Market brief 18/02/2022

VIETNAM STOCK MARKET

1,504.84

1D -0.21%

YTD 0.44%

1,531.47

1D -0.59%

YTD -0.28%

435.61

1D 1.25%

YTD -8.10%

112.72

1D 0.27%

YTD 0.04%

53.16

1D 0.00%

YTD 0.00%

25,951.97

1D 14.00%

YTD -16.48%

Foreign investors net bought 53 billion dong in session 18/2. Foreign investors on HoSE were the biggest net buyers of KBC with 48 billion dong. MSN and DXG are behind with a net buying value of VND 43 billion and VND 35 billion, respectively. On the other side, SSI was sold the most with 58.7 billion dong. NVL and VND were net bought 35.4 billion dong and 23.6 billion dong respectively.

ETF & DERIVATIVES

25,750

1D -0.77%

YTD -0.31%

18,040

1D 0.06%

YTD -0.28%

18,800

1D 5.56%

YTD -1.05%

22,500

1D 0.00%

YTD -1.75%

22,800

1D 0.00%

YTD 1.42%

28,500

1D 0.00%

YTD 1.60%

19,930

1D -0.60%

YTD -7.22%

1,513

1D 0.13%

YTD 0.00%

1,509

1D -0.53%

YTD 0.00%

1,525

1D -0.33%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

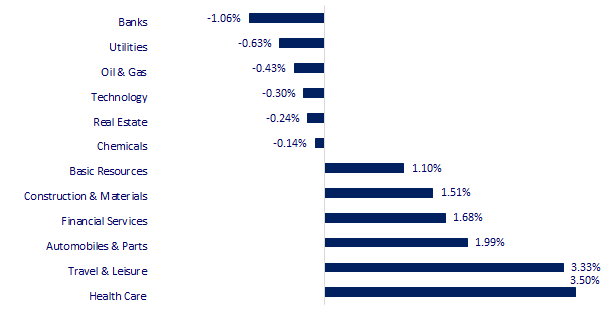

CHANGE IN PRICE BY SECTOR

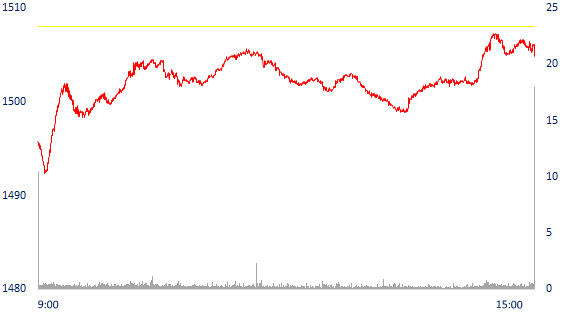

INTRADAY VNINDEX

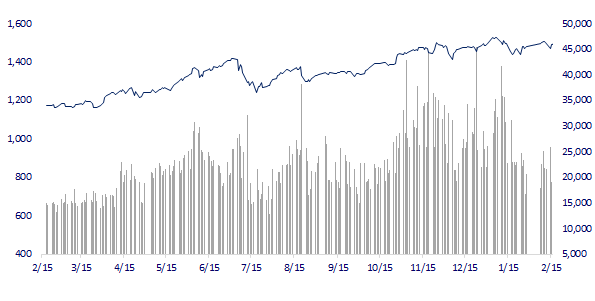

VNINDEX (12M)

GLOBAL MARKET

27,122.07

1D 0.21%

YTD -5.80%

3,490.76

1D 0.66%

YTD -4.09%

2,744.52

1D 0.02%

YTD -7.83%

24,327.71

1D -1.53%

YTD 3.97%

3,428.90

1D -0.37%

YTD 9.77%

1,713.20

1D 0.09%

YTD 3.35%

89.66

1D -1.76%

YTD 17.20%

1,894.90

1D -0.02%

YTD 4.07%

Investors worried about Ukraine crisis, Asian stocks mixed. In Japan, the Nikkei 225 gained 0.21%. The Chinese market rallied with the Shanghai Composite up 0.66%. Hong Kong's Hang Seng fell 1.53%. South Korea's Kospi index rose 0.02%.

