Market brief 12/11/2021

VIETNAM STOCK MARKET

1,473.37

1D 0.75%

YTD 34.00%

1,527.94

1D 0.90%

YTD 44.36%

441.63

1D 0.66%

YTD 124.06%

110.66

1D 1.33%

YTD 49.88%

201.96

1D 0.00%

YTD 0.00%

34,408.39

1D -24.86%

YTD 100.60%

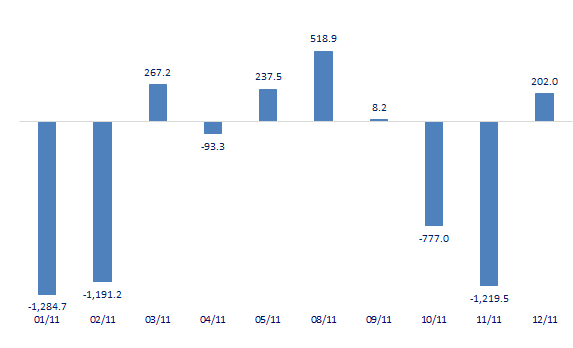

- Foreign investors net bought again 202 billion dong in 11/12 session. CTG was bought the most by foreign investors on HoSE with 117 billion dong. MSN and STB were net bought 103 billion dong and 79.5 billion dong respectively. On the other side, HPG was sold the most with 77.5 billion dong. PLX and NLG were net sold at 40 billion dong and 25 billion dong, respectively.

ETF & DERIVATIVES

25,890

1D 0.78%

YTD 37.71%

17,980

1D 0.84%

YTD 43.50%

18,950

1D 6.40%

YTD 42.48%

22,800

1D -1.30%

YTD 44.30%

20,750

1D -1.19%

YTD 52.01%

28,140

1D 1.26%

YTD 63.60%

19,500

1D -0.51%

YTD 39.78%

1,489

1D 0.00%

YTD 0.00%

1,531

1D 1.17%

YTD 0.00%

1,527

1D 1.01%

YTD 0.00%

1,524

1D 0.89%

YTD 0.00%

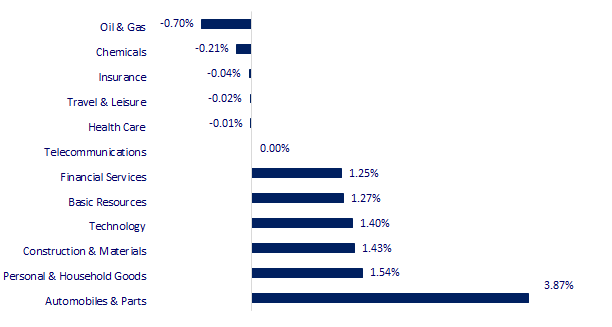

CHANGE IN PRICE BY SECTOR

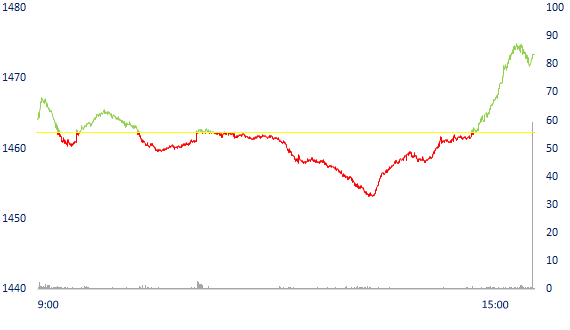

INTRADAY VNINDEX

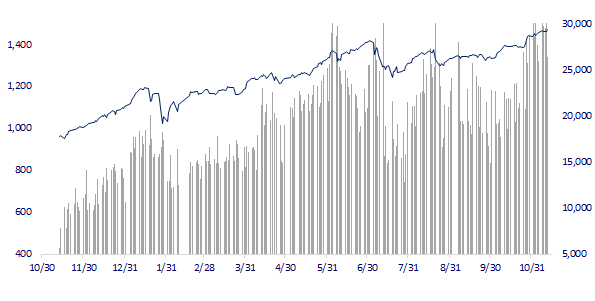

VNINDEX (12M)

GLOBAL MARKET

29,609.97

1D 0.12%

YTD 7.89%

3,539.10

1D 0.18%

YTD 3.65%

2,968.80

1D 1.50%

YTD 3.32%

25,327.97

1D -0.28%

YTD -6.70%

3,242.34

1D 0.00%

YTD 13.00%

1,633.94

1D 0.09%

YTD 12.74%

80.41

1D -0.97%

YTD 66.48%

1,851.55

1D -0.50%

YTD -2.74%

- Asian stocks mixed, oil prices fell. In Japan, the Nikkei 225 gained 0.12%. The Chinese market edged higher with the Shanghai Composite up 0.18% . Hong Kong's Hang Seng fell 0.28%. JD.com shares rose nearly 5% after the 11/11 Singles Day shopping event, Alibaba fell 0.67%. South Korea's Kospi index rose 1.5%.

