Market brief 09/03/2022

VIETNAM STOCK MARKET

1,473.74

1D 0.00%

YTD -1.64%

1,489.25

1D -0.06%

YTD -3.03%

444.60

1D -0.29%

YTD -6.20%

113.37

1D 0.67%

YTD 0.61%

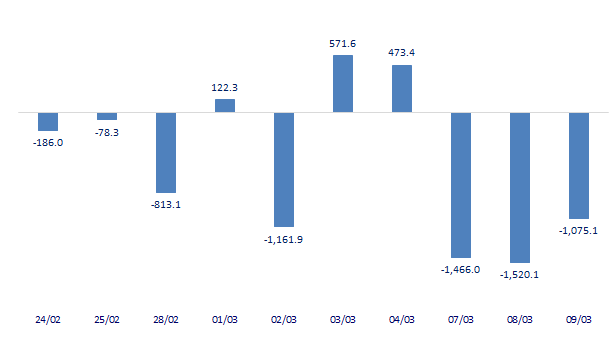

-1,075.13

1D 0.00%

YTD 0.00%

36,982.76

1D -10.51%

YTD 19.02%

At the end of today's session, market liquidity remained at a high level with a total matched value of 34,843 billion dong, down 9.7% compared to the previous session, of which, the matched value on HoSE decreased by 10 .2% to 28,932 billion dong. Foreign investors traded in a negative direction when they sold more than 1,000 billion dong in the whole market.

ETF & DERIVATIVES

25,000

1D -1.19%

YTD -3.21%

17,530

1D 0.17%

YTD -3.10%

18,640

1D 4.66%

YTD -1.89%

22,440

1D 0.58%

YTD -2.01%

21,950

1D -0.14%

YTD -2.36%

28,400

1D 0.89%

YTD 1.25%

19,890

1D -0.25%

YTD -7.40%

1,489

1D 0.34%

YTD 0.00%

1,489

1D 0.07%

YTD 0.00%

1,491

1D 0.03%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

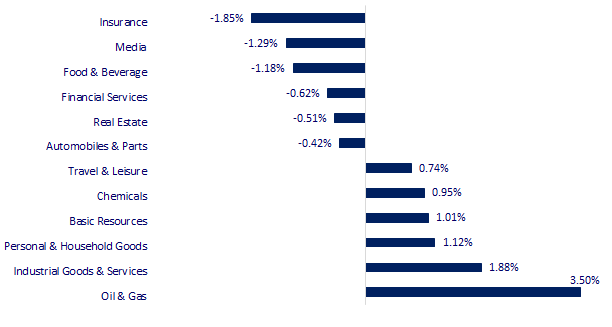

CHANGE IN PRICE BY SECTOR

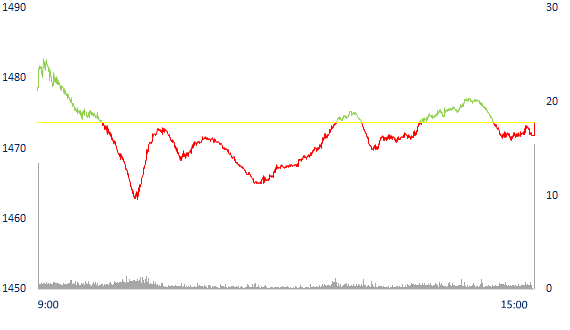

INTRADAY VNINDEX

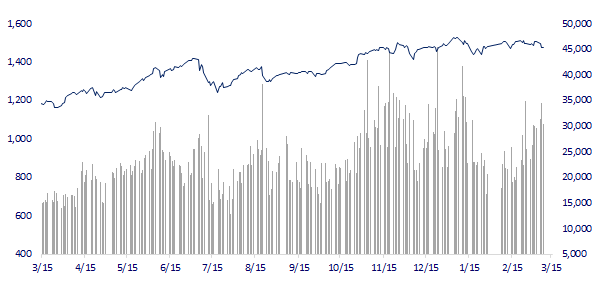

VNINDEX (12M)

GLOBAL MARKET

24,717.53

1D -1.25%

YTD -14.15%

3,256.39

1D -1.13%

YTD -10.53%

2,622.40

1D 0.00%

YTD -11.93%

20,627.71

1D -0.93%

YTD -11.84%

3,195.38

1D 1.48%

YTD 2.30%

1,643.64

1D 1.52%

YTD -0.84%

120.50

1D -3.41%

YTD 57.52%

2,019.80

1D -1.35%

YTD 10.93%

Asian stocks mixed after being sold strongly. In Japan, the Nikkei 225 fell 1.25%. The Chinese market fell with Shanghai Composite down 1.13%, Shenzhen Component down 1.122%. Hong Kong's Hang Seng fell 0.93%. The Korean market is closed because today is the day of the presidential election.

