Market Brief 05/11/2021

VIETNAM STOCK MARKET

1,456.51

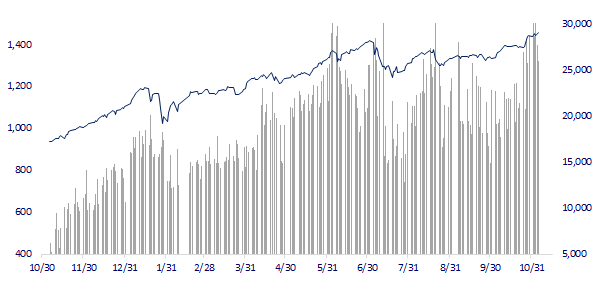

1D 0.56%

YTD 32.47%

1,531.76

1D 0.23%

YTD 44.73%

427.64

1D 1.24%

YTD 116.97%

108.20

1D 0.76%

YTD 46.55%

237.45

1D 0.00%

YTD 0.00%

32,203.98

1D -4.73%

YTD 87.74%

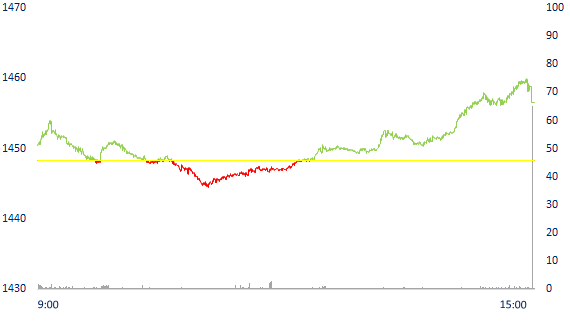

- At the end of the session, pillar codes such as GAS, PLX, BCM, FPT... gained well and contributed to maintaining the green color of VN-Index. In which, GAS increased by 4.5%, PLX increased by 2.3%... The total matched value reached VND30,568b, down 5.4% compared to the previous session, of which, the matched value on HoSE reached 24,810b dong, down 6%.

ETF & DERIVATIVES

25,960

1D 1.21%

YTD 38.09%

18,090

1D 0.67%

YTD 44.37%

18,900

1D 6.12%

YTD 42.11%

22,600

1D -0.88%

YTD 43.04%

20,950

1D 2.20%

YTD 53.48%

28,000

1D 0.79%

YTD 62.79%

19,390

1D -0.05%

YTD 39.00%

1,489

1D 0.00%

YTD 0.00%

1,535

1D 0.35%

YTD 0.00%

1,534

1D 0.42%

YTD 0.00%

1,529

1D 0.08%

YTD 0.00%

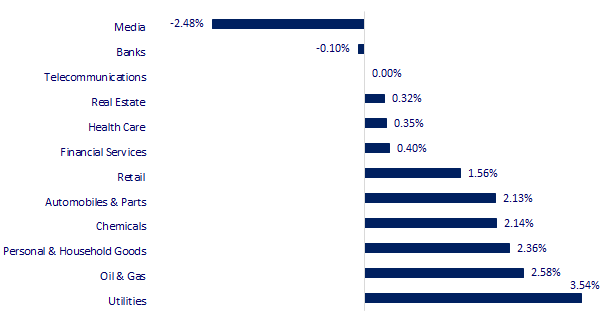

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

29,611.57

1D 0.04%

YTD 7.90%

3,491.57

1D -1.00%

YTD 2.26%

2,969.27

1D -0.47%

YTD 3.33%

24,870.51

1D 0.35%

YTD -8.39%

3,242.34

1D 0.70%

YTD 13.00%

1,626.22

1D 0.00%

YTD 12.20%

79.67

1D -0.10%

YTD 64.95%

1,795.25

1D -0.05%

YTD -5.69%

- Asian stocks mixed, Chinese real estate stocks fell. In Japan, the Nikkei 225 gained 0.04%. The Chinese market fell with the Shanghai Composite down 1%, Shenzhen Component down 0.637%. Hong Kong's Hang Seng rose 0.35%. South Korea's Kospi index fell 0.47%.

