Market brief 10/11/2021

VIETNAM STOCK MARKET

1,465.02

1D 0.24%

YTD 33.25%

1,523.79

1D -0.22%

YTD 43.97%

438.24

1D 1.29%

YTD 122.34%

109.66

1D 0.44%

YTD 48.53%

-777.02

1D 0.00%

YTD 0.00%

36,311.91

1D -2.29%

YTD 111.69%

- In October of this year, the number of newly opened accounts reached 129,751 accounts, in the first 10 months of this year reached 1,086 million accounts. On average, the Vietnamese stock market receives more than 108,600 new accounts every month. This boom in market entry is equal to the previous 4 years combined

ETF & DERIVATIVES

25,710

1D 0.08%

YTD 36.76%

17,970

1D -0.17%

YTD 43.42%

19,090

1D 7.19%

YTD 43.53%

22,800

1D 0.00%

YTD 44.30%

21,200

1D 0.00%

YTD 55.31%

27,750

1D -0.82%

YTD 61.34%

19,500

1D 0.26%

YTD 39.78%

1,489

1D 0.00%

YTD 0.00%

1,529

1D 0.25%

YTD 0.00%

1,526

1D 0.13%

YTD 0.00%

1,525

1D 0.23%

YTD 0.00%

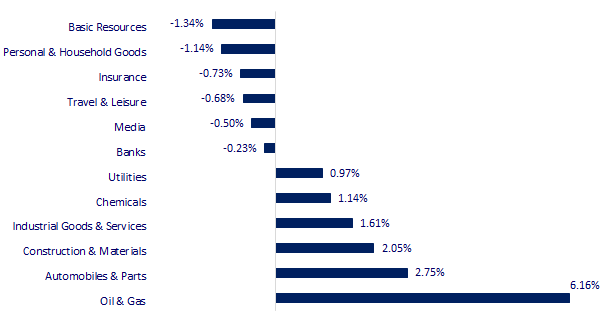

CHANGE IN PRICE BY SECTOR

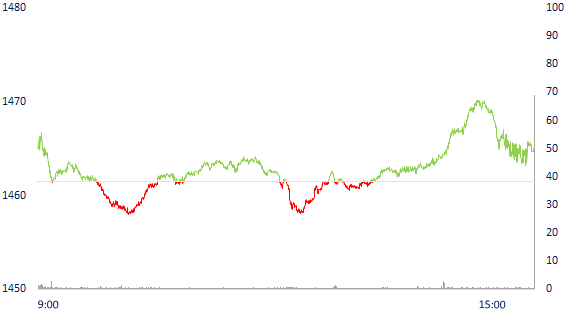

INTRADAY VNINDEX

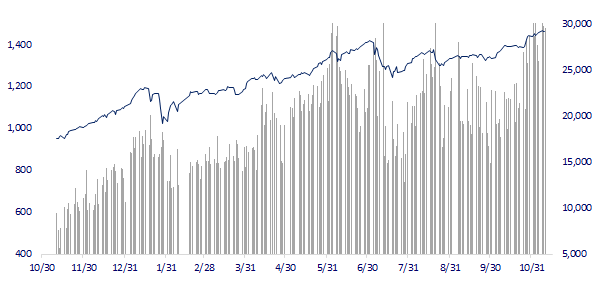

VNINDEX (12M)

GLOBAL MARKET

29,106.78

1D -0.36%

YTD 6.06%

3,492.46

1D -0.41%

YTD 2.28%

2,930.17

1D -1.09%

YTD 1.97%

24,996.14

1D 1.34%

YTD -7.92%

3,242.34

1D 0.00%

YTD 13.00%

1,630.47

1D -0.07%

YTD 12.50%

83.80

1D -0.69%

YTD 73.50%

1,827.35

1D -0.21%

YTD -4.01%

- China releases inflation data, Asian stocks mixed. In Japan, the Nikkei 225 fell 0.36%. The Chinese market fell with Shanghai Composite down 0.41%, Shenzhen Component down 0.385%. Hong Kong's Hang Seng rose 1.34%. South Korea's Kospi index fell 1.09%.

