Market Brief 09/11/2021

VIETNAM STOCK MARKET

1,461.50

1D -0.41%

YTD 32.93%

1,527.13

1D -0.56%

YTD 44.29%

432.64

1D 0.12%

YTD 119.50%

109.18

1D 0.14%

YTD 47.88%

8.24

1D 0.00%

YTD 0.00%

37,163.88

1D -5.08%

YTD 116.66%

- In general, on all 3 exchanges, foreign investors were a slight net buy in 9/11 session. HPG was bought the most by foreign investors with 173 billion dong. CTG and VHM were net bought 95 billion dong and 86 billion dong respectively. On the other side, MSN was sold the most with 97 billion dong DXG and NVL were sold 91 billion dong and 80 billion dong respectively.

ETF & DERIVATIVES

25,690

1D -1.00%

YTD 36.65%

18,000

1D -0.50%

YTD 43.66%

19,090

1D 7.19%

YTD 43.53%

22,800

1D 0.00%

YTD 44.30%

21,200

1D -0.24%

YTD 55.31%

27,980

1D -0.07%

YTD 62.67%

19,450

1D -0.77%

YTD 39.43%

1,489

1D 0.00%

YTD 0.00%

1,526

1D -0.79%

YTD 0.00%

1,524

1D -0.71%

YTD 0.00%

1,521

1D -0.75%

YTD 0.00%

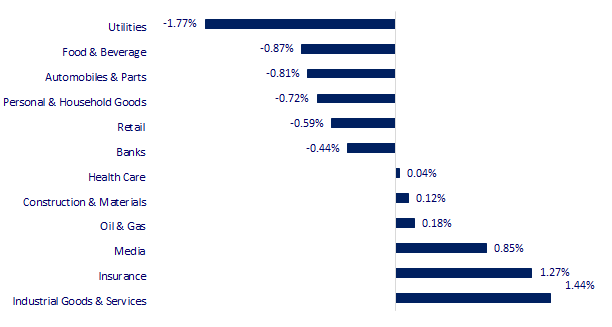

CHANGE IN PRICE BY SECTOR

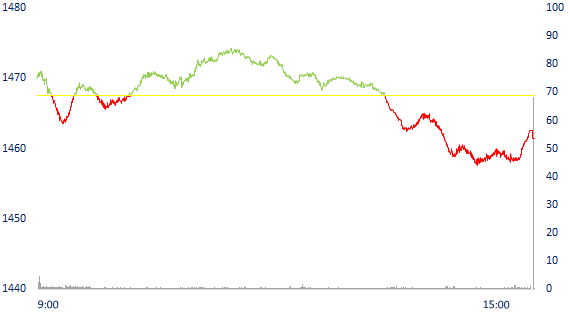

INTRADAY VNINDEX

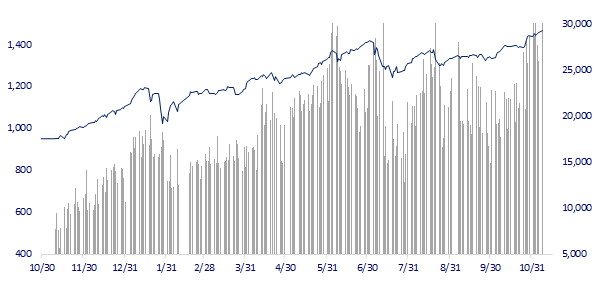

VNINDEX (12M)

GLOBAL MARKET

29,285.46

1D -0.82%

YTD 6.71%

3,507.00

1D 0.24%

YTD 2.71%

2,962.46

1D 0.08%

YTD 3.10%

24,813.13

1D -0.24%

YTD -8.60%

3,242.34

1D 0.00%

YTD 13.00%

1,631.69

1D 0.34%

YTD 12.58%

82.28

1D 0.32%

YTD 70.35%

1,826.95

1D 0.04%

YTD -4.03%

- Asian stocks mixed after Wall Street's peak session. In Japan, the Nikkei 225 fell 0.82%. The Chinese market rose with Shanghai Composite up 0.24%, Shenzhen Component up 0.435%. Hong Kong's Hang Seng fell 0.24%. South Korea's Kospi index rose 0.08%.

