Market brief 14/03/2022

VIETNAM STOCK MARKET

1,446.25

1D -1.38%

YTD -3.47%

1,461.10

1D -1.09%

YTD -4.86%

436.57

1D -1.27%

YTD -7.89%

115.05

1D -0.28%

YTD 2.10%

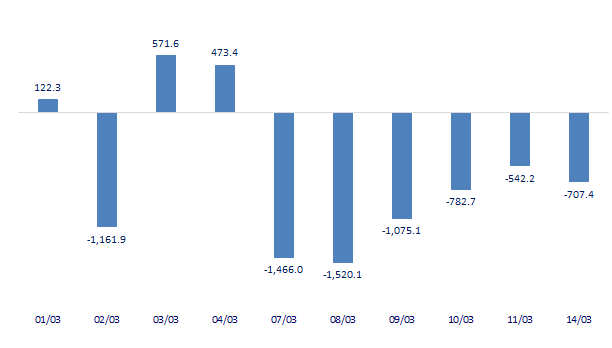

-707.39

1D 0.00%

YTD 0.00%

33,565.29

1D -3.40%

YTD 8.02%

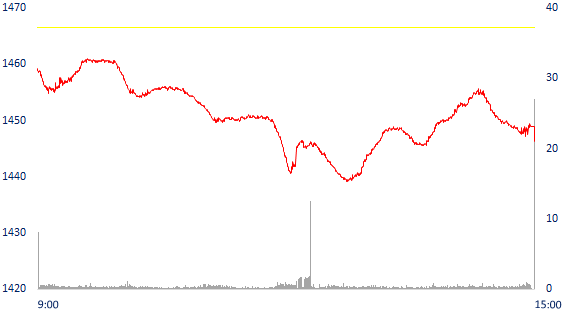

Session 14/03: Basic commodities and shipping stocks plunged, VN-Index dropped more than 20 points. Market liquidity decreased DoD. The total matched value reached 30,335b dong, down 9% DoD, of which, the matched value on HoSE decreased by 4.6% to 25,616b dong. Foreign investors still net sold more than 700b dong on HoSE.

ETF & DERIVATIVES

24,500

1D -1.96%

YTD -5.15%

17,210

1D -0.86%

YTD -4.86%

18,600

1D 4.44%

YTD -2.11%

21,600

1D -1.82%

YTD -5.68%

21,520

1D -2.18%

YTD -4.27%

27,450

1D -1.96%

YTD -2.14%

19,950

1D 3.37%

YTD -7.12%

1,460

1D -0.97%

YTD 0.00%

1,458

1D -0.96%

YTD 0.00%

1,463

1D -0.85%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

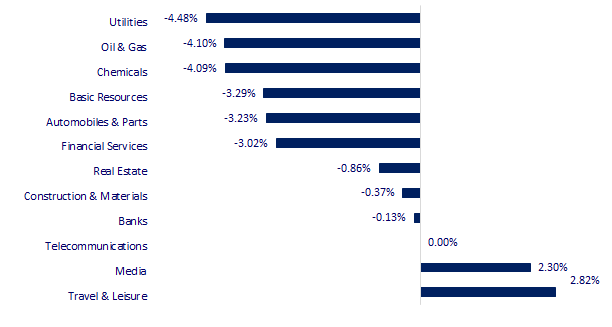

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

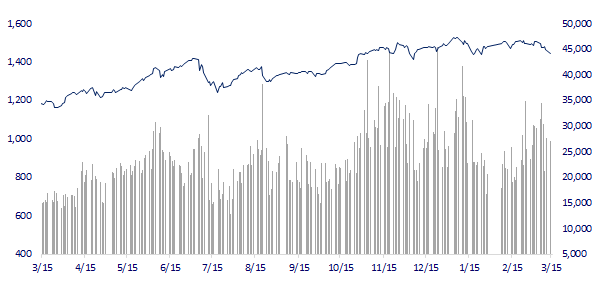

VNINDEX (12M)

GLOBAL MARKET

25,307.85

1D -0.51%

YTD -12.10%

3,223.53

1D -2.61%

YTD -11.44%

2,645.65

1D -0.59%

YTD -11.15%

19,531.66

1D -2.89%

YTD -16.52%

3,232.03

1D -0.54%

YTD 3.47%

1,660.15

1D 0.13%

YTD 0.15%

103.70

1D -2.14%

YTD 35.56%

1,965.10

1D -0.63%

YTD 7.93%

Asian stocks fell, Hang Seng sometimes "evaporated" nearly 5%. In Japan, the Nikkei 225 fell 0.58%. The Chinese market fell with Shanghai Composite down 2.6%, Shenzhen Component down 3.083%. Hong Kong's Hang Seng fell 2.89%. South Korea's Kospi index fell 0.59%.

