Market brief 25/01/2022

VIETNAM STOCK MARKET

1,479.58

1D 2.77%

YTD -1.25%

1,516.16

1D 3.05%

YTD -1.27%

410.23

1D 2.36%

YTD -13.45%

108.03

1D 1.24%

YTD -4.13%

1,280.34

1D 0.00%

YTD 0.00%

25,551.04

1D -12.41%

YTD -17.77%

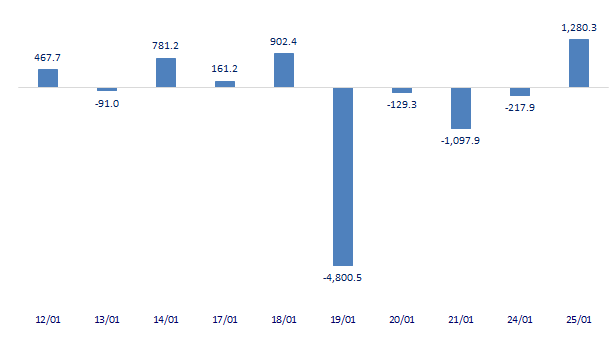

Foreign investors saw a sudden net buying of 1,280b dong on HoSE on January 25. VHM topped the list of foreign investors' net buying on HSX with a value of 182b dong. CTG was also net bought 157b dong. KBC and STB saw a net buying of 135b dong and 106b dong, respectively. On the other side, VNM was sold the most on this floor with a value of 140b dong. VIC was also net sold 120b dong.

ETF & DERIVATIVES

25,180

1D 0.84%

YTD -2.52%

17,780

1D 2.54%

YTD -1.71%

18,950

1D 6.40%

YTD -0.26%

22,000

1D 2.33%

YTD -3.93%

22,100

1D 0.91%

YTD -1.69%

27,400

1D 1.14%

YTD -2.32%

19,530

1D 1.35%

YTD -9.08%

1,497

1D 2.11%

YTD 0.00%

1,500

1D 2.02%

YTD 0.00%

1,504

1D 2.43%

YTD 0.00%

1,493

1D 0.00%

YTD 0.00%

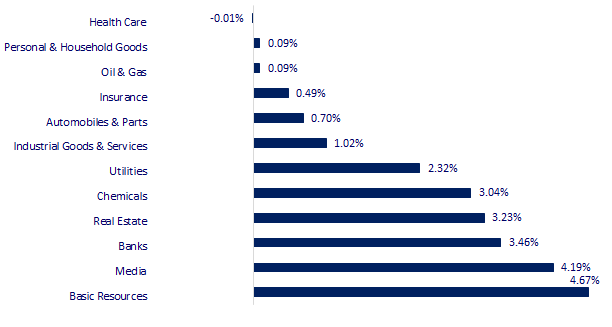

CHANGE IN PRICE BY SECTOR

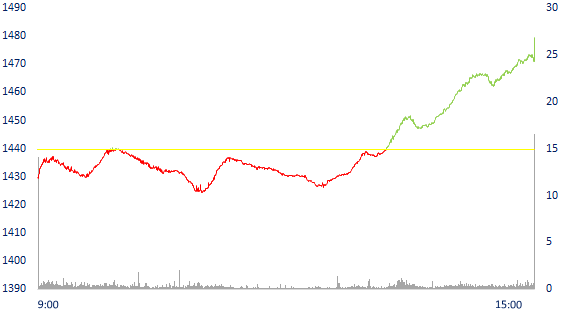

INTRADAY VNINDEX

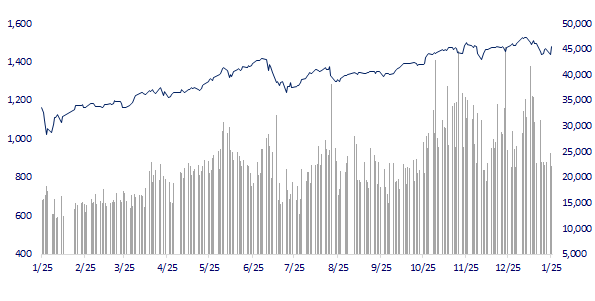

VNINDEX (12M)

GLOBAL MARKET

27,131.34

1D 0.28%

YTD -5.77%

3,433.06

1D -2.58%

YTD -5.68%

2,720.39

1D -2.56%

YTD -8.64%

24,243.61

1D 0.34%

YTD 3.62%

3,247.76

1D -1.08%

YTD 3.97%

1,639.09

1D -0.09%

YTD -1.12%

84.03

1D 0.60%

YTD 9.84%

1,837.85

1D -0.14%

YTD 0.94%

Asian stocks mixed after a volatile session on Wall Street. In Japan, the Nikkei 225 gained 0.28%. The Chinese market fell with Shanghai Composite down 2.58%, Shenzhen Component down 2.83%. Hong Kong's Hang Seng rose 0.34%. South Korea's Kospi index fell 2.56%. South Korea's economy grew 1.1% in the fourth quarter of 2021 from the previous quarter, the Bank of Korea said today. For the whole year of 2021, the Korean economy grew by 4%, the fastest in 11 years.