VIETNAM ECONOMY

0.62%

1D (bps) -4

YTD (bps) 49

5.60%

YTD (bps) -20

1.15%

1D (bps) -6

YTD (bps) -7

1.85%

1D (bps) -9

YTD (bps) -18

22,770

1D (%) -0.02%

YTD (%) -1.76%

26,586

1D (%) -0.17%

YTD (%) -8.65%

3,611

1D (%) -0.08%

YTD (%) 1.06%

- According to the Ministry of Finance, in October 2021, the Government's debt repayment reached about 7,308 billion VND. Accumulating 10 months, the total debt repayment obligation of the Government reached about 298,222 billion VND reached 75.6% of the plan, of which, the Government's direct debt repayment obligation was about VND 278,577 billion (76.1% of the plan); the on-lending debt repayment obligation is about VND 19,646 billion (69.5% of the plan).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The government repays about 298,222 billion VND in 10 months

- The US has officially announced its agreement to recognize Vietnam's vaccine passports

- The Civil Aviation Authority of Vietnam proposes to reopen regular international routes from January 2022

- Global food prices are approaching record highs

- The US will continue to make efforts to lower oil prices

- UK decided to keep interest rates at record low 0.1%

VN30

BANK

97,500

1D -0.91%

5D -0.51%

Buy Vol. 2,114,300

Sell Vol. 1,846,200

43,600

1D -0.91%

5D 5.06%

Buy Vol. 3,250,100

Sell Vol. 4,692,700

32,700

1D 0.31%

5D 3.81%

Buy Vol. 19,125,800

Sell Vol. 20,055,800

53,000

1D -0.56%

5D 2.71%

Buy Vol. 22,354,100

Sell Vol. 27,920,800

37,950

1D -0.13%

5D -0.26%

Buy Vol. 7,235,300

Sell Vol. 10,494,100

28,650

1D -0.87%

5D 0.53%

Buy Vol. 14,223,800

Sell Vol. 19,472,300

26,700

1D -1.29%

5D 5.74%

Buy Vol. 6,339,600

Sell Vol. 6,643,100

43,500

1D -0.57%

5D -3.01%

Buy Vol. 3,568,900

Sell Vol. 4,655,000

27,650

1D 0.73%

5D 3.95%

Buy Vol. 21,164,600

Sell Vol. 21,815,200

33,500

1D 0.00%

5D 1.52%

Buy Vol. 9,213,500

Sell Vol. 11,782,500

- VPB: In the current context, with the approved capital increase plan, VPBank's Board of Directors is considering opening a securities company to expand its business network, expand customers, and enhance cross-selling of products. and service.

REAL ESTATE

105,000

1D 0.96%

5D -3.93%

Buy Vol. 4,250,600

Sell Vol. 4,318,600

48,200

1D 1.58%

5D -5.49%

Buy Vol. 3,820,200

Sell Vol. 4,281,400

94,900

1D 1.28%

5D -1.15%

Buy Vol. 5,543,500

Sell Vol. 5,209,800

- KDH: reduced cost of commissions and advertising, but the gross profit of real estate dropped sharply by 66b dong, causing the 3rd quarter net profit to decrease by 12% Q0Q to 317b dong.

OIL & GAS

122,400

1D 4.53%

5D -1.69%

Buy Vol. 2,532,400

Sell Vol. 2,247,300

13,000

1D 2.77%

5D 2.77%

Buy Vol. 37,848,100

Sell Vol. 46,295,000

53,900

1D 2.28%

5D -0.37%

Buy Vol. 4,226,400

Sell Vol. 4,288,000

- GAS: was in the top of stocks that were bought the most by foreign investors in today's session (only after HPG) with a value of more than 40 billion dong.

VINGROUP

95,000

1D 0.00%

5D -0.84%

Buy Vol. 2,875,200

Sell Vol. 2,890,300

82,000

1D -0.85%

5D -4.09%

Buy Vol. 15,188,200

Sell Vol. 12,222,500

31,200

1D -1.11%

5D 0.00%

Buy Vol. 8,811,600

Sell Vol. 12,568,300

- VHM: Successfully issued 22.8 million 36-month bonds with a total value of VND2,280 billion, non-convertible bonds, unwarranted and unsecured by assets

FOOD & BEVERAGE

89,200

1D 0.90%

5D -1.65%

Buy Vol. 5,335,000

Sell Vol. 5,976,500

147,800

1D -0.07%

5D -2.05%

Buy Vol. 1,818,900

Sell Vol. 1,977,400

172,000

1D 0.12%

5D 7.17%

Buy Vol. 187,300

Sell Vol. 166,800

- VNM: Moc Chau Milk has advanced a 10% dividend, the group of 3 major shareholders related to Vinamilk will receive about VND 75 billion from this upcoming dividend payment.

