Market brief 04/03/2022

VIETNAM STOCK MARKET

1,505.33

1D 0.02%

YTD 0.47%

1,525.34

1D 0.19%

YTD -0.68%

450.59

1D 0.28%

YTD -4.94%

113.29

1D 0.09%

YTD 0.54%

473.40

1D 0.00%

YTD 0.00%

35,589.19

1D -1.57%

YTD 14.54%

Data from the Vietnam Securities Depository (VSD) showed that in February, domestic investors opened 210,883 new securities accounts, an increase of more than 16,000 accounts compared to the previous month. In which, individual investors opened 210,765 new accounts and 118 accounts came from institutional investors.

ETF & DERIVATIVES

25,700

1D 0.08%

YTD -0.50%

17,910

1D 0.00%

YTD -1.00%

18,700

1D 5.00%

YTD -1.58%

22,500

1D 0.45%

YTD -1.75%

22,590

1D -0.44%

YTD 0.49%

28,600

1D -0.66%

YTD 1.96%

20,520

1D -3.12%

YTD -4.47%

1,508

1D -0.11%

YTD 0.00%

1,509

1D 0.05%

YTD 0.00%

1,513

1D -0.30%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

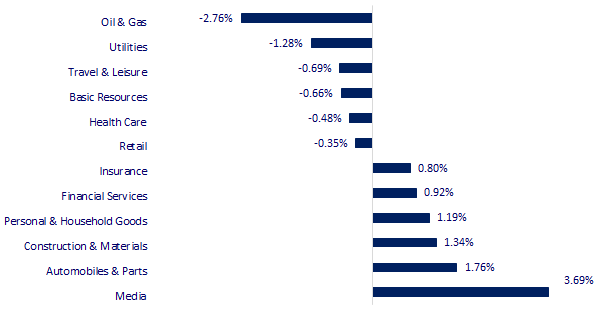

CHANGE IN PRICE BY SECTOR

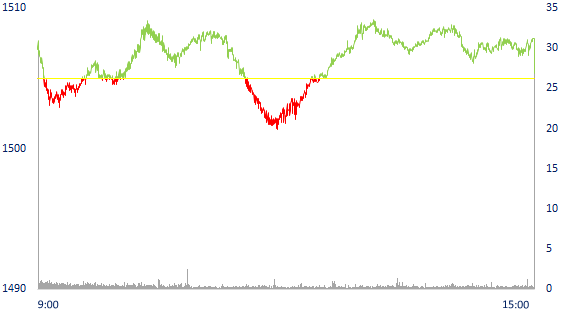

INTRADAY VNINDEX

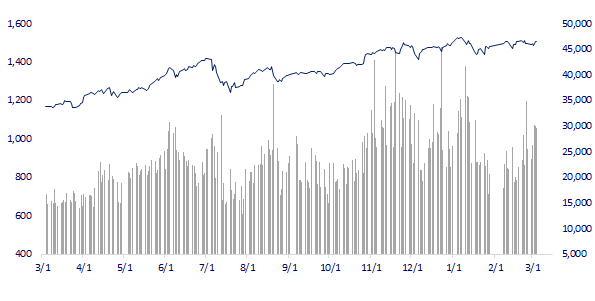

VNINDEX (12M)

GLOBAL MARKET

25,985.47

1D -0.14%

YTD -9.75%

3,447.65

1D -0.96%

YTD -5.28%

2,713.43

1D -1.22%

YTD -8.87%

21,905.29

1D -0.19%

YTD -6.38%

3,226.78

1D -0.83%

YTD 3.30%

1,671.72

1D -1.44%

YTD 0.85%

110.24

1D 0.25%

YTD 44.10%

1,950.80

1D 0.89%

YTD 7.14%

Asian stocks fell, South Korea was the worst in the region. In Japan, the Nikkei 225 fell 0.14%. The Chinese market fell with the Shanghai Composite down 0.96%. Hong Kong's Hang Seng fell 0.19%. South Korea's Kospi index fell 1.22%.