VIETNAM ECONOMY

0.61%

1D (bps) -2

YTD (bps) 48

5.60%

YTD (bps) -20

1.03%

1D (bps) 10

YTD (bps) -19

1.98%

1D (bps) 1

YTD (bps) -5

22,748

1D (%) -0.04%

YTD (%) -1.86%

26,610

1D (%) -0.36%

YTD (%) -8.57%

3,614

1D (%) 0.00%

YTD (%) 1.15%

- On November 9, the European Business Association in Vietnam (EuroCham) announced the EuroCham Business Climate Index for the third quarter of 2021 (Business Climate Index - BCI) reaching 18.3 percentage points. This is a slight but encouraging increase compared to the record low of 15 percentage points recorded during the most difficult period of the fourth Covid-19 outbreak in September 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Supervising but not obstruct foreign investment activities in Vietnam

- The Ministry of Industry and Trade proposes to put fertilizers on the list subject to VAT

- European businesses are optimistic about Vietnam's business environment

- Fed Vice Chairman: The US may be ready to raise interest rates by the end of 2022

- China's producer price index rose 13.5%, the strongest in 26 years

- US extends ban on investment in Chinese companies

VN30

BANK

97,600

1D 0.51%

5D -1.11%

Buy Vol. 2,005,100

Sell Vol. 1,374,900

43,000

1D 0.00%

5D -0.12%

Buy Vol. 3,539,900

Sell Vol. 3,934,100

32,500

1D -1.37%

5D -1.52%

Buy Vol. 11,879,000

Sell Vol. 17,323,000

51,700

1D -1.15%

5D -3.72%

Buy Vol. 29,136,900

Sell Vol. 38,076,900

36,700

1D -0.94%

5D -4.43%

Buy Vol. 11,833,500

Sell Vol. 10,903,700

28,600

1D 0.00%

5D -1.89%

Buy Vol. 18,417,000

Sell Vol. 26,287,600

28,000

1D 1.08%

5D 2.94%

Buy Vol. 7,034,400

Sell Vol. 10,507,500

44,000

1D 1.38%

5D -0.45%

Buy Vol. 3,488,000

Sell Vol. 2,906,300

28,450

1D 1.25%

5D 1.97%

Buy Vol. 29,029,300

Sell Vol. 35,583,000

33,400

1D -0.15%

5D -1.33%

Buy Vol. 7,779,300

Sell Vol. 9,186,100

- STB: On October 28, 2021, Sacombank successfully closed the book of issuing 5,000 bonds, equivalent to VND 5,000 billion with the method of private placement for professional securities investors only 1 month after the date of issuance. The proceeds are used by Sacombank to supplement capital sources, meet customers' borrowing needs for medium and long-term projects, and at the same time contribute to increasing safety limits and ratios in the Bank's operations.

REAL ESTATE

104,000

1D 0.97%

5D -1.14%

Buy Vol. 3,275,100

Sell Vol. 3,077,700

48,300

1D -0.21%

5D 2.33%

Buy Vol. 4,429,000

Sell Vol. 3,944,400

89,200

1D -3.36%

5D -4.60%

Buy Vol. 4,157,300

Sell Vol. 4,515,300

- NVL: approved the implementation of the plan to issue shares to pay dividends and distribute bonus shares to shareholders at the total rate of 60%.

OIL & GAS

120,400

1D 1.01%

5D 0.33%

Buy Vol. 2,091,900

Sell Vol. 2,060,900

13,100

1D 1.95%

5D 3.97%

Buy Vol. 36,762,200

Sell Vol. 54,197,900

58,300

1D 6.97%

5D 10.00%

Buy Vol. 16,065,800

Sell Vol. 8,715,700

- Gasoline prices continued to increase to the highest level in the past 7 years. On November 10, the domestic price of E5 RON 92 increased by 559 VND/liter and RON 95 increased by 658 VND/liter.

VINGROUP

94,900

1D 0.00%

5D -0.42%

Buy Vol. 2,928,900

Sell Vol. 3,509,000

82,600

1D -0.48%

5D -0.36%

Buy Vol. 13,713,000

Sell Vol. 8,341,700

30,900

1D 1.64%

5D -2.52%

Buy Vol. 13,948,900

Sell Vol. 11,986,700

- VRE: As of September 30, VRE is operating 80 shopping malls with a total retail floor area of 1.7 million m2. In the fourth quarter, VRE will open stores at Vincom Mega Mall Smart City.

