Market brief 15/02/2022

VIETNAM STOCK MARKET

1,492.75

1D 1.41%

YTD -0.37%

1,527.36

1D 1.48%

YTD -0.54%

423.84

1D 0.67%

YTD -10.58%

111.22

1D 0.33%

YTD -1.30%

975.53

1D 0.00%

YTD 0.00%

21,874.69

1D -26.58%

YTD -29.60%

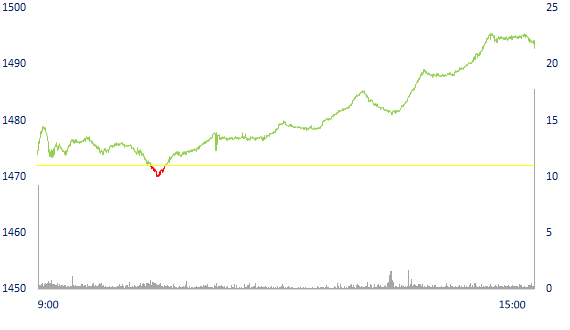

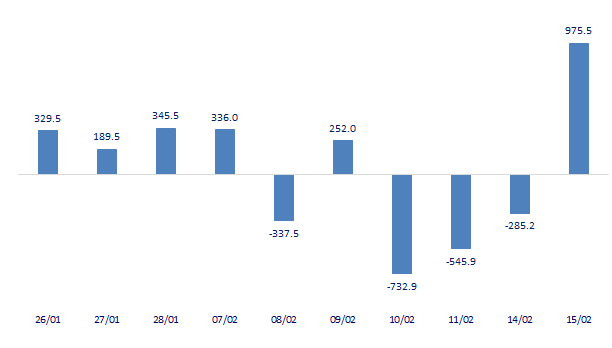

Large stocks raced to recover, VN-Index up to nearly 21 points. Market liquidity dropped sharply compared to the previous session, the total matched value reached 19,374 billion dong, down 29.3%, of which the matched value on HoSE decreased by 26.7% and reached 17,486 billion dong. Foreign investors boosted their net buying of about 975 billion dong on HoSE.

ETF & DERIVATIVES

25,690

1D -1.19%

YTD -0.54%

18,010

1D 0.61%

YTD -0.44%

18,900

1D 6.12%

YTD -0.53%

22,400

1D -0.22%

YTD -2.18%

22,600

1D -5.40%

YTD 0.53%

28,500

1D 0.18%

YTD 1.60%

20,000

1D 0.15%

YTD -6.89%

1,509

1D 0.49%

YTD 0.00%

1,513

1D 0.87%

YTD 0.00%

1,521

1D 0.56%

YTD 0.00%

1,522

1D 0.79%

YTD 0.00%

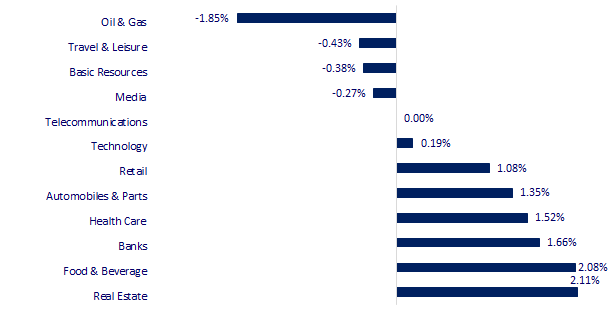

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

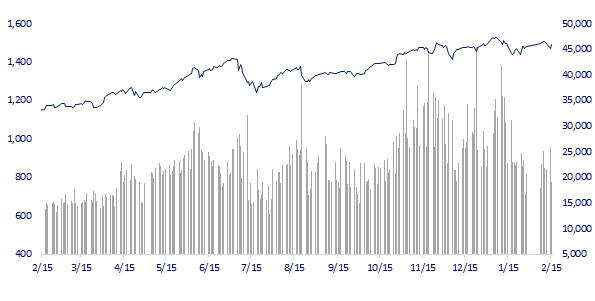

VNINDEX (12M)

GLOBAL MARKET

26,865.19

1D -0.45%

YTD -6.69%

3,446.09

1D 0.50%

YTD -5.32%

2,676.54

1D -1.03%

YTD -10.11%

24,355.71

1D -0.38%

YTD 4.09%

3,421.38

1D 0.01%

YTD 9.53%

1,701.45

1D 0.99%

YTD 2.64%

92.61

1D -2.50%

YTD 21.06%

1,856.05

1D -0.93%

YTD 1.94%

Asian stocks mixed, Ukraine situation is still the focus. In Japan, the Nikkei 225 fell 0.45%. Japan's economy in the first quarter of 2021 grew by 5.4% year-on-year, lower than analysts' forecast of 5.8% growth. The Chinese market rose with the Shanghai Composite up 0.5%. Hong Kong's Hang Seng fell 0.38%. South Korea's Kospi index fell 1.03%.

