Market brief 21/03/2022

VIETNAM STOCK MARKET

1,494.95

1D 1.76%

YTD -0.22%

1,502.67

1D 1.74%

YTD -2.15%

458.29

1D 1.57%

YTD -3.31%

116.18

1D 0.12%

YTD 3.11%

1,088.44

1D 0.00%

YTD 0.00%

29,170.70

1D -1.66%

YTD -6.12%

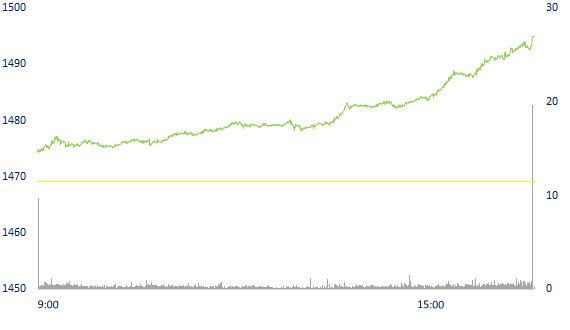

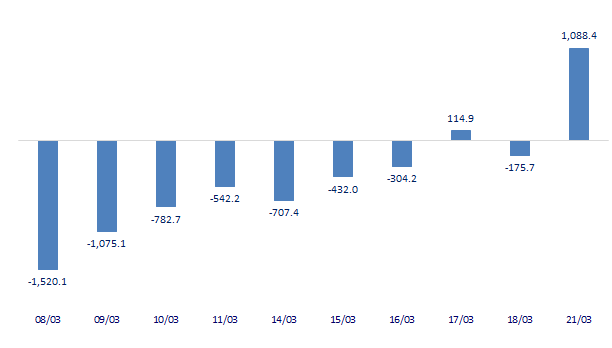

At the end of the session, market liquidity decreased slightly compared to the last session of last week. The total matched value reached 25,972 billion dong, down 6%, of which, the matched value on HoSE only decreased by 6% and reached 21,909 billion dong. Foreign investors saw a sudden net buying of 1,100 billion dong on HoSE.

ETF & DERIVATIVES

25,280

1D 1.12%

YTD -2.13%

17,620

1D 1.03%

YTD -2.60%

18,510

1D 3.93%

YTD -2.58%

21,900

1D 0.92%

YTD -4.37%

22,340

1D 1.04%

YTD -0.62%

28,500

1D 0.96%

YTD 1.60%

19,790

1D 0.97%

YTD -7.87%

1,490

1D 0.88%

YTD 0.00%

1,489

1D 0.88%

YTD 0.00%

1,472

1D 0.00%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

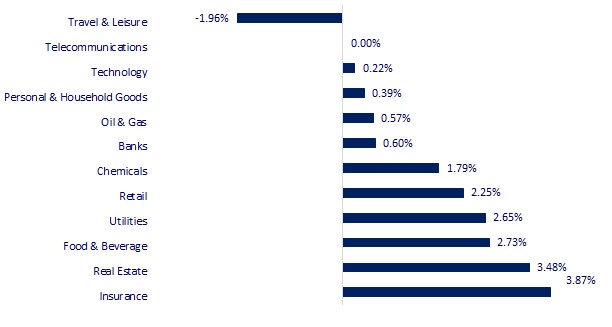

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

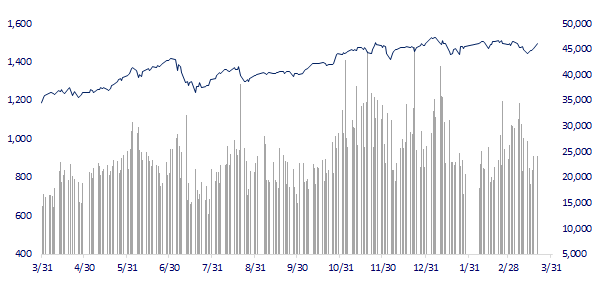

VNINDEX (12M)

GLOBAL MARKET

26,827.43

1D 0.00%

YTD -6.82%

3,253.69

1D 0.08%

YTD -10.61%

2,686.05

1D -0.77%

YTD -9.79%

21,221.34

1D -0.96%

YTD -9.30%

3,355.51

1D 0.75%

YTD 7.42%

1,673.87

1D -0.28%

YTD 0.98%

107.75

1D 1.63%

YTD 40.85%

1,926.05

1D -0.11%

YTD 5.78%

Asian stocks mixed, oil prices up 4%. Japanese market holiday. The Chinese market rallied with the Shanghai Composite up 0.08%. Hong Kong's Hang Seng fell 0.96% after a volatile week. China kept its one-year loan prime rate unchanged at 3.7% as expected in the market. Investors are watching for signals of supportive policy from Beijing after Chinese media reported support for the market last week.

