Market brief 28/01/2022

VIETNAM STOCK MARKET

1,478.96

1D 0.56%

YTD -1.29%

1,532.24

1D 1.03%

YTD -0.23%

416.73

1D 1.33%

YTD -12.08%

109.69

1D 0.88%

YTD -2.65%

345.46

1D 0.00%

YTD 0.00%

24,116.82

1D 23.43%

YTD -22.38%

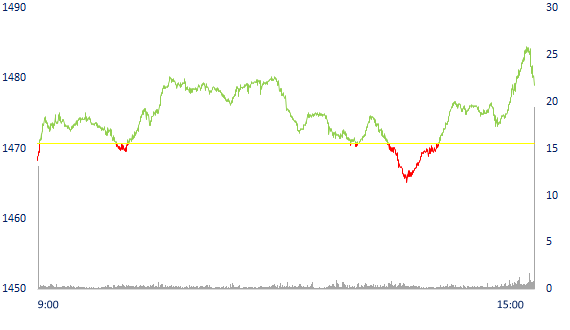

Today is the session of ETFs simulating VNFIN Lead, VN Dinamond, VN30... performing transactions to complete the portfolio structure, so the market fluctuated strongly in the ATC session, in which, VND was pushed to the ceiling price because it was added to the VNFIN Lead index this period, so at the end of the session, it increased by 6.2%.

ETF & DERIVATIVES

25,740

1D 0.63%

YTD -0.35%

18,040

1D 1.06%

YTD -0.28%

18,920

1D 6.23%

YTD -0.42%

22,100

1D -0.90%

YTD -3.49%

21,710

1D -6.22%

YTD -3.43%

27,900

1D 1.09%

YTD -0.53%

19,930

1D 1.22%

YTD -7.22%

1,513

1D 0.62%

YTD 0.00%

1,515

1D 0.93%

YTD 0.00%

1,528

1D 1.66%

YTD 0.00%

1,528

1D 1.06%

YTD 0.00%

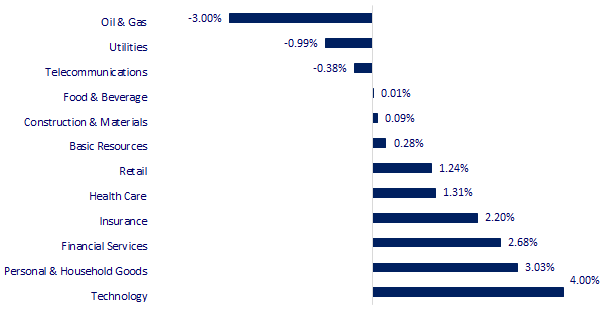

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

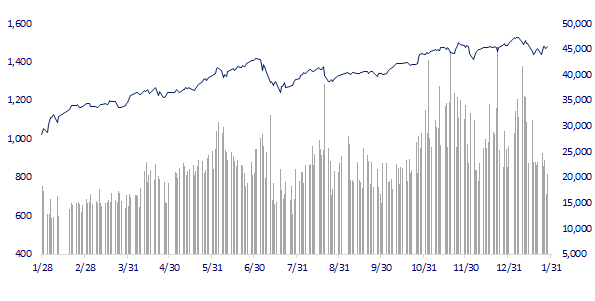

VNINDEX (12M)

GLOBAL MARKET

26,717.34

1D 0.10%

YTD -7.20%

3,361.44

1D -0.97%

YTD -7.65%

2,663.34

1D 1.87%

YTD -10.56%

23,550.08

1D -0.38%

YTD 0.65%

3,246.33

1D -0.42%

YTD 3.93%

1,639.51

1D 0.33%

YTD -1.09%

86.92

1D -0.13%

YTD 13.62%

1,789.20

1D -0.44%

YTD -1.74%

Asian stocks mixed after the volatile session of the US market. In Japan, the Nikkei 225 gained 0.1% after falling nearly 3% in the previous session. The Chinese market fell with Shanghai Composite down 0.97%, Shenzhen Component down 0.53%. Hong Kong's Hang Seng fell 0.38%. Hong Kong is expected to announce its GDP for the fourth quarter of 2021 this afternoon. Korea's Kospi Index up 1.87%

