Market brief 14/01/2022

VIETNAM STOCK MARKET

1,496.02

1D 0.00%

YTD -0.15%

1,523.57

1D -0.19%

YTD -0.79%

466.86

1D 1.31%

YTD -1.50%

112.22

1D -0.40%

YTD -0.41%

781.18

1D 0.00%

YTD 0.00%

27,542.34

1D -24.68%

YTD -11.36%

Session 14/1: Foreign investors suddenly net bought 781 billion dong. Foreign investors focused on net buying in fund certificates FUEVFVND, shares of STB and VNM while recording net selling in stocks such as VND, VCI.

ETF & DERIVATIVES

25,650

1D -0.62%

YTD -0.70%

17,900

1D -1.16%

YTD -1.05%

18,800

1D 5.56%

YTD -1.05%

22,800

1D -0.44%

YTD -0.44%

22,030

1D -2.09%

YTD -2.00%

27,640

1D -0.32%

YTD -1.46%

19,980

1D -1.48%

YTD -6.98%

1,524

1D -0.07%

YTD 0.00%

1,523

1D -0.70%

YTD 0.00%

1,522

1D -0.28%

YTD 0.00%

1,520

1D -0.37%

YTD 0.00%

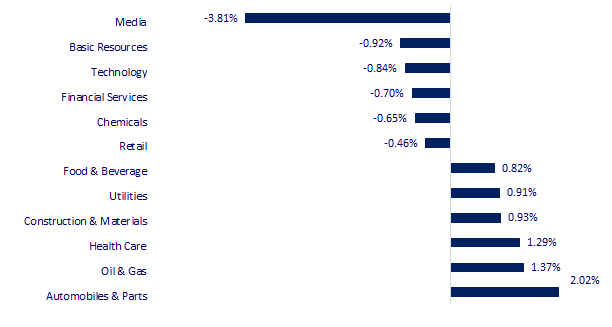

CHANGE IN PRICE BY SECTOR

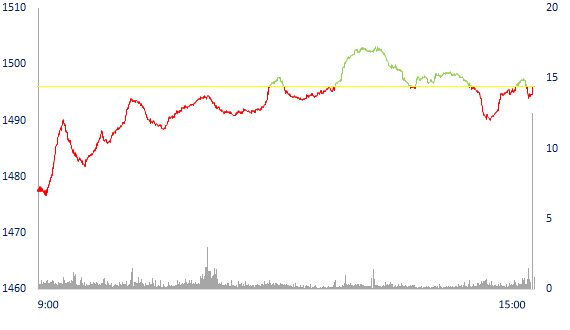

INTRADAY VNINDEX

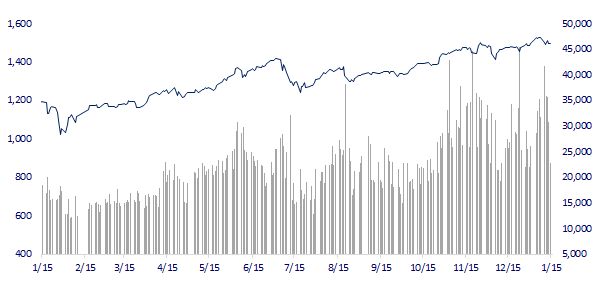

VNINDEX (12M)

GLOBAL MARKET

28,124.28

1D 0.26%

YTD -2.32%

3,521.26

1D -0.96%

YTD -3.26%

2,921.92

1D -1.36%

YTD -1.87%

24,383.32

1D 0.85%

YTD 4.21%

3,281.97

1D 0.76%

YTD 5.07%

1,672.63

1D -0.44%

YTD 0.91%

82.89

1D 1.30%

YTD 8.35%

1,821.85

1D -0.08%

YTD 0.06%

China releases December trade data, Asian stocks mixed. In Japan, the Nikkei 225 gained 0.26%. The Chinese market was mixed with Shanghai Composite down 0.96%, Shenzhen Component up 0.09%. Hong Kong's Hang Seng Index rose 0.85%. South Korea's Kospi index fell 1.36%.

