Market brief 04/01/2022

VIETNAM STOCK MARKET

1,525.58

1D 1.82%

YTD 1.82%

1,558.87

1D 1.51%

YTD -38.52%

474.10

1D 0.02%

YTD 0.02%

113.72

1D 0.92%

YTD 0.92%

456.57

1D 0.00%

YTD 0.00%

34,039.09

1D 9.55%

YTD 9.55%

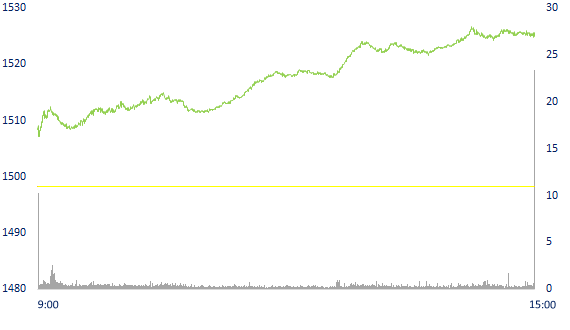

The stock market recorded positive movements in the first trading session of 2022, stocks of securities groups, banks, real estate, steel, oil and gas... consensus broke out, helping investor sentiment become excited. VN-Index hardly encountered any resistance, strongly surpassed 1,500 points to end the session at a new high.

ETF & DERIVATIVES

26,200

1D 1.43%

YTD 1.43%

18,360

1D 1.49%

YTD 1.49%

19,260

1D 8.14%

YTD 1.37%

23,300

1D 1.75%

YTD 1.75%

22,300

1D -0.80%

YTD -0.80%

28,600

1D 1.96%

YTD 1.96%

20,610

1D -4.05%

YTD -4.05%

1,555

1D 1.55%

YTD 0.00%

1,556

1D 28.43%

YTD 0.00%

1,555

1D 1.20%

YTD 0.00%

1,559

1D 1.41%

YTD 0.00%

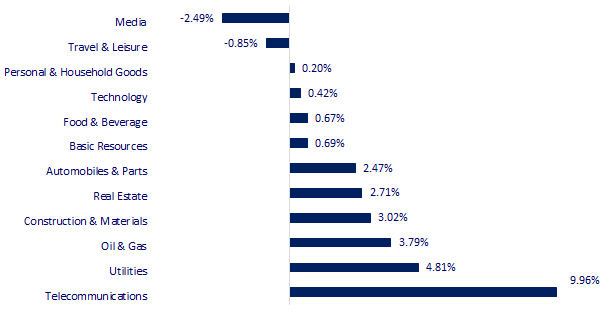

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

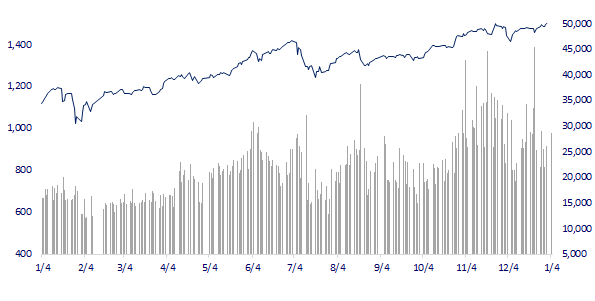

VNINDEX (12M)

GLOBAL MARKET

29,301.79

1D 0.24%

YTD 1.77%

3,632.33

1D -0.20%

YTD -0.20%

2,989.24

1D 0.39%

YTD 0.39%

23,289.84

1D -0.30%

YTD -0.46%

3,181.13

1D 1.84%

YTD 1.84%

1,670.28

1D 0.76%

YTD 0.76%

76.64

1D 0.59%

YTD 0.18%

1,804.35

1D 0.02%

YTD -0.90%

Chinese factory activity increased in December, Asian stocks mixed. In Japan, the Nikkei 225 gained 0.24%. The Chinese market fell with Shanghai Composite down 0.2%, Shenzhen Component down 0.444%. Hong Kong's Hang Seng fell 0.3%. China's manufacturing grew in December with the Caixin/Markit PMI of 50.9 points, higher than 49.9 points in the previous month and 50 points above the Reuters forecast.

