large capital flows from Europe

- Partners commit USD 665 million to support green recovery for ASEAN

- South Korea: CPI hit a record high in nearly 10 years

- China's coal shortage eases after many government interventions

VN30

BANK

98,700

1D 0.82%

5D 2.71%

Buy Vol. 5,764,900

Sell Vol. 3,018,500

43,050

1D 2.62%

5D 7.89%

Buy Vol. 8,588,400

Sell Vol. 8,191,100

33,000

1D 1.85%

5D 6.11%

Buy Vol. 33,149,200

Sell Vol. 31,560,300

53,700

1D 4.07%

5D 4.27%

Buy Vol. 62,145,500

Sell Vol. 59,126,700

38,400

1D 2.26%

5D 1.19%

Buy Vol. 26,049,500

Sell Vol. 27,436,900

29,150

1D 2.64%

5D 2.64%

Buy Vol. 42,874,000

Sell Vol. 49,063,200

27,200

1D 6.25%

5D 7.94%

Buy Vol. 20,400,600

Sell Vol. 15,622,800

44,200

1D 0.91%

5D 2.08%

Buy Vol. 6,546,900

Sell Vol. 7,837,000

27,900

1D 4.69%

5D 5.28%

Buy Vol. 71,718,400

Sell Vol. 63,603,100

33,850

1D 2.11%

5D 7.80%

Buy Vol. 19,843,900

Sell Vol. 21,727,500

- CTG: As of October 31, total bank assets increased by 8.1%. Total capital increased by nearly 8%, of which market capital 1 increased by 10%. Credit increased by 8%. Indicators such as ROA and ROE are at 1.3% and 16.1% respectively. The capital adequacy ratio is more than 9%. Accumulating 9 months, pre-tax profit reached 13,910 billion dong, up 34% over the same period last year.

REAL ESTATE

105,200

1D -2.68%

5D 1.25%

Buy Vol. 8,263,800

Sell Vol. 7,380,600

47,200

1D -6.35%

5D -1.67%

Buy Vol. 6,691,200

Sell Vol. 8,697,800

93,500

1D -1.89%

5D -3.71%

Buy Vol. 4,902,200

Sell Vol. 5,267,600

- KDH: Mr. Bui Quang Huy, Deputy GD, registered to sell 174,075 shares out of a total of 274,075 shares owned. The transaction is expected to take place from November 5 to December 4, 2021.

OIL & GAS

120,000

1D -1.32%

5D -1.40%

Buy Vol. 2,743,000

Sell Vol. 3,245,000

12,600

1D -1.95%

5D 1.61%

Buy Vol. 42,100,900

Sell Vol. 44,041,800

53,000

1D -2.39%

5D -4.16%

Buy Vol. 2,586,300

Sell Vol. 3,296,600

- PLX: reported a 91% decrease in after-tax profit to nearly VND80 billion in Q3, the lowest profit since a loss of more than VND1,800 billion in the first quarter of last year.

VINGROUP

95,300

1D -0.52%

5D 0.32%

Buy Vol. 11,135,000

Sell Vol. 5,700,200

82,900

1D -2.47%

5D 2.35%

Buy Vol. 16,318,900

Sell Vol. 18,335,400

31,700

1D 2.76%

5D 1.60%

Buy Vol. 23,002,300

Sell Vol. 22,977,800

- VIC: In the industrial sector, VinFast continues to affirm its leading position in Vietnam as well as accelerate its expansion strategy to foreign markets.

FOOD & BEVERAGE

88,200

1D -1.12%

5D -2.43%

Buy Vol. 12,430,300

Sell Vol. 7,698,700

145,500

1D 0.00%

5D -0.89%

Buy Vol. 2,270,800

Sell Vol. 2,314,300

172,600

1D 4.48%

5D 7.94%

Buy Vol. 596,000

Sell Vol. 503,500

- MSN and VNM were both among the top net sellers of foreign investors today with a value of VND 43.8 billion and VND 41.3 billion, respectively.

