Market brief 22/03/2022

VIETNAM STOCK MARKET

1,503.78

1D 0.59%

YTD 0.37%

1,513.40

1D 0.71%

YTD -1.45%

461.35

1D 0.67%

YTD -2.67%

116.80

1D 0.53%

YTD 3.66%

530.47

1D 0.00%

YTD 0.00%

34,103.24

1D 16.91%

YTD 9.76%

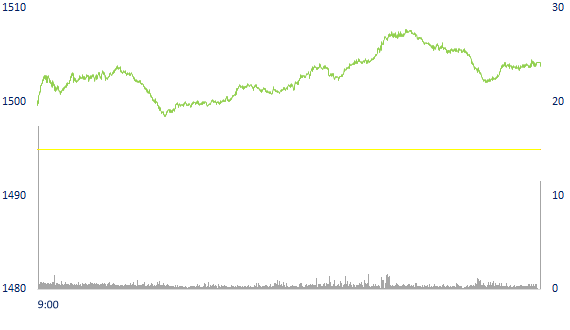

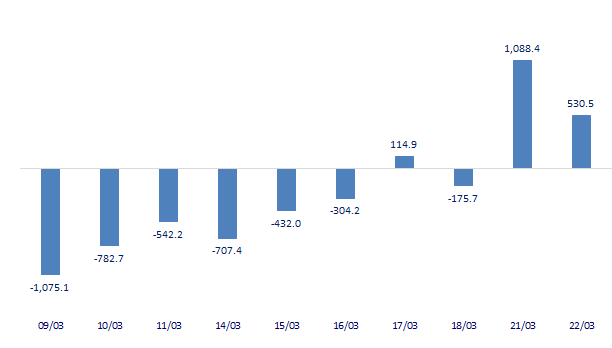

Banking, Oil and Gas, Fertilizer, and Coal stocks gained strongly, VN-Index maintained the 1,500 point mark in the session 22/3. Foreign investors' trade was also quite positive as they had the second net buying session in a row with the value of 530 billion dong. The buying force focused on DGC, STB, GEX, VRE, VHM...

ETF & DERIVATIVES

25,410

1D 0.51%

YTD -1.63%

17,810

1D 1.08%

YTD -1.55%

18,530

1D 4.04%

YTD -2.47%

22,400

1D 2.28%

YTD -2.18%

22,200

1D -0.63%

YTD -1.25%

28,750

1D 0.88%

YTD 2.50%

19,980

1D 0.96%

YTD -6.98%

1,495

1D 0.36%

YTD 0.00%

1,493

1D 0.30%

YTD 0.00%

1,472

1D 0.00%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

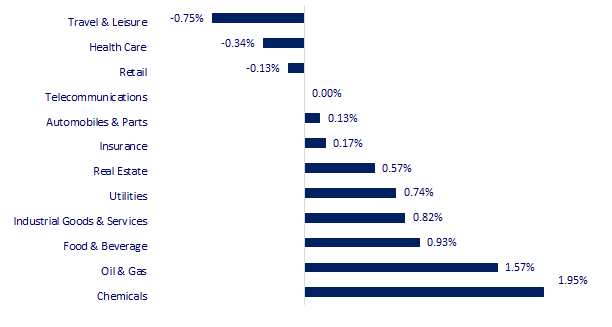

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

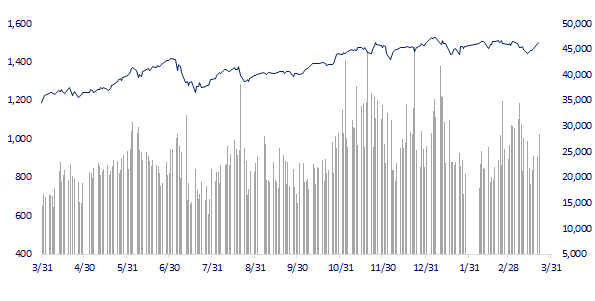

VNINDEX (12M)

GLOBAL MARKET

27,224.11

1D -0.14%

YTD -5.44%

3,259.86

1D 0.19%

YTD -10.44%

2,710.00

1D 0.89%

YTD -8.99%

21,889.28

1D 2.16%

YTD -6.45%

3,350.17

1D -0.16%

YTD 7.25%

1,677.87

1D 0.24%

YTD 1.22%

109.55

1D -2.91%

YTD 43.20%

1,928.85

1D -0.19%

YTD 5.93%

Asian stocks mostly rose, with Hong Kong leading the region. In Japan alone, the Nikkei 225 fell 0.14%. The Chinese market was mixed with Shanghai Composite up 0.19%, Shenzhen Component down 0.492%. Hong Kong's Hang Seng rose 2.16%. South Korea's Kospi index rose 0.89%.

