Market brief 02/03/2022

VIETNAM STOCK MARKET

1,485.52

1D -0.88%

YTD -0.85%

1,498.61

1D -1.42%

YTD -2.42%

442.25

1D -0.30%

YTD -6.70%

111.80

1D -0.52%

YTD -0.78%

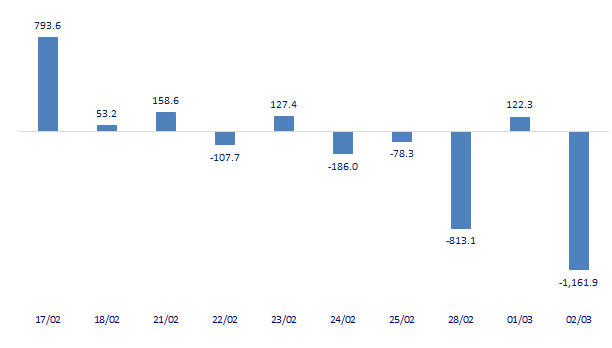

-1,161.87

1D 0.00%

YTD 0.00%

35,657.80

1D 13.48%

YTD 14.76%

Foreign investors had the strongest net selling session since the beginning of the year with a value of nearly 1,162 billion dong. Bank shares HDB and steel industry HPG today were the two stocks under the strongest net selling pressure of foreign investors net selling with value of 154 and 131 billion dong. Following the list of net sellers are CTG (105 billion dong), KBC (77 billion dong), VIC (67 billion dong).

ETF & DERIVATIVES

25,400

1D -0.78%

YTD -1.66%

17,660

1D -1.12%

YTD -2.38%

18,800

1D 5.56%

YTD -1.05%

22,000

1D -1.35%

YTD -3.93%

22,770

1D -0.35%

YTD 1.29%

28,100

1D -2.43%

YTD 0.18%

19,810

1D -1.25%

YTD -7.77%

1,497

1D -0.38%

YTD 0.00%

1,496

1D -0.71%

YTD 0.00%

1,502

1D -0.90%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

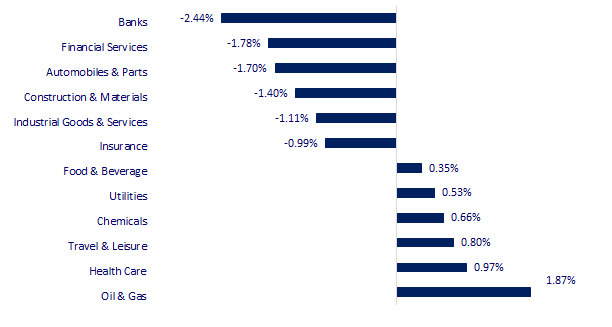

CHANGE IN PRICE BY SECTOR

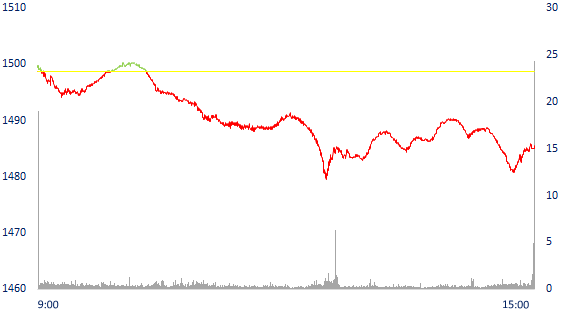

INTRADAY VNINDEX

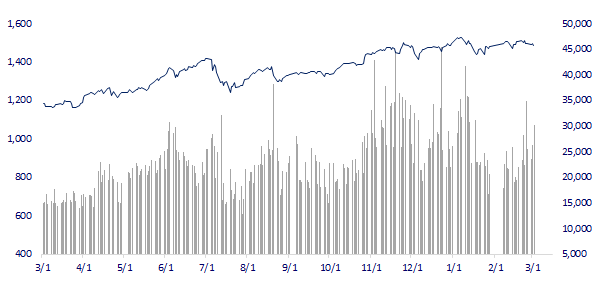

VNINDEX (12M)

GLOBAL MARKET

26,393.03

1D -0.27%

YTD -8.33%

3,484.19

1D -0.13%

YTD -4.27%

2,703.52

1D 0.16%

YTD -9.21%

22,343.92

1D -1.20%

YTD -4.50%

3,244.40

1D -1.04%

YTD 3.86%

1,689.81

1D -0.26%

YTD 1.94%

107.93

1D 0.24%

YTD 41.08%

1,926.80

1D -0.60%

YTD 5.82%

Russia-Ukraine conflict continues, Asian stocks mixed. In Japan, the Nikkei 225 fell 0.27%. The Chinese market fell with Shanghai Composite down 0.13%, Shenzhen Component down 1.05%. Hong Kong's Hang Seng fell 1.2%. South Korea's Kospi index rose 0.16%.

