Market Brief 17/11/2021

VIETNAM STOCK MARKET

1,475.85

1D 0.64%

YTD 34.23%

1,519.58

1D 0.16%

YTD 43.57%

462.95

1D 2.37%

YTD 134.88%

112.21

1D 0.65%

YTD 51.98%

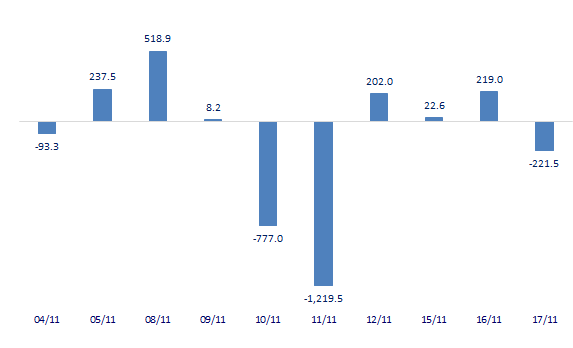

-221.52

1D 0.00%

YTD 0.00%

32,588.06

1D -22.81%

YTD 89.98%

- Foreign investors net sold again 221 billion dong on November 17. On HoSE, they were the strongest net sellers of VPB with 112 billion dong. HPG was also net sold 108 billion dong. VND and NLG are behind with a net selling value of VND 93 billion and VND 52 billion, respectively. Meanwhile, VHM topped the list of net buyers with 148 billion dong.

ETF & DERIVATIVES

25,520

1D 0.08%

YTD 35.74%

17,920

1D 0.50%

YTD 43.02%

18,920

1D 6.23%

YTD 42.26%

22,700

1D 0.22%

YTD 43.67%

21,000

1D -0.10%

YTD 53.85%

28,200

1D -0.11%

YTD 63.95%

19,620

1D 0.05%

YTD 40.65%

1,489

1D 0.00%

YTD 0.00%

1,520

1D 0.20%

YTD 0.00%

1,521

1D 0.18%

YTD 0.00%

1,518

1D -0.04%

YTD 0.00%

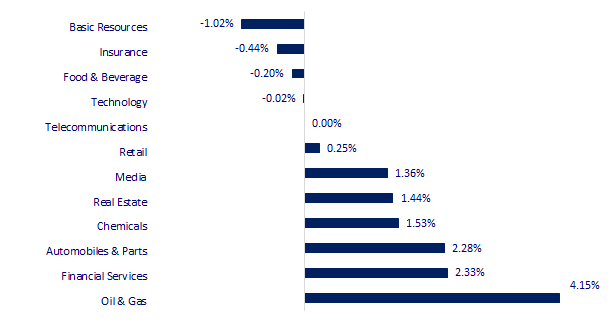

CHANGE IN PRICE BY SECTOR

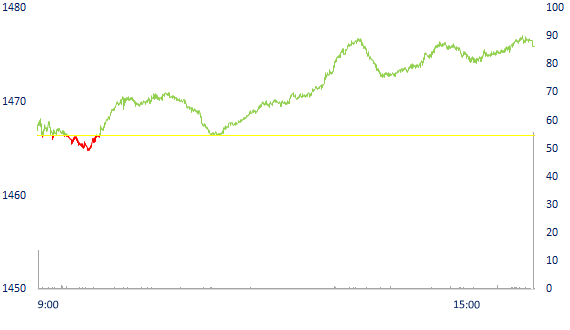

INTRADAY VNINDEX

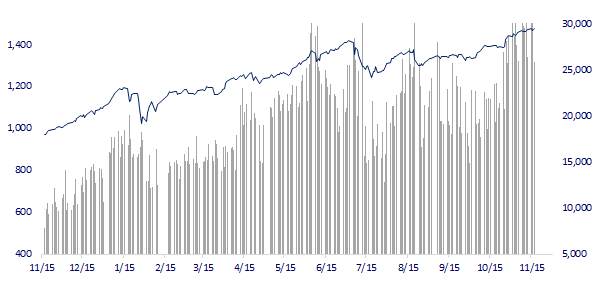

VNINDEX (12M)

GLOBAL MARKET

29,688.33

1D -0.15%

YTD 8.18%

3,537.37

1D 0.44%

YTD 3.60%

2,962.42

1D -1.16%

YTD 3.10%

25,650.08

1D 0.43%

YTD -5.51%

3,232.68

1D -0.30%

YTD 12.67%

1,644.60

1D 0.04%

YTD 13.47%

78.67

1D -0.79%

YTD 62.88%

1,862.95

1D 0.33%

YTD -2.14%

- Japan's export growth slowest in 8 months, Asian stocks mixed. In Japan, the Nikkei 225 fell 0.15%. Japan's exports rose 9.4% in October, the lowest increase in 8 months. September's increase was 13%. The Chinese market rose with the Shanghai Composite up 0.44% and the Shenzhen Component up 0.67%. Hong Kong's Hang Seng rose 0.43%. South Korea's Kospi index fell 1.16%.