VIETNAM ECONOMY

2.51%

1D (bps) -3

YTD (bps) 170

5.60%

1.70%

1D (bps) 5

YTD (bps) 69

2.29%

1D (bps) 4

YTD (bps) 29

23,050

1D (%) 0.30%

YTD (%) 0.48%

25,556

1D (%) -1.33%

YTD (%) -3.45%

3,685

1D (%) 0.03%

YTD (%) 0.74%

Yesterday, March 3, the State Treasury is expected to announce the need to buy foreign currency 01/DTNT-2022. Accordingly, the State Treasury has the need to buy 150 million USD from commercial banks in the form of spot. The transaction execution date is March 1 and the expected payment date is March 3. With 150 million USD, it is estimated that about 3,400 billion VND will be pumped to the market through this channel.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In 2 months, Vietnam has a trade deficit of 12.5 billion USD from China, a strong trade surplus to the US and EU

- State Treasury offers to buy 150 million USD from commercial banks

- The Ministry of Industry and Trade commits to have enough gasoline until the end of March

- Banks of Japan, the US, Europe and the scenario of loss of up to 150 billion USD in the Russian market

- Germany opposes ban on energy imports from Russia

- JPMorgan: Russian economy may shrink 35% in Q2

VN30

BANK

84,900

1D -0.70%

5D -0.24%

Buy Vol. 1,654,200

Sell Vol. 1,649,700

43,300

1D 1.17%

5D -2.81%

Buy Vol. 3,863,500

Sell Vol. 2,859,300

32,750

1D 0.46%

5D -3.25%

Buy Vol. 11,537,300

Sell Vol. 11,031,500

49,950

1D 0.60%

5D -1.48%

Buy Vol. 11,093,500

Sell Vol. 11,667,100

38,100

1D 1.74%

5D -0.26%

Buy Vol. 74,898,100

Sell Vol. 96,436,400

32,900

1D -0.60%

5D -3.52%

Buy Vol. 19,587,700

Sell Vol. 21,715,000

28,000

1D -0.88%

5D -4.27%

Buy Vol. 6,461,100

Sell Vol. 7,099,200

40,750

1D -1.81%

5D -2.86%

Buy Vol. 7,912,700

Sell Vol. 8,354,800

32,000

1D 0.47%

5D -3.03%

Buy Vol. 22,593,500

Sell Vol. 23,788,900

34,300

1D 2.54%

5D -0.15%

Buy Vol. 11,543,700

Sell Vol. 9,571,900

VPB: has just issued a document on adjusting the foreign ownership ratio at the bank to 17.5% of charter capital. Previously, VPBank had consulted shareholders on adjusting the foreign room at VPBank from 15% to 17.5%/charter capital (which is a rate enough for VPBank to issue more shares to foreign strategic shareholders). up to 15%/charter capital after issuance).

REAL ESTATE

77,000

1D -1.28%

5D 0.92%

Buy Vol. 4,564,000

Sell Vol. 5,826,800

54,600

1D 0.00%

5D 2.44%

Buy Vol. 2,516,400

Sell Vol. 2,701,900

90,500

1D 2.84%

5D 3.43%

Buy Vol. 5,440,700

Sell Vol. 4,975,200

PDR: Is orienting to develop service-urban industrial clusters with a scale of 1,000-6,000ha in localities that have development infrastructure and advantages for industrial park development.

OIL & GAS

118,000

1D -2.24%

5D 0.68%

Buy Vol. 2,161,300

Sell Vol. 2,506,800

17,300

1D 0.58%

5D -3.08%

Buy Vol. 35,029,800

Sell Vol. 38,355,100

61,100

1D -2.71%

5D -2.08%

Buy Vol. 4,591,800

Sell Vol. 6,218,300

Nghi Son oil refinery reduced 35% - 40% of capacity, expected to deliver only 540 thousand m3 in March, down 20% compared to the plan

VINGROUP

79,000

1D 0.00%

5D -0.13%

Buy Vol. 6,276,800

Sell Vol. 6,233,400

77,900

1D -0.13%

5D -0.51%

Buy Vol. 6,787,500

Sell Vol. 7,180,400

33,750

1D 3.21%

5D -0.74%

Buy Vol. 19,616,700

Sell Vol. 16,226,100

VIC: wants to invest in two industrial clusters in Quang Ninh with a total area of nearly 143ha, of which industrial cluster No. 1 has an area of 75ha and industrial cluster No. 2 has 67.94 ha.

FOOD & BEVERAGE

77,900

1D -0.64%

5D -1.27%

Buy Vol. 4,191,700

Sell Vol. 4,282,500

161,300

1D 1.38%

5D 2.09%

Buy Vol. 1,670,100

Sell Vol. 2,109,300

160,000

1D -4.25%

5D -4.81%

Buy Vol. 172,200

Sell Vol. 192,700

VNM: net direct export revenue in 2021 reached VND 6,128 billion, up 10.2% over the same period. Growth drivers come from the Middle East and Africa markets.

