Market brief 22/02/2022

VIETNAM STOCK MARKET

1,503.47

1D -0.49%

YTD 0.35%

1,532.36

1D -0.07%

YTD -0.22%

434.43

1D -1.49%

YTD -8.35%

113.01

1D -0.58%

YTD 0.29%

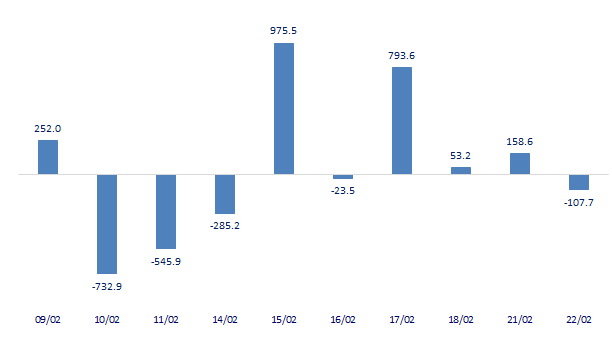

-107.65

1D 0.00%

YTD 0.00%

33,601.98

1D 19.92%

YTD 8.14%

Foreign investors no longer kept the positivity as in previous sessions but net sold again. Specifically, today's foreign capital flow bought 29.6 million shares, worth 1,238 billion dong, while selling 35.5 million shares, worth 1,339 billion dong. Total net selling volume was at 6 million shares, equivalent to a net selling value of 107 billion dong.

ETF & DERIVATIVES

25,900

1D 0.00%

YTD 0.27%

18,000

1D 0.00%

YTD -0.50%

18,980

1D 6.57%

YTD -0.11%

22,800

1D 1.33%

YTD -0.44%

23,000

1D 1.77%

YTD 2.31%

28,650

1D 0.53%

YTD 2.14%

19,960

1D -0.70%

YTD -7.08%

1,505

1D -0.67%

YTD 0.00%

1,506

1D -0.92%

YTD 0.00%

1,518

1D -0.82%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

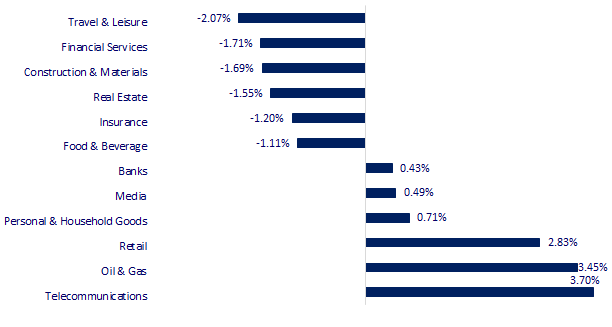

CHANGE IN PRICE BY SECTOR

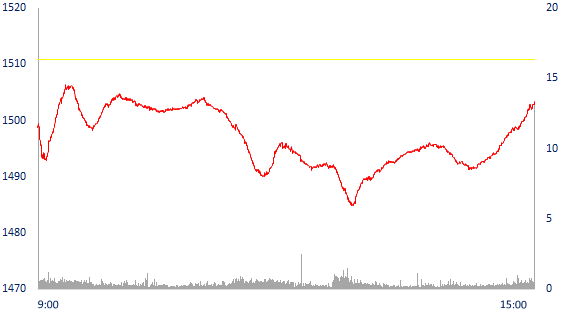

INTRADAY VNINDEX

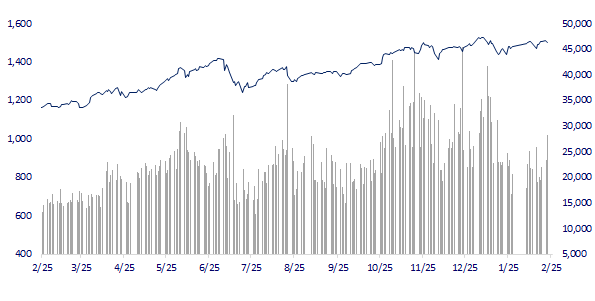

VNINDEX (12M)

GLOBAL MARKET

26,449.61

1D 0.28%

YTD -8.13%

3,457.15

1D 0.02%

YTD -5.02%

2,706.79

1D 0.02%

YTD -9.10%

23,520.00

1D -0.46%

YTD 0.52%

3,400.58

1D -0.25%

YTD 8.86%

1,691.12

1D -0.19%

YTD 2.02%

93.84

1D 0.85%

YTD 22.67%

1,897.70

1D -0.72%

YTD 4.22%

Asian stocks mixed, Hong Kong lost the most in the region. In Japan, the Nikkei 225 gained 0.28%. The Chinese market rose with the Shanghai Composite up 0.02%. Hong Kong's Hang Seng fell 0.46%. South Korea's Kospi index rose 0.02%.

