Market brief 17/01/2022

VIETNAM STOCK MARKET

1,452.84

1D -2.89%

YTD -3.03%

1,478.61

1D -2.95%

YTD -3.72%

445.34

1D -4.61%

YTD -6.04%

109.36

1D -2.55%

YTD -2.95%

161.23

1D 0.00%

YTD 0.00%

37,301.77

1D 35.43%

YTD 20.05%

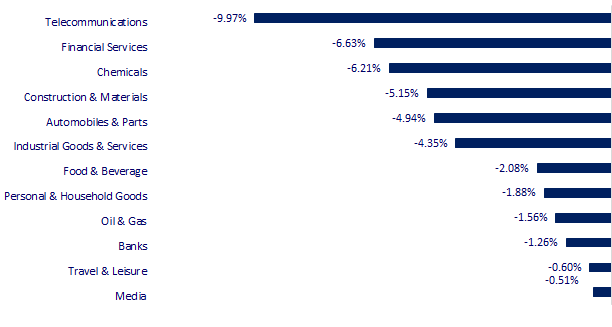

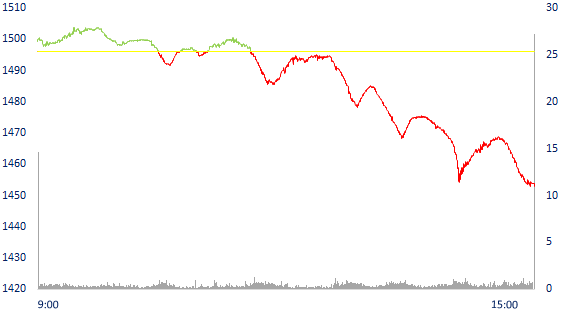

The drop in the session on January 17 spread to all industry groups. In which, securities, electrical equipment, plastic production and chemicals were the sectors that fell the most in the market. VHM, GVR, VPB, VIC are the 4 stocks that pulled back the VN-Index the most with nearly 10 points. On the other side, almost only VCB was the pillar of the market with 3.6 support points.

ETF & DERIVATIVES

25,000

1D -2.53%

YTD -3.21%

17,480

1D -2.35%

YTD -3.37%

18,550

1D 4.15%

YTD -2.37%

22,000

1D -3.51%

YTD -3.93%

22,490

1D 2.09%

YTD 0.04%

26,700

1D -3.40%

YTD -4.81%

19,570

1D -2.05%

YTD -8.89%

1,484

1D -2.62%

YTD 0.00%

1,486

1D -2.43%

YTD 0.00%

1,482

1D -2.63%

YTD 0.00%

1,480

1D -2.64%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

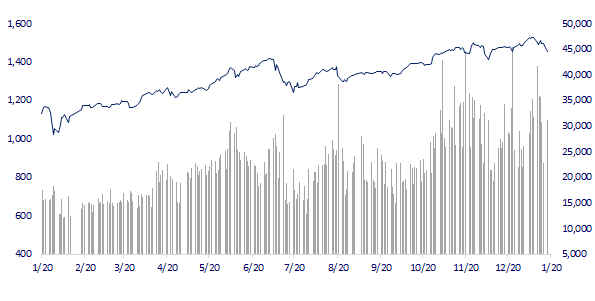

VNINDEX (12M)

GLOBAL MARKET

28,333.52

1D -0.10%

YTD -1.59%

3,541.67

1D 0.58%

YTD -2.70%

2,890.10

1D -1.09%

YTD -2.94%

24,218.03

1D -0.37%

YTD 3.51%

3,287.95

1D 0.18%

YTD 5.26%

1,676.87

1D 0.25%

YTD 1.16%

83.36

1D -0.56%

YTD 8.97%

1,820.05

1D 0.30%

YTD -0.04%

China releases economic data, Asian stocks mixed. In Japan, the Nikkei 225 fell 0.1%. The Chinese market rose with Shanghai Composite up 0.58%, Shenzhen Component up 1.51%. Hong Kong's Hang Seng Index fell 0.37%. South Korea's Kospi index fell 1.09%.