VIETNAM ECONOMY

2.31%

1D (bps) -9

YTD (bps) 150

5.60%

1.69%

1D (bps) -1

YTD (bps) 68

2.27%

1D (bps) -3

YTD (bps) 27

22,985

1D (%) 0.00%

YTD (%) 0.20%

25,670

1D (%) 0.00%

YTD (%) -3.01%

3,685

1D (%) 0.00%

YTD (%) 0.74%

According to the statistical report on bad debts of credit institutions, accumulated from August 15, 2017 to November 30, 2021, the whole system of credit institutions has handled 373,300 billion bad debts, of which 193,300 billion is bad debt on the balance sheet, debts being recorded off the balance sheet are 98,400 billion dong.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Credit balance unexpectedly decreased by 96,000 billion in February

- It is expected to extend the bad debt settlement time under Resolution 42 for another 3 years

- Russian tourists to Khanh Hoa get 20% off

- Sanctions put an end to Russian banks' global ambitions

- The US, EU and Japan find ways to 'block' Russians using virtual currency to avoid sanctions

- Food prices in China escalate

VN30

BANK

83,000

1D 1.84%

5D -2.35%

Buy Vol. 2,233,900

Sell Vol. 2,261,700

40,500

1D -2.64%

5D -4.59%

Buy Vol. 3,030,000

Sell Vol. 3,550,000

32,000

1D -0.16%

5D 0.00%

Buy Vol. 10,560,400

Sell Vol. 10,473,000

49,100

1D 0.20%

5D -0.20%

Buy Vol. 11,136,800

Sell Vol. 11,121,600

36,850

1D -0.41%

5D 0.96%

Buy Vol. 21,500,400

Sell Vol. 21,269,200

30,750

1D -0.81%

5D -5.38%

Buy Vol. 40,502,500

Sell Vol. 34,740,900

27,000

1D -1.28%

5D -1.28%

Buy Vol. 6,878,200

Sell Vol. 7,383,100

38,800

1D 0.00%

5D -6.39%

Buy Vol. 3,749,500

Sell Vol. 4,501,400

31,100

1D 0.81%

5D -0.48%

Buy Vol. 24,961,400

Sell Vol. 27,037,800

32,700

1D 0.31%

5D -0.61%

Buy Vol. 8,658,200

Sell Vol. 7,035,400

HDB: HDBank sets a high growth plan, service revenue will continue to accelerate in 2022. Operating income is expected to increase by 23% - 25% compared to last year, profit and profitability indicators are among the top in the industry. Revenue from insurance business is planned to be 3 times higher in the context that the bank has competitive advantages in second-class urban areas and rural markets.

REAL ESTATE

76,500

1D 0.66%

5D 0.13%

Buy Vol. 4,541,000

Sell Vol. 4,332,400

51,200

1D -1.73%

5D -4.66%

Buy Vol. 2,526,400

Sell Vol. 2,167,200

88,000

1D 1.03%

5D 0.92%

Buy Vol. 4,051,800

Sell Vol. 3,921,300

Khanh Hoa approved the housing development plan for the period 2021-2025. By 2025, the total housing area in the province will increase by at least 5.3m m2 of floor space, ~ 51,275 houses.

OIL & GAS

122,200

1D 1.24%

5D 2.52%

Buy Vol. 2,131,400

Sell Vol. 2,485,100

16,750

1D -2.62%

5D -4.01%

Buy Vol. 29,955,600

Sell Vol. 41,268,500

63,000

1D 2.77%

5D 2.44%

Buy Vol. 5,747,400

Sell Vol. 7,569,200

The price of US WTI crude oil increased 0.81% to 125.72 USD/barrel at 7:07 am (Vietnam time) on March 9. Brent crude for May delivery increased 0.09% to $129.3 per barrel.