VIETNAM ECONOMY

2.95%

1D (bps) -13

YTD (bps) 214

5.60%

1.23%

YTD (bps) 22

1.97%

1D (bps) -1

YTD (bps) -3

22,975

1D (%) 0.48%

YTD (%) 0.15%

26,262

1D (%) -0.67%

YTD (%) -0.78%

3,653

1D (%) 0.25%

YTD (%) -0.14%

According to the latest data from the State Bank, credit growth in the first month of this year reached 2.74%, or more than 5 times higher than the same period last year. This is also the strongest credit growth in the past 10 years. Loans increase, whether deposit interest rates will increase to ensure the balance between supply and demand for capital. The pressure is in fact there but not too great.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Deposit interest rates are unlikely to increase

- Domestic steel prices simultaneously increased

- Indian enterprises invest in an international pharmaceutical park with an area of 900ha in Hai Duong

- Fed remains open to rate hike after two months of policy meeting

- IEA chief urges OPEC+ to close gap between commitment and action

- Singapore approves use of Novavax's COVID-19 Nuvaxovid vaccine

VN30

BANK

87,000

1D 1.16%

5D -5.43%

Buy Vol. 4,178,700

Sell Vol. 3,366,600

46,200

1D 3.24%

5D -2.43%

Buy Vol. 5,953,600

Sell Vol. 5,423,800

34,950

1D 1.01%

5D -4.25%

Buy Vol. 22,573,300

Sell Vol. 20,382,300

51,800

1D 0.58%

5D -3.72%

Buy Vol. 15,430,300

Sell Vol. 13,964,800

35,950

1D 2.71%

5D -3.62%

Buy Vol. 24,787,900

Sell Vol. 20,944,800

32,700

1D 2.19%

5D -3.25%

Buy Vol. 38,866,000

Sell Vol. 31,495,700

29,500

1D 1.03%

5D -6.05%

Buy Vol. 12,690,600

Sell Vol. 10,166,900

40,750

1D 1.88%

5D -2.98%

Buy Vol. 6,335,000

Sell Vol. 5,356,000

33,500

1D 1.98%

5D -6.56%

Buy Vol. 60,197,700

Sell Vol. 50,450,900

34,500

1D 1.47%

5D -3.50%

Buy Vol. 11,473,100

Sell Vol. 13,200,300

VPB: A major contribution to VPBank's sudden profit in the past year came from the proceeds from the sale of 49% stake in subsidiary FE Credit to Japanese partner SMBC. VPBank's Q4 financial report has recorded over 20 trillion dong. The large sum also contributed to VPBank's total consolidated assets skyrocketing by 30.7% in 2021 to approximately VND 550 trillion. In particular, VPBank's equity has increased to nearly 90 trillion dong, far ahead of many banks in the group of private commercial joint stock companies and rising to the top of the entire banking industry.

REAL ESTATE

79,000

1D 1.28%

5D -0.25%

Buy Vol. 3,701,000

Sell Vol. 3,532,300

53,500

1D 1.52%

5D 6.15%

Buy Vol. 2,764,700

Sell Vol. 2,076,000

90,000

1D 0.56%

5D 1.12%

Buy Vol. 3,134,500

Sell Vol. 3,075,800

KDH: VinaCapital registered to buy 170,000 shares from February 14 to March 15. If the transaction is successful, the fund will hold 0.03%. Previously, the fund did not own any KDH shares.

OIL & GAS

117,400

1D 1.21%

5D 2.98%

Buy Vol. 2,343,500

Sell Vol. 3,129,600

18,100

1D 2.26%

5D 1.12%

Buy Vol. 53,144,600

Sell Vol. 40,022,000

59,000

1D -1.99%

5D 0.34%

Buy Vol. 4,133,900

Sell Vol. 5,446,800

POW: January power output was at 1,192 million kWH, exceeding 29% of the monthly plan, but decreasing by 28% compared to the same period last year, notably the output at Nhon Trach 1

VINGROUP

83,700

1D 2.32%

5D -4.12%

Buy Vol. 5,980,000

Sell Vol. 6,002,500

80,000

1D 2.43%

5D -1.48%

Buy Vol. 6,553,800

Sell Vol. 7,811,700

34,000

1D 3.03%

5D -4.23%

Buy Vol. 16,799,000

Sell Vol. 12,380,800

VIC: In 2021, Vingroup achieved VND 125,306 billion in net revenue, up 13% over the same period last year. Profit before tax reached VND 3,346 billion, loss after tax was VND 7,523 billion.