VIETNAM ECONOMY

0.98%

1D (bps) -11

YTD (bps) 17

5.60%

1.20%

1D (bps) 16

YTD (bps) 19

1.90%

1D (bps) -11

YTD (bps) -10

22,950

1D (%) 0.44%

YTD (%) 0.04%

26,394

1D (%) -1.02%

YTD (%) -0.28%

3,651

1D (%) 0.27%

YTD (%) -0.19%

The People's Committee of Quang Ninh province has just announced the suspension of receiving vehicles carrying fresh fruits and frozen seafood to the border gate and opening of the border of Quang Ninh province for export from January 17. In addition, Chinese agencies have announced a policy to control the amount of vehicles imported through Dong Hung (China), whereby at the opening Km 3+4 Hai Yen (Mong Cai, Quang Ninh) only import 50 cars/day.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam's GDP is forecasted to grow by 6.5-7% this year

- Stop receiving frozen fruits and seafood through the border gate, the border gate of Mong Cai city from January 17

- Cambodia suspends imports of live pigs from Vietnam

- German economy grew by 2.7%

- China lowers medium-term lending rates for the first time since April 2020

- China GDP to grow by 8.1% in 2021

VN30

BANK

86,200

1D 3.36%

5D 8.43%

Buy Vol. 4,809,600

Sell Vol. 4,263,800

43,650

1D -1.36%

5D 12.36%

Buy Vol. 11,224,800

Sell Vol. 12,464,500

35,000

1D -1.27%

5D 5.11%

Buy Vol. 39,262,700

Sell Vol. 47,156,600

48,600

1D -2.31%

5D -0.10%

Buy Vol. 15,485,700

Sell Vol. 19,643,000

33,050

1D -5.16%

5D -3.92%

Buy Vol. 20,348,600

Sell Vol. 22,347,700

29,500

1D -0.51%

5D 4.98%

Buy Vol. 43,772,600

Sell Vol. 57,628,200

29,000

1D -5.23%

5D -2.03%

Buy Vol. 10,834,000

Sell Vol. 15,245,800

40,200

1D -4.06%

5D -0.62%

Buy Vol. 11,386,100

Sell Vol. 14,264,800

32,600

1D -6.86%

5D 3.16%

Buy Vol. 65,693,600

Sell Vol. 76,388,500

32,750

1D -0.91%

5D -0.76%

Buy Vol. 10,951,600

Sell Vol. 12,132,100

STB: in 2021, despite the difficulties of the global economy, the bank is expected to record pre-tax profit is more than 4,400 billion dong, up nearly 32% over the same period last year. Banking operating costs are decreasing significantly, CIR in 2021 is about 36.2% and is expected to decrease to 34.2% in 2022. However, achievements in bad debt handling and asset quality improvement are really the most impressive points at Sacombank.

REAL ESTATE

80,000

1D -2.44%

5D -4.65%

Buy Vol. 3,544,300

Sell Vol. 4,458,100

49,800

1D -6.92%

5D -7.95%

Buy Vol. 3,172,000

Sell Vol. 4,636,900

86,500

1D -5.77%

5D -7.49%

Buy Vol. 3,456,500

Sell Vol. 4,891,500

NVL: Nova Consumer officially became the first unit to open the IPO wave in 2022. After the successful IPO, Nova Consumer will proceed to submit a listing application at HoSE.

OIL & GAS

104,600

1D -0.85%

5D 2.55%

Buy Vol. 2,368,900

Sell Vol. 2,871,600

16,500

1D -6.78%

5D -12.00%

Buy Vol. 43,392,100

Sell Vol. 70,257,000

53,600

1D -2.55%

5D -2.55%

Buy Vol. 2,792,000

Sell Vol. 4,126,600

POW: suffered a loss of 116b dong in Q4.2021 due to a prolonged incident at Vung Ang 1 Thermal Power Plant. NI in 2021 reached 1,917b dong, down 25% yoy but exceeding 41% of the year plan.

VINGROUP

97,000

1D -1.92%

5D -5.18%

Buy Vol. 3,677,600

Sell Vol. 4,787,500

79,100

1D -3.77%

5D -7.38%

Buy Vol. 11,643,200

Sell Vol. 14,536,700

32,000

1D -6.98%

5D -8.57%

Buy Vol. 14,208,900

Sell Vol. 19,731,600

VIC: VinFast Fadil surpassed last year's champion Toyota Vios to become the best-selling car model in 2021.