VIETNAM ECONOMY

0.63%

1D (bps) -2

YTD (bps) 50

5.60%

YTD (bps) -20

0.93%

1D (bps) -21

YTD (bps) -29

1.92%

1D (bps) 7

YTD (bps) -11

22,748

1D (%) -0.01%

YTD (%) -1.86%

26,050

1D (%) -0.91%

YTD (%) -10.49%

3,619

1D (%) 0.17%

YTD (%) 1.29%

- In the fourth quarter, many manufacturing enterprises are entering the rush season for year-end orders, leading to a sharp increase in capital demand to restore production. However, the cash flow disruption and the tragic business situation are making the opportunity for businesses to access production and business loans from banks become slim.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- WB: Vietnam's total spending on social assistance during the pandemic stands at 0.86% of GDP

- Businesses are thirsty for capital to restore production

- Vietnam should take advantage of the opportunity to accelerate the digital transformation process

- Trillions of USD will be withdrawn from the world economy in 2022

- Inflation in the UK is the highest in 10 years

- Japan - US trade officials consider import tax on steel and aluminum

VN30

BANK

98,000

1D 0.82%

5D 0.41%

Buy Vol. 1,148,500

Sell Vol. 1,416,700

43,600

1D 1.87%

5D 1.40%

Buy Vol. 4,264,900

Sell Vol. 4,420,400

32,250

1D -0.46%

5D -0.77%

Buy Vol. 11,676,600

Sell Vol. 13,198,600

52,200

1D 0.38%

5D 0.97%

Buy Vol. 18,219,500

Sell Vol. 20,750,800

36,150

1D 0.00%

5D -1.50%

Buy Vol. 20,204,400

Sell Vol. 19,497,000

28,700

1D 0.17%

5D 0.35%

Buy Vol. 12,159,900

Sell Vol. 15,487,900

27,800

1D -0.36%

5D -0.71%

Buy Vol. 7,764,600

Sell Vol. 6,829,200

43,250

1D -1.03%

5D -1.70%

Buy Vol. 2,638,000

Sell Vol. 3,194,800

28,000

1D -0.18%

5D -1.58%

Buy Vol. 17,806,300

Sell Vol. 25,356,600

33,300

1D 0.45%

5D -0.30%

Buy Vol. 6,635,400

Sell Vol. 7,599,400

- Techcombank is one of the first banks to use the “zero fee” program, so it has the highest CASA proportion in the industry with 38%. Other banks also promote to attract and increase the proportion of this capital, such as MB with 36% and Vietcombank with 31%. MB and Vietcombank are also the two nearest banks to launch free transfer programs, paying for customers who maintain a certain amount of deposit on a certain current account.

REAL ESTATE

103,200

1D 0.10%

5D -0.77%

Buy Vol. 2,739,200

Sell Vol. 3,488,300

48,300

1D 0.10%

5D 0.00%

Buy Vol. 1,985,700

Sell Vol. 1,807,800

90,000

1D -0.55%

5D 0.90%

Buy Vol. 3,804,800

Sell Vol. 4,218,300

- NVL: is one of the agile corporations when developing 3 key projects in potential areas: NovaWorld Ho Tram, NovaWorld Phan Thiet, and Aqua City

OIL & GAS

117,400

1D 0.60%

5D -2.49%

Buy Vol. 1,027,000

Sell Vol. 1,845,000

14,150

1D 0.71%

5D 8.02%

Buy Vol. 31,037,700

Sell Vol. 35,094,900

62,100

1D 5.61%

5D 6.52%

Buy Vol. 8,304,400

Sell Vol. 7,204,300

- GAS: PV Gas is completing the infrastructure system to be able to import LNG from 2022. PV Gas has signed 6 framework contracts for LNG purchase and sale with LNG suppliers.

