Market brief 31/12/2021

VIETNAM STOCK MARKET

1,498.28

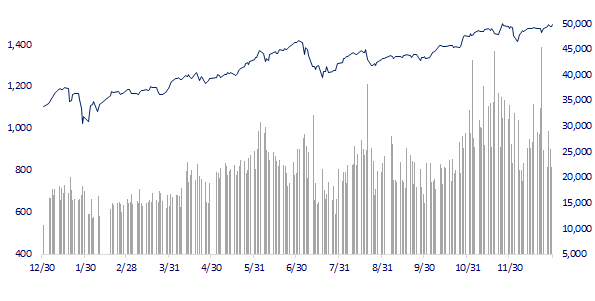

1D 0.83%

YTD 36.27%

1,535.71

1D 1.06%

YTD 45.10%

473.99

1D 2.67%

YTD 140.48%

112.68

1D 1.00%

YTD 52.62%

131.35

1D 0.00%

YTD 0.00%

31,071.88

1D 13.43%

YTD 81.14%

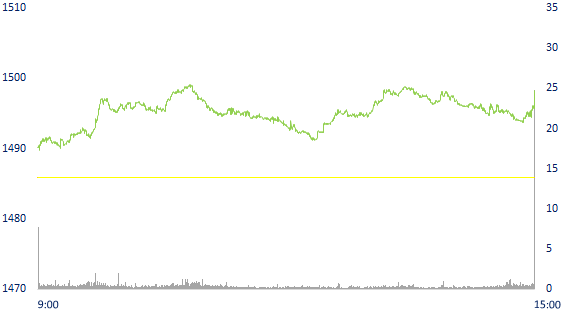

Due to the influence of NAV closing activities of funds, the market usually fluctuates strongly in the last trading session of the year. Large-cap stocks fluctuated positively during the session. In which, a series of stocks in the VN30 group such as NVL, BID, PNJ, STB, ACB... all gained well.

ETF & DERIVATIVES

25,830

1D 0.90%

YTD 37.39%

18,090

1D 1.12%

YTD 44.37%

19,000

1D 6.68%

YTD 42.86%

22,900

1D 1.33%

YTD 44.94%

22,480

1D 4.56%

YTD 64.69%

28,050

1D 0.90%

YTD 63.08%

21,480

1D 6.97%

YTD 53.98%

1,531

1D 0.35%

YTD 0.00%

1,212

1D 0.00%

YTD 0.00%

1,537

1D 0.75%

YTD 0.00%

1,537

1D 0.83%

YTD 0.00%

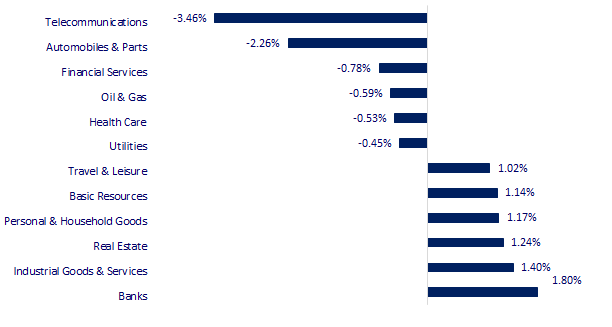

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,791.71

1D 0.00%

YTD 4.91%

3,639.78

1D 0.57%

YTD 6.60%

2,977.65

1D 0.00%

YTD 3.63%

23,397.67

1D -0.80%

YTD -13.81%

3,123.68

1D -0.09%

YTD 8.87%

1,657.62

1D 0.00%

YTD 14.37%

76.50

1D 0.25%

YTD 58.39%

1,820.80

1D 0.18%

YTD -4.35%

Asian stocks mixed in the last session of the year, many markets closed for trading. Markets in Japan and Korea are closed. The Chinese market rallied with the Shanghai Composite up 0.57%. Hong Kong's Hang Seng Index decreased by 0.8%, in general in 2021, Hang Seng is still down about 14%.