VIETNAM ECONOMY

0.63%

YTD (bps) 50

5.60%

YTD (bps) -20

1.20%

1D (bps) 2

YTD (bps) -2

1.91%

1D (bps) 1

YTD (bps) -12

22,746

1D (%) 0.02%

YTD (%) -1.86%

26,553

1D (%) 0.82%

YTD (%) -8.76%

3,619

1D (%) 0.17%

YTD (%) 1.29%

- The Governor of the State Bank said that with a large open economy, with a total import-export turnover of over 200% of GDP, Vietnam may face import inflation risks. Governor of the State Bank (SBV) Nguyen Thi Hong said that by assessing the actual situation of the bank's monetary activities and the macro-economy, the National Assembly's target of controlling inflation below 4% this year can be achieved.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Governor of the State Bank: The pressure on inflation and monetary policy management in the coming time will be great

- By the end of 2021, 2 component projects of the East North - South Expressway will be completed

- Minister of Finance: It is expected to issue bonds to mobilize 180,000b from the people to lead the growth.

- OPEC: Rising oil prices slow the recovery of oil demand

- World food prices broke their peak in October

- Hong Kong (China): Nearly 1.1 million people have successfully escaped poverty

VN30

BANK

98,200

1D -0.10%

5D 0.72%

Buy Vol. 1,368,400

Sell Vol. 1,111,900

43,200

1D 0.93%

5D -0.92%

Buy Vol. 4,107,700

Sell Vol. 3,322,200

32,700

1D 2.35%

5D 0.00%

Buy Vol. 23,598,100

Sell Vol. 17,918,300

52,500

1D 1.94%

5D -0.94%

Buy Vol. 23,664,500

Sell Vol. 20,139,800

36,750

1D 0.68%

5D -3.16%

Buy Vol. 13,385,700

Sell Vol. 9,957,200

28,550

1D 1.60%

5D -0.35%

Buy Vol. 20,388,700

Sell Vol. 18,768,500

28,000

1D 1.08%

5D 4.87%

Buy Vol. 7,843,100

Sell Vol. 7,480,900

43,500

1D 1.16%

5D 0.00%

Buy Vol. 2,569,500

Sell Vol. 2,257,000

28,100

1D 1.44%

5D 1.63%

Buy Vol. 27,121,500

Sell Vol. 30,576,300

33,350

1D 1.06%

5D -0.45%

Buy Vol. 7,806,300

Sell Vol. 7,696,100

- HDB: just announced the approval of additional capital contribution at HD Saison Finance Company Limited. Accordingly, HDBank plans to pour another 175 billion dong into HD Saison, bringing the total value of capital contributed to this financial company to 1,175 billion dong. Ownership rate reaches 50%. HD Saison has a charter capital of 2,000 billion VND. In which, HDBank holds 50% of capital, Credit Saison (Japan) holds 49% of capital and Ho Chi Minh City Securities Joint Stock Company. Ho Chi Minh City (HSC) holds 1% of capital.

REAL ESTATE

106,000

1D 0.47%

5D 0.95%

Buy Vol. 1,975,700

Sell Vol. 2,982,900

49,500

1D -0.60%

5D 2.70%

Buy Vol. 3,910,100

Sell Vol. 4,078,700

91,400

1D -0.54%

5D -3.69%

Buy Vol. 4,217,700

Sell Vol. 4,827,100

- PDR: On November 12, MSCI announced 9 more stocks into the basket of MSCI Frontier Market Index, of which 1 Vietnamese ticker is PDR.