VIETNAM ECONOMY

0.63%

1D (bps) 1

YTD (bps) 50

5.60%

YTD (bps) -20

0.93%

1D (bps) -28

YTD (bps) -29

1.97%

1D (bps) 3

YTD (bps) -6

22,758

1D (%) -0.01%

YTD (%) -1.81%

26,699

1D (%) 0.05%

YTD (%) -8.26%

3,615

1D (%) 0.00%

YTD (%) 1.18%

- The Ministry of Transport proposes to reopen regular passenger flights to Vietnam in 3 phases, of which phase 1 starts from the first quarter of next year. The ministry also proposed the Government decide on a specific time to implement the stages of resumption of regular international passenger flights.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Transport proposes to reopen international flights to 15 countries and territories

- Standard Chartered: Vietnam is a priority destination in new economies

- In 5 years, Vietnam has increased 16 places in the ranking of global industry competitiveness

- Fed warns of risks of risky assets and stablecoins

- Fear of bubbles is growing as financial markets explode rapidly

- The Fed warns of the impact of China's real estate market on the US

VN30

BANK

97,100

1D -1.12%

5D -0.82%

Buy Vol. 2,015,300

Sell Vol. 2,111,300

43,000

1D -2.05%

5D 2.50%

Buy Vol. 3,839,700

Sell Vol. 5,093,900

32,950

1D 0.46%

5D 1.70%

Buy Vol. 26,633,500

Sell Vol. 28,849,800

52,300

1D -0.57%

5D 1.36%

Buy Vol. 32,159,200

Sell Vol. 40,101,900

37,050

1D -1.33%

5D -1.33%

Buy Vol. 14,899,500

Sell Vol. 15,950,100

28,600

1D 0.35%

5D 0.70%

Buy Vol. 22,655,600

Sell Vol. 26,141,900

27,700

1D 2.59%

5D 8.20%

Buy Vol. 10,987,800

Sell Vol. 14,399,800

43,400

1D -0.91%

5D -0.91%

Buy Vol. 3,655,200

Sell Vol. 3,878,700

28,100

1D 0.90%

5D 5.44%

Buy Vol. 41,512,600

Sell Vol. 47,515,700

33,450

1D 0.15%

5D 0.90%

Buy Vol. 8,884,600

Sell Vol. 10,545,000

- TPB: 4 organizations in SoftBank's Investment Block bought 24.1 million TPB shares, estimated to spend VND 1,041 billion. Transactions took place from October 5 to November 3 by order matching and put-through methods. - TCB: Additional listing of 6,008,568 shares due to ESOP issuance, bringing the total number of securities after listing change to 3,510,914,798 shares. Official trading date September 16, 2022

REAL ESTATE

103,000

1D -1.53%

5D -4.72%

Buy Vol. 4,588,700

Sell Vol. 4,895,800

48,400

1D 0.73%

5D -3.97%

Buy Vol. 5,428,200

Sell Vol. 4,674,200

92,300

1D -0.86%

5D -3.15%

Buy Vol. 4,468,600

Sell Vol. 4,929,300

- NVL: Novaland group has just mobilized nearly 1,600 billion VND of bonds. Part of the capital was contributed by Novaland to its subsidiary and M&A Hoan Vu Resort - Ho Tram.

OIL & GAS

119,200

1D -3.09%

5D -1.97%

Buy Vol. 2,410,000

Sell Vol. 3,140,400

12,850

1D -1.91%

5D 0.00%

Buy Vol. 26,396,600

Sell Vol. 41,126,200

54,500

1D -0.37%

5D 0.37%

Buy Vol. 2,172,800

Sell Vol. 2,505,400

- POW: In October, the power demand on the system continued to decrease due to COVID-19 and natural disasters, making PV Power's power output only 42% of the monthly plan.

VINGROUP

94,900

1D 0.00%

5D -0.94%

Buy Vol. 3,231,500

Sell Vol. 4,112,700

83,000

1D 0.73%

5D -2.35%

Buy Vol. 12,971,600

Sell Vol. 14,888,000

30,400

1D -1.46%

5D -1.46%

Buy Vol. 14,601,600

Sell Vol. 15,722,300

- VHM was in the top of stocks that were bought the most by foreign investors in today's session with a value of up to 86.4 billion dong.

