Market brief 03/03/2022

VIETNAM STOCK MARKET

1,505.00

1D 1.31%

YTD 0.45%

1,522.49

1D 1.59%

YTD -0.86%

449.31

1D 1.60%

YTD -5.21%

113.19

1D 1.24%

YTD 0.45%

571.60

1D 0.00%

YTD 0.00%

36,156.88

1D 1.40%

YTD 16.37%

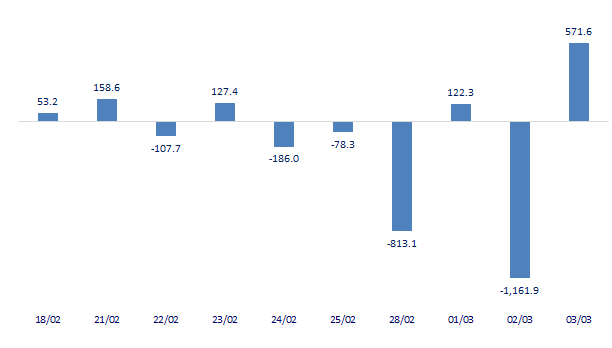

Session 3/3: Foreign investors returned to buy a net of 571 billion dong, focusing on "collecting" fertilizers and chemicals. DGC and DCM were net bought by foreign investors today, 87 billion dong and 67 billion dong, respectively. Besides, the net buying list also includes HPG (64 billion dong), STB (63 billion dong), KBC (55 billion dong).

ETF & DERIVATIVES

25,680

1D 1.10%

YTD -0.58%

17,910

1D 1.42%

YTD -1.00%

18,800

1D 5.56%

YTD -1.05%

22,400

1D 1.82%

YTD -2.18%

22,690

1D -0.35%

YTD 0.93%

28,790

1D 2.46%

YTD 2.64%

21,180

1D 6.92%

YTD -1.40%

1,510

1D 0.90%

YTD 0.00%

1,508

1D 0.83%

YTD 0.00%

1,518

1D 1.03%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

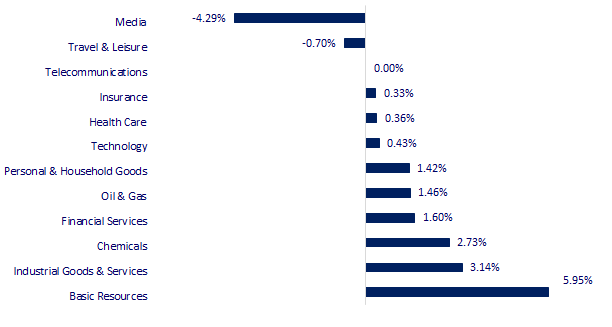

CHANGE IN PRICE BY SECTOR

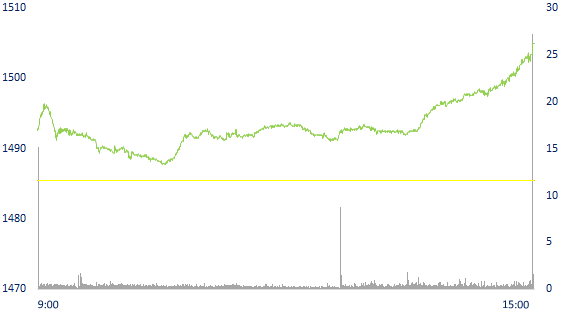

INTRADAY VNINDEX

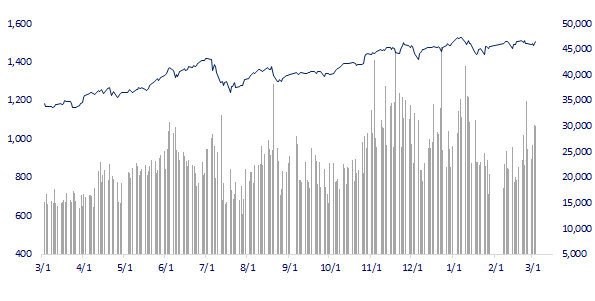

VNINDEX (12M)

GLOBAL MARKET

26,577.27

1D -0.12%

YTD -7.69%

3,481.11

1D -0.09%

YTD -4.36%

2,747.08

1D 1.61%

YTD -7.74%

22,467.34

1D 0.04%

YTD -3.98%

3,253.65

1D 0.29%

YTD 4.16%

1,696.08

1D 0.37%

YTD 2.32%

113.12

1D -0.26%

YTD 47.87%

1,934.55

1D 0.15%

YTD 6.25%

Asian stocks were mostly mixed, oil price exceeded 117 USD/barrel. In Japan, the Nikkei 225 fell 0.12%. The Chinese market with the Shanghai Composite fell 0.09%. Hong Kong's Hang Seng rose 0.04%. China's Caixin/Markit Services Purchasing Managers' Index (PMI) was 50.2 in February, down from 51.4 in January, indicating a slowdown in growth in the sector. PMI above 50 reflects expansion and vice versa.