VIETNAM ECONOMY

1.48%

1D (bps) 45

YTD (bps) 67

5.60%

1.21%

1D (bps) 18

YTD (bps) 20

1.92%

1D (bps) -7

YTD (bps) -8

22,860

1D (%) 0.20%

YTD (%) -0.35%

25,982

1D (%) -1.27%

YTD (%) -1.84%

3,647

1D (%) -0.14%

YTD (%) -0.30%

On January 24, the State Bank successfully bid to buy more than 2,937 billion VND of valuable papers from 3 participants, with a term of 14 days and an interest rate of 2.5%/year. Thereby bringing the total amount of bills in circulation through the OMO channel to VND4,037 billion. Last week, the operator also lent to credit institutions VND1,060 billion with interest rate of 2.5% and term of 28 days.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- World Bank: Vietnam needs 14 billion USD per year for energy transition

- The State Bank has just injected more than 2,900 billion into the market

- Hai Phong received nearly $230m in capital, including the project of a factory to produce electronic components for Apple and Samsung.

- Energy prices in Europe could be at record highs

- The US tries to reduce the oil price fever

- Korea's economy grew to a record 11 years thanks to booming exports

VN30

BANK

95,800

1D 3.01%

5D 9.36%

Buy Vol. 3,497,100

Sell Vol. 3,456,400

49,000

1D 4.48%

5D 9.13%

Buy Vol. 7,275,800

Sell Vol. 7,212,800

37,000

1D 3.79%

5D 7.09%

Buy Vol. 27,491,200

Sell Vol. 30,040,200

51,900

1D 3.18%

5D 6.46%

Buy Vol. 22,241,400

Sell Vol. 28,225,600

34,900

1D 4.33%

5D 4.96%

Buy Vol. 19,527,800

Sell Vol. 17,393,900

32,600

1D 1.56%

5D 9.03%

Buy Vol. 35,145,700

Sell Vol. 36,700,000

30,050

1D 3.62%

5D 1.69%

Buy Vol. 9,776,300

Sell Vol. 7,834,700

39,750

1D 5.30%

5D 2.19%

Buy Vol. 14,993,600

Sell Vol. 14,276,200

34,700

1D 4.20%

5D 2.36%

Buy Vol. 40,404,000

Sell Vol. 39,494,700

34,850

1D 1.46%

5D 6.25%

Buy Vol. 6,755,500

Sell Vol. 10,519,200

TCB: Profit before tax in 2021 reached more than 1 billion USD (approximately 23 trillion VND), equivalent to an increase of about 45% compared to 2020. Specifically, in the past year, Techcombank's total operating income increased by 35.4% over the same period last year, up 37,100 billion. In which, interest income reached VND 26,700 billion, up 42.4%, led by net profit margin (NIM - calculated over the last 12 months) reaching 5.6% (compared to 4.9% in 2020).

REAL ESTATE

79,000

1D 1.15%

5D -1.37%

Buy Vol. 2,162,900

Sell Vol. 2,868,700

49,900

1D 1.63%

5D -1.19%

Buy Vol. 2,619,800

Sell Vol. 2,373,100

90,000

1D 5.39%

5D 2.27%

Buy Vol. 5,371,700

Sell Vol. 4,699,200

PDR: Phat Dat Holdings Co., Ltd. received 20m shares (4.06%). The transaction was made on January 20, 2022. These shares received as contribution by Mr. Nguyen Van Dat - Chairman of BOD

OIL & GAS

109,500

1D 2.24%

5D 2.34%

Buy Vol. 2,217,000

Sell Vol. 2,062,000

16,550

1D 6.77%

5D 7.47%

Buy Vol. 46,658,500

Sell Vol. 25,130,000

54,400

1D 0.18%

5D 0.74%

Buy Vol. 1,852,200

Sell Vol. 1,477,100

GAS: POW's bad debt increased by more than 817b dong compared to the beginning of the year to 1,007b dong while the recoverable value as calculated by GAS was only 629b dong.

