Market brief 27/12/2021

VIETNAM STOCK MARKET

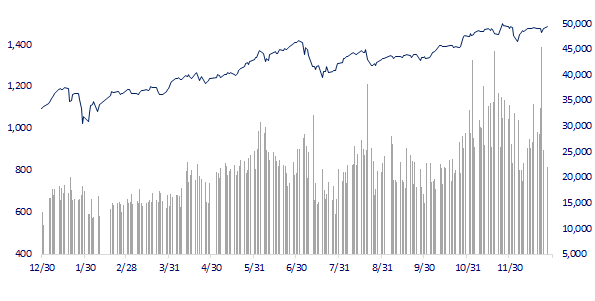

1,488.88

1D 0.80%

YTD 35.42%

1,514.55

1D 0.52%

YTD 43.10%

449.41

1D 0.85%

YTD 128.01%

110.37

1D 0.15%

YTD 49.49%

137.78

1D 0.00%

YTD 0.00%

26,684.77

1D -13.03%

YTD 55.57%

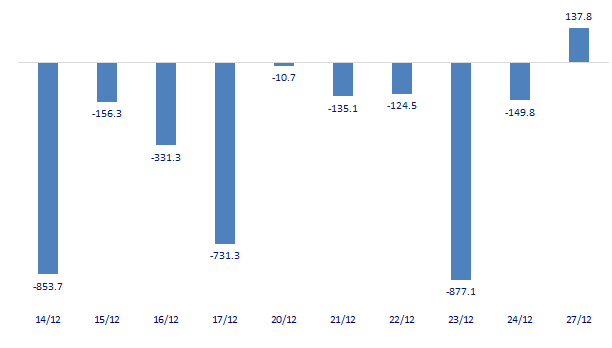

Similar to previous sessions, foreign investors' transactions were still mixed between HoSE and HNX. However, for the whole market, foreign investors bought 30 million shares, worth 1,133 billion VND, while selling 24.4 million shares, worth 988 billion VND. Total net buying volume was at 5.3 million shares, equivalent to a net buying value of 137 billion dong.

ETF & DERIVATIVES

25,500

1D 0.79%

YTD 35.64%

17,840

1D 0.73%

YTD 42.38%

18,800

1D 5.56%

YTD 41.35%

22,500

1D 0.90%

YTD 42.41%

21,300

1D -0.93%

YTD 56.04%

27,710

1D 0.69%

YTD 61.10%

19,830

1D 1.33%

YTD 42.15%

1,512

1D 0.37%

YTD 0.00%

1,212

1D 0.00%

YTD 0.00%

1,516

1D 0.46%

YTD 0.00%

1,515

1D 0.52%

YTD 0.00%

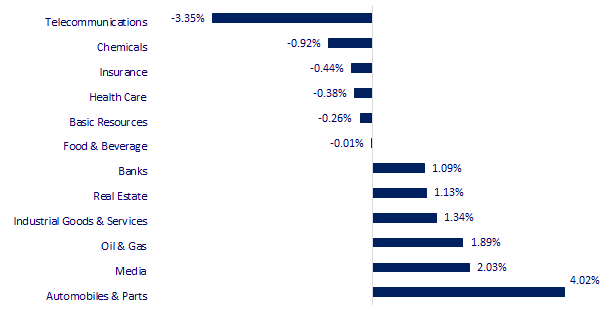

CHANGE IN PRICE BY SECTOR

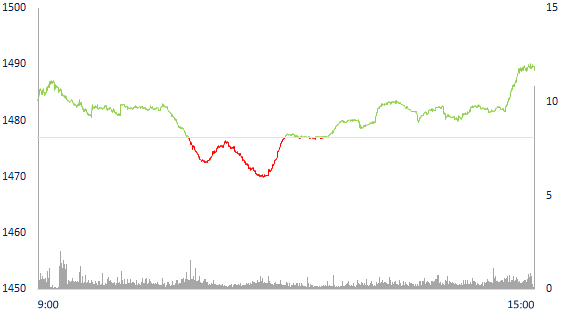

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,676.46

1D -0.17%

YTD 4.49%

3,615.97

1D -0.06%

YTD 5.90%

2,999.55

1D -0.43%

YTD 4.39%

23,223.76

1D 0.00%

YTD -14.45%

3,104.24

1D -0.13%

YTD 8.19%

1,636.50

1D -0.04%

YTD 12.91%

72.98

1D -0.38%

YTD 51.10%

1,805.95

1D -0.35%

YTD -5.13%

Asian stocks mixed, many major markets holiday. In Japan, the Nikkei 225 fell 0.17%. The Chinese market was mixed with Shanghai Composite down 0.06%, Shenzhen Component up 0.04%. China's industrial profits in November rose 9% year-on-year, according to data from China's National Bureau of Statistics. South Korea's Kospi index fell 0.43%. Markets in Hong Kong and Australia are closed for Christmas.