FOOD & BEVERAGE

89,800

1D -1.10%

5D 0.67%

Buy Vol. 5,393,800

Sell Vol. 8,379,200

147,800

1D -2.76%

5D 1.58%

Buy Vol. 2,148,800

Sell Vol. 2,325,700

174,000

1D 0.17%

5D 5.33%

Buy Vol. 95,700

Sell Vol. 121,600

- MSN: Masan has a strategic partnership with De Heus Vietnam to maintain the 3F value chain model

OTHERS

131,000

1D -0.61%

5D -0.76%

Buy Vol. 889,800

Sell Vol. 1,064,800

131,000

1D -0.61%

5D -0.76%

Buy Vol. 889,800

Sell Vol. 1,064,800

96,400

1D -1.03%

5D 0.31%

Buy Vol. 3,302,000

Sell Vol. 3,474,700

130,000

1D -1.22%

5D 0.85%

Buy Vol. 1,427,000

Sell Vol. 2,031,500

106,000

1D -1.85%

5D 0.95%

Buy Vol. 1,176,500

Sell Vol. 1,017,600

40,600

1D -0.25%

5D -3.56%

Buy Vol. 5,874,400

Sell Vol. 8,449,600

44,300

1D -0.45%

5D 4.60%

Buy Vol. 28,490,600

Sell Vol. 30,869,000

56,500

1D -0.53%

5D 1.80%

Buy Vol. 44,091,300

Sell Vol. 45,061,000

- MWG: Announces consolidated financial statements for the third quarter of 2021 with a decrease in net profit compared to the same period last year due to the impact of the Covid-19 pandemic, equivalent to VND 967 billion. Notably, during the period, the Company recorded a sudden financial revenue, mainly from interest on deposits with VND 686 billion - 2 times higher than the same period in 2020.

Market by numbers

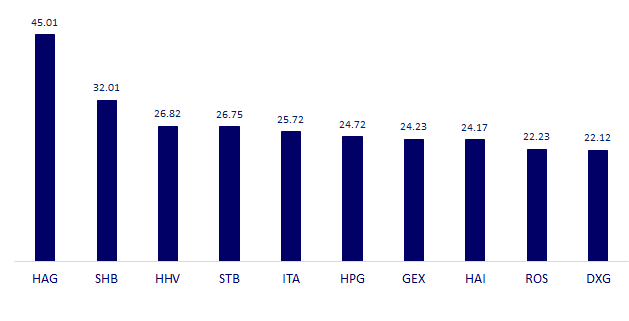

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

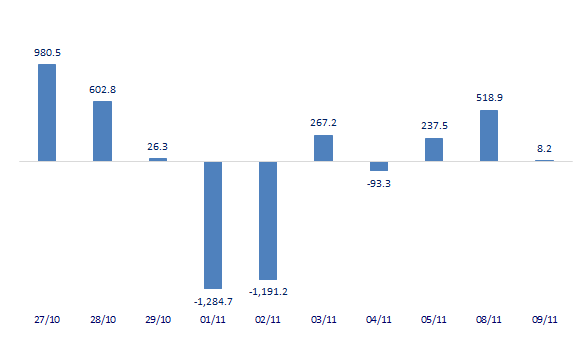

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

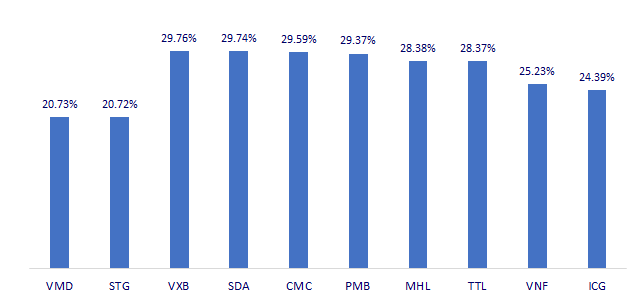

TOP INCREASES 3 CONSECUTIVE SESSIONS

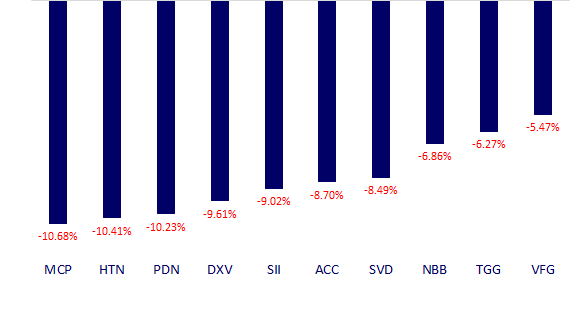

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.