Market brief 28/02/2022

VIETNAM STOCK MARKET

1,490.13

1D -0.58%

YTD -0.54%

1,517.18

1D -0.61%

YTD -1.21%

440.42

1D 0.06%

YTD -7.08%

112.20

1D -0.41%

YTD -0.43%

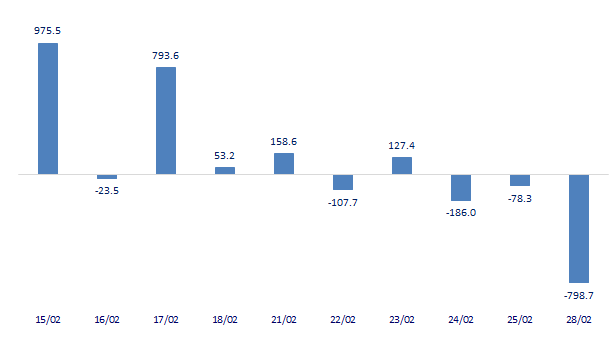

-798.72

1D 0.00%

YTD 0.00%

28,024.81

1D -8.69%

YTD -9.81%

Foreign investors boosted their net selling of nearly 800 billion dong on February 28. HPG was strongly sold by foreign investors with a value of more than 352 billion dong. After that, CTG and VIC were net sold at 122 billion dong and 106 billion dong respectively. On the other hand, FUEVFVND fund certificates were bought the most with the value of 142 billion dong. NLG was behind and was net bought 58 billion dong.

ETF & DERIVATIVES

25,800

1D 1.18%

YTD -0.12%

17,900

1D -0.28%

YTD -1.05%

19,200

1D 7.80%

YTD 1.05%

22,320

1D -1.67%

YTD -2.53%

22,700

1D -1.60%

YTD 0.98%

29,500

1D 0.00%

YTD 5.17%

20,000

1D -0.30%

YTD -6.89%

1,505

1D -0.44%

YTD 0.00%

1,505

1D -0.11%

YTD 0.00%

1,511

1D -0.38%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

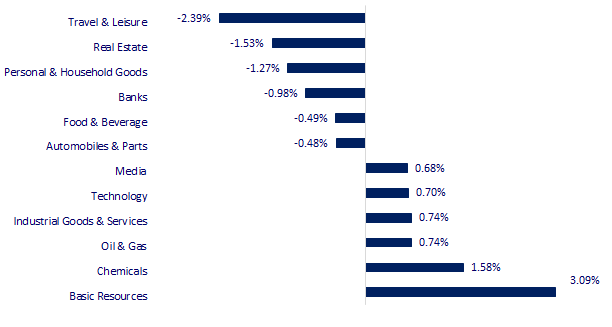

CHANGE IN PRICE BY SECTOR

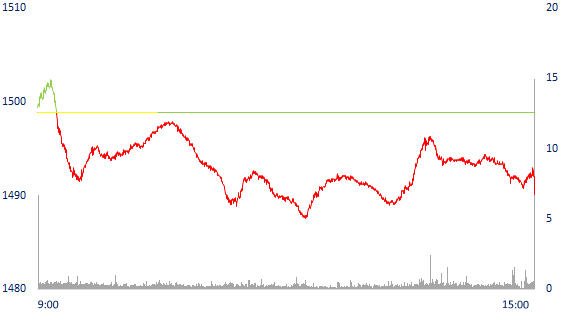

INTRADAY VNINDEX

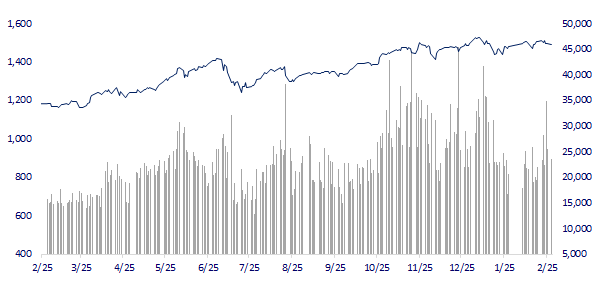

VNINDEX (12M)

GLOBAL MARKET

26,526.82

1D 0.12%

YTD -7.87%

3,462.31

1D 0.32%

YTD -4.88%

2,699.18

1D 0.84%

YTD -9.35%

22,713.02

1D 0.52%

YTD -2.93%

3,242.24

1D -1.59%

YTD 3.80%

1,685.18

1D 0.31%

YTD 1.66%

96.17

1D -0.36%

YTD 25.71%

1,906.30

1D -0.49%

YTD 4.70%

Asian stocks mostly rose, oil futures prices 'jumped' more than 4%. In Japan, the Nikkei 225 gained 0.12%. The Chinese market went up with Shanghai Composite up 0.32%, Shenzhen Component up 0.32%. Hong Kong's Hang Seng rose 0.52%. Korea's Kospi index reversed to the green, up 0.84%, Kosdaq gained 0.93%.