VINGROUP

78,000

1D 0.13%

5D -1.14%

Buy Vol. 4,393,700

Sell Vol. 6,184,800

74,000

1D -0.80%

5D -4.52%

Buy Vol. 9,471,300

Sell Vol. 10,760,800

31,600

1D -2.77%

5D -3.66%

Buy Vol. 9,594,700

Sell Vol. 11,278,100

VHM was one of the top net sellers of foreign investors in today's session with a value of 87 billion dong, just behind HPG and VNM.

FOOD & BEVERAGE

75,100

1D -1.31%

5D -4.33%

Buy Vol. 4,685,100

Sell Vol. 5,506,900

155,500

1D -2.08%

5D -0.96%

Buy Vol. 1,174,400

Sell Vol. 1,677,400

155,000

1D -0.39%

5D -8.28%

Buy Vol. 295,000

Sell Vol. 419,600

VNM: In the early days of 2022, VNM has promoted trade at many major international fairs such as Gulfood Dubai, Foodex Japan, and created highlights with many new and outstanding products.

OTHERS

140,000

1D 2.19%

5D -3.45%

Buy Vol. 1,233,400

Sell Vol. 1,144,500

140,000

1D 2.19%

5D -3.45%

Buy Vol. 1,233,400

Sell Vol. 1,144,500

95,500

1D 0.74%

5D 2.58%

Buy Vol. 2,737,400

Sell Vol. 5,210,200

133,800

1D -0.30%

5D -0.52%

Buy Vol. 1,671,600

Sell Vol. 2,204,300

110,500

1D 4.25%

5D 7.47%

Buy Vol. 3,798,100

Sell Vol. 4,275,400

36,000

1D -0.83%

5D 1.69%

Buy Vol. 3,880,700

Sell Vol. 5,182,700

46,600

1D -0.85%

5D 4.02%

Buy Vol. 20,942,600

Sell Vol. 27,528,300

49,850

1D 0.81%

5D 6.29%

Buy Vol. 56,878,000

Sell Vol. 56,032,200

HPG: Hoa Phat has received export steel orders until May 2022 with more than 720,000 tons. Hoa Phat's crude steel production capacity is over 8 million tons/year, or about 700,000 tons/month. The above output results show that the steel production complexes of this group in Quang Ngai, Hai Duong and Hung Yen have operated at maximum capacity to serve the needs of domestic and foreign markets.

Market by numbers

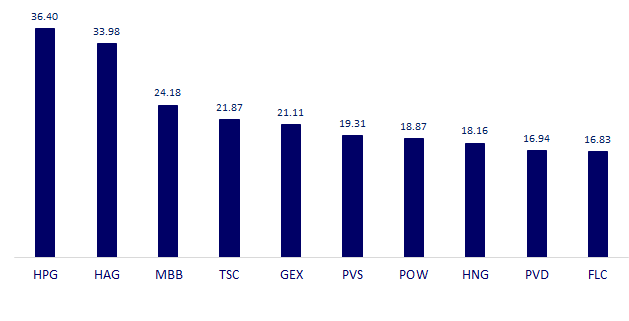

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

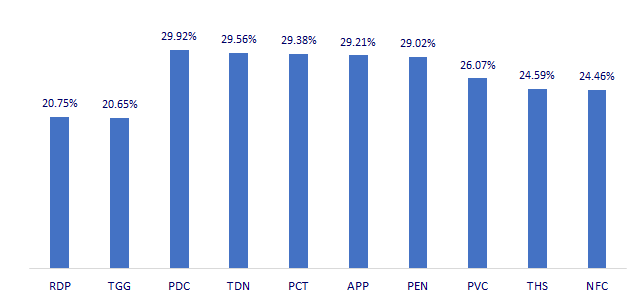

TOP INCREASES 3 CONSECUTIVE SESSIONS

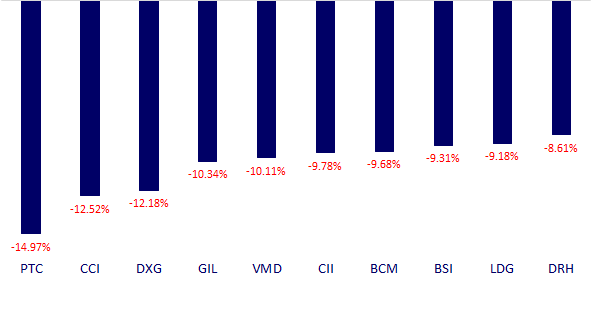

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.