Market brief 13/01/2022

VIETNAM STOCK MARKET

1,496.05

1D -0.96%

YTD -0.15%

1,526.43

1D -0.24%

YTD -0.60%

460.83

1D -2.70%

YTD -2.78%

112.67

1D -1.33%

YTD -0.01%

-91.03

1D 0.00%

YTD 0.00%

36,564.94

1D -15.13%

YTD 17.68%

Foreign investors net sold again 118b dong on HoSE in the session 13/1. Foreign investors were the biggest net sellers of VRE shares with the value of 126b dong, NVL's value of 61b dong. Meanwhile, KDH was the strongest net buyer with a value of 104b dong. BID and VHM were both net bought over 80b dong. On the HNX, foreign investors were net buyers for the 10th consecutive session with a decrease of 22.5% dod.

ETF & DERIVATIVES

25,810

1D 2.38%

YTD -0.08%

18,110

1D 0.67%

YTD 0.11%

19,020

1D 6.79%

YTD 0.11%

22,900

1D 0.88%

YTD 0.00%

22,500

1D 1.35%

YTD 0.09%

27,730

1D -0.25%

YTD -1.14%

20,280

1D 1.35%

YTD -5.59%

1,525

1D -0.20%

YTD 0.00%

1,534

1D -0.40%

YTD 0.00%

1,526

1D 0.14%

YTD 0.00%

1,526

1D -0.21%

YTD 0.00%

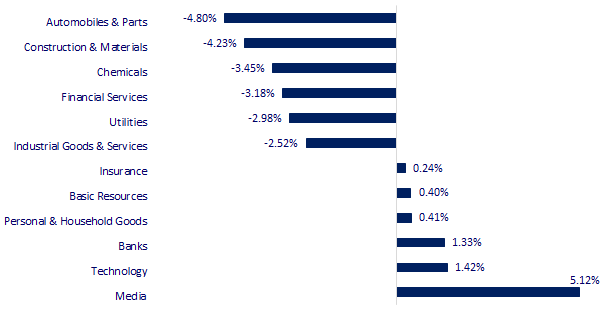

CHANGE IN PRICE BY SECTOR

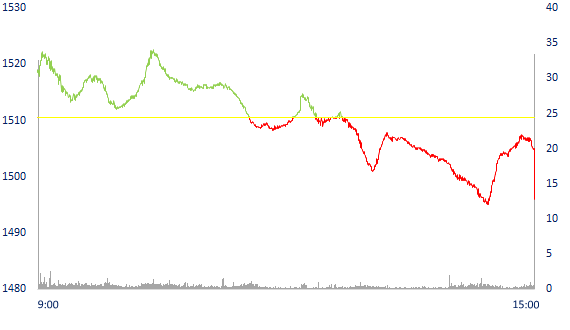

INTRADAY VNINDEX

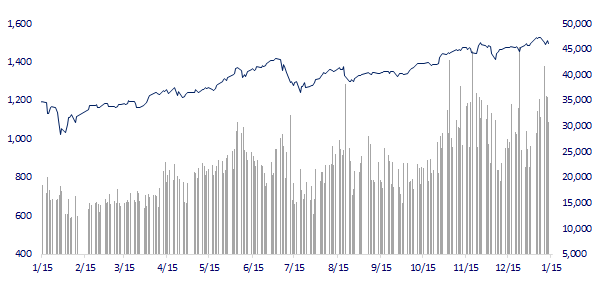

VNINDEX (12M)

GLOBAL MARKET

28,489.13

1D -0.16%

YTD -1.05%

3,555.26

1D -1.17%

YTD -2.32%

2,962.09

1D -0.35%

YTD -0.52%

24,429.77

1D -0.13%

YTD 4.41%

3,257.30

1D 0.07%

YTD 4.28%

1,680.02

1D 0.09%

YTD 1.35%

82.65

1D -0.10%

YTD 8.04%

1,822.40

1D -0.22%

YTD 0.09%

Investors worried about Covid-19, Asian stocks mostly fell. In Japan, the Nikkei 225 fell 0.16%. Retail stocks fell sharply with Seven & I losing 3.28%, Fast Retailing down 1.92%. The Chinese market fell with Shanghai Composite down 1.17%, Shenzhen Component down 1.96%. Hong Kong's Hang Seng fell 0.13%. South Korea's Kospi index fell 0.35%.