OTHERS

139,400

1D -2.79%

5D -3.93%

Buy Vol. 905,100

Sell Vol. 1,074,200

139,400

1D -2.79%

5D -3.93%

Buy Vol. 905,100

Sell Vol. 1,074,200

93,500

1D 0.11%

5D 1.30%

Buy Vol. 2,458,200

Sell Vol. 2,729,600

135,800

1D -0.51%

5D -1.31%

Buy Vol. 1,869,800

Sell Vol. 1,936,700

106,200

1D 2.69%

5D -0.93%

Buy Vol. 2,152,600

Sell Vol. 2,739,700

36,000

1D -0.83%

5D 5.88%

Buy Vol. 5,357,500

Sell Vol. 6,112,300

46,600

1D 2.42%

5D 1.97%

Buy Vol. 32,214,700

Sell Vol. 40,404,600

49,800

1D -0.60%

5D 8.50%

Buy Vol. 53,797,700

Sell Vol. 73,965,700

HPG: Hoa Phat container factory will test run in Q3. 2022 and start bringing products to market from Q4 of this year. The plant is expected to reach a capacity of 200,000 TEU/year by the end of 2023. Hoa Phat aims to complete the factory as quickly as possible in order to take advantage of market opportunities due to the serious shortage of empty containers shipped from abroad to Vietnam and at the same time contribute to promoting export of goods and global trade.

Market by numbers

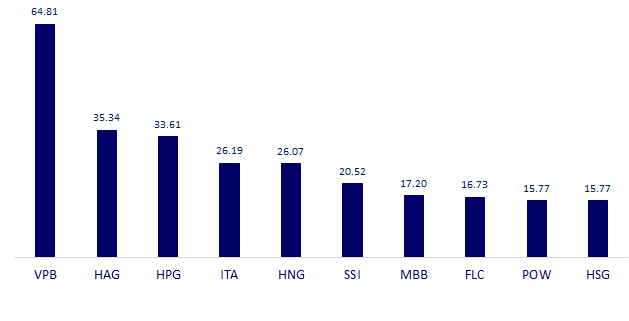

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

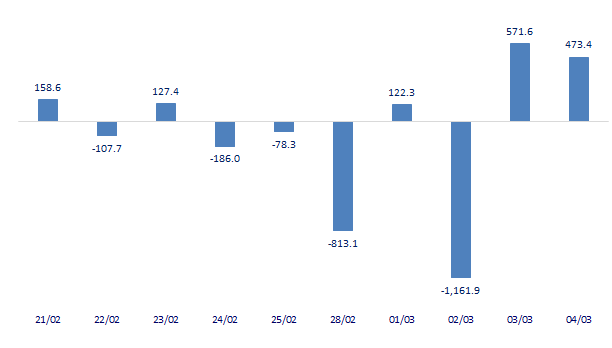

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

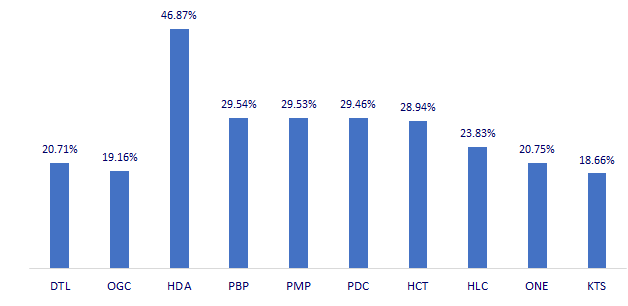

TOP INCREASES 3 CONSECUTIVE SESSIONS

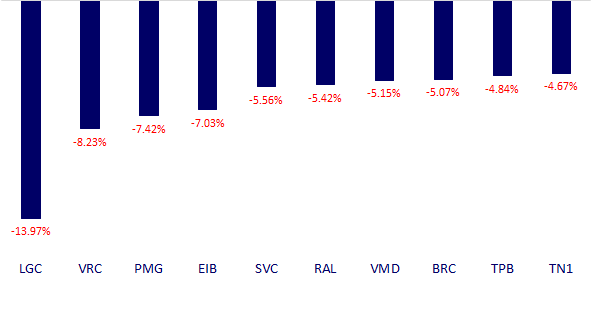

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.