Market brief 04/11/2021

VIETNAM STOCK MARKET

1,448.34

1D 0.28%

YTD 31.73%

1,528.21

1D -0.16%

YTD 44.39%

422.42

1D 1.61%

YTD 114.32%

107.38

1D 0.37%

YTD 45.44%

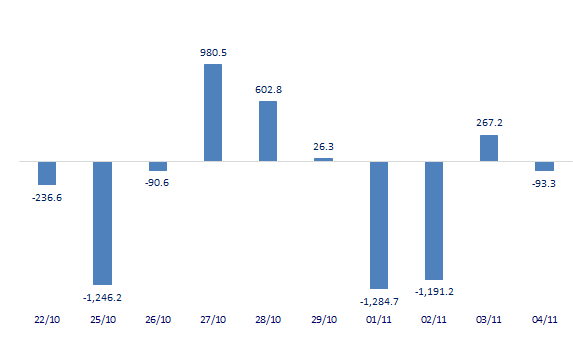

-93.26

1D 0.00%

YTD 0.00%

33,803.14

1D -34.90%

YTD 97.07%

- Foreign investors net sold again 93 billion dong on November 4. PAN was sold the most by foreign investors with 457 billion dong. SSI and GEX were net sold 163 billion dong and 61 billion dong respectively. Meanwhile, CTG was bought the most with 68 billion dong. VHM was also net bought 62 billion dong.

ETF & DERIVATIVES

25,650

1D -0.19%

YTD 36.44%

17,970

1D -0.61%

YTD 43.42%

18,950

1D 6.40%

YTD 42.48%

22,800

1D 0.88%

YTD 44.30%

20,500

1D -2.38%

YTD 50.18%

27,780

1D -0.07%

YTD 61.51%

19,400

1D -0.41%

YTD 39.07%

1,489

1D 0.00%

YTD 0.00%

1,530

1D 0.09%

YTD 0.00%

1,528

1D 0.03%

YTD 0.00%

1,528

1D 0.23%

YTD 0.00%

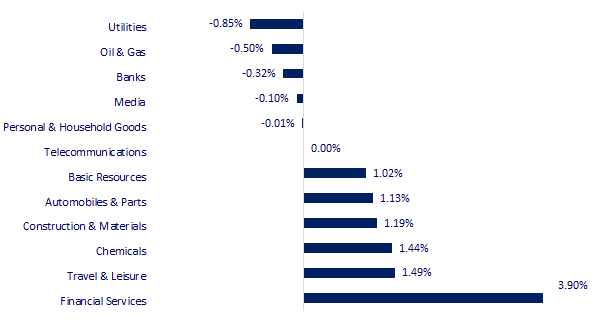

CHANGE IN PRICE BY SECTOR

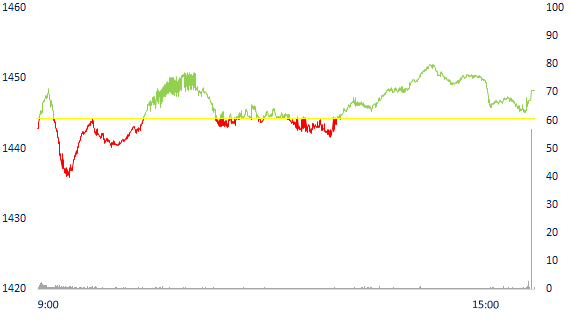

INTRADAY VNINDEX

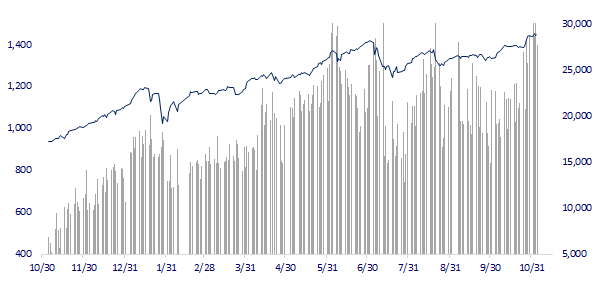

VNINDEX (12M)

GLOBAL MARKET

29,794.37

1D 0.03%

YTD 8.56%

3,526.87

1D 0.81%

YTD 3.29%

2,983.22

1D 0.25%

YTD 3.82%

25,225.19

1D 0.63%

YTD -7.08%

3,219.69

1D 0.00%

YTD 12.21%

1,626.27

1D 0.89%

YTD 12.21%

82.28

1D 3.15%

YTD 70.35%

1,780.55

1D 0.29%

YTD -6.47%

- Asian stocks rose after the Fed meeting. In Japan, the Nikkei 225 gained 0.03%. The Chinese market rose with the Shanghai Composite up 0.81% and the Shenzhen Component up 1,305%. Hong Kong's Hang Seng rose 0.63%. South Korea's Kospi index rose 0.25%.