VIETNAM ECONOMY

0.73%

1D (bps) -8

YTD (bps) -8

5.60%

1.16%

1D (bps) 15

YTD (bps) 15

1.86%

1D (bps) -14

YTD (bps) -14

22,975

1D (%) 0.13%

YTD (%) 0.15%

26,143

1D (%) -1.08%

YTD (%) -1.23%

3,640

1D (%) -0.49%

YTD (%) -0.49%

According to VASEP, from 2015, Vietnam used to be the world's largest shrimp exporter. However, Indian shrimp has risen strongly since 2015, Ecuadorian shrimp has made a breakthrough since 2018, making Vietnamese shrimp ranked 3rd in the world. However, this gap between the top 3 proportions is not much different. Specifically, in the annual value of 26-28 billion USD of shrimp imports worldwide, India accounted for 15.7%, Ecuador was 14% and Vietnam was 13.6%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Government submits to the National Assembly an economic recovery package worth VND 350,000 billion

- Budget revenue from stock market is nearly 11,000 billion dong, more than double last year

- Shrimp exports in 2025 are forecast to reach USD 5.6 billion

- Markets and economies are gearing up for the Fed's first rate hike, possibly in the next two months

- Global chip sales are estimated to exceed 600 billion USD in 2022

- The IPO fever in 2022 will calm down after a boom year

VN30

BANK

79,000

1D 0.25%

5D -1.25%

Buy Vol. 1,962,200

Sell Vol. 1,813,200

37,400

1D 0.81%

5D 6.25%

Buy Vol. 2,834,700

Sell Vol. 4,295,700

34,750

1D 2.51%

5D 2.51%

Buy Vol. 26,097,200

Sell Vol. 22,037,800

50,900

1D 1.80%

5D 3.56%

Buy Vol. 17,057,200

Sell Vol. 20,991,600

36,050

1D 0.70%

5D 4.34%

Buy Vol. 19,342,800

Sell Vol. 25,884,000

29,100

1D 0.69%

5D 2.83%

Buy Vol. 14,713,600

Sell Vol. 20,157,200

31,100

1D 0.81%

5D 1.97%

Buy Vol. 11,328,800

Sell Vol. 12,255,200

42,750

1D 4.14%

5D 1.66%

Buy Vol. 17,372,500

Sell Vol. 19,328,700

32,100

1D 1.90%

5D 6.82%

Buy Vol. 69,671,300

Sell Vol. 65,229,500

34,400

1D -0.29%

5D 2.23%

Buy Vol. 7,867,300

Sell Vol. 10,629,600

TPB: By the end of 2021, TPBank's total assets reached VND 295,000 billion, an increase of nearly 42% compared to the beginning of the year, exceeding 17% of the plan, profit before tax reached VND 6,038 billion, completing 4% higher than the plan, besides that total operating income increased by 30% over the same period, the bad debt ratio was controlled at 0.9%.

REAL ESTATE

89,000

1D -2.20%

5D 2.30%

Buy Vol. 3,991,800

Sell Vol. 3,675,600

54,400

1D 6.67%

5D 3.62%

Buy Vol. 5,019,000

Sell Vol. 4,278,000

94,800

1D -0.42%

5D 0.74%

Buy Vol. 3,965,500

Sell Vol. 4,151,000

NVL: From 2019 until now, NVL has continuously contributed thousands of billions of VND to Nova Hospitality to invest in many projects such as NovaWorld Phat Thiet, NovaWorld Ho Tram

OIL & GAS

101,900

1D 5.93%

5D 3.87%

Buy Vol. 3,220,000

Sell Vol. 2,713,500

18,700

1D 6.86%

5D 1.91%

Buy Vol. 50,346,500

Sell Vol. 26,867,900

55,900

1D 3.71%

5D 3.90%

Buy Vol. 4,166,200

Sell Vol. 4,111,900

POW: The technical problem of Unit 1 of Vung Ang 1 Thermal Power Plant occurred on September 19, 2021, which affects the Company's 2021 business results.

VINGROUP

101,000

1D 6.20%

5D 2.64%

Buy Vol. 5,099,500

Sell Vol. 4,346,800

85,100

1D 3.78%

5D 2.78%

Buy Vol. 15,625,500

Sell Vol. 16,691,300

31,150

1D 3.49%

5D 1.14%

Buy Vol. 12,673,500

Sell Vol. 14,362,500

VinFast's valuation of 60 billion USD is among the most awaited IPO deals in the US in 2022

FOOD & BEVERAGE

86,700

1D 0.35%

5D 1.40%

Buy Vol. 3,135,000

Sell Vol. 4,237,400

170,000

1D -0.58%

5D -0.87%

Buy Vol. 1,339,800

Sell Vol. 2,755,400

157,000

1D 3.97%

5D 5.87%

Buy Vol. 763,600

Sell Vol. 580,400

MSN: the total amount of capital MSN received in 2021 is estimated at nearly 2.3b USD, equal to the total investment MSN received during 11 years since its listing on the stock exchange