VIETNAM ECONOMY

1.09%

1D (bps) -2

YTD (bps) 28

5.60%

1.04%

1D (bps) 5

YTD (bps) 3

2.01%

1D (bps) 6

YTD (bps) 1

22,852

1D (%) 0.10%

YTD (%) -0.38%

26,691

1D (%) 0.33%

YTD (%) 0.84%

3,641

1D (%) 0.05%

YTD (%) -0.46%

In a new report on Vietnam's economy, Standard Chartered Bank forecasts Vietnam's GDP growth rate in 2022 to reach 6.7% and raises its forecast for 2023 to 7%, along with Vietnam's assessment continues to have a positive outlook in the medium term. According to forecast, inflation is likely to become a concern for Vietnam in 2022. Inflation is forecasted in 2022 and 2023 at 4.2% and 5.5% respectively.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ministry of Industry and Trade: The calculation of the car localization rate applied since 2004 does not fully reflect the value

- The Prime Minister directed to focus on inspecting public investment, finance and banking, securities, land…

- Standard Chartered: Inflation will be a concern for Vietnam this year

- China's inflation decline helps reinforce PBOC's interest rate cut stance

- The Fed will release a report on virtual currencies in the next few weeks

- Many European countries reduce the isolation period for COVID-19 epidemic prevention

VN30

BANK

81,900

1D 2.38%

5D 3.54%

Buy Vol. 4,178,900

Sell Vol. 4,260,900

44,000

1D 4.39%

5D 15.79%

Buy Vol. 18,509,900

Sell Vol. 11,958,800

35,150

1D 2.93%

5D 3.38%

Buy Vol. 54,478,500

Sell Vol. 58,913,300

50,500

1D 0.20%

5D 1.20%

Buy Vol. 19,546,800

Sell Vol. 27,639,900

35,250

1D -0.42%

5D 0.28%

Buy Vol. 24,936,100

Sell Vol. 31,484,400

29,700

1D 1.71%

5D 4.76%

Buy Vol. 56,615,500

Sell Vol. 64,702,000

30,800

1D -0.48%

5D 0.98%

Buy Vol. 15,952,900

Sell Vol. 22,014,300

42,150

1D -1.98%

5D 0.36%

Buy Vol. 31,188,600

Sell Vol. 29,357,100

34,300

1D -1.15%

5D 4.89%

Buy Vol. 76,678,500

Sell Vol. 80,209,200

33,350

1D 0.76%

5D -1.19%

Buy Vol. 13,147,500

Sell Vol. 12,087,500

At the end of 2021, BIDV's credit balance will reach about VND 1.33 million billion, up 11.8% compared to 2020. Accordingly, the bank's total bad debt is estimated at more than VND 10,700 billion, a "shock" decrease compared to more than 21,400 billion VND at the end of September 2021. Similarly, VietinBank also said that asset quality had positive changes when by the end of 2021, VietinBank's bad debt ratio was controlled at 1.3%, bad debt coverage ratio 171% - higher compared to 2020.

REAL ESTATE

83,500

1D -0.36%

5D -5.33%

Buy Vol. 4,356,200

Sell Vol. 4,351,500

53,500

1D -0.37%

5D -5.81%

Buy Vol. 4,867,200

Sell Vol. 5,215,400

90,500

1D 0.56%

5D -3.52%

Buy Vol. 4,723,300

Sell Vol. 5,102,400

The real estate market in late 2021 and early 2022 is recording many positive signs. However, the supply of new apartments is scarce, especially the product that is about to be handed over.

OIL & GAS

105,000

1D -2.78%

5D 1.25%

Buy Vol. 1,286,000

Sell Vol. 2,163,800

16,900

1D -6.89%

5D -12.21%

Buy Vol. 61,206,600

Sell Vol. 67,547,700

54,200

1D -1.09%

5D -2.34%

Buy Vol. 1,834,400

Sell Vol. 2,780,600

Petrol prices today 13/1: Continuing the 2% gain of the previous session, Brent crude oil surpassed $84, thanks to tight supply and a weak dollar.

VINGROUP

98,800

1D -1.98%

5D -5.45%

Buy Vol. 3,064,700

Sell Vol. 3,136,900

82,200

1D -1.67%

5D -3.63%

Buy Vol. 10,651,400

Sell Vol. 10,910,900

33,800

1D -6.11%

5D -5.06%

Buy Vol. 14,713,100

Sell Vol. 21,980,800

The famous American magazine Forbes has named 10 car models that are rated as "great" at CES 2022, in which, VinFast is especially mentioned with its first three debuts, VF5, VF6 and VF7.

