Market brief 23/02/2022

VIETNAM STOCK MARKET

1,512.30

1D 0.59%

YTD 0.94%

1,538.83

1D 0.42%

YTD 0.20%

442.54

1D 1.87%

YTD -6.64%

113.51

1D 0.44%

YTD 0.74%

127.36

1D 0.00%

YTD 0.00%

27,675.30

1D -17.64%

YTD -10.93%

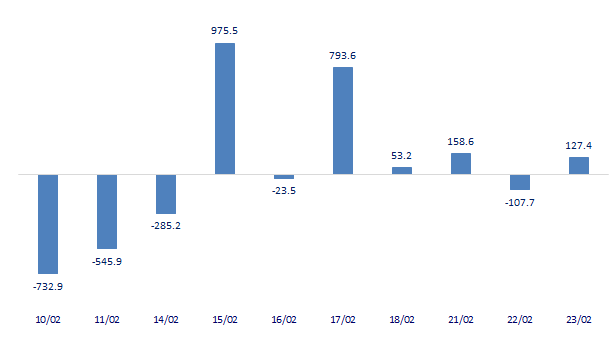

Foreign investors net bought back 127b dong in the session 23/2. Foreign investors on HoSE were the strongest net buyers of DXG with 73bi dong. VJC and VHM were net bought 54b dong and 50b dong respectively. Meanwhile, VNM was sold the most with 83b dong. PLX and MSN were net sold at 50b dong and 36b dong, respectively.

ETF & DERIVATIVES

25,780

1D -0.46%

YTD -0.19%

18,100

1D 0.56%

YTD 0.06%

18,820

1D 5.67%

YTD -0.95%

22,800

1D 0.00%

YTD -0.44%

22,690

1D -1.35%

YTD 0.93%

29,730

1D 3.77%

YTD 5.99%

20,100

1D 0.70%

YTD -6.42%

1,509

1D 0.27%

YTD 0.00%

1,520

1D 0.93%

YTD 0.00%

1,529

1D 0.78%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

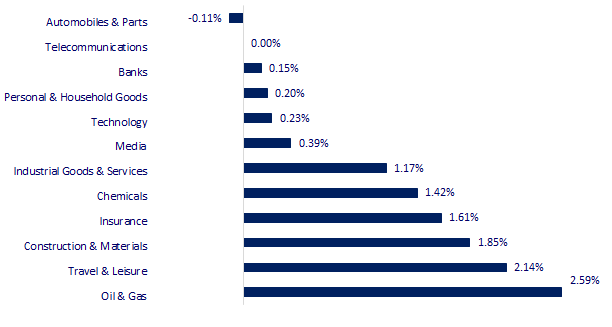

CHANGE IN PRICE BY SECTOR

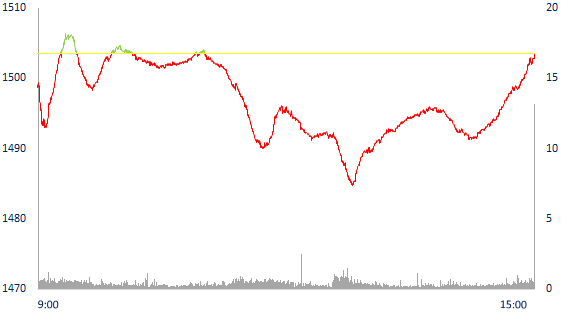

INTRADAY VNINDEX

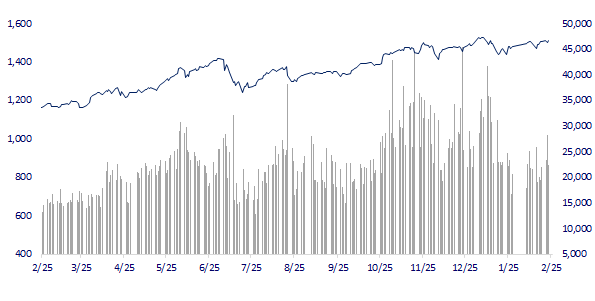

VNINDEX (12M)

GLOBAL MARKET

26,449.61

1D 0.00%

YTD -8.13%

3,489.15

1D 0.93%

YTD -4.14%

2,719.53

1D 0.47%

YTD -8.67%

23,660.28

1D 0.18%

YTD 1.12%

3,393.00

1D -0.22%

YTD 8.62%

1,696.45

1D 0.32%

YTD 2.34%

91.17

1D -0.82%

YTD 19.18%

1,896.50

1D -0.21%

YTD 4.16%

Asian stocks rose, Ukraine situation was the focus. Japanese market holiday. The Chinese market rose with Shanghai Composite up 0.93%, Shenzhen Component up 1.092%. Hong Kong's Hang Seng rose 0.18%. South Korea's Kospi index rose 0.47%