VIETNAM ECONOMY

0.66%

1D (bps) 6

YTD (bps) 53

5.60%

YTD (bps) -20

1.21%

1D (bps) 5

YTD (bps) -1

1.94%

1D (bps) 7

YTD (bps) -9

22,775

1D (%) -0.18%

YTD (%) -1.74%

26,621

1D (%) -0.70%

YTD (%) -8.53%

3,614

1D (%) -0.06%

YTD (%) 1.15%

- Binh Dinh is currently a strong investment attraction thanks to the implementation of a series of administrative reform solutions that reduce the time to settle investment procedures from 32 days to 25 days. From the beginning of 2021 up to now, the total amount of foreign direct investment (FDI) attracted has reached more than 72.5 million USD and over 71,000 billion dong of domestic investment.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Signing multi-billion dollar cooperation agreements between Vietnam and France

- Vietnam - Russia soon signed a cooperation protocol on automobile production

- Binh Dinh attracts more than 72.5 million USD and 71 trillion VND in investment capital

- ECB is very unlikely to raise interest rates next year

- China's economy experienced a period of inflation and recession

- Coal and electricity shortage crisis in China cools down

VN30

BANK

98,400

1D -0.30%

5D 0.51%

Buy Vol. 4,055,100

Sell Vol. 1,939,000

44,000

1D 2.21%

5D 10.41%

Buy Vol. 6,836,700

Sell Vol. 7,039,300

32,600

1D -1.21%

5D 4.15%

Buy Vol. 17,295,700

Sell Vol. 22,792,400

53,300

1D -0.74%

5D 2.90%

Buy Vol. 30,121,000

Sell Vol. 36,922,400

38,000

1D -1.04%

5D -1.55%

Buy Vol. 7,882,400

Sell Vol. 10,906,200

28,900

1D -0.86%

5D 1.40%

Buy Vol. 18,472,200

Sell Vol. 28,660,200

27,050

1D -0.55%

5D 5.87%

Buy Vol. 8,652,100

Sell Vol. 9,338,300

43,750

1D -1.02%

5D -1.46%

Buy Vol. 2,830,900

Sell Vol. 3,354,900

27,450

1D -1.61%

5D 2.81%

Buy Vol. 25,142,500

Sell Vol. 29,367,200

33,500

1D -1.03%

5D 5.18%

Buy Vol. 7,172,400

Sell Vol. 12,074,000

- VPB: Since 2020, VPBank has issued ESOPs in August 2021, completed the divestment of 49% of the capital of Vietnam Prosperity Bank Finance Company Limited (FE Credit) and completed 90% of the plan pay stock dividends and issue more shares. VPBank expects the State Bank to consider approving a credit line (credit room) with a high coefficient after completing capital increase plans.

REAL ESTATE

104,000

1D -1.14%

5D -3.53%

Buy Vol. 4,774,500

Sell Vol. 4,806,800

47,450

1D 0.53%

5D -4.14%

Buy Vol. 6,091,400

Sell Vol. 5,607,300

93,700

1D 0.21%

5D -1.68%

Buy Vol. 5,833,300

Sell Vol. 5,408,900

- NVL: Up to the third quarter of 2021, NVL has made payment of the total value of principal and interest of nearly VND 25,949 billion for due loans and loans for early settlement.

OIL & GAS

117,100

1D -2.42%

5D -6.32%

Buy Vol. 2,592,300

Sell Vol. 2,857,500

12,650

1D 0.40%

5D -0.78%

Buy Vol. 27,377,900

Sell Vol. 26,787,000

52,700

1D -0.57%

5D -3.83%

Buy Vol. 2,702,600

Sell Vol. 2,357,400

- GAS: Despite the decline in both dry gas consumption and LPG output, GAS's Q3/21 revenue still grew by 16.3% QoQ to VND 18,543 billion mainly thanks to soaring energy prices.