VIETNAM ECONOMY

2.55%

1D (bps) -1

YTD (bps) 174

5.60%

1.49%

1D (bps) 6

YTD (bps) 48

2.15%

1D (bps) 4

YTD (bps) 15

23,025

1D (%) 0.26%

YTD (%) 0.37%

25,961

1D (%) -0.99%

YTD (%) -1.92%

3,686

1D (%) 0.08%

YTD (%) 0.77%

The February socio-economic situation report of the General Statistics Office said that the consumer price index (CPI) in February increased by 1% compared to the previous month, by 1.42% over the same period last year and up 1.2% compared to December 2021. The main reason is the increase in gasoline prices in line with world fuel prices; Prices of food, groceries, out-of-home dining and public transport service prices increase during the Lunar New Year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- CPI in February increased by 1.42% due to increase in petrol and food prices

- Further reduction of solar power capacity in Power Planning VIII

- Industrial production in the first 2 months of the year increased by 5.4% over the same period in 2021

- Russia raises interest rates from 9.5% to 20% to save the ruble

- The US, Canada and Europe have the strongest sanctions - A series of Russian banks are excluded from SWIFT

- The US announced additional military aid worth $350 million to Ukraine

VN30

BANK

84,500

1D -0.71%

5D -3.32%

Buy Vol. 2,093,700

Sell Vol. 2,067,800

43,700

1D -1.91%

5D -3.43%

Buy Vol. 4,574,700

Sell Vol. 4,256,200

33,150

1D -2.07%

5D -3.63%

Buy Vol. 20,683,800

Sell Vol. 21,280,200

50,400

1D -0.59%

5D -2.14%

Buy Vol. 12,504,100

Sell Vol. 12,313,300

38,000

1D -0.52%

5D 5.85%

Buy Vol. 31,506,400

Sell Vol. 41,847,900

34,400

1D 0.88%

5D 5.36%

Buy Vol. 22,109,000

Sell Vol. 25,677,600

28,800

1D -1.54%

5D -2.70%

Buy Vol. 12,155,600

Sell Vol. 8,514,800

42,250

1D 0.72%

5D 3.30%

Buy Vol. 8,964,200

Sell Vol. 13,189,900

32,850

1D -0.45%

5D -1.05%

Buy Vol. 25,563,900

Sell Vol. 28,208,600

33,900

1D -1.31%

5D -1.45%

Buy Vol. 6,246,200

Sell Vol. 7,003,400

HDB: HDBank cooperates with Thought Machine (Singapore) to implement the world's leading latest generation core banking solution to replace the current core banking solution and build a new standard for modern core banking technology in future.

REAL ESTATE

75,300

1D -1.31%

5D -4.08%

Buy Vol. 3,992,300

Sell Vol. 3,999,800

52,900

1D -0.75%

5D -2.40%

Buy Vol. 1,182,700

Sell Vol. 1,314,900

85,000

1D -2.86%

5D -6.80%

Buy Vol. 3,061,700

Sell Vol. 3,504,100

Real estate business ranked second in the list of industries attracting FDI in the 2 months 2021 with nearly 1.52 billion USD, accounting for 30.4% of total registered investment capital.

OIL & GAS

118,000

1D 0.68%

5D 1.90%

Buy Vol. 1,632,600

Sell Vol. 1,900,000

17,350

1D -2.80%

5D -5.71%

Buy Vol. 52,103,000

Sell Vol. 49,376,900

62,300

1D -0.16%

5D 4.01%

Buy Vol. 3,890,700

Sell Vol. 5,085,200

The price of US WTI crude oil increased by 5.71% to 96.82 USD/barrel at 7:20 am (GMT) on February 28. Brent crude oil price for February delivery also increased by 5.16% to 102.98 USD/barrel.