VIETNAM ECONOMY

2.54%

1D (bps) -2

YTD (bps) 173

5.60%

1.57%

YTD (bps) 56

2.23%

1D (bps) 1

YTD (bps) 23

23,060

1D (%) 0.46%

YTD (%) 0.52%

25,778

1D (%) -1.29%

YTD (%) -2.61%

3,687

1D (%) 0.08%

YTD (%) 0.79%

According to the socio-economic report just released by the General Statistics Office, the total retail sales of consumer goods and services in February stood at VND 421,800 billion, down 7.1% from the previous month but up 3. 1% over the same period last year. In the first 2 months of the year, the total retail sales of consumer goods and services was more than VND 876,000 billion, up 1.7% over the same period last year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- SBV net withdrew more than 14,000 billion dong last week

- Vietnam is the most important destination for German and EU investors

- Retail sales of consumer goods and services in February decreased by 7.1%

- IEA member states agree to release 60 million barrels of oil

- Russia's largest banks were blown away by nearly 80% of their capitalization

- World Bank and IMF pledge financial support to Ukraine

VN30

BANK

85,000

1D 0.00%

5D -2.19%

Buy Vol. 2,551,700

Sell Vol. 2,508,900

42,450

1D -3.74%

5D -6.91%

Buy Vol. 4,947,700

Sell Vol. 5,028,300

32,000

1D -3.90%

5D -8.18%

Buy Vol. 29,019,500

Sell Vol. 31,191,200

49,200

1D -2.19%

5D -4.84%

Buy Vol. 26,399,800

Sell Vol. 25,160,900

36,500

1D -3.31%

5D 1.67%

Buy Vol. 39,533,600

Sell Vol. 42,952,200

32,500

1D -4.41%

5D -5.39%

Buy Vol. 79,137,000

Sell Vol. 77,355,200

27,350

1D -4.20%

5D -7.76%

Buy Vol. 18,748,200

Sell Vol. 20,923,100

41,450

1D -3.15%

5D -2.70%

Buy Vol. 12,411,000

Sell Vol. 17,069,000

31,250

1D -4.29%

5D -6.99%

Buy Vol. 68,803,200

Sell Vol. 69,034,000

32,900

1D -2.81%

5D -4.91%

Buy Vol. 18,829,400

Sell Vol. 19,563,800

BID: BIDV's bad debt ratio by the end of 2021 has reached the lowest level in 10 years, at 0.98%. Previously, during the period 2012 - 2020, the bad debt ratio on the balance sheet of this bank fluctuated between 1.61% - 2.92%; if including bad debt not yet provisioned at VAMC, the range is 1.76% - 5%. Notably, the bad debt coverage ratio jumped to 219%, putting BIDV in the top 3 banks with the highest consolidated bad debt coverage ratio in the system.

REAL ESTATE

76,400

1D 1.33%

5D -1.29%

Buy Vol. 5,841,700

Sell Vol. 6,184,400

53,700

1D -0.74%

5D -0.74%

Buy Vol. 1,890,200

Sell Vol. 2,357,800

87,200

1D 3.20%

5D -3.11%

Buy Vol. 6,499,700

Sell Vol. 6,005,900

KDH: offering a maximum of 2,000 billion dong of bonds to the public. This is a non-convertible, warrantless and unsecured type. The bond has a term of 36 months.

OIL & GAS

119,200

1D 1.27%

5D 1.88%

Buy Vol. 2,085,600

Sell Vol. 3,200,400

17,450

1D 0.00%

5D -3.86%

Buy Vol. 29,857,600

Sell Vol. 33,586,000

61,500

1D 0.33%

5D -1.60%

Buy Vol. 8,641,200

Sell Vol. 11,858,000

PLX: As of 3pm on March 1, the Petrolimex Petroleum Price Stabilization Fund continued to be negative 158 billion VND compared to the previous price adjustment (February 21).