VINGROUP

96,300

1D 1.58%

5D 1.48%

Buy Vol. 4,364,900

Sell Vol. 5,046,000

83,500

1D 0.60%

5D 1.09%

Buy Vol. 8,151,100

Sell Vol. 12,929,700

30,450

1D 1.33%

5D -1.46%

Buy Vol. 11,269,000

Sell Vol. 11,538,600

- VIC: On November 16, 2021, the global smart electric car company from Vietnam - VinFast officially announced and put into operation the headquarters of the US branch.

FOOD & BEVERAGE

88,800

1D 0.23%

5D -1.00%

Buy Vol. 4,773,800

Sell Vol. 5,225,700

150,500

1D -0.99%

5D 1.90%

Buy Vol. 990,200

Sell Vol. 970,200

170,500

1D -0.06%

5D -2.01%

Buy Vol. 96,600

Sell Vol. 110,200

- MSN: Last week, De Heus Vietnam officially announced that it will acquire the entire MNS Feed production segment (including 100% Anco and 75.2% Proconco) of Masan Group.

OTHERS

127,900

1D 0.00%

5D -1.39%

Buy Vol. 844,700

Sell Vol. 861,300

127,900

1D 0.00%

5D -1.39%

Buy Vol. 844,700

Sell Vol. 861,300

98,300

1D 0.00%

5D 1.34%

Buy Vol. 2,091,200

Sell Vol. 3,124,200

137,900

1D 0.00%

5D 4.87%

Buy Vol. 1,672,900

Sell Vol. 1,540,600

106,400

1D -1.48%

5D 3.30%

Buy Vol. 1,049,900

Sell Vol. 803,300

40,000

1D 1.65%

5D -2.68%

Buy Vol. 6,241,800

Sell Vol. 7,097,700

45,850

1D 2.46%

5D 2.57%

Buy Vol. 31,144,700

Sell Vol. 48,206,100

51,400

1D -1.15%

5D -7.05%

Buy Vol. 49,800,700

Sell Vol. 49,236,100

- HPG: Norges Bank and Samsung Vietnam Securities Master Investment Trust (Equity) announced to have sold 1.2 million and 200,000 shares of HPG, respectively. The transaction caused the holding volume of the entire Dragon Capital group to decrease from 268.39 million shares to 266.99 million units, equivalent to a ratio of 6% to 5.96%. The transaction date to change the group ownership ratio is 11/10.

Market by numbers

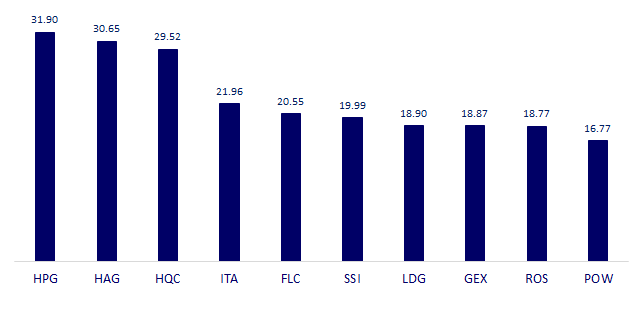

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

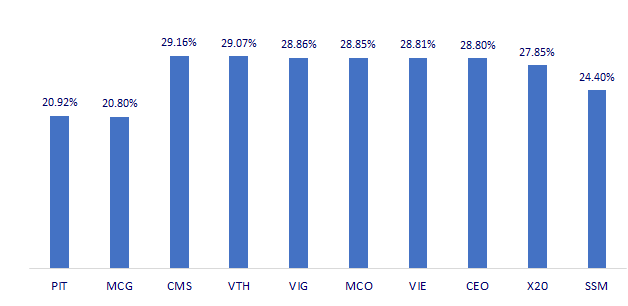

TOP INCREASES 3 CONSECUTIVE SESSIONS

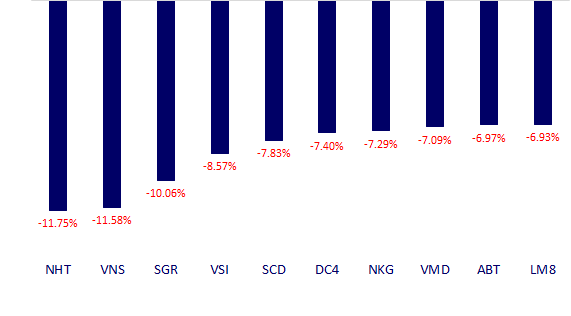

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.