VINGROUP

77,000

1D -2.65%

5D -7.89%

Buy Vol. 8,081,600

Sell Vol. 7,767,000

77,500

1D -1.02%

5D -3.13%

Buy Vol. 5,173,200

Sell Vol. 5,705,200

33,500

1D -1.47%

5D -1.76%

Buy Vol. 8,257,100

Sell Vol. 9,668,100

VHM: Vinhomes contributed more than 2,800b VND to establish 2 subsidiaries, Vinpearl Landmark 81 and Vincom Retail Landmark 81 with Vinhomes' capital contribution of 99.88% and 99.84%.

FOOD & BEVERAGE

78,400

1D -0.63%

5D -3.21%

Buy Vol. 3,702,500

Sell Vol. 4,113,200

156,000

1D -1.27%

5D -2.68%

Buy Vol. 570,800

Sell Vol. 802,000

169,800

1D 0.12%

5D 0.12%

Buy Vol. 96,700

Sell Vol. 188,100

VNM: In the early days of 2022, VNM has promoted trade at many major international fairs such as Gulfood Dubai, Foodex Japan, and created highlights with many new and outstanding products.

OTHERS

140,100

1D -3.45%

5D -4.04%

Buy Vol. 1,223,000

Sell Vol. 1,258,600

140,100

1D -3.45%

5D -4.04%

Buy Vol. 1,223,000

Sell Vol. 1,258,600

93,300

1D 1.08%

5D -0.21%

Buy Vol. 2,046,200

Sell Vol. 2,971,100

136,000

1D -1.16%

5D 1.57%

Buy Vol. 2,598,300

Sell Vol. 2,873,400

103,000

1D -4.45%

5D -3.29%

Buy Vol. 3,094,200

Sell Vol. 3,584,200

34,150

1D 0.44%

5D -1.30%

Buy Vol. 3,700,800

Sell Vol. 3,423,300

45,700

1D 0.00%

5D -0.65%

Buy Vol. 12,304,600

Sell Vol. 16,475,300

47,200

1D 2.83%

5D 1.18%

Buy Vol. 52,642,100

Sell Vol. 63,115,500

PNJ: announced the resolution of the Board of Directors to implement the plan to issue up to 15 million private shares, the rate of 6.6%. Charter capital is expected to increase from 2,276 billion VND to 2,426 billion VND. Privately issued shares are restricted to transfer for 3 years for strategic investors and 1 year for professional securities investors. With the asking price of 95,000 VND/share, PNJ is expected to collect 1,425 billion VND.

Market by numbers

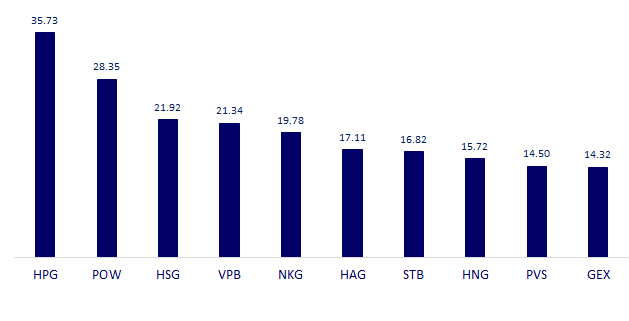

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

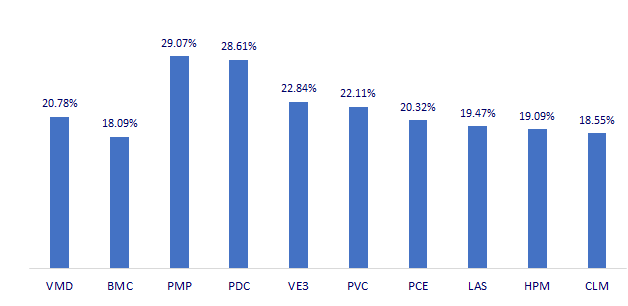

TOP INCREASES 3 CONSECUTIVE SESSIONS

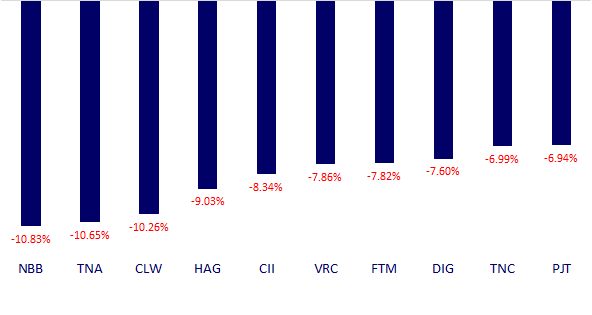

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.