VINGROUP

78,900

1D -0.38%

5D -4.36%

Buy Vol. 4,130,000

Sell Vol. 4,675,200

77,500

1D -0.64%

5D -2.39%

Buy Vol. 5,547,300

Sell Vol. 6,854,800

32,800

1D -2.09%

5D -6.02%

Buy Vol. 12,401,100

Sell Vol. 11,473,900

VIC: VinFast has just signed an agreement with LeasePlan (a Dutch company) to provide car rental services, aiming to expand the market in Europe.

FOOD & BEVERAGE

78,500

1D -0.88%

5D -1.88%

Buy Vol. 3,089,300

Sell Vol. 3,680,300

157,000

1D 0.32%

5D -0.13%

Buy Vol. 1,113,300

Sell Vol. 1,371,500

169,000

1D 1.50%

5D 0.42%

Buy Vol. 121,000

Sell Vol. 145,600

MSN: MEATLife grew strongly in revenue and quickly contributed to 20% of the total number of Masan, while in 2020 it only accounts for about 3%.

OTHERS

145,000

1D 2.91%

5D -2.16%

Buy Vol. 1,429,200

Sell Vol. 1,396,500

145,000

1D 2.91%

5D -2.16%

Buy Vol. 1,429,200

Sell Vol. 1,396,500

93,100

1D -0.32%

5D 0.11%

Buy Vol. 1,629,000

Sell Vol. 2,092,700

134,500

1D -1.10%

5D -2.39%

Buy Vol. 2,460,600

Sell Vol. 2,492,900

103,400

1D -1.52%

5D -5.66%

Buy Vol. 1,874,200

Sell Vol. 2,338,500

35,400

1D -0.84%

5D 3.36%

Buy Vol. 4,870,400

Sell Vol. 6,684,000

44,800

1D -2.61%

5D -1.10%

Buy Vol. 21,662,400

Sell Vol. 22,317,000

46,900

1D 0.00%

5D 0.43%

Buy Vol. 32,493,700

Sell Vol. 41,909,400

HPG: sales volume of construction steel in February reached 450,000 tons, 2.3 times higher than the same period in 2021 and up 17% compared to January 2022. In which, the export of construction steel reached 60,000 tons, nearly 2 times higher than the same period last year. The enterprise said it had received orders to export construction steel until May with 720,000 tons.

Market by numbers

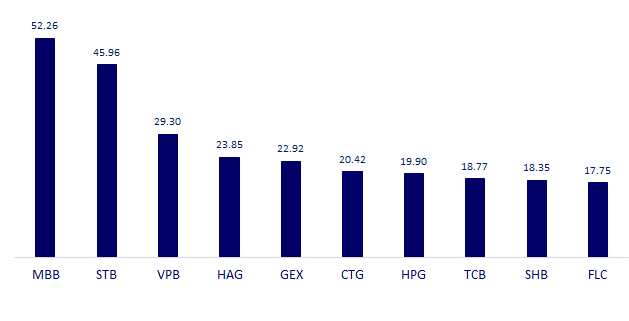

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

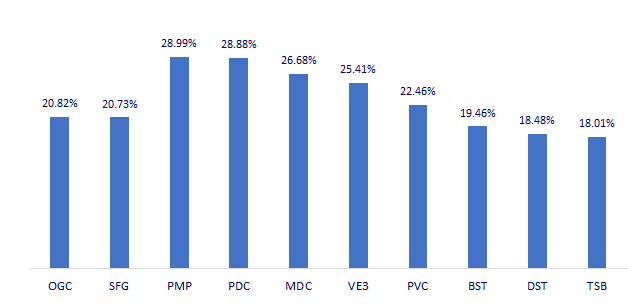

TOP INCREASES 3 CONSECUTIVE SESSIONS

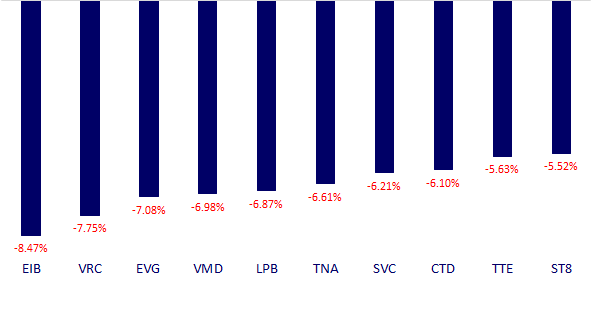

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.