OTHERS

126,000

1D -1.79%

5D 0.64%

Buy Vol. 801,800

Sell Vol. 906,900

126,000

1D -1.79%

5D 0.64%

Buy Vol. 801,800

Sell Vol. 906,900

93,500

1D 0.54%

5D -1.06%

Buy Vol. 2,729,300

Sell Vol. 2,870,800

137,800

1D 1.40%

5D 1.47%

Buy Vol. 2,043,600

Sell Vol. 2,384,200

96,500

1D 0.31%

5D 0.94%

Buy Vol. 651,200

Sell Vol. 715,700

37,600

1D 1.76%

5D -0.66%

Buy Vol. 3,990,900

Sell Vol. 4,450,000

53,000

1D 2.32%

5D 8.61%

Buy Vol. 28,232,000

Sell Vol. 30,606,600

46,750

1D 0.75%

5D 2.07%

Buy Vol. 27,804,300

Sell Vol. 34,605,900

MWG: In October, MWG revealed its ability to expand into new industries, beyond technology. As a result, after just over two months of ideation and construction, the first stores of all 5 chains named AVA appeared simultaneously on major roads in Ho Chi Minh City. The previous experience of opening more than 5,000 stores of The Gioi Di Dong, Dien May Xanh, Bach Hoa Xanh... has given this retailer an incredible capacity to open new chains.

Market by numbers

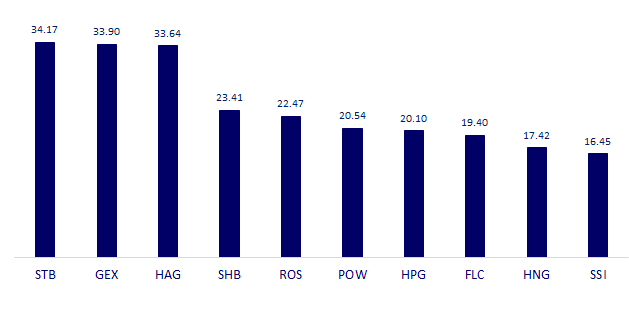

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

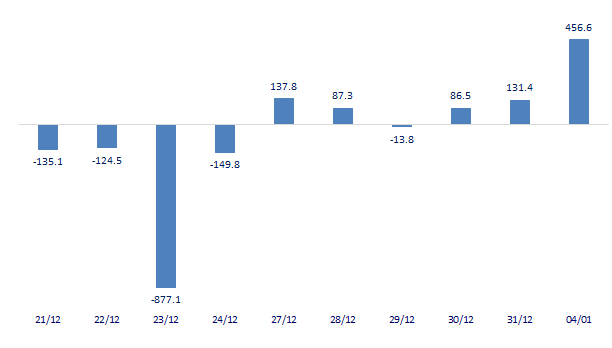

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

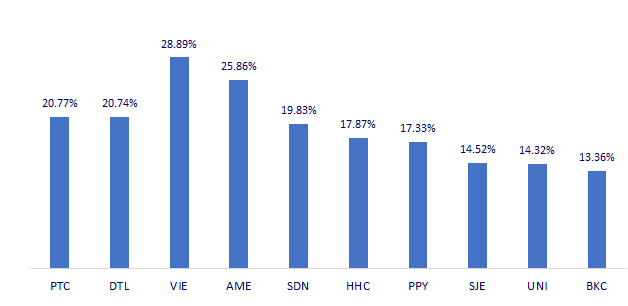

TOP INCREASES 3 CONSECUTIVE SESSIONS

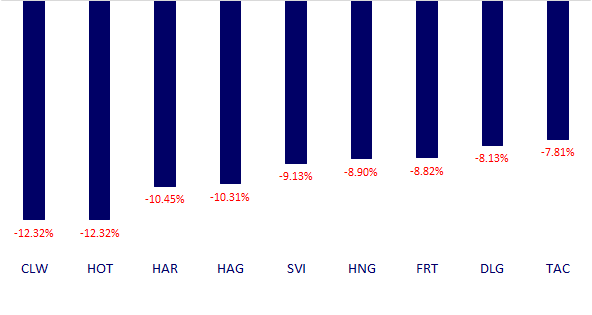

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.