VINGROUP

95,000

1D -0.31%

5D 0.00%

Buy Vol. 8,473,200

Sell Vol. 3,419,700

82,700

1D -0.24%

5D 2.10%

Buy Vol. 13,551,400

Sell Vol. 13,393,900

31,550

1D -0.47%

5D 1.77%

Buy Vol. 9,720,000

Sell Vol. 12,362,700

- VHM: Successfully issued 22.8 million 36-month bonds with a total value of VND2,280 billion, non-convertible bonds, unwarranted and unsecured by assets

FOOD & BEVERAGE

88,400

1D 0.23%

5D -2.43%

Buy Vol. 11,183,200

Sell Vol. 3,997,500

147,900

1D 1.65%

5D -2.50%

Buy Vol. 2,099,100

Sell Vol. 2,201,500

171,800

1D -0.46%

5D 4.37%

Buy Vol. 210,700

Sell Vol. 241,600

- VNM: SCIC registered to sell all 900,000 VNM shares. Transaction time from 02/11/2021-01/12/2021

OTHERS

129,600

1D -0.15%

5D -2.92%

Buy Vol. 831,600

Sell Vol. 1,049,700

129,600

1D -0.15%

5D -2.92%

Buy Vol. 831,600

Sell Vol. 1,049,700

96,000

1D -0.10%

5D -2.04%

Buy Vol. 3,633,300

Sell Vol. 3,169,000

129,900

1D 0.85%

5D -1.59%

Buy Vol. 1,763,900

Sell Vol. 2,056,500

104,000

1D -0.48%

5D 2.36%

Buy Vol. 934,700

Sell Vol. 1,293,200

39,950

1D 1.65%

5D -0.25%

Buy Vol. 7,412,900

Sell Vol. 7,855,800

43,000

1D 3.12%

5D 5.39%

Buy Vol. 40,448,900

Sell Vol. 48,062,700

56,300

1D 1.26%

5D -2.93%

Buy Vol. 31,331,400

Sell Vol. 31,484,400

- BVH: In Q3, BVH's original premium revenue decreased by nearly 400 billion dong QoQ, equivalent to 4%, to nearly 9,279 billion dong. However, thanks to a 22% decrease in reinsurance ceding fees, to more than VND 849 billion, net income from insurance business increased slightly by 3% to nearly VND 8,985 billion. Meanwhile, total insurance business expenses no longer exceeded revenue as in the same period, so BVH had a gross profit from insurance business of nearly 293 billion dong.

Market by numbers

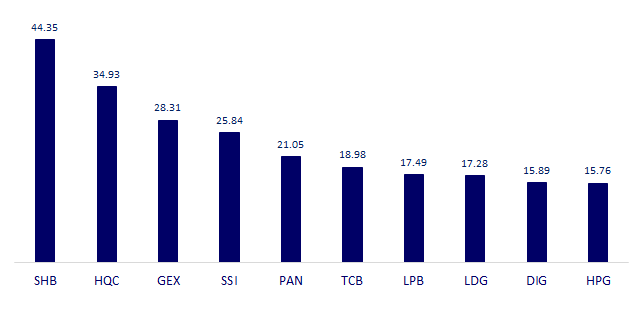

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

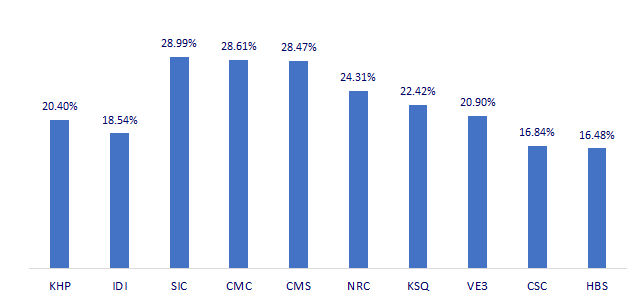

TOP INCREASES 3 CONSECUTIVE SESSIONS

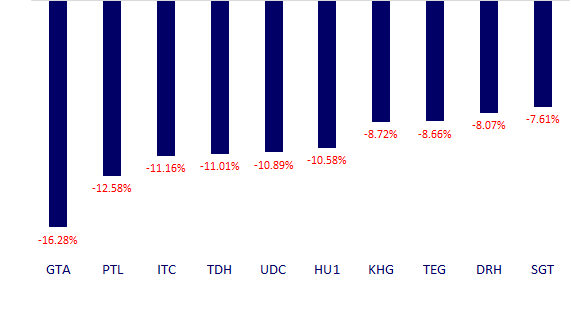

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.