VIETNAM ECONOMY

0.81%

YTD (bps) 68

5.60%

YTD (bps) -20

1.01%

1D (bps) -2

YTD (bps) -21

2.00%

1D (bps) -3

YTD (bps) -3

22,940

1D (%) 0.15%

YTD (%) -1.03%

26,468

1D (%) 0.19%

YTD (%) -9.05%

3,658

1D (%) 0.44%

YTD (%) 2.38%

The US did not investigate the anti-corrosion steel tax evasion (CORE) of Vietnam. The DOC believes that there is no basis to extend the anti-dumping duty on hot rolled steel (HRS) and cold rolled steel (CRS) of Japan to anti-corrosion steel products of Vietnam.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The US did not investigate the anti-corrosion tax evasion (CORE) of Vietnam

- 5 markets agree to resume international routes with Vietnam

- Da Nang has the lowest growth rate in the central key economic region in 2021

- The fact that OPEC+ can meet production quotas in 2022 is a determining factor in oil prices

- 20-year journey of expanding the influence of the euro

- The US economy is moving in a worrying direction

VN30

BANK

78,800

1D 0.51%

5D 0.38%

Buy Vol. 734,000

Sell Vol. 1,372,000

37,100

1D 4.80%

5D 6.00%

Buy Vol. 7,742,700

Sell Vol. 8,014,800

33,900

1D 0.30%

5D 3.04%

Buy Vol. 25,324,100

Sell Vol. 28,919,100

50,000

1D 1.42%

5D 2.25%

Buy Vol. 14,375,700

Sell Vol. 16,821,600

35,800

1D 1.13%

5D 4.53%

Buy Vol. 16,117,900

Sell Vol. 26,508,900

28,900

1D 1.58%

5D 2.66%

Buy Vol. 19,328,600

Sell Vol. 30,198,100

30,850

1D 0.82%

5D 7.49%

Buy Vol. 11,272,100

Sell Vol. 15,319,200

41,050

1D 0.74%

5D 4.59%

Buy Vol. 5,576,800

Sell Vol. 8,783,100

31,500

1D 3.28%

5D 11.70%

Buy Vol. 78,159,100

Sell Vol. 73,463,400

34,500

1D 1.77%

5D 4.55%

Buy Vol. 9,114,700

Sell Vol. 12,608,500

Proposing to continue to increase capital for Big4 group are VCB, BID, CTG and Agribank. According to the SBV, the increase in charter capital of State-owned commercial banks is disproportionate to the role and position, which has limited their capacity in credit expansion and affected their role in leading and regulating the market.

REAL ESTATE

91,000

1D 5.45%

5D 2.36%

Buy Vol. 4,212,700

Sell Vol. 4,062,100

51,000

1D -2.11%

5D 0.00%

Buy Vol. 2,982,800

Sell Vol. 4,062,500

95,200

1D 0.85%

5D 0.74%

Buy Vol. 6,366,800

Sell Vol. 5,878,700

PDR: Additional listing of 6 million ESOP shares, bringing the total number of securities to 492,771,916 shares. These shares will be restricted to transfer for 24 months and 36 months.

OIL & GAS

96,200

1D -0.82%

5D 0.52%

Buy Vol. 1,242,200

Sell Vol. 1,339,000

17,500

1D 0.29%

5D 1.45%

Buy Vol. 36,173,700

Sell Vol. 33,523,500

53,900

1D -0.19%

5D 1.70%

Buy Vol. 1,237,600

Sell Vol. 2,017,100

On December 29, data from the EIA showed that crude oil inventories in the United States fell by 3.6 million barrels for the week ending December 24, 2021, more than expected.

VINGROUP

95,100

1D 0.11%

5D -1.45%

Buy Vol. 2,339,600

Sell Vol. 2,716,800

82,000

1D 0.49%

5D -1.09%

Buy Vol. 9,070,700

Sell Vol. 8,778,000

30,100

1D -1.31%

5D -3.68%

Buy Vol. 8,761,700

Sell Vol. 10,657,400

VHM: Listed 22.8 million bonds with a total par value of VND2,280 billion on the Hanoi Stock Exchange (HNX)

FOOD & BEVERAGE

86,400

1D 1.29%

5D 0.47%

Buy Vol. 4,343,900

Sell Vol. 5,144,800

171,000

1D -0.29%

5D 0.00%

Buy Vol. 7,633,700

Sell Vol. 12,538,400

151,000

1D 1.41%

5D 2.72%

Buy Vol. 511,700

Sell Vol. 425,000

MSN: Starting to implement franchising, Masan sets an ambition to have up to 30,000 WinMart+ stores by 2025, of which 20,000 are franchised and 10,000 are self-owned.