VIETNAM ECONOMY

2.54%

YTD (bps) 173

5.60%

1.65%

1D (bps) 8

YTD (bps) 64

2.25%

1D (bps) 2

YTD (bps) 25

22,977

1D (%) -0.01%

YTD (%) 0.16%

26,032

1D (%) -0.16%

YTD (%) -1.65%

3,683

1D (%) 0.00%

YTD (%) 0.68%

According to information at the regular Government meeting in February, held on the morning of March 3, credit grew by 1.82% compared to the end of 2021. This figure is lower than the 2.74% rate at the end of January once reported. The State Bank of Vietnam (SBV) announced, however, it is still higher than the same period in 2021. In the first two months of 2021, credit increased by only 0.66%..

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- For the first time, Vietnam holds over 10% of the global shoe export market share

- Credit decreased in February

- SBV requires banks to urgently report the situation of transactions to the Russian market

- Fed Chairman Jerome Powell: Will continue to raise interest rates in March

- German unemployment rate drops to pre-COVID-19 levels

- The US House of Representatives passes resolution in favor of Ukraine

VN30

BANK

85,500

1D 0.59%

5D 0.23%

Buy Vol. 1,587,500

Sell Vol. 1,682,400

42,800

1D 0.82%

5D -4.04%

Buy Vol. 3,831,400

Sell Vol. 4,114,600

32,600

1D 1.88%

5D -3.69%

Buy Vol. 13,692,000

Sell Vol. 12,514,400

49,650

1D 0.91%

5D -1.68%

Buy Vol. 14,596,200

Sell Vol. 11,426,800

37,450

1D 2.60%

5D 1.49%

Buy Vol. 29,102,100

Sell Vol. 30,962,300

33,100

1D 1.85%

5D -2.65%

Buy Vol. 50,576,300

Sell Vol. 46,464,600

28,250

1D 3.29%

5D -1.91%

Buy Vol. 9,982,700

Sell Vol. 7,009,400

41,500

1D 0.12%

5D 0.61%

Buy Vol. 7,051,100

Sell Vol. 9,621,600

31,850

1D 1.92%

5D -3.19%

Buy Vol. 34,349,500

Sell Vol. 31,027,800

33,450

1D 1.67%

5D -2.90%

Buy Vol. 12,467,400

Sell Vol. 11,853,500

STB: Recently, STB has been approved by the State Bank of Vietnam (SBV) to add the content of "Business and supply of interest rate derivative products in the domestic market" to its License for establishment and operation. This tool will assist customers in hedging against adverse fluctuations in interest rates and exchange rates for lending activities, especially medium and long-term loans. Besides, interest rate swap is also a solution to help customers reduce capital mobilization costs when converting from a high interest rate currency to a lower interest rate currency.

REAL ESTATE

78,000

1D 2.09%

5D 2.63%

Buy Vol. 4,602,800

Sell Vol. 4,083,400

54,600

1D 1.68%

5D 3.41%

Buy Vol. 1,912,600

Sell Vol. 1,920,000

88,000

1D 0.92%

5D -0.68%

Buy Vol. 5,983,400

Sell Vol. 5,853,900

PDR: After-audited financial statements, pre-tax profit increased by 52.2% yoy, reaching over VND 2,344 billion. EPS in 2021 will reach 3,656 VND/share, up 49.6%.

OIL & GAS

120,700

1D 1.26%

5D 1.43%

Buy Vol. 2,370,600

Sell Vol. 3,325,400

17,200

1D -1.43%

5D -3.10%

Buy Vol. 36,134,700

Sell Vol. 39,110,700

62,800

1D 2.11%

5D -0.95%

Buy Vol. 5,184,400

Sell Vol. 6,116,000

The price of gas in the UK on March 2 was 405 cents/therm, up 39.7% compared to March 1. Gas price on the Dutch TTF on March 2 at 173.1 euros/mwh, 42.3% increase from the previous day.