VIETNAM ECONOMY

2.19%

YTD (bps) 138

5.60%

1.74%

YTD (bps) 73

2.31%

YTD (bps) 31

23,075

1D (%) -0.04%

YTD (%) 0.59%

25,686

1D (%) 48.25%

YTD (%) -2.95%

3,666

1D (%) -78.87%

YTD (%) 0.22%

The Ministry of Finance forecasts the average CPI in the first 3 months will be at 2-2.1% and still in the inflation scenario. In case CPI in the remaining months increases steadily at the same rate as compared to the previous month, in the remaining 9 months of this year, CPI each month has room to increase by 0.5% to ensure the target of controlling inflation around 4%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Import and export in the first 2 months of the year: FDI enterprises still dominate

- The Ministry of Finance forecasts the average CPI in 3 months from 2 to 2.1%

- 18% of the public investment capital plan assigned by the Prime Minister has not been allocated

- Germany and Qatar sign energy deal to reduce dependence on Russia

- Oil prices rise again due to concerns about Russia - Ukraine and IEA call to cut energy use

- This year, the poorest countries have to pay China 14 billion USD

VN30

BANK

84,900

1D 0.83%

5D 0.83%

Buy Vol. 1,414,900

Sell Vol. 1,583,700

43,800

1D -0.23%

5D 6.05%

Buy Vol. 2,528,800

Sell Vol. 3,204,300

32,850

1D 0.15%

5D 2.98%

Buy Vol. 6,960,500

Sell Vol. 6,997,900

49,450

1D 0.51%

5D 1.96%

Buy Vol. 6,484,000

Sell Vol. 7,437,100

36,800

1D 1.52%

5D 2.22%

Buy Vol. 11,956,500

Sell Vol. 12,034,700

32,200

1D 0.31%

5D 1.74%

Buy Vol. 19,569,800

Sell Vol. 20,819,200

28,300

1D 2.54%

5D 4.43%

Buy Vol. 6,580,300

Sell Vol. 7,036,800

39,900

1D 1.01%

5D 1.79%

Buy Vol. 5,030,000

Sell Vol. 7,926,000

33,100

1D 0.00%

5D 1.85%

Buy Vol. 22,262,000

Sell Vol. 22,370,100

32,950

1D 0.46%

5D 0.76%

Buy Vol. 5,771,400

Sell Vol. 7,105,900

STB: STB wants to collect at least VND 14,577 billion from 18 debts related to Phong Phu Industrial Park. According to the announcement, this is a debt incurred at Sacombank and sold to VAMC. After that, VAMC authorized Sacombank to sell these debts according to regulations. The total outstanding balance of these debts as of December 31, 2021 is VND 16,196 billion. In which, the outstanding principal is more than 5,134 billion VND, outstanding interest is more than 1,061 billion VND. The starting price announced by the bank is VND 14,577 billion, nearly 10% lower than the value of the debt.

REAL ESTATE

82,400

1D 6.87%

5D 7.71%

Buy Vol. 17,386,000

Sell Vol. 8,419,000

53,300

1D 4.51%

5D 6.18%

Buy Vol. 3,399,500

Sell Vol. 2,654,100

90,900

1D 6.94%

5D 3.89%

Buy Vol. 8,980,900

Sell Vol. 6,907,900

NVL: In Ho Chi Minh City, NVL is about to launch the Grand Sentosa project in the South Saigon area (8.3 ha area, more than 2,000 apartment products).

OIL & GAS

114,000

1D 4.68%

5D 7.55%

Buy Vol. 1,509,600

Sell Vol. 1,506,200

16,200

1D 0.62%

5D 3.51%

Buy Vol. 22,614,100

Sell Vol. 20,090,300

56,000

1D 0.18%

5D 0.18%

Buy Vol. 2,678,200

Sell Vol. 2,812,900

POW: The incident at Vung Ang 1 factory was not the main reason for the loss of revenue in February. The main reason was the sharp drop in the demand for electricity throughout the system.