VIETNAM ECONOMY

2.52%

1D (bps) 5

YTD (bps) 171

5.60%

1.29%

1D (bps) -2

YTD (bps) 28

2.16%

1D (bps) 5

YTD (bps) 16

23,045

1D (%) 0.48%

YTD (%) 0.46%

26,325

1D (%) -0.67%

YTD (%) -0.54%

3,674

1D (%) 0.22%

YTD (%) 0.44%

It is proposed to add 20,450 billion VND to the planned capital in 2022 for economic recovery. If including the estimated capital in 2022 of projects under the Socio-Economic Development and Recovery Program, the total additional capital in 2022 is nearly 37,300 billion VND.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Proposing to add 20,450 billion VND to the planned capital in 2022 for economic recovery

- By the end of 2022, the risk of bad debt is up to 6%

- Proposing the State Bank to loosen the credit room for banks

- IMF warns virtual currencies are not compatible with central bank digital currencies

- OPEC+ wants to maintain its current production increase plan

- Russia's Ministry of Finance paves the way for digital asset management law

VN30

BANK

86,800

1D -0.69%

5D -0.23%

Buy Vol. 3,013,100

Sell Vol. 2,258,500

46,000

1D 1.66%

5D -0.43%

Buy Vol. 3,921,100

Sell Vol. 3,829,100

34,600

1D 0.58%

5D -1.00%

Buy Vol. 18,921,800

Sell Vol. 16,451,600

51,400

1D -0.19%

5D -0.77%

Buy Vol. 17,887,700

Sell Vol. 15,904,200

35,550

1D -0.97%

5D -1.11%

Buy Vol. 17,888,600

Sell Vol. 18,952,100

34,400

1D 5.36%

5D 5.20%

Buy Vol. 61,136,100

Sell Vol. 53,816,600

29,550

1D -0.17%

5D 0.17%

Buy Vol. 9,808,300

Sell Vol. 8,831,500

41,500

1D 1.47%

5D 1.84%

Buy Vol. 12,226,900

Sell Vol. 14,190,600

33,700

1D 1.51%

5D 0.60%

Buy Vol. 45,983,500

Sell Vol. 38,546,100

34,700

1D 0.87%

5D 0.58%

Buy Vol. 13,185,600

Sell Vol. 13,572,300

Following the credit growth, the total bad debt at 27 banks as of December 31, 2021 also increased, accounting for 98.878b VND of the total outstanding loans, up 10.22% yoy. In which, 9/27 banks announced that bad debt decreased compared to the beginning of the year, all decreased by less than 10%, except for some banks that improved strongly such as Eximbank (-11.33%), BIDV (-37.94%), OCB ( -10.54%) and KLB (-61.43%). It is alarming that in the opposite direction, bad debts of banks increased by 45% on average. Some banks also had a sudden increase such as Vietbank (+135%), NCB (+105%), NAB (+116%).

REAL ESTATE

78,100

1D -0.51%

5D -1.14%

Buy Vol. 4,058,900

Sell Vol. 4,721,700

53,900

1D -0.55%

5D 0.75%

Buy Vol. 2,645,500

Sell Vol. 2,737,200

89,800

1D -1.54%

5D -0.22%

Buy Vol. 3,508,500

Sell Vol. 4,003,300

NVL: just issued VND1,000 billion of bonds with a term of 12 months. Release date is December 24, 2021, completion date is February 15.

OIL & GAS

116,500

1D 0.60%

5D -0.77%

Buy Vol. 1,209,500

Sell Vol. 1,662,400

17,800

1D -3.26%

5D -1.66%

Buy Vol. 79,754,500

Sell Vol. 64,513,400

62,000

1D 3.51%

5D 5.08%

Buy Vol. 9,938,700

Sell Vol. 10,465,000

PLX: Compared to nearly a month ago, the market price of PLX has increased by nearly 15% to 62,300 VND/share, the highest in more than 3 years due to the record high gasoline price.