FOOD & BEVERAGE

82,900

1D -2.13%

5D -0.96%

Buy Vol. 3,065,700

Sell Vol. 5,095,700

142,000

1D -1.93%

5D -7.19%

Buy Vol. 1,083,000

Sell Vol. 1,716,500

150,000

1D -1.25%

5D -1.32%

Buy Vol. 274,200

Sell Vol. 368,500

MSN: On January 15, WinCommerce General Trading Service Joint Stock Company held a ceremony to announce the change of the brand name of the VinMart retail system to WinMart.

OTHERS

120,500

1D -1.23%

5D -2.67%

Buy Vol. 718,800

Sell Vol. 872,800

120,500

1D -1.23%

5D -2.67%

Buy Vol. 718,800

Sell Vol. 872,800

89,000

1D -2.52%

5D -3.26%

Buy Vol. 2,129,300

Sell Vol. 2,419,300

130,000

1D -2.99%

5D -2.26%

Buy Vol. 1,001,600

Sell Vol. 1,647,000

93,500

1D -0.43%

5D 0.32%

Buy Vol. 753,900

Sell Vol. 782,500

33,250

1D -6.86%

5D -11.80%

Buy Vol. 5,398,800

Sell Vol. 9,791,400

45,300

1D -6.98%

5D -8.58%

Buy Vol. 41,067,800

Sell Vol. 61,473,100

44,700

1D -3.35%

5D -2.08%

Buy Vol. 28,960,500

Sell Vol. 35,153,500

MWG: In 2022 only, MWG plans to achieve revenue of VND 140,000 billion and profit after tax of VND 6,350 billion. It is known that this plan is built on the assumption that the epidemic will continue to develop in a complicated way, but it will not lead to a shutdown due to the blockade or a worse impact on production and business activities compared to the past 2 years.

Market by numbers

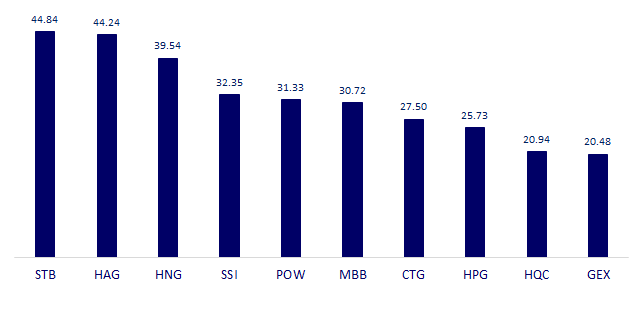

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

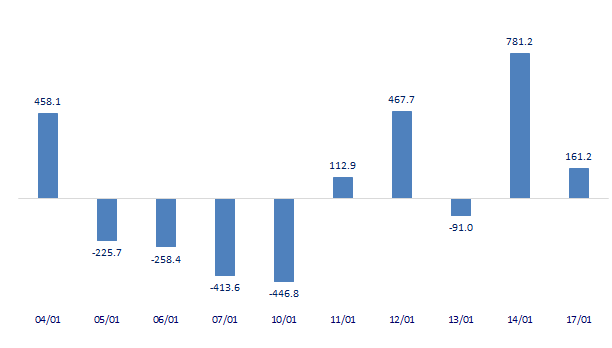

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

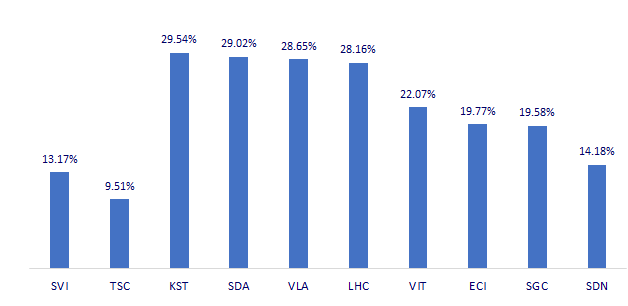

TOP INCREASES 3 CONSECUTIVE SESSIONS

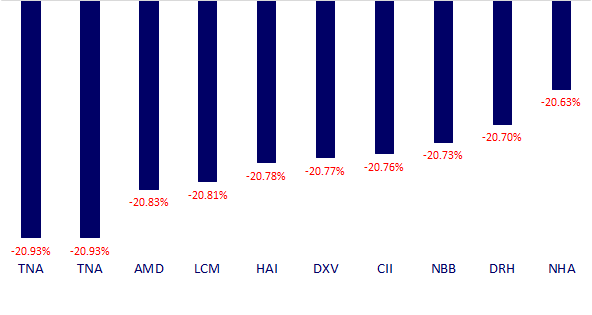

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.