VIETNAM ECONOMY

2.90%

YTD (bps) 209

5.60%

1.27%

1D (bps) -7

YTD (bps) 26

2.18%

1D (bps) 6

YTD (bps) 18

22,960

1D (%) 0.15%

YTD (%) 0.09%

26,681

1D (%) 0.21%

YTD (%) 0.80%

3,677

1D (%) 0.27%

YTD (%) 0.52%

In southern provinces such as Ho Chi Minh City, Binh Duong, Dong Nai..., the number of workers returning to work after the Lunar New Year decreased significantly due to the impact of the COVID-19 epidemic. Currently, many businesses in this area are facing the risk of labor shortage.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In 2022, hundreds of millions of dollars will be poured into new projects

- The Ministry of Finance proposes to ease the conditions for opening casinos

- Southern businesses and labor shortage concerns

- Inflation risks, new era of currency stress for central banks

- Russia expels deputy head of US diplomatic mission in Moscow

- More than 1,500 billion USD has been poured into the coal industry in the period of 2019 - 2021 alone

VN30

BANK

87,200

1D -0.34%

5D -3.11%

Buy Vol. 2,379,200

Sell Vol. 1,808,800

44,700

1D -2.83%

5D -6.68%

Buy Vol. 4,884,300

Sell Vol. 5,167,600

34,600

1D -0.86%

5D -5.98%

Buy Vol. 13,743,000

Sell Vol. 14,620,000

51,600

1D -1.15%

5D -3.91%

Buy Vol. 11,473,600

Sell Vol. 12,215,800

35,900

1D -1.10%

5D -1.91%

Buy Vol. 15,781,200

Sell Vol. 17,746,000

32,650

1D -1.66%

5D -3.83%

Buy Vol. 24,866,900

Sell Vol. 22,696,200

29,500

1D -0.84%

5D -5.45%

Buy Vol. 8,998,300

Sell Vol. 7,821,100

40,800

1D -0.85%

5D -4.78%

Buy Vol. 6,910,800

Sell Vol. 5,928,700

33,350

1D -1.62%

5D -5.52%

Buy Vol. 32,686,700

Sell Vol. 33,096,700

33,850

1D -1.31%

5D -5.18%

Buy Vol. 12,252,200

Sell Vol. 13,810,900

VPB: Investing capital to make VPBank Securities one of the top securities companies with the highest capital in the market, VPBank is aiming to become a leading unit in terms of capital. This bank has ambitions to sharply increase investment banking, especially securities investment in the context of the vibrant stock market again and become an investment channel of top interest to investors.

REAL ESTATE

78,500

1D -0.63%

5D 0.51%

Buy Vol. 4,475,700

Sell Vol. 4,340,200

54,000

1D -1.64%

5D 2.27%

Buy Vol. 1,608,800

Sell Vol. 2,307,100

91,200

1D -0.87%

5D 1.22%

Buy Vol. 3,847,900

Sell Vol. 4,757,800

NVL: In 2022, Nova Consumer will complete the 3F chain to produce fresh and clean food. This strategy helps Nova Consumer close the production chain.

OIL & GAS

117,000

1D -1.43%

5D 5.41%

Buy Vol. 1,601,100

Sell Vol. 1,719,500

18,550

1D -0.27%

5D 1.37%

Buy Vol. 48,930,700

Sell Vol. 48,161,700

59,800

1D -0.33%

5D 0.67%

Buy Vol. 4,006,400

Sell Vol. 4,700,200

The more than USD5 billion Southern refinery and petrochemical project started this year and will be fully operational by 2023 to meet high demand in line with the country's economic growth.

VINGROUP

82,200

1D -1.08%

5D 0.61%

Buy Vol. 5,459,600

Sell Vol. 5,433,400

79,700

1D -1.36%

5D 0.00%

Buy Vol. 5,573,800

Sell Vol. 7,590,800

33,600

1D -2.47%

5D -2.89%

Buy Vol. 11,715,700

Sell Vol. 10,779,600

VIC: The theme of the VinFuture 2022 award is towards scientific inventions and inventions that bring the world revival and sustainable development after the Covid-19 pandemic.

FOOD & BEVERAGE

80,600

1D -0.25%

5D -1.71%

Buy Vol. 3,460,100

Sell Vol. 2,989,500

163,300

1D 0.18%

5D 9.01%

Buy Vol. 1,705,000

Sell Vol. 1,694,700

169,400

1D -0.65%

5D 6.14%

Buy Vol. 282,900

Sell Vol. 375,800

IDP overthrew Vinamilk in terms of efficiency in core business, with a profit of more than trillion dong for the first time and gross profit margin of 44.2%.