FOOD & BEVERAGE

83,100

1D 0.00%

5D -1.07%

Buy Vol. 2,829,200

Sell Vol. 2,982,200

144,800

1D -0.07%

5D -5.85%

Buy Vol. 1,417,300

Sell Vol. 1,376,500

151,000

1D -1.18%

5D -2.33%

Buy Vol. 188,700

Sell Vol. 182,800

MSN: Masan Group Corp recently said it will step up technology acquisition activities, aiming to serve 50 million customers in the next 3-5 years.

OTHERS

122,000

1D -0.97%

5D -1.45%

Buy Vol. 863,100

Sell Vol. 896,700

122,000

1D -0.97%

5D -1.45%

Buy Vol. 863,100

Sell Vol. 896,700

92,100

1D 2.79%

5D -1.50%

Buy Vol. 3,473,200

Sell Vol. 3,165,300

135,500

1D -0.37%

5D -1.45%

Buy Vol. 1,507,400

Sell Vol. 2,273,800

94,100

1D 1.51%

5D -0.53%

Buy Vol. 675,200

Sell Vol. 818,100

35,500

1D -4.05%

5D -8.03%

Buy Vol. 5,066,800

Sell Vol. 5,348,600

48,850

1D -3.27%

5D -5.88%

Buy Vol. 17,602,700

Sell Vol. 23,255,500

46,700

1D 1.08%

5D 1.30%

Buy Vol. 35,679,300

Sell Vol. 41,355,000

GVR: Total revenue in 2021 of GVR is estimated at more than VND 28,500 billion, exceeding 6% of the plan and increasing by 10% yoy. Profit before tax is estimated at more than VND 6,100 billion, exceeding 7% of the plan and increasing by 4% yoy. As for the parent company, this unit brought in revenue of VND 3,900 billion, exceeding 3% of the plan; profit after tax reached 2,160 billion dong, exceeding 5% of the plan. Notably, GVR has just adjusted down 32% of the parent company's profit target in 2021.

Market by numbers

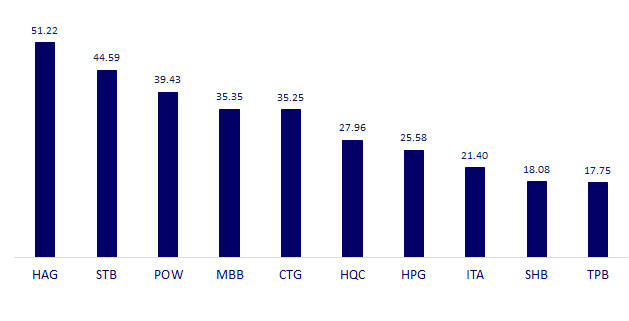

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

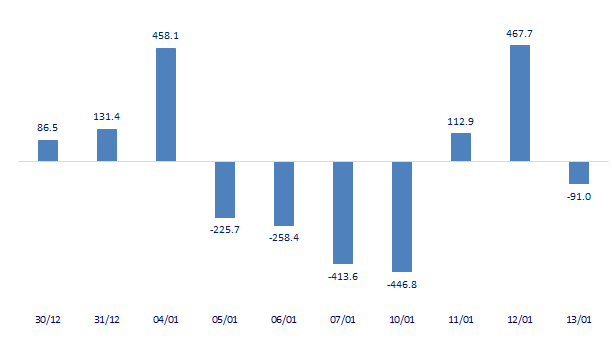

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

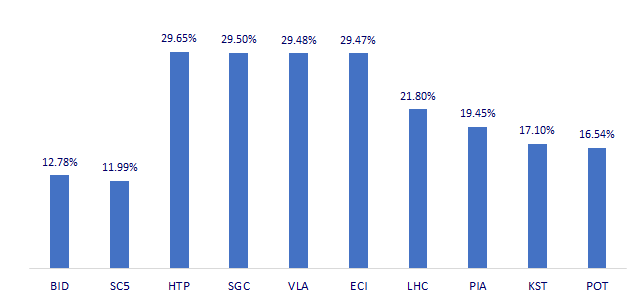

TOP INCREASES 3 CONSECUTIVE SESSIONS

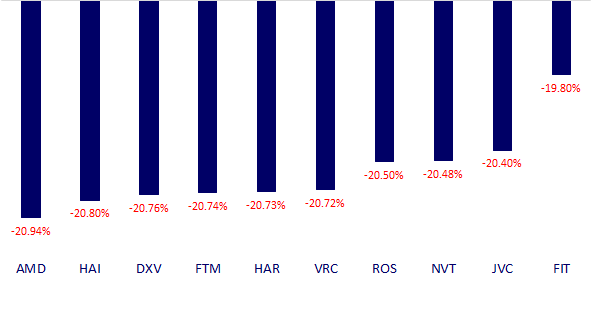

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.