FOOD & BEVERAGE

81,200

1D 0.12%

5D -0.98%

Buy Vol. 2,956,600

Sell Vol. 2,491,900

160,500

1D 5.87%

5D 10.31%

Buy Vol. 2,477,300

Sell Vol. 2,346,900

170,000

1D 1.25%

5D 9.82%

Buy Vol. 557,700

Sell Vol. 681,500

MSN: Thanks to the strong synergies between business segments, in 2021 MSN achieved net revenue of VND 88,629 billion, up 14.8% compared to 2020.

OTHERS

139,200

1D -0.57%

5D 5.86%

Buy Vol. 1,056,900

Sell Vol. 1,207,200

139,200

1D -0.57%

5D 5.86%

Buy Vol. 1,056,900

Sell Vol. 1,207,200

91,100

1D 0.11%

5D 0.55%

Buy Vol. 1,282,100

Sell Vol. 1,419,600

133,300

1D 0.98%

5D -2.20%

Buy Vol. 1,021,400

Sell Vol. 1,271,700

105,500

1D 0.86%

5D 0.48%

Buy Vol. 922,300

Sell Vol. 1,253,500

33,350

1D 0.15%

5D 1.06%

Buy Vol. 1,641,000

Sell Vol. 1,852,900

44,200

1D 1.38%

5D -3.18%

Buy Vol. 10,624,200

Sell Vol. 11,287,800

46,000

1D -0.43%

5D 0.99%

Buy Vol. 24,600,100

Sell Vol. 28,048,600

HPG: Hoa Phat, which accounts for 32.6% of the nationwide construction steel market share in 2021, announced a change in product prices from February 15. In the North and South, the price of CB240 coil steel is at 17.02 million VND/ton, D10 CB300 is 17.12 million VND/ton, simultaneously increasing 300,000 VND/ton compared to February 14.

Market by numbers

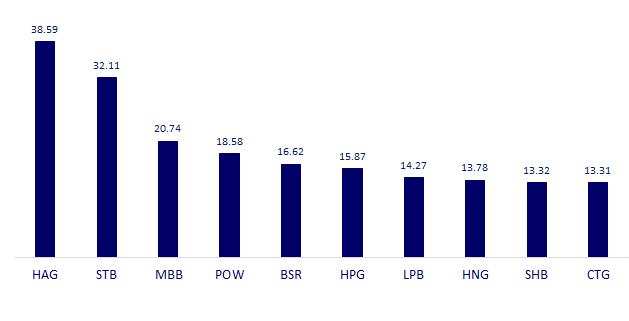

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

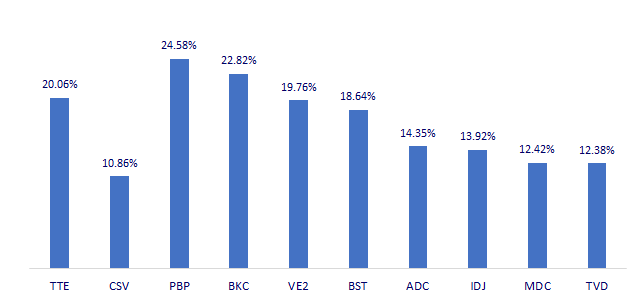

TOP INCREASES 3 CONSECUTIVE SESSIONS

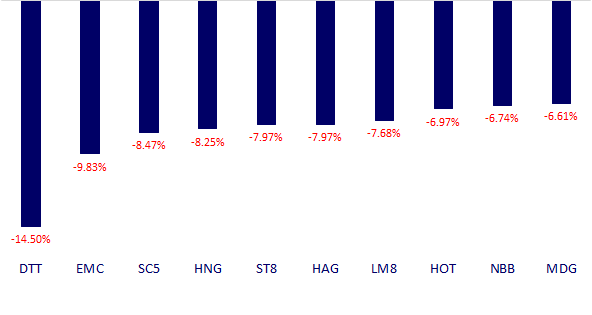

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.