VIETNAM ECONOMY

2.51%

1D (bps) -1

YTD (bps) 170

5.60%

1.30%

1D (bps) 1

YTD (bps) 29

2.18%

1D (bps) 2

YTD (bps) 18

22,966

1D (%) 0.00%

YTD (%) 0.11%

26,651

1D (%) 0.22%

YTD (%) 0.69%

3,685

1D (%) 0.22%

YTD (%) 0.74%

According to preliminary statistics of the General Department of Customs, fertilizer exports in January stood at 226,155 tons, equivalent to 171.7 million USD, up 51.5% in volume, up 70% in turnover compared to December 2021. Cambodia is Vietnam's largest market for this product, accounting for 15.7% of the total volume and 10% of Vietnam's total fertilizer export turnover, reaching 35,552 tons, equivalent to over 17.16 million USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Minister of Industry and Trade: Gasoline is enough to supply until the end of March

- The fertilizer industry had a trade surplus of 18 million USD in January

- Banks are not too worried about restructuring debt

- Britons are facing a cost of living crisis

- EU approves sanctions against Russia

- Gas prices increased by more than 10% after the US - EU imposed sanctions on Russia

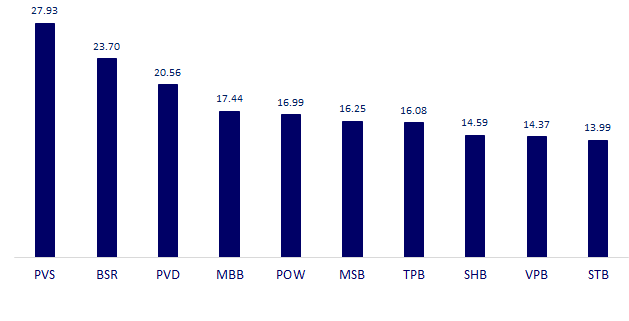

VN30

BANK

86,900

1D 0.12%

5D -0.11%

Buy Vol. 1,807,100

Sell Vol. 1,921,700

45,600

1D -0.87%

5D 1.00%

Buy Vol. 4,762,400

Sell Vol. 6,039,300

34,850

1D 0.72%

5D 0.58%

Buy Vol. 11,182,400

Sell Vol. 13,998,600

51,700

1D 0.58%

5D 0.19%

Buy Vol. 11,281,600

Sell Vol. 13,052,300

35,900

1D 0.98%

5D 0.70%

Buy Vol. 21,736,600

Sell Vol. 26,112,300

34,350

1D -0.15%

5D 5.21%

Buy Vol. 27,213,900

Sell Vol. 43,812,000

29,650

1D 0.34%

5D 1.37%

Buy Vol. 8,320,200

Sell Vol. 9,400,900

42,600

1D 2.65%

5D 5.45%

Buy Vol. 22,934,700

Sell Vol. 24,987,600

33,600

1D -0.30%

5D 0.00%

Buy Vol. 28,901,400

Sell Vol. 27,078,600

34,600

1D -0.29%

5D 1.17%

Buy Vol. 9,127,900

Sell Vol. 14,232,200

ACB: As of December 31, 2021, total assets stood at VND 527,770 billion, an increase of 18.7% compared to 2020. Outstanding loans to customers increased by 16.2% to VND 361,912 billion. Bad debt increased by 50% to 2,799 billion dong. Group 3 debt and group 4 debt increased by 153% and 114% respectively to 537 billion and 882 billion dong. NPL ratio from 0.6% to 0.78% at the end of 2021. Customer deposits increased by 7.6% to VND 379,920 billion. In which, demand deposits were VND 87,534 billion, up 27%, accounting for 23% of the structure. Issuance of valuable papers increased by 39%, to 30,547 billion dong.

REAL ESTATE

77,400

1D -0.90%

5D -0.90%

Buy Vol. 3,967,800

Sell Vol. 3,283,200

54,100

1D 0.37%

5D 0.56%

Buy Vol. 1,664,400

Sell Vol. 1,885,100

90,000

1D 0.22%

5D -0.22%

Buy Vol. 3,427,900

Sell Vol. 3,499,600

NVL: will participate in revitalizing the Kenton Node project in Saigon South after more than a decade of stagnation. Initial information, NVl will play the role of developer at this project.