OIL & GAS

118,100

1D -0.76%

5D -3.51%

Buy Vol. 2,807,200

Sell Vol. 2,527,600

12,950

1D 0.39%

5D -0.38%

Buy Vol. 35,589,100

Sell Vol. 33,245,500

60,000

1D 0.33%

5D 11.32%

Buy Vol. 4,719,000

Sell Vol. 4,290,600

- PLX: New regulations in Decree 95 will have a slight positive impact on Vietnam National Petroleum Group

VINGROUP

94,500

1D -0.32%

5D -0.53%

Buy Vol. 1,998,200

Sell Vol. 2,634,300

82,000

1D 0.61%

5D 0.00%

Buy Vol. 8,769,900

Sell Vol. 8,704,300

30,100

1D -0.66%

5D -3.53%

Buy Vol. 9,782,900

Sell Vol. 11,515,900

- VIC: VinFast issues another 1,500 billion dong of bonds. The bond lot has a term of 3 years with a coupon interest rate of 9%/year.

FOOD & BEVERAGE

89,300

1D -0.33%

5D 0.11%

Buy Vol. 4,544,600

Sell Vol. 4,916,900

149,600

1D 1.84%

5D 1.22%

Buy Vol. 2,237,900

Sell Vol. 2,545,200

172,000

1D 0.00%

5D 0.00%

Buy Vol. 84,100

Sell Vol. 115,800

- VNM: Vinamilk brings premium organic fresh milk with double standard to Shanghai International Exhibition

OTHERS

128,600

1D 0.00%

5D -1.08%

Buy Vol. 860,000

Sell Vol. 893,500

128,600

1D 0.00%

5D -1.08%

Buy Vol. 860,000

Sell Vol. 893,500

98,000

1D 2.08%

5D 0.41%

Buy Vol. 4,023,000

Sell Vol. 4,142,400

136,000

1D 0.74%

5D 3.03%

Buy Vol. 1,830,700

Sell Vol. 2,345,900

109,900

1D 5.17%

5D 1.76%

Buy Vol. 1,457,200

Sell Vol. 1,436,400

41,400

1D -1.19%

5D 3.24%

Buy Vol. 5,035,200

Sell Vol. 6,510,300

44,600

1D 1.02%

5D 3.96%

Buy Vol. 22,113,200

Sell Vol. 28,045,300

54,600

1D 1.11%

5D -3.53%

Buy Vol. 40,371,200

Sell Vol. 33,456,400

- FPT: revenue and profit before tax in the first 10 months of the year reached VND 28,215 billion and VND 5,206 billion, up 19.4% and 19.7% over the same period. Pre-tax profit margin increased from 18.4% to 18.5%. Thus, the company has completed 84% of the profit plan for the whole year. Profit after tax for shareholders of parent company and EPS reached VND 3,482 billion and VND 3,844 respectively, up 19.0% and 18.4% respectively.

Market by numbers

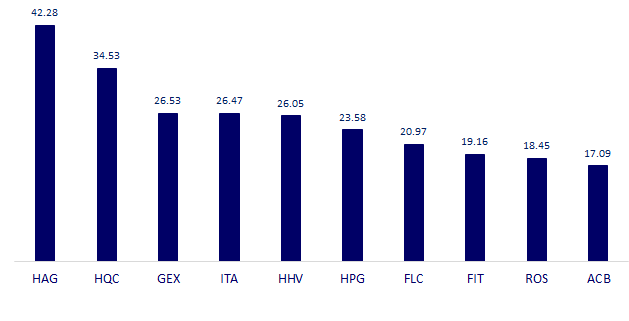

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

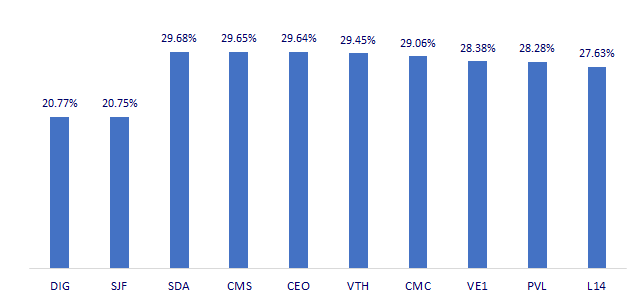

TOP INCREASES 3 CONSECUTIVE SESSIONS

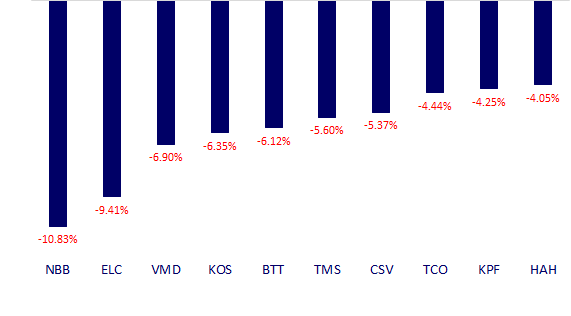

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.