VINGROUP

96,000

1D 1.05%

5D 0.10%

Buy Vol. 4,868,500

Sell Vol. 4,850,100

81,000

1D 6.30%

5D 5.19%

Buy Vol. 8,930,100

Sell Vol. 7,543,200

33,150

1D 6.94%

5D 2.31%

Buy Vol. 12,472,400

Sell Vol. 8,271,800

While VHM was at the top of the list of foreign net buying stocks in today's session, VIC was the focus of net selling with a value of nearly 120 billion dong.

FOOD & BEVERAGE

79,200

1D -2.22%

5D -5.04%

Buy Vol. 5,060,900

Sell Vol. 5,944,700

153,000

1D 6.99%

5D 7.67%

Buy Vol. 1,723,500

Sell Vol. 1,412,900

145,000

1D 0.00%

5D -3.97%

Buy Vol. 260,700

Sell Vol. 262,900

VNM: Vilico (VLC), which VNM owns indirectly through GTN, reported a profit of VND 323 billion in 2021, nearly 3 times higher than the profit target for the whole year.

OTHERS

121,300

1D 0.66%

5D -2.57%

Buy Vol. 684,900

Sell Vol. 672,500

121,300

1D 0.66%

5D -2.57%

Buy Vol. 684,900

Sell Vol. 672,500

86,500

1D 1.41%

5D -1.82%

Buy Vol. 2,430,400

Sell Vol. 1,839,600

131,000

1D 0.85%

5D 0.69%

Buy Vol. 1,355,900

Sell Vol. 1,401,000

97,000

1D 0.10%

5D 3.97%

Buy Vol. 1,173,800

Sell Vol. 1,455,400

31,250

1D 3.65%

5D 0.48%

Buy Vol. 3,236,800

Sell Vol. 2,423,500

42,800

1D 3.26%

5D 1.18%

Buy Vol. 20,470,900

Sell Vol. 15,919,200

43,250

1D 6.27%

5D -1.70%

Buy Vol. 37,374,500

Sell Vol. 23,969,200

PNJ: Approving the implementation of the private placement plan with the maximum number of shares expected to be issued is 15 million shares (equivalent to 6.6% of the total number of outstanding shares). Expected time in the first 6 months of 2022.

Market by numbers

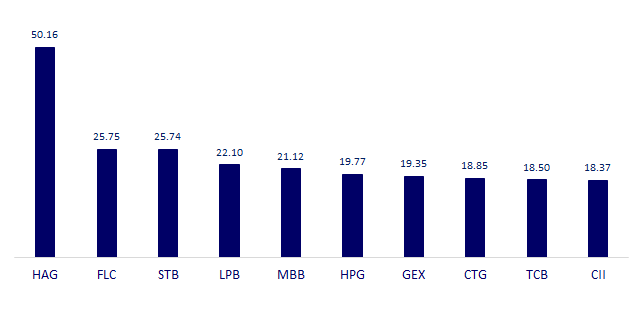

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

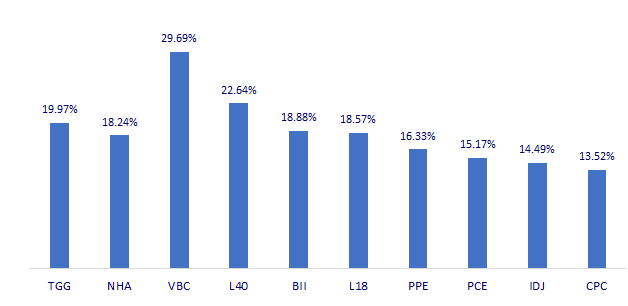

TOP INCREASES 3 CONSECUTIVE SESSIONS

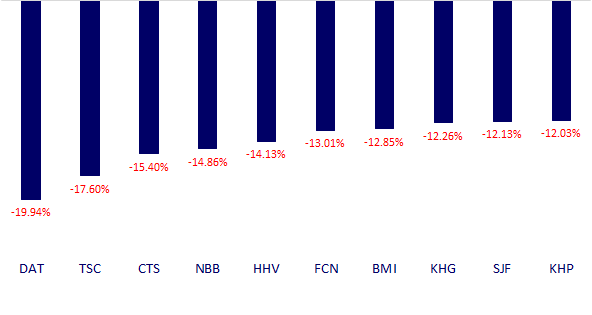

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.