OTHERS

130,000

1D 0.31%

5D -1.52%

Buy Vol. 953,700

Sell Vol. 1,383,800

130,000

1D 0.31%

5D -1.52%

Buy Vol. 953,700

Sell Vol. 1,383,800

97,600

1D 1.67%

5D 0.72%

Buy Vol. 3,686,900

Sell Vol. 4,204,400

132,000

1D 1.62%

5D 0.46%

Buy Vol. 2,319,500

Sell Vol. 4,338,400

108,000

1D 3.85%

5D 3.85%

Buy Vol. 1,557,400

Sell Vol. 1,209,900

40,100

1D 0.38%

5D 0.75%

Buy Vol. 6,546,300

Sell Vol. 7,719,300

42,900

1D -0.23%

5D 5.93%

Buy Vol. 24,264,200

Sell Vol. 31,102,100

56,600

1D 0.53%

5D -0.88%

Buy Vol. 35,658,500

Sell Vol. 46,345,200

- MWG: just passed a Resolution to establish a subsidiary in the field of warehousing and freight services. The purpose according to MWG is to optimize the management and operation of the warehouse system, transport and delivery activities between general warehouses and stores, expand logistics service provision to external partners as well as opportunities to raise capital in the future.

Market by numbers

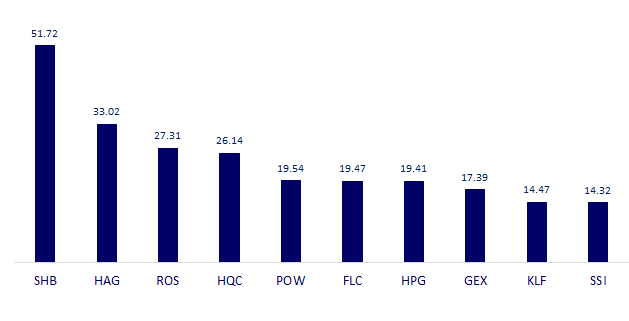

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

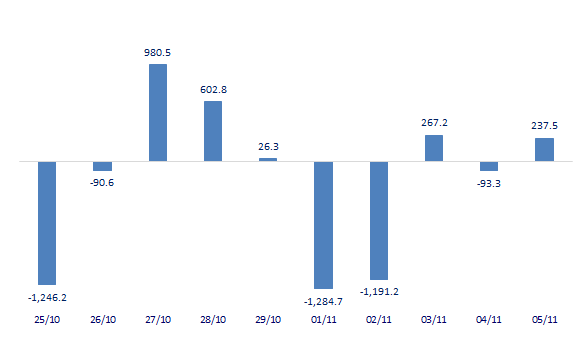

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

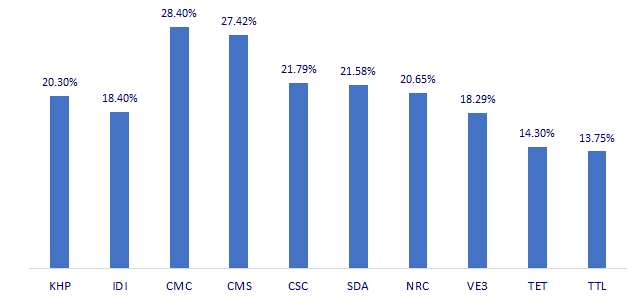

TOP INCREASES 3 CONSECUTIVE SESSIONS

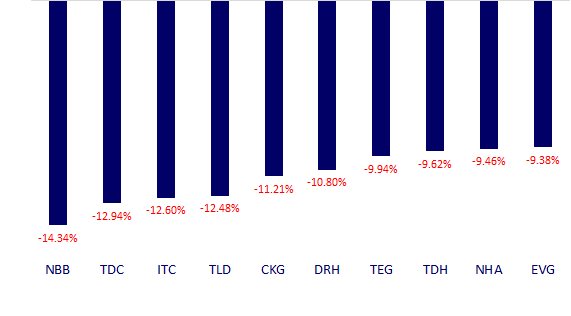

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.