VIETNAM ECONOMY

1.04%

1D (bps) -5

YTD (bps) 23

5.60%

1.13%

1D (bps) 9

YTD (bps) 12

1.90%

1D (bps) -11

YTD (bps) -10

22,856

1D (%) 0.03%

YTD (%) -0.37%

26,667

1D (%) 0.01%

YTD (%) 0.75%

3,647

1D (%) 0.16%

YTD (%) -0.30%

Just a few days ago, on the last working days of 2021, Nghe An awarded the investment registration certificate to Excel Smart Global Limited (Samoa) to build a factory for manufacturing electrical components. Ju Teng electronics and auto parts at Hoang Mai 1 Industrial Park, with investment capital up to 200 million USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister: Set up a working group to solve the congestion of goods at the border gate

- Credit is forecasted to increase by 13-14% in 2022

- In 2022, Vietnam can attract 40 billion USD of FDI

- Inflationary pressure weighs heavily on the US economy

- China's trade turnover exceeded 6 trillion USD for the first time

- Argentina promotes nuclear energy cooperation with China

VN30

BANK

83,400

1D 1.83%

5D 4.51%

Buy Vol. 2,269,100

Sell Vol. 2,752,300

44,250

1D 0.57%

5D 12.88%

Buy Vol. 6,336,700

Sell Vol. 6,544,000

35,450

1D 0.85%

5D 6.78%

Buy Vol. 15,591,400

Sell Vol. 26,418,300

49,750

1D -1.49%

5D 0.61%

Buy Vol. 7,113,100

Sell Vol. 11,211,700

34,850

1D -1.13%

5D 0.72%

Buy Vol. 11,809,300

Sell Vol. 15,905,100

29,650

1D -0.17%

5D 3.67%

Buy Vol. 15,641,900

Sell Vol. 27,174,700

30,600

1D -0.65%

5D 0.99%

Buy Vol. 5,206,600

Sell Vol. 6,618,200

41,900

1D -0.59%

5D 2.20%

Buy Vol. 7,377,500

Sell Vol. 11,479,500

35,000

1D 2.04%

5D 9.55%

Buy Vol. 48,225,500

Sell Vol. 44,494,400

33,050

1D -0.90%

5D -0.75%

Buy Vol. 4,515,800

Sell Vol. 4,801,900

According to data from the VBMA, in December, there were a total of 80 separate bond issuances with a total issuance value of VND 65,757b. In which, banking and real estate were the two groups that issued the largest amount of bonds with the value of 46,926b dong and 9,538b dong, respectively, equivalent to more than 71% and 14% of the total issued value of the month. VPBank is the largest issuer in the banking group with a total value of 9,970b dong through 6 installments, with an interest rate of 2.4%/year to increase working capital. VIB issued VND 9,000b of bonds with a term of 3-7 years.

REAL ESTATE

82,000

1D -1.80%

5D -5.09%

Buy Vol. 4,950,000

Sell Vol. 4,685,300

53,500

1D 0.00%

5D -5.48%

Buy Vol. 2,199,300

Sell Vol. 2,180,400

91,800

1D 1.44%

5D -1.29%

Buy Vol. 4,708,800

Sell Vol. 4,163,500

NVL: Nova Consumer announces IPO of 10.9 million shares, equivalent to 10% of capital. Minimum asking price is 43,462 VND/share, mobilized money is about 474 billion VND.

OIL & GAS

105,500

1D 0.48%

5D -1.86%

Buy Vol. 1,034,700

Sell Vol. 1,295,700

17,700

1D 4.73%

5D -12.16%

Buy Vol. 51,048,600

Sell Vol. 39,442,600

55,000

1D 1.48%

5D -2.31%

Buy Vol. 1,840,700

Sell Vol. 1,348,700

POW: In 2021, the epidemic will reduce demand of the whole market, reduce the output of POW's power plants by about 1.9b kWh, a decrease in revenue of about 3,750b VND.

VINGROUP

98,900

1D 0.10%

5D -3.23%

Buy Vol. 2,131,800

Sell Vol. 1,805,300

82,200

1D 0.00%

5D -3.75%

Buy Vol. 7,122,700

Sell Vol. 6,138,300

34,400

1D 1.78%

5D -1.01%

Buy Vol. 10,812,900

Sell Vol. 10,548,800

Up to now, Phu Quoc has attracted 372 investment projects, with total registered capital of about 16.5bUSD. Vingroup is the largest investor with a total disbursed more than 2 billion USD.