VINGROUP

81,000

1D 2.79%

5D 3.45%

Buy Vol. 5,726,300

Sell Vol. 6,235,200

77,500

1D 3.89%

5D 4.03%

Buy Vol. 7,924,700

Sell Vol. 7,490,000

33,200

1D 0.61%

5D 3.75%

Buy Vol. 5,255,900

Sell Vol. 7,804,400

VIC: reported to Prime Minister Pham Minh Chinh and members of the Government delegation on the idea of investing in a mega-urban project in Cam Lam district, Khanh Hoa province.

FOOD & BEVERAGE

77,600

1D 2.11%

5D 0.52%

Buy Vol. 3,792,000

Sell Vol. 3,321,600

145,000

1D 6.07%

5D 6.54%

Buy Vol. 1,886,300

Sell Vol. 1,434,200

152,200

1D 0.46%

5D -1.17%

Buy Vol. 169,400

Sell Vol. 110,800

VNM: Vinamilk expects in 2022 it will increase its market share by 0.5% to 56% and total revenue will also increase slightly, to 64,070 billion dong.

OTHERS

143,300

1D -3.31%

5D -1.17%

Buy Vol. 1,007,900

Sell Vol. 1,253,800

143,300

1D -3.31%

5D -1.17%

Buy Vol. 1,007,900

Sell Vol. 1,253,800

95,300

1D 0.21%

5D 3.81%

Buy Vol. 2,480,500

Sell Vol. 4,454,200

134,900

1D 2.51%

5D 2.43%

Buy Vol. 1,575,100

Sell Vol. 1,601,300

105,600

1D 2.03%

5D 7.21%

Buy Vol. 1,255,200

Sell Vol. 1,406,800

34,600

1D 1.76%

5D 3.75%

Buy Vol. 2,761,000

Sell Vol. 2,675,100

44,300

1D 1.14%

5D 2.55%

Buy Vol. 11,421,500

Sell Vol. 12,770,300

46,850

1D 0.75%

5D 2.29%

Buy Vol. 30,484,700

Sell Vol. 33,806,300

FPT: FPT has just announced its estimated business results for the first 2 months of 2022 with revenue of VND 6,102 billion, up 27% and pre-tax profit (PBT) of VND 1,102 billion, up 30% over the same period last year. Profit after tax of shareholders of parent company in the first 2 months of the year reached 756 billion dong, up 35.7%, reaching 106% of the plan.

Market by numbers

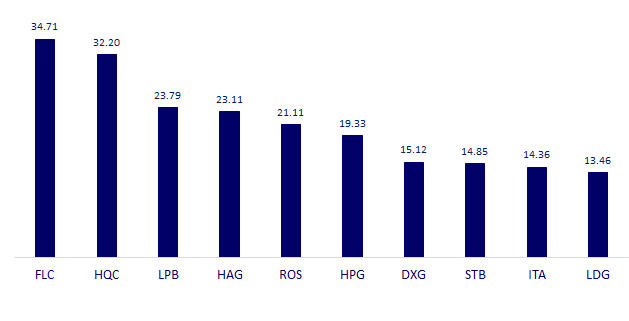

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

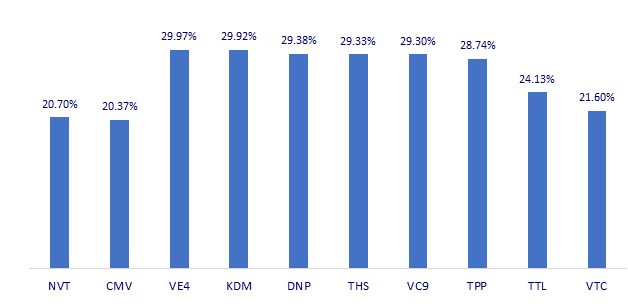

TOP INCREASES 3 CONSECUTIVE SESSIONS

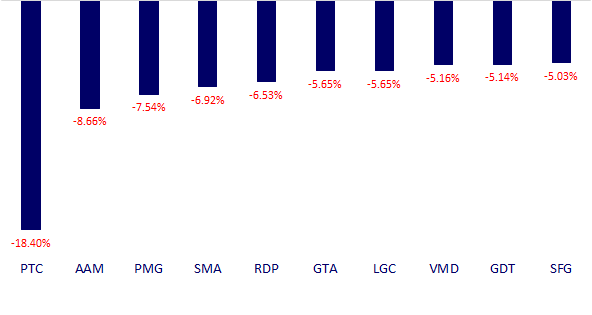

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.