VIETNAM ECONOMY

2.11%

1D (bps) -4

YTD (bps) 130

5.60%

1.68%

1D (bps) 1

YTD (bps) 67

2.30%

1D (bps) 4

YTD (bps) 30

23,115

1D (%) 0.39%

YTD (%) 0.76%

25,556

1D (%) -0.69%

YTD (%) -3.45%

3,669

1D (%) -0.19%

YTD (%) 0.30%

Figures just announced by the Ministry of Finance show that the total budget revenue in February reached 138,500 billion VND. The two-month budget accrual is about 323,800 billion dong, up nearly 11% over the same period and equaling approximately 23% of the estimate. The three main revenues, namely domestic revenue, revenue from crude oil and revenue from import and export, all increased over the same period in 2021, 7.6% respectively; 57.2% and 29.4%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Banks and Real Estate "absent" among the top issuers of corporate bonds in February 2022

- The US market will be the main driving force for shrimp exports

- Budget increase revenue from crude oil

- Budget increase revenue from crude oil

- Russian stock market stops trading for another week

- IMF: Russia may default, but not cause global financial crisis

- Blockade because of Covid-19, half of China's economy may be affected

VN30

BANK

84,200

1D 0.48%

5D -0.82%

Buy Vol. 1,909,100

Sell Vol. 1,987,500

41,300

1D -1.31%

5D -2.25%

Buy Vol. 2,040,500

Sell Vol. 3,199,600

31,900

1D -1.09%

5D -0.78%

Buy Vol. 8,518,900

Sell Vol. 9,562,300

48,500

1D -0.82%

5D -1.52%

Buy Vol. 8,926,600

Sell Vol. 8,681,700

36,000

1D -1.10%

5D -4.51%

Buy Vol. 21,203,600

Sell Vol. 21,630,900

31,650

1D 0.64%

5D -1.71%

Buy Vol. 26,972,300

Sell Vol. 28,089,300

27,100

1D -0.73%

5D -1.09%

Buy Vol. 4,166,300

Sell Vol. 4,938,300

39,200

1D 1.42%

5D 0.51%

Buy Vol. 3,665,300

Sell Vol. 4,898,700

32,500

1D 1.40%

5D 3.17%

Buy Vol. 36,036,200

Sell Vol. 37,103,300

32,700

1D 0.00%

5D -1.65%

Buy Vol. 5,063,700

Sell Vol. 5,095,300

TCB: Techcombank has just issued a Resolution approving a credit of VND 1,500 billion to Nui Phao Mining and Mineral Processing Company Limited (NPM) and Tungsten Masan Company Limited (MTC). For Nui Phao Minerals is up to 1,500 billion VND and for Tungsten Masan is not more than 600 billion VND. Credit limit has a term of 12 months, including loan limit, guarantee limit, letter of credit limit, discount limit The collateral for the credit line is the stock of Masan High-Tech Materials JSC (UPCoM: MSR) owned by Masan Vision JSC (MH).

REAL ESTATE

76,500

1D -0.91%

5D 0.66%

Buy Vol. 6,197,900

Sell Vol. 6,316,300

50,200

1D -1.57%

5D -6.69%

Buy Vol. 1,714,600

Sell Vol. 1,894,200

87,500

1D -0.23%

5D -2.23%

Buy Vol. 3,504,400

Sell Vol. 3,548,100

PDR: The Board of Directors approved a foreign loan of USD 30 million to convert the principal balance into common shares for the lender when the company offered private shares.

OIL & GAS

106,000

1D -6.11%

5D -14.93%

Buy Vol. 2,191,400

Sell Vol. 2,186,900

15,650

1D -3.10%

5D -8.21%

Buy Vol. 31,785,100

Sell Vol. 35,368,900

55,900

1D -3.62%

5D -11.69%

Buy Vol. 7,334,400

Sell Vol. 6,249,300

Environmental protection tax for gasoline will be reduced by 2,000VND/liter. The reduction for diesel, fuel oil, lubricant is 1,000VND/liter, grease is 1,000VND/kg.

