Market brief 08/03/2022

VIETNAM STOCK MARKET

1,473.71

1D -1.69%

YTD -1.64%

1,490.17

1D -1.26%

YTD -2.97%

445.89

1D -1.54%

YTD -5.93%

112.61

1D -0.54%

YTD -0.06%

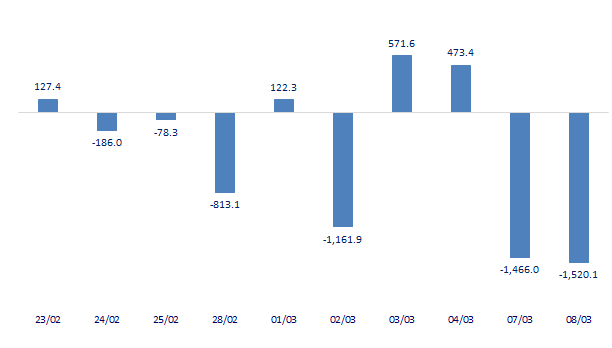

-1,520.05

1D 0.00%

YTD 0.00%

41,191.78

1D 8.93%

YTD 32.57%

Foreign investors continued to net sell more than 1,500 billion dong in session 8/3. Foreign investors were strong net sellers of HPG with 221 billion dong. GEX, VCB or VIC stocks were all net sold over 100 billion dong. Meanwhile, NKG was bought the most with 24.3 billion dong. VND and DXG were net bought at 17 billion dong and 15.8 billion dong respectively.

ETF & DERIVATIVES

25,300

1D -1.17%

YTD -2.05%

17,500

1D -1.13%

YTD -3.26%

18,450

1D 3.59%

YTD -2.89%

22,310

1D -0.84%

YTD -2.58%

21,980

1D -1.83%

YTD -2.22%

28,150

1D -1.23%

YTD 0.36%

19,940

1D -3.39%

YTD -7.17%

1,484

1D -0.90%

YTD 0.00%

1,488

1D -0.69%

YTD 0.00%

1,490

1D -0.92%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

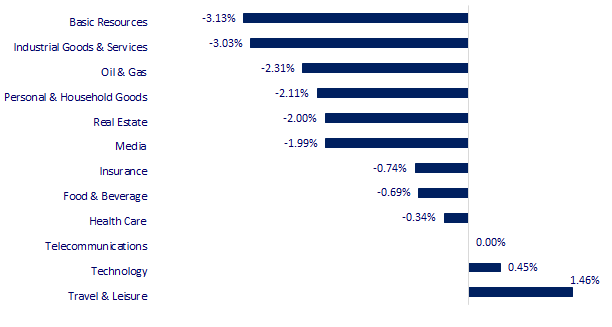

CHANGE IN PRICE BY SECTOR

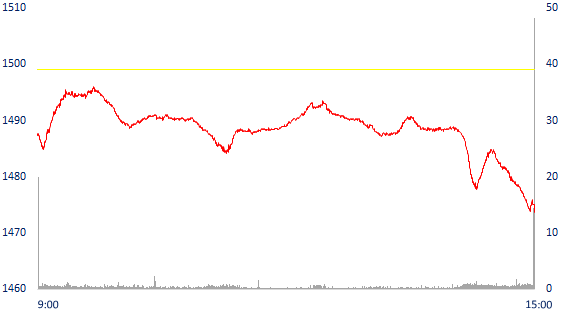

INTRADAY VNINDEX

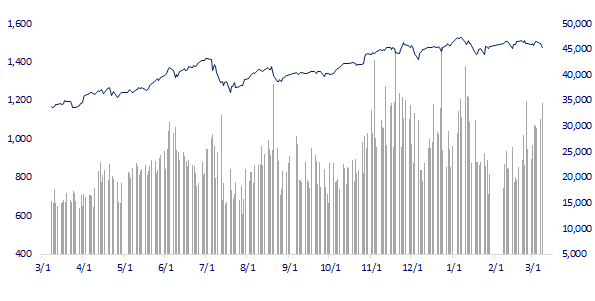

VNINDEX (12M)

GLOBAL MARKET

24,790.95

1D -1.47%

YTD -13.90%

3,293.53

1D -2.35%

YTD -9.51%

2,622.40

1D -1.09%

YTD -11.93%

20,765.87

1D -2.32%

YTD -11.25%

3,148.86

1D -1.22%

YTD 0.81%

1,619.10

1D -0.47%

YTD -2.32%

123.20

1D 4.10%

YTD 61.05%

2,013.30

1D 1.18%

YTD 10.57%

Asian stocks mostly fell, Ukraine war continued. In Japan, the Nikkei 225 fell 1.71%. The Chinese market fell with Shanghai Composite down 2.35%, Shenzhen Component down 2,616%. The Hong Kong market fell 2.32% after the deepest drop in the region in the previous session. South Korea's Kospi index fell 1.09%.