OTHERS

128,300

1D 1.83%

5D 3.47%

Buy Vol. 964,400

Sell Vol. 1,098,400

128,300

1D 1.83%

5D 3.47%

Buy Vol. 964,400

Sell Vol. 1,098,400

93,000

1D -0.64%

5D -0.85%

Buy Vol. 2,307,900

Sell Vol. 2,623,900

135,900

1D 1.19%

5D 0.97%

Buy Vol. 1,522,000

Sell Vol. 1,658,100

96,200

1D 4.00%

5D 1.58%

Buy Vol. 1,229,800

Sell Vol. 1,110,100

36,950

1D -0.14%

5D -5.38%

Buy Vol. 3,473,000

Sell Vol. 4,787,300

51,800

1D -1.52%

5D 5.61%

Buy Vol. 18,783,100

Sell Vol. 23,816,500

46,400

1D 1.53%

5D 0.76%

Buy Vol. 26,212,100

Sell Vol. 26,604,800

MWG: 4 Topzone stores operating in November contributed more than 110 billion dong, equivalent to an average revenue of more than 25 billion dong/store/month and exceeded the initial expectation of MWG. The company plans to operate 10 Topzone stores (including the APR large-area independent store model) by the end of this year and estimates that sales in the stable period will reach VND 8-10 billion/store/month next when the new product launch effect is over.

Market by numbers

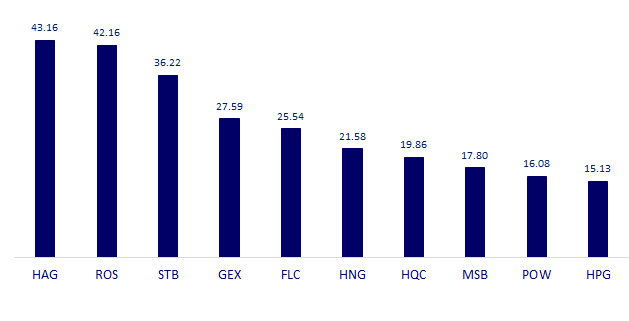

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

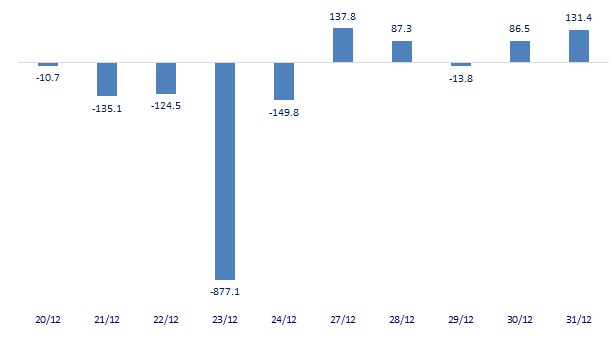

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

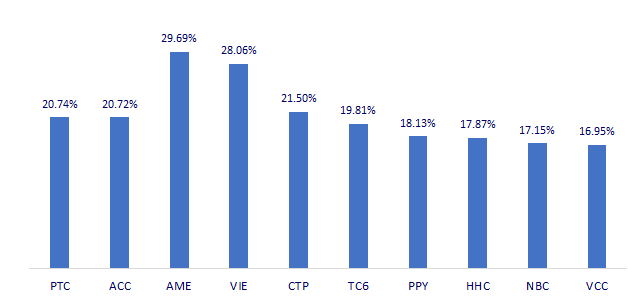

TOP INCREASES 3 CONSECUTIVE SESSIONS

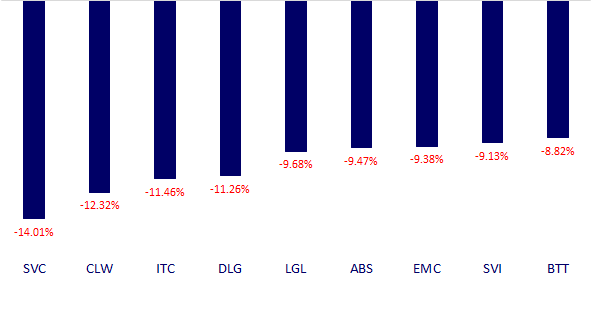

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.