VINGROUP

78,300

1D -0.89%

5D -0.25%

Buy Vol. 3,604,000

Sell Vol. 4,769,000

74,500

1D -0.67%

5D -2.23%

Buy Vol. 5,273,600

Sell Vol. 5,614,200

32,000

1D 0.47%

5D -2.74%

Buy Vol. 8,295,600

Sell Vol. 9,650,000

VIC: Vingroup proposes to invest in a megacity in Khanh Hoa. If the investment proposal is approved by the government, Vingroup is expected to start the project in June 2023.

FOOD & BEVERAGE

77,200

1D -1.03%

5D 0.52%

Buy Vol. 3,041,800

Sell Vol. 3,509,200

136,100

1D -4.49%

5D -13.97%

Buy Vol. 2,829,700

Sell Vol. 2,636,700

154,000

1D 0.00%

5D -0.39%

Buy Vol. 294,300

Sell Vol. 244,600

VNM: During the 2016-2019 period, Vinamilk spent about VND 2,000 billion/year on advertising, but this expenditure suddenly dropped sharply in the 2 Covid years.

OTHERS

145,000

1D 4.69%

5D 8.05%

Buy Vol. 2,232,800

Sell Vol. 1,847,100

145,000

1D 4.69%

5D 8.05%

Buy Vol. 2,232,800

Sell Vol. 1,847,100

91,800

1D -1.50%

5D -2.13%

Buy Vol. 3,135,800

Sell Vol. 4,045,000

131,700

1D -0.98%

5D -1.86%

Buy Vol. 1,884,900

Sell Vol. 2,189,400

98,500

1D -5.74%

5D -8.80%

Buy Vol. 2,855,700

Sell Vol. 2,789,000

33,350

1D -3.33%

5D -9.25%

Buy Vol. 3,949,600

Sell Vol. 3,832,300

43,200

1D -4.00%

5D -7.69%

Buy Vol. 27,300,800

Sell Vol. 28,803,900

45,800

1D -3.78%

5D -10.37%

Buy Vol. 51,549,500

Sell Vol. 53,233,800

- MWG: Board resolution approving MWG's policy on overseas investment in Indonesia - HPG: Hoa Phat Dung Quat Steel Joint Stock Company has just sent an official letter to the People's Committee of Quang Ngai province about the investment in the project of a steel rolling mill. Accordingly, this project will scale about 12 hectares, in Binh Thuan commune, in Dung Quat economic zone.

Market by numbers

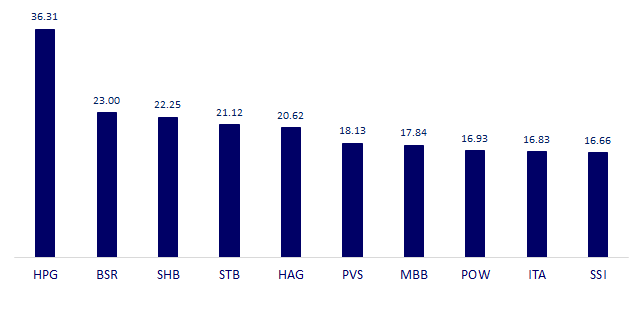

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

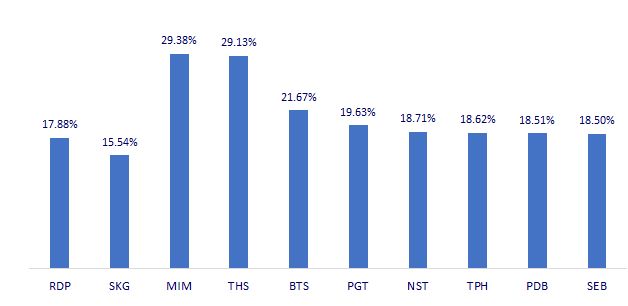

TOP INCREASES 3 CONSECUTIVE SESSIONS

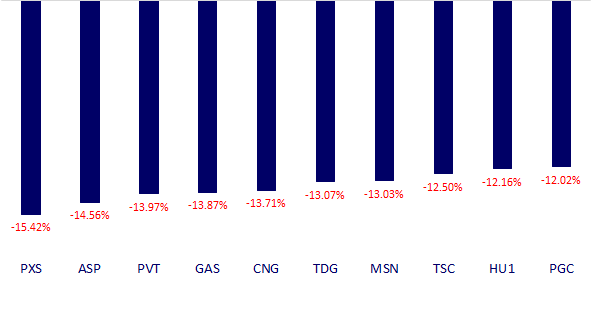

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.