VIETNAM ECONOMY

2.40%

1D (bps) -7

YTD (bps) 159

5.60%

1.70%

1D (bps) 3

YTD (bps) 69

2.30%

1D (bps) 3

YTD (bps) 30

23,065

1D (%) 0.35%

YTD (%) 0.54%

25,275

1D (%) -1.15%

YTD (%) -4.51%

3,686

1D (%) -0.08%

YTD (%) 0.77%

Preliminary statistics have just been showed by the General Department of Customs that in February, exports to Russia were more than 180m USD, down 44% MoM. Compared to the same period in 2021, the turnover also decreased by 12.45%. With the Ukraine market, Vietnam's exports to this country also decreased in February. The turnover was at nearly 13m USD, down 60.3% MoM, 32.8% over the same period last year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Exports to Russia fell 44% in February

- Vietnam's car production loses to Thailand because it imports too many components

- Vietnam - US trade turnover increased about 250 times after 26 years

- Gas prices in Europe have risen again due to concerns about supply cuts from Russia

- Consequences of war: US growth slows, Europe and Russia are hit harder

- High wheat prices and food security concerns due to influence from Ukraine

VN30

BANK

81,500

1D -4.00%

5D -4.12%

Buy Vol. 4,019,300

Sell Vol. 4,447,600

41,600

1D -1.54%

5D -5.67%

Buy Vol. 4,306,200

Sell Vol. 4,488,000

32,050

1D -0.31%

5D -3.75%

Buy Vol. 12,182,000

Sell Vol. 11,459,300

49,000

1D -0.51%

5D -2.58%

Buy Vol. 16,520,700

Sell Vol. 13,087,200

37,000

1D -1.86%

5D -1.99%

Buy Vol. 23,507,200

Sell Vol. 25,785,900

31,000

1D -3.73%

5D -8.82%

Buy Vol. 36,868,200

Sell Vol. 39,837,500

27,350

1D -0.18%

5D -4.20%

Buy Vol. 8,352,700

Sell Vol. 8,934,200

38,800

1D -0.51%

5D -9.35%

Buy Vol. 9,159,900

Sell Vol. 9,274,400

30,850

1D -2.06%

5D -5.51%

Buy Vol. 25,492,700

Sell Vol. 26,155,400

32,600

1D -1.95%

5D -3.69%

Buy Vol. 11,178,400

Sell Vol. 11,590,000

In February, the total capitalization of 27 banks listed on the stock exchange decreased by more than 100,000 billion VND (equivalent to more than 4 billion USD) to 1.97 million billion VND. This figure decreased by 5% compared to VND 2.07 million billion at the end of January. Among state-owned banks, CTG's capitalization dropped the most with a decrease of 10%. Meanwhile, the capitalization of the other two giants, BID and VCB, both decreased by 9% in the past month.

REAL ESTATE

76,000

1D 0.00%

5D 0.80%

Buy Vol. 4,570,500

Sell Vol. 4,248,200

52,100

1D -3.16%

5D -3.70%

Buy Vol. 2,231,200

Sell Vol. 2,546,400

87,100

1D -2.68%

5D 3.08%

Buy Vol. 3,688,700

Sell Vol. 4,199,900

PDR: The pre-tax profit plan in 2022 is expected to be based on 4 key projects: Nhon Hoi tourist urban area, Subdivision 9 high-rise project, Astral City project, Serenity Phuoc Hai project.

OIL & GAS

120,700

1D -3.13%

5D 2.55%

Buy Vol. 2,030,300

Sell Vol. 2,930,800

17,200

1D 0.88%

5D -1.43%

Buy Vol. 35,560,900

Sell Vol. 38,772,900

61,300

1D -3.16%

5D 0.00%

Buy Vol. 4,860,300

Sell Vol. 5,515,200

Gas prices in the UK are 539.5 UK cents/therm, up 17.2% from last week's session and all-time high. Gas prices in the UK and Europe are both up more than 300% year to date.