FOOD & BEVERAGE

89,700

1D -0.11%

5D 1.70%

Buy Vol. 4,950,600

Sell Vol. 5,023,300

147,700

1D -0.07%

5D 1.51%

Buy Vol. 2,121,300

Sell Vol. 1,939,600

174,000

1D 0.00%

5D 0.81%

Buy Vol. 94,800

Sell Vol. 175,700

- MSN: In today's session, MSN was bought the most by foreign investors with a value of up to 46 billion dong.

OTHERS

129,700

1D -0.99%

5D -0.08%

Buy Vol. 841,200

Sell Vol. 1,100,300

129,700

1D -0.99%

5D -0.08%

Buy Vol. 841,200

Sell Vol. 1,100,300

97,000

1D 0.62%

5D 0.94%

Buy Vol. 3,422,100

Sell Vol. 2,509,400

131,500

1D 1.15%

5D 2.10%

Buy Vol. 1,418,400

Sell Vol. 1,295,500

103,000

1D -2.83%

5D -1.44%

Buy Vol. 1,308,600

Sell Vol. 967,400

41,100

1D 1.23%

5D 4.58%

Buy Vol. 7,494,000

Sell Vol. 10,080,000

44,700

1D 0.90%

5D 7.19%

Buy Vol. 37,152,700

Sell Vol. 37,386,600

55,300

1D -2.12%

5D -0.54%

Buy Vol. 67,440,400

Sell Vol. 70,820,300

- PNJ: PNJ expects profit after tax to increase by 30% in 2022, possibly even faster if market conditions are favorable. Along with that, the company is promoting the private placement of shares to enhance long-term capital.

Market by numbers

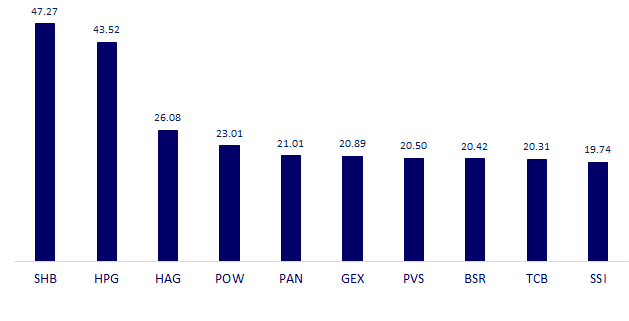

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

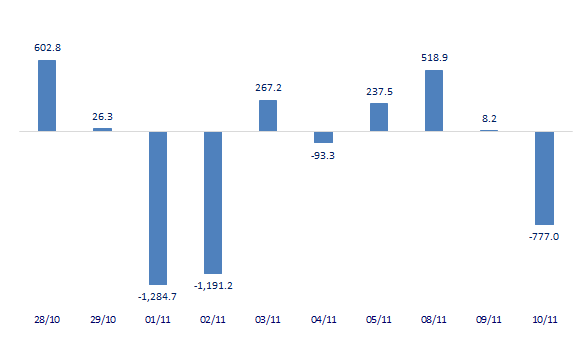

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

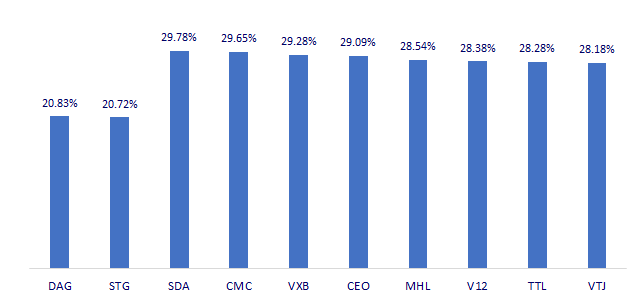

TOP INCREASES 3 CONSECUTIVE SESSIONS

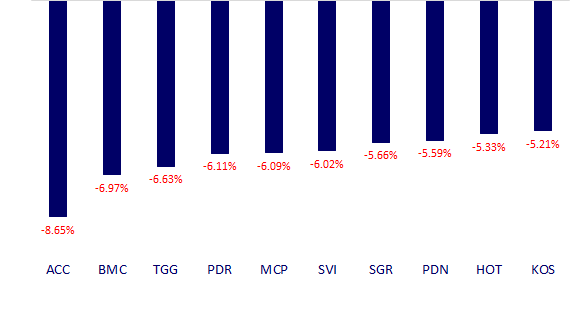

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.