FOOD & BEVERAGE

84,700

1D 1.93%

5D 1.07%

Buy Vol. 4,151,000

Sell Vol. 4,451,800

144,800

1D 0.00%

5D -5.97%

Buy Vol. 1,156,800

Sell Vol. 825,000

151,900

1D 0.60%

5D -0.85%

Buy Vol. 126,700

Sell Vol. 193,700

SAB: estimated net revenue and profit after tax at VND 6,500 billion (down 16.8%) and VND 1,450 billion (down 6%) in Q4.2021 as both on-trade and off-trade channels recovered slow

OTHERS

122,000

1D 0.00%

5D -1.45%

Buy Vol. 655,800

Sell Vol. 704,500

122,000

1D 0.00%

5D -1.45%

Buy Vol. 655,800

Sell Vol. 704,500

91,300

1D -0.87%

5D -2.25%

Buy Vol. 1,252,600

Sell Vol. 1,508,600

134,000

1D -1.11%

5D -1.11%

Buy Vol. 806,500

Sell Vol. 1,381,800

93,900

1D -0.21%

5D 0.00%

Buy Vol. 855,900

Sell Vol. 536,600

35,700

1D 0.56%

5D -7.27%

Buy Vol. 3,429,400

Sell Vol. 3,088,900

48,700

1D -0.31%

5D -5.62%

Buy Vol. 12,421,100

Sell Vol. 14,008,900

46,250

1D -0.96%

5D 0.98%

Buy Vol. 12,699,400

Sell Vol. 17,592,400

HPG: According to Hai Duong Electronic Newspaper, Hoa Phat Group proposed to Hai Duong Provincial People's Committee to approve the enterprise to implement a project to build an international golf course and an ecological urban area with a scale of about 385 hectares, belonging to two communes Duc Xuong, Doan Thuong, Gia Loc district and Hong Duc commune, Ninh Giang district, Hai Duong province.

Market by numbers

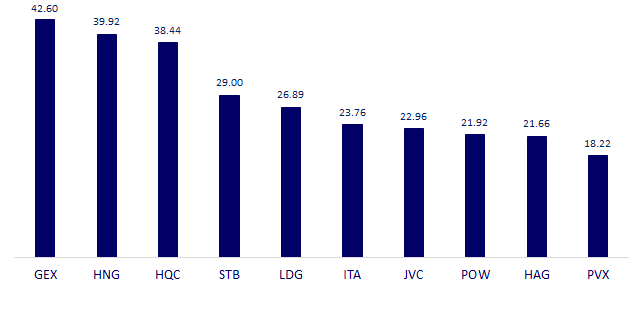

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

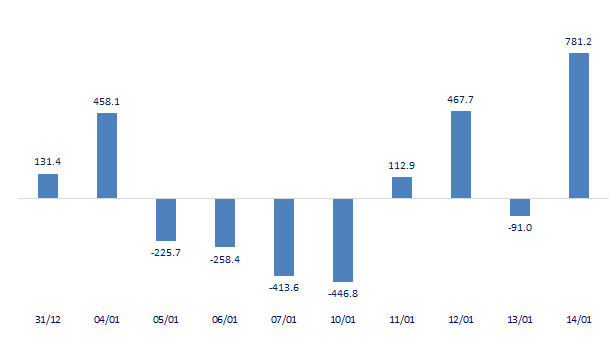

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

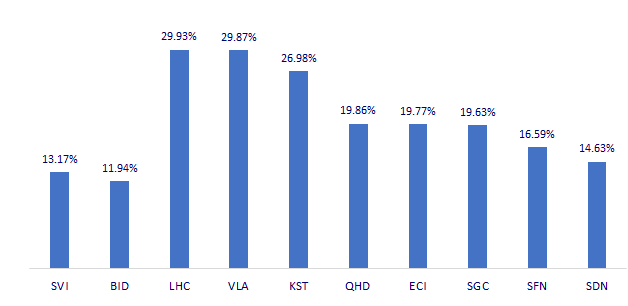

TOP INCREASES 3 CONSECUTIVE SESSIONS

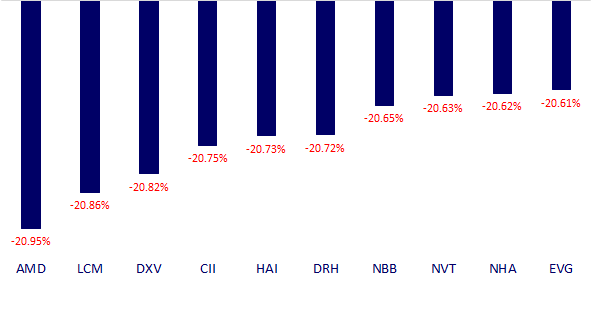

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.