VINGROUP

77,900

1D -0.76%

5D -1.64%

Buy Vol. 6,763,500

Sell Vol. 7,069,700

74,600

1D -2.10%

5D -4.36%

Buy Vol. 11,419,400

Sell Vol. 9,047,300

32,500

1D -1.22%

5D -2.99%

Buy Vol. 7,418,200

Sell Vol. 8,454,700

VHM: In 2021, thanks to highly effective business activities, VHM reported a net profit of more than 39 trillion dong, the highest since listing.

FOOD & BEVERAGE

76,100

1D -0.91%

5D -3.91%

Buy Vol. 4,002,800

Sell Vol. 3,823,500

158,800

1D 0.38%

5D 1.47%

Buy Vol. 955,100

Sell Vol. 1,164,700

155,600

1D 0.65%

5D -6.55%

Buy Vol. 234,300

Sell Vol. 180,600

VNM: In 2021, VNM's gross profit margin will also decrease to more than 43% from 46.4%, mainly due to the increase in cost of finished products, goods and promotional costs.

OTHERS

137,000

1D 2.09%

5D -2.77%

Buy Vol. 1,107,300

Sell Vol. 939,800

137,000

1D 2.09%

5D -2.77%

Buy Vol. 1,107,300

Sell Vol. 939,800

94,800

1D 1.07%

5D 1.50%

Buy Vol. 3,505,300

Sell Vol. 4,238,900

134,200

1D 0.00%

5D -1.32%

Buy Vol. 2,850,500

Sell Vol. 3,335,500

106,000

1D -1.85%

5D 1.52%

Buy Vol. 2,187,600

Sell Vol. 4,096,200

36,300

1D -1.22%

5D 1.68%

Buy Vol. 5,847,200

Sell Vol. 8,697,300

47,000

1D 0.43%

5D 2.17%

Buy Vol. 39,407,100

Sell Vol. 46,092,700

49,450

1D -3.23%

5D 5.44%

Buy Vol. 64,208,200

Sell Vol. 70,816,800

PNJ: According to PNJ's consolidated report, by the end of 2021, the company has an inventory of VND 8,686 billion, an increase of more than VND 2,100 billion compared to the previous year. In which, finished products reached VND 5,187 billion, goods reached VND 2,682 billion.

Market by numbers

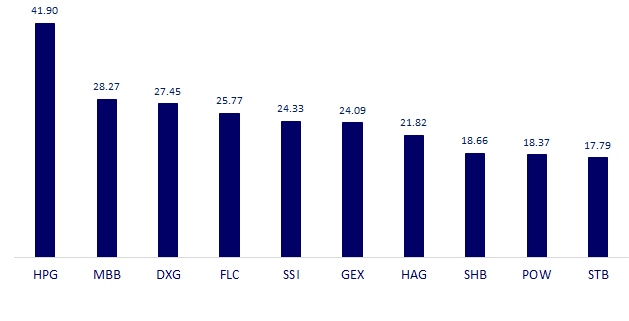

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

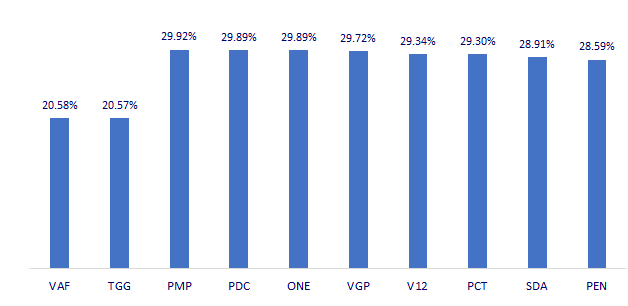

TOP INCREASES 3 CONSECUTIVE SESSIONS

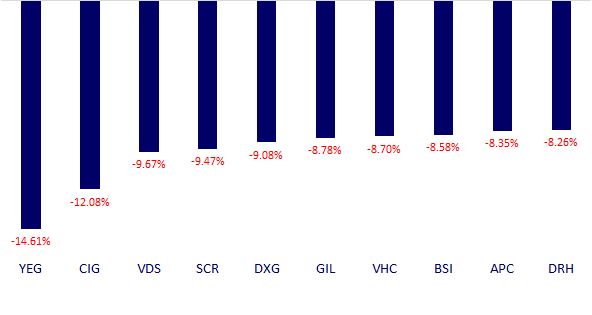

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.