VIETNAM ECONOMY

2.42%

1D (bps) -14

YTD (bps) 161

5.60%

1.19%

1D (bps) 1

YTD (bps) 18

1.87%

1D (bps) -3

YTD (bps) -13

22,775

1D (%) 0.00%

YTD (%) -0.72%

25,930

1D (%) -0.11%

YTD (%) -2.03%

3,629

1D (%) 0.03%

YTD (%) -0.79%

In 2021, VAMC bought debt with special bonds reaching VND 20,999 billion at the debt purchase price, an increase of 43.35% compared to 2020. With many measures VAMC has handled, it has recovered VND 2,960 billion from the debt. Debts purchased at market value, of which principal balance is VND 2,632 billion, up 127% compared to 2020.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Developing offshore wind power projects associated with renewable energy supporting industries

- The Prime Minister requested to urgently open schools and tourism as soon as possible

- Banks sell nearly 21 trillion dong of bad debt to VAMC in 2021

- IMF: Potential for market instability when Central Banks raise interest rates

- Central banks are ready to hit hard to suppress inflation

- China's crude oil imports expected to recover in 2022

VN30

BANK

89,000

1D -2.20%

5D -0.22%

Buy Vol. 3,085,300

Sell Vol. 3,367,900

47,950

1D 0.74%

5D 1.27%

Buy Vol. 6,799,300

Sell Vol. 6,390,500

36,900

1D 0.00%

5D 3.80%

Buy Vol. 15,541,200

Sell Vol. 16,683,300

52,800

1D 1.73%

5D 6.02%

Buy Vol. 17,694,300

Sell Vol. 21,068,400

36,650

1D 3.39%

5D 6.85%

Buy Vol. 34,440,800

Sell Vol. 42,850,500

33,700

1D 2.12%

5D 5.97%

Buy Vol. 41,139,400

Sell Vol. 44,399,100

30,900

1D 0.32%

5D 5.82%

Buy Vol. 7,380,000

Sell Vol. 9,657,600

41,950

1D 4.35%

5D 4.88%

Buy Vol. 23,742,100

Sell Vol. 24,856,800

35,550

1D 0.42%

5D 2.75%

Buy Vol. 47,860,700

Sell Vol. 43,489,500

34,550

1D -1.00%

5D 3.29%

Buy Vol. 18,666,400

Sell Vol. 16,741,500

MBB: profit before tax in 2021, increased by 55% compared to the previous year, reaching more than 16,527b VND, exceeding 25% of the plan thanks to increasing both main revenue and non-interest income. In general, for the whole year of 2021, MB's business activities gave positive results yoy. Main activities brought in nearly 26,200 billion dong of net interest income, up 29% over the previous year. Profit from service activities increased by 22% to VND4,367 billion thanks to increased revenue from insurance business and services, from securities brokerage activities, and from debt settlement.

REAL ESTATE

79,900

1D 1.14%

5D -0.13%

Buy Vol. 2,030,000

Sell Vol. 2,598,500

50,000

1D -0.20%

5D -1.57%

Buy Vol. 1,298,100

Sell Vol. 1,125,800

90,800

1D 3.77%

5D 1.11%

Buy Vol. 4,447,500

Sell Vol. 4,072,900

NVL: Additional listing of nearly 457m shares due to the issue of shares to pay dividends to existing shareholders, bringing the total number of outstanding shares to more than 1,930m shares.

OIL & GAS

109,000

1D -2.50%

5D 1.49%

Buy Vol. 2,639,500

Sell Vol. 2,778,800

16,800

1D 2.44%

5D 0.90%

Buy Vol. 41,355,200

Sell Vol. 35,606,800

56,100

1D -1.58%

5D 2.37%

Buy Vol. 2,196,700

Sell Vol. 2,987,200

Oil prices fell on Thursday (January 27) after Brent hit a seven-year high above $90 a barrel, as the market balanced concerns about tight supply around the world.

VINGROUP

97,000

1D 0.52%

5D 1.57%

Buy Vol. 4,706,600

Sell Vol. 4,556,600

80,300

1D -0.86%

5D 1.13%

Buy Vol. 7,321,700

Sell Vol. 7,737,400

34,950

1D 2.19%

5D 5.59%

Buy Vol. 15,463,300

Sell Vol. 20,515,800

VRE: The profit before tax in Q4.2021 was more than four times higher than in Q3.2021, helping Vincom Retail to record a full year net profit of more than 1,300 billion dong.

FOOD & BEVERAGE

83,100

1D 0.00%

5D 0.61%

Buy Vol. 4,293,500

Sell Vol. 4,985,100

143,000

1D 0.70%

5D -5.30%

Buy Vol. 937,100

Sell Vol. 691,000

148,700

1D -0.07%

5D 0.47%

Buy Vol. 309,500

Sell Vol. 304,500

MSN: Masan Consumer subsidiary has a profit of more than 5,500b dong after tax in 2021, more than 13,000b dong is deposited. Particularly in Q4.2021, NI was VND 2,040b, up 33.3% QoQ.