OTHERS

129,800

1D -1.67%

5D -3.13%

Buy Vol. 891,300

Sell Vol. 1,072,000

129,800

1D -1.67%

5D -3.13%

Buy Vol. 891,300

Sell Vol. 1,072,000

96,100

1D 0.00%

5D -2.14%

Buy Vol. 4,164,500

Sell Vol. 4,320,200

128,800

1D -0.08%

5D -2.42%

Buy Vol. 2,048,600

Sell Vol. 2,216,800

104,500

1D -0.48%

5D 2.55%

Buy Vol. 1,336,900

Sell Vol. 1,519,500

39,300

1D -6.65%

5D -1.75%

Buy Vol. 9,479,800

Sell Vol. 13,120,900

41,700

1D -1.53%

5D 3.22%

Buy Vol. 29,038,800

Sell Vol. 35,683,700

55,600

1D 0.18%

5D -3.97%

Buy Vol. 49,638,900

Sell Vol. 44,044,500

- HPG: announced October sales volume reached 968,000 tons of steel of all kinds, up 64% over the same period and up 31% compared to September – recording the 4th consecutive month of increase. At the same time, the sales volume in October was only lower than the record level set in March (reaching 1 million tons). In which, construction steel contributed the most with 467,000 tons, up 87% over the same period last year and up 42% over the previous month.

Market by numbers

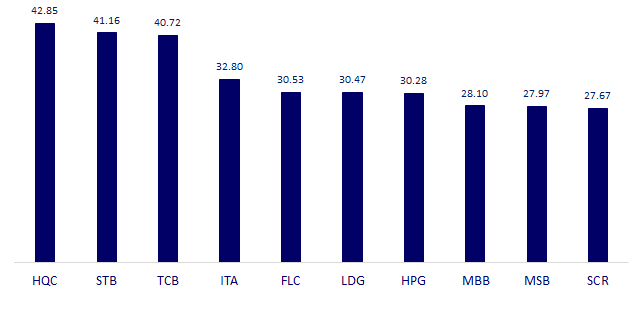

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

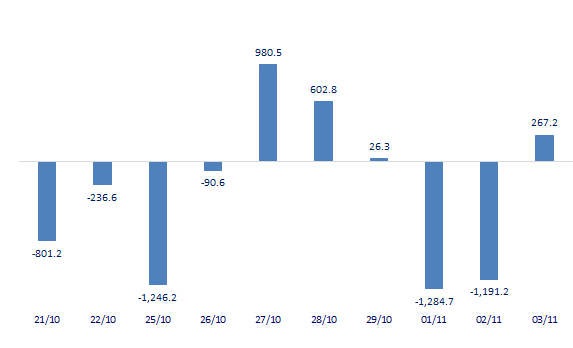

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

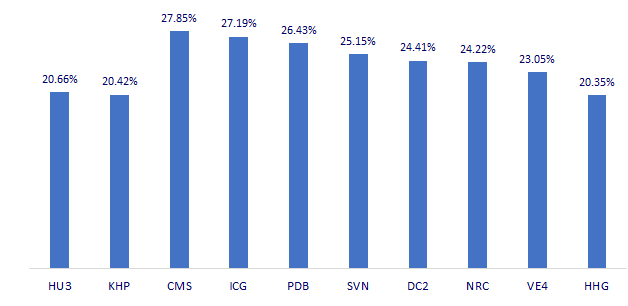

TOP INCREASES 3 CONSECUTIVE SESSIONS

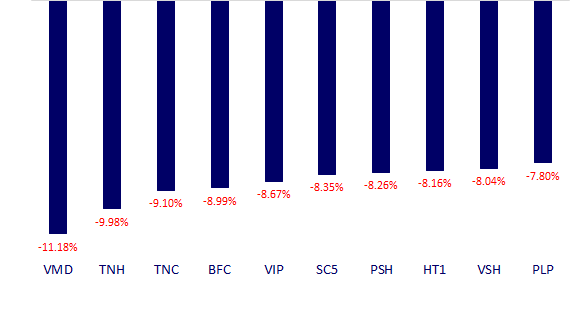

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.