VIETNAM ECONOMY

1.12%

1D (bps) -15

YTD (bps) 99

5.60%

YTD (bps) -20

0.98%

1D (bps) -4

YTD (bps) -24

1.97%

1D (bps) -3

YTD (bps) -6

23,030

1D (%) 0.24%

YTD (%) -0.64%

26,260

1D (%) -0.87%

YTD (%) -9.77%

3,650

1D (%) -0.16%

YTD (%) 2.16%

The World Bank and the Government of Vietnam have just signed a credit agreement worth 221.5 million USD (about 4,900 billion VND) to help Vietnam recover from the pandemic. This credit will be provided through the World Bank's International Development Association (IDA). This is a unit specializing in providing preferential loans to low-income countries.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam gets more than $221 million in preferential loans for economic recovery

- In 2021, inflation is expected to be only about 2%

- Deposit interest rates surged

- China: Industrial production profit growth was dragged down

- Global bond markets have worst year since 1999

- US holiday sales this year up 8.5%

VN30

BANK

79,800

1D 1.66%

5D 3.59%

Buy Vol. 1,499,100

Sell Vol. 1,499,300

35,300

1D 0.86%

5D 0.01%

Buy Vol. 1,970,500

Sell Vol. 2,230,600

33,400

1D 1.52%

5D 2.93%

Buy Vol. 12,732,300

Sell Vol. 15,901,800

48,850

1D -0.10%

5D -1.31%

Buy Vol. 7,431,300

Sell Vol. 8,968,100

34,350

1D 0.29%

5D 0.59%

Buy Vol. 11,811,500

Sell Vol. 15,187,900

28,150

1D 0.00%

5D 0.90%

Buy Vol. 7,965,400

Sell Vol. 9,751,100

28,750

1D 0.17%

5D -2.87%

Buy Vol. 6,678,300

Sell Vol. 8,603,100

40,750

1D 3.82%

5D 2.39%

Buy Vol. 14,430,600

Sell Vol. 15,168,700

28,100

1D -0.35%

5D -1.92%

Buy Vol. 10,637,200

Sell Vol. 14,853,500

33,150

1D 0.45%

5D 0.15%

Buy Vol. 3,986,500

Sell Vol. 5,045,800

Until now, the State Bank has loosened the credit growth room twice in the third and fourth quarters of 2021. Due to the relatively low level of credit room at the beginning of the year, many banks have applied for an additional grant and have been granted a room by the SBV twice in 2021. In the most recent expansion of room, TPB and TCB were the two banks that were approved. assigned the highest credit growth rate of 23.4% and 22.1% respectively. In addition, many other banks were also allowed to expand their room, in which MSB was assigned a limit of 22%, MBB 21%, LPB 18.1%, VPB 17.1%, OCB 15%, VCB 15%...

REAL ESTATE

89,000

1D 0.11%

5D 1.11%

Buy Vol. 1,646,900

Sell Vol. 1,883,100

53,000

1D 3.92%

5D 6.00%

Buy Vol. 5,003,900

Sell Vol. 4,721,200

94,600

1D 0.11%

5D -0.94%

Buy Vol. 4,220,900

Sell Vol. 4,204,900

NVL: Novaland mobilized nearly 5,900 billion bonds to pour capital into 3 subsidiaries including Nova Hospitality, No Va Real Estate Investment and No Va My Dinh Real Estate.

OIL & GAS

95,900

1D 0.21%

5D -0.83%

Buy Vol. 623,700

Sell Vol. 772,500

18,450

1D 6.96%

5D 1.10%

Buy Vol. 78,880,300

Sell Vol. 54,827,400

54,100

1D 2.08%

5D 2.08%

Buy Vol. 1,987,300

Sell Vol. 1,667,500

POW: PV Power is estimated to reach VND 25,175 billion in revenue and VND 1,917 billion in profit in 2021, equivalent to 88.6% and 144.7 percent of the year plan.