OIL & GAS

117,000

1D 0.43%

5D 2.18%

Buy Vol. 1,775,300

Sell Vol. 2,600,800

18,150

1D 1.97%

5D -0.27%

Buy Vol. 38,188,600

Sell Vol. 43,355,400

62,500

1D 0.81%

5D 5.93%

Buy Vol. 7,530,600

Sell Vol. 7,698,100

GAS: In January, 2022, thanks to the strong increase in oil price, GAS earned a revenue of 8,481 billion VND, exceeding 29% of the monthly plan and increasing by 42% over the same period.

VINGROUP

82,500

1D 0.61%

5D -0.48%

Buy Vol. 2,836,000

Sell Vol. 3,434,400

79,400

1D 0.13%

5D -0.75%

Buy Vol. 4,602,300

Sell Vol. 6,757,000

34,900

1D 1.16%

5D 1.75%

Buy Vol. 12,048,500

Sell Vol. 13,534,400

VHM: In the period of 2022-2024, VHM begins to develop new centers such as Dream City (460 ha), Wonder Park (133 ha), Co Loa (385 ha), Ha Long Xanh (4,110 ha), Long Beach Can Gio (2,870 ha)

FOOD & BEVERAGE

80,000

1D 0.00%

5D -0.50%

Buy Vol. 3,443,500

Sell Vol. 3,877,100

157,200

1D -0.19%

5D -0.57%

Buy Vol. 793,700

Sell Vol. 764,200

169,800

1D 0.83%

5D 0.83%

Buy Vol. 214,200

Sell Vol. 326,700

MSN: reached VND 88,629 billion in revenue in 2021. Profit after tax increased by 5934% to VND 8,563 billion, a record level in history - 243% higher than the whole year 2021 plan.

OTHERS

148,200

1D 3.78%

5D 6.47%

Buy Vol. 1,894,700

Sell Vol. 1,428,900

148,200

1D 3.78%

5D 6.47%

Buy Vol. 1,894,700

Sell Vol. 1,428,900

93,000

1D 0.11%

5D 1.86%

Buy Vol. 1,618,900

Sell Vol. 2,409,600

137,800

1D 0.07%

5D 3.69%

Buy Vol. 2,502,000

Sell Vol. 4,549,600

109,600

1D -0.36%

5D 3.10%

Buy Vol. 2,484,400

Sell Vol. 2,351,100

34,250

1D 0.00%

5D 1.48%

Buy Vol. 3,809,700

Sell Vol. 4,895,400

45,300

1D 0.67%

5D 0.89%

Buy Vol. 9,489,100

Sell Vol. 12,159,000

46,700

1D 0.65%

5D 1.52%

Buy Vol. 22,203,000

Sell Vol. 26,362,600

- HPG: announced the Resolution of BoD to increase capital contribution to Hoa Phat Real Estate Development Joint Stock Company. Specifically, Hoa Phat will contribute VND 3,300 billion to the real estate company to increase its capital from VND 2,700 billion to VND 6,000 billion, the ownership rate is 99.93% to 99.97%.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

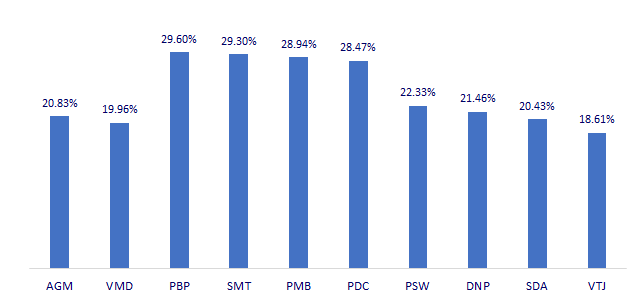

TOP INCREASES 3 CONSECUTIVE SESSIONS

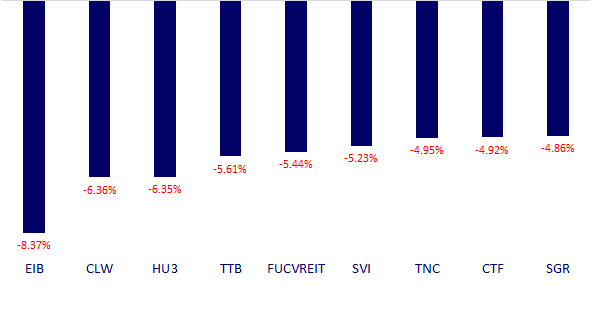

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.