VINGROUP

82,000

1D -1.91%

5D -2.03%

Buy Vol. 4,746,500

Sell Vol. 5,197,000

79,300

1D -0.88%

5D -0.88%

Buy Vol. 7,974,300

Sell Vol. 9,633,800

34,500

1D 1.17%

5D 1.47%

Buy Vol. 12,984,700

Sell Vol. 14,099,200

VHM: Vinhomes will invest more than 9,300 billion VND in the construction of the central industrial park, block CN4, CN5 Vung Ang Economic Zone with an area of nearly 1,236 hectares.

FOOD & BEVERAGE

80,000

1D -1.23%

5D -1.48%

Buy Vol. 4,682,000

Sell Vol. 5,236,400

157,500

1D -1.75%

5D -1.87%

Buy Vol. 831,200

Sell Vol. 967,700

168,400

1D -0.71%

5D -0.94%

Buy Vol. 235,300

Sell Vol. 273,000

MSN: Behind the valuation of more than 8000b dong, the P/E forward 15x - equivalent to Vinamilk of the M&A between Phuc Long and Masan is the synergistic advantage of the two giants..

OTHERS

142,800

1D -2.19%

5D 2.59%

Buy Vol. 1,201,800

Sell Vol. 1,164,400

142,800

1D -2.19%

5D 2.59%

Buy Vol. 1,201,800

Sell Vol. 1,164,400

92,900

1D -0.64%

5D 1.98%

Buy Vol. 1,940,600

Sell Vol. 2,392,600

137,700

1D 2.84%

5D 3.30%

Buy Vol. 4,957,300

Sell Vol. 5,221,100

110,000

1D 3.29%

5D 4.27%

Buy Vol. 4,022,000

Sell Vol. 4,368,700

34,250

1D -1.01%

5D 2.70%

Buy Vol. 2,919,700

Sell Vol. 2,868,000

45,000

1D -2.17%

5D 1.81%

Buy Vol. 13,478,900

Sell Vol. 14,884,200

46,400

1D -0.54%

5D 0.87%

Buy Vol. 29,518,500

Sell Vol. 28,790,100

PNJ: announced January net revenue of 3,476 billion dong, up 60% over the same period last year; EAT is 270 billion dong, up 60.7% and is the highest level since announcing monthly profit. The reason is due to the strong growth from the retail channel.

Market by numbers

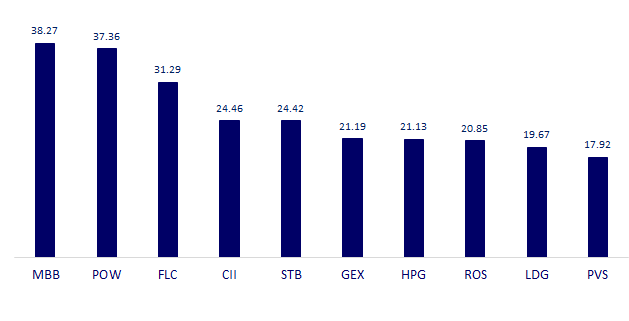

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

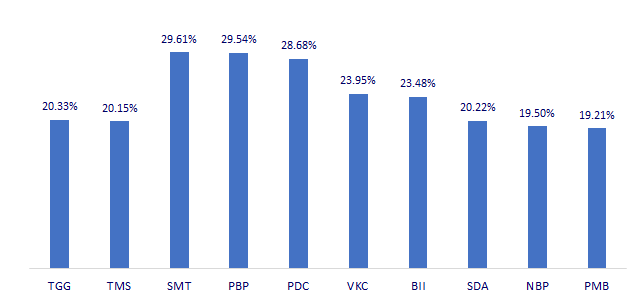

TOP INCREASES 3 CONSECUTIVE SESSIONS

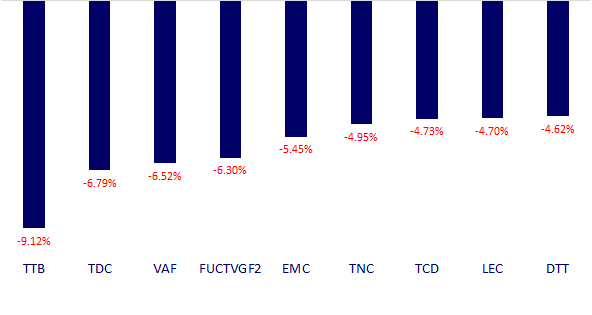

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.