VINGROUP

99,000

1D 2.59%

5D 0.00%

Buy Vol. 2,628,100

Sell Vol. 2,855,600

82,800

1D -0.12%

5D -0.84%

Buy Vol. 10,344,900

Sell Vol. 8,591,400

31,300

1D 0.16%

5D 0.81%

Buy Vol. 6,714,500

Sell Vol. 9,388,300

VHM: is in the final stage of signing for sale with 27,700 apartments in Vinhomes Grand Park, Ocean Park and Smart City projects..

FOOD & BEVERAGE

86,100

1D 0.12%

5D 0.47%

Buy Vol. 2,030,200

Sell Vol. 2,778,700

169,000

1D -1.17%

5D 4.32%

Buy Vol. 7,727,700

Sell Vol. 9,625,600

147,900

1D 0.61%

5D -0.74%

Buy Vol. 175,000

Sell Vol. 161,600

VNM: Vinamilk and Vilico embarked on building a super milk factory of nearly VND 4,600 billion in Hung Yen, which is oriented to become a leading super milk factory in Vietnam.

OTHERS

125,000

1D 0.81%

5D 2.38%

Buy Vol. 766,400

Sell Vol. 903,900

125,000

1D 0.81%

5D 2.38%

Buy Vol. 766,400

Sell Vol. 903,900

94,500

1D 0.75%

5D -1.36%

Buy Vol. 1,518,000

Sell Vol. 1,542,600

134,900

1D 0.22%

5D 1.43%

Buy Vol. 1,131,500

Sell Vol. 1,352,000

96,000

1D 1.37%

5D 1.91%

Buy Vol. 430,200

Sell Vol. 534,300

38,600

1D -1.15%

5D 2.66%

Buy Vol. 4,581,600

Sell Vol. 6,239,500

49,150

1D 0.20%

5D -8.13%

Buy Vol. 11,308,500

Sell Vol. 11,261,400

45,900

1D -0.33%

5D -2.13%

Buy Vol. 16,215,900

Sell Vol. 20,225,400

- VJC: Vietjet Air welcomes the first wide-body A330 to join the fleet, ready for plans to expand its network worldwide. - SSI: SSI Securities wants to continue to offer 104 million individual shares, raising the charter capital close to the threshold of 16,000 billion dong. It is expected that this plan will be implemented by SSI after the offering of more than 497 million shares to existing shareholders at a ratio of 2:1 ends.

Market by numbers

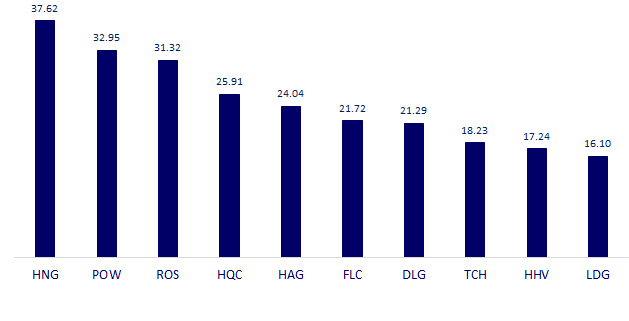

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

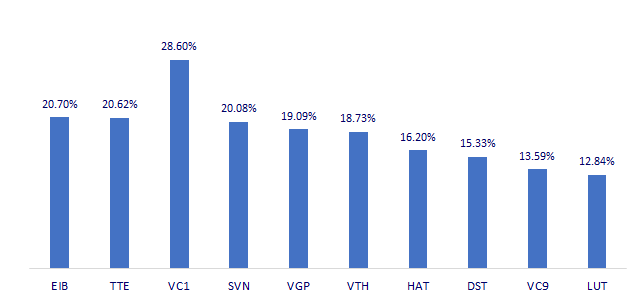

TOP INCREASES 3 CONSECUTIVE SESSIONS

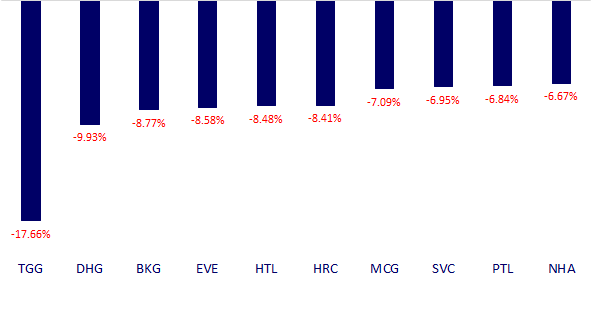

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.