VINGROUP

79,000

1D 0.13%

5D -1.37%

Buy Vol. 4,616,700

Sell Vol. 5,494,700

78,000

1D 0.65%

5D -0.76%

Buy Vol. 6,582,200

Sell Vol. 7,583,600

32,700

1D -0.30%

5D -3.82%

Buy Vol. 10,250,900

Sell Vol. 10,370,700

VIC: At the beginning of the year, VIC was the largest enterprise on the Vietnamese stock exchange. However, at the moment, VIC has dropped to third place, behind Vietcombank and Vinhomes.

FOOD & BEVERAGE

78,400

1D -0.13%

5D -0.25%

Buy Vol. 2,872,900

Sell Vol. 3,087,500

159,100

1D 1.34%

5D -0.25%

Buy Vol. 1,144,400

Sell Vol. 1,312,300

167,100

1D -1.12%

5D -0.65%

Buy Vol. 40,700

Sell Vol. 117,500

VNM: In 2021, total consolidated revenue exceeded VND 60,000b for the first time, reaching VND 61,012b, up 2.2% over the same period and completing 98.2% of the year plan.

OTHERS

143,400

1D -1.10%

5D -3.11%

Buy Vol. 736,400

Sell Vol. 1,289,200

143,400

1D -1.10%

5D -3.11%

Buy Vol. 736,400

Sell Vol. 1,289,200

93,400

1D 0.32%

5D 1.52%

Buy Vol. 1,519,400

Sell Vol. 2,585,800

136,500

1D 1.49%

5D -0.22%

Buy Vol. 1,727,000

Sell Vol. 1,888,800

104,000

1D 0.58%

5D -4.59%

Buy Vol. 1,608,700

Sell Vol. 1,748,300

36,300

1D 2.54%

5D 7.72%

Buy Vol. 4,507,700

Sell Vol. 5,061,500

45,500

1D 1.56%

5D 2.02%

Buy Vol. 15,381,300

Sell Vol. 16,928,300

50,100

1D 6.82%

5D 8.91%

Buy Vol. 125,709,800

Sell Vol. 109,587,900

HPG: Chairman of the BOD of Hoa Phat Group shared that the group will not only be the "king of steel" but also want to do real estate. The real estate segment that the group targets are industrial parks, mega-urban areas, and golf courses. Core products are megacities with an area of 300-500 hectares, high-class real estate aimed at people with middle and high incomes. In 2021, the group has surveyed, researched and proposed many projects in Can Tho, Khanh Hoa, and Quang Ngai.

Market by numbers

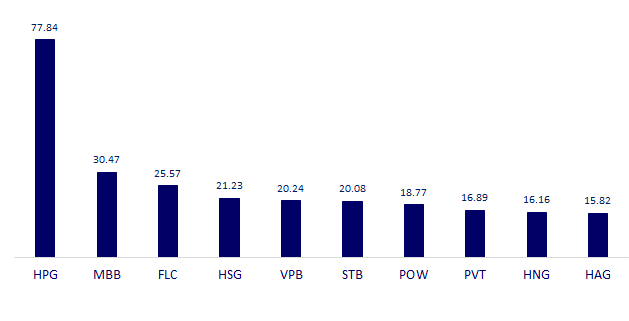

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

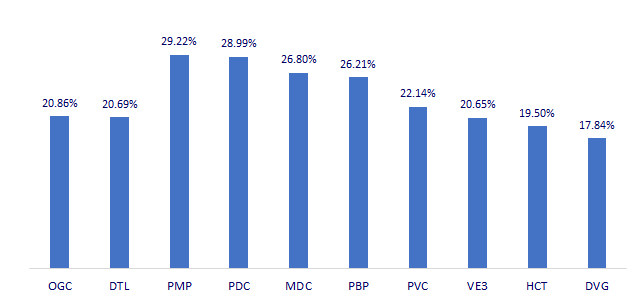

TOP INCREASES 3 CONSECUTIVE SESSIONS

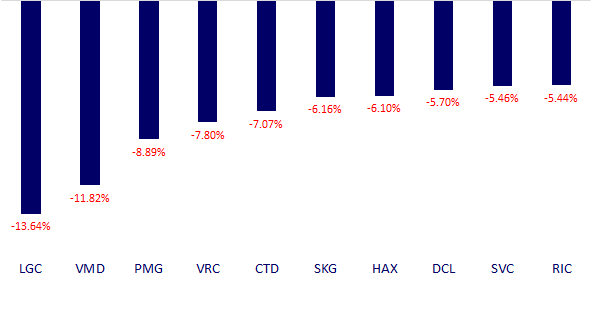

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.