OTHERS

149,000

1D 5.23%

5D 12.20%

Buy Vol. 2,036,000

Sell Vol. 1,675,900

149,000

1D 5.23%

5D 12.20%

Buy Vol. 2,036,000

Sell Vol. 1,675,900

92,200

1D -0.65%

5D 0.66%

Buy Vol. 1,264,200

Sell Vol. 1,497,900

134,000

1D -0.37%

5D -0.96%

Buy Vol. 1,100,200

Sell Vol. 1,150,100

107,000

1D -0.83%

5D 2.10%

Buy Vol. 942,900

Sell Vol. 1,465,000

33,600

1D -1.18%

5D -1.03%

Buy Vol. 3,043,400

Sell Vol. 2,973,300

45,200

1D 0.44%

5D 0.22%

Buy Vol. 16,343,000

Sell Vol. 18,930,100

47,050

1D 1.18%

5D -0.21%

Buy Vol. 36,380,000

Sell Vol. 45,320,700

PNJ: On March 8, PNJ will finalize the list of shareholders to advance the dividend for the 1st period of 2021. Accordingly, dividend is paid in cash at the rate of 6%, corresponding to a shareholder owning 1 share will receive 600 dong. And with more than 227 million shares outstanding, PNJ will have to spend about 136.2 billion dong to pay dividends to existing shareholders. Expected dividend payment time from April 7, 2022.

Market by numbers

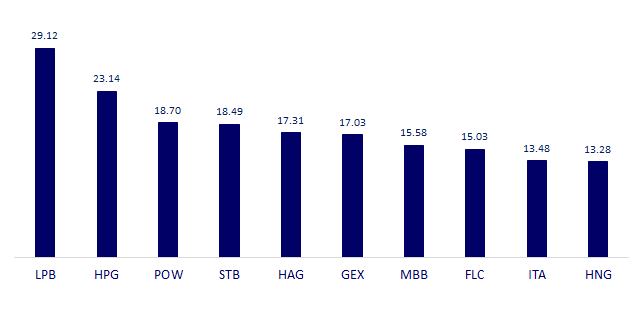

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

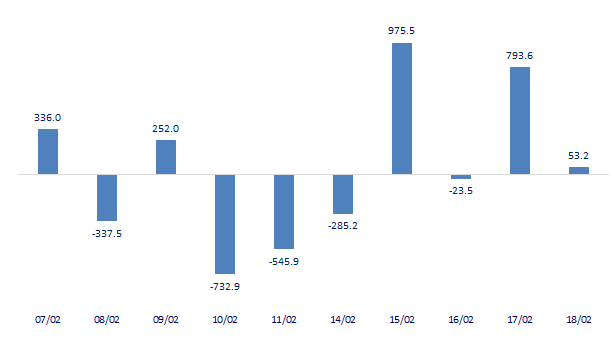

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

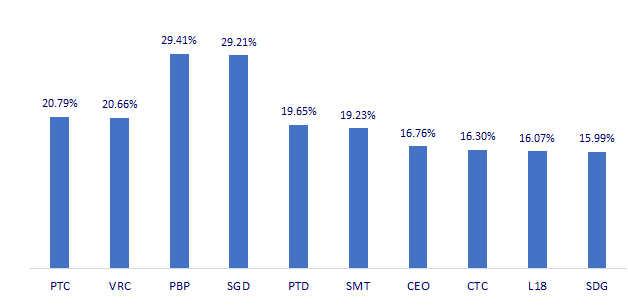

TOP INCREASES 3 CONSECUTIVE SESSIONS

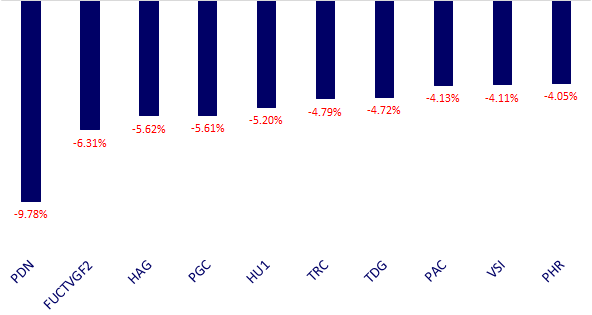

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.