OTHERS

121,900

1D 0.66%

5D -0.08%

Buy Vol. 783,200

Sell Vol. 651,000

121,900

1D 0.66%

5D -0.08%

Buy Vol. 783,200

Sell Vol. 651,000

89,500

1D 4.19%

5D 1.47%

Buy Vol. 2,329,100

Sell Vol. 2,075,400

132,500

1D 0.76%

5D -0.53%

Buy Vol. 1,178,700

Sell Vol. 1,574,400

104,000

1D 2.97%

5D 8.90%

Buy Vol. 1,708,300

Sell Vol. 1,440,300

31,200

1D 1.63%

5D -3.70%

Buy Vol. 2,036,800

Sell Vol. 1,587,300

45,050

1D 3.80%

5D 1.12%

Buy Vol. 12,781,600

Sell Vol. 12,962,400

42,200

1D 0.12%

5D -2.54%

Buy Vol. 32,243,800

Sell Vol. 22,943,900

MWG: For the whole year, MWG recorded a revenue increase of 13.3% to 122,958b dong, profit after tax of parent company's shareholders increased by 25% to 4,899b dong. The enterprise did not meet the revenue target of VND125,000b but slightly exceeded the target of profit after tax of VND4,750b by 3%. MWG sharply increased short-term loans by VND6,254b to VND21,879b, long-term loans by VND 1,641b to VND2,268b. Total debt increased by VND7,895b to VND24,647b, D/E ratio at 1.2 times.

Market by numbers

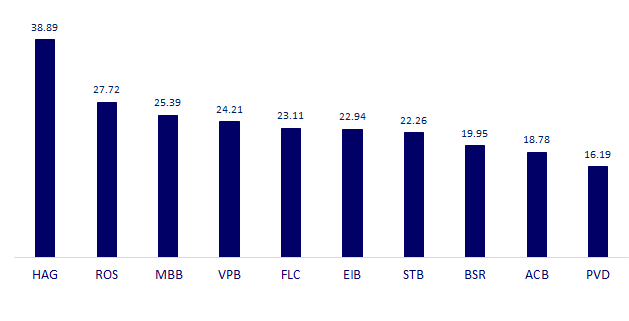

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

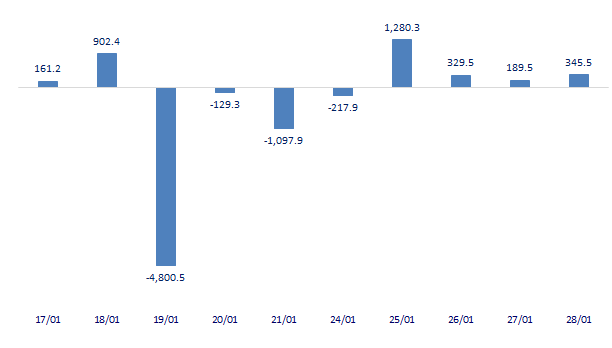

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

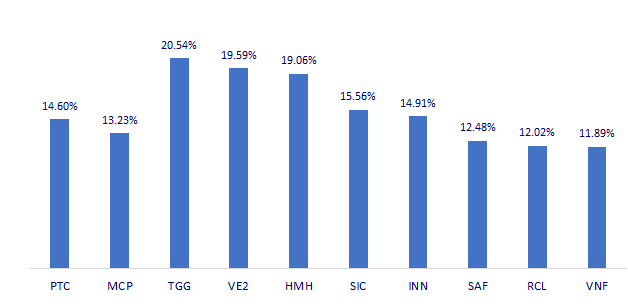

TOP INCREASES 3 CONSECUTIVE SESSIONS

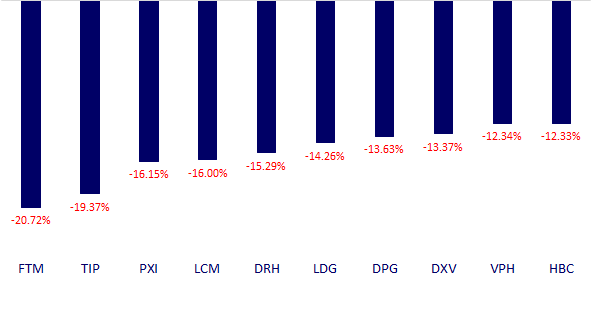

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.