VIETNAM ECONOMY

2.17%

1D (bps) -2

YTD (bps) 136

5.60%

1.87%

1D (bps) 13

YTD (bps) 86

2.43%

1D (bps) 12

YTD (bps) 43

23,095

1D (%) 0.43%

YTD (%) 0.68%

25,596

1D (%) -1.02%

YTD (%) -3.29%

3,664

1D (%) -0.05%

YTD (%) 0.16%

Deputy Minister of Industry and Trade Tran Quoc Khanh said that in addition to two-way trade growing by 17% in the first year of implementation of the Vietnam-UK bilateral FTA, FDI flows from the UK into Vietnam have significantly increased. Specifically, in 2021, there are 48 newly granted British investment projects in Vietnam, with a total registered capital of more than 53 million USD, an increase of 157% compared to the previous year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Funding for tourism businesses to return

- GDP growth despite the pandemic and social support policies helped Vietnam rise 2 places in the world's happiest country rankings

- Investment capital from the UK is poured into the processing and manufacturing industry in Vietnam

- EU relaxes to support businesses affected by sanctions

- The EU is divided over the plan to embargo oil and gas from Russia

- Cheap Russian oil finds buyers in India

VN30

BANK

84,900

1D 0.00%

5D 4.69%

Buy Vol. 1,270,900

Sell Vol. 1,560,900

43,500

1D -0.68%

5D 3.33%

Buy Vol. 4,827,600

Sell Vol. 4,923,800

33,000

1D 0.46%

5D 3.29%

Buy Vol. 11,445,700

Sell Vol. 11,351,200

49,900

1D 0.91%

5D 2.67%

Buy Vol. 8,624,200

Sell Vol. 11,111,200

36,850

1D 0.14%

5D -0.14%

Buy Vol. 13,692,800

Sell Vol. 23,503,000

32,450

1D 0.78%

5D 2.69%

Buy Vol. 16,473,900

Sell Vol. 21,611,400

28,300

1D 0.00%

5D 4.04%

Buy Vol. 8,646,900

Sell Vol. 9,070,600

40,500

1D 1.50%

5D 1.50%

Buy Vol. 9,153,100

Sell Vol. 11,208,200

34,050

1D 2.87%

5D 4.13%

Buy Vol. 40,838,600

Sell Vol. 45,191,800

33,300

1D 1.06%

5D 1.52%

Buy Vol. 5,864,400

Sell Vol. 6,726,100

STB: From a bank with good financial capacity and stable development, after merging with Phuong Nam Bank, Sacombank faced nearly VND 97,000 billion of bad debts and outstanding assets, accounting for 30% of total assets. But after 5 years, Sacombank has a very positive speed of bad debt handling. The bank has recovered nearly 72,000 billion dong of bad debts and outstanding assets, of which about 60,000 billion dong are items under the scheme, reaching nearly 70% of the overall plan.

REAL ESTATE

84,100

1D 2.06%

5D 9.79%

Buy Vol. 10,091,700

Sell Vol. 10,870,300

52,800

1D -0.94%

5D 5.60%

Buy Vol. 2,084,100

Sell Vol. 2,706,600

91,300

1D 0.44%

5D 5.79%

Buy Vol. 5,578,000

Sell Vol. 6,053,900

NVL: In 2021, Novaland's unrealized revenue increased by $3.2 billion to $7.8 billion (+70%). Of which, $3,859 million comes from Aqua City, $1,485 million comes from NovaWorld Phan Thiet…

OIL & GAS

115,000

1D 0.88%

5D 6.48%

Buy Vol. 1,134,900

Sell Vol. 1,739,400

16,500

1D 1.85%

5D 0.61%

Buy Vol. 31,578,600

Sell Vol. 30,349,200

56,800

1D 1.43%

5D 1.43%

Buy Vol. 4,206,900

Sell Vol. 3,892,000

Oil prices jumped more than 7% on Monday (March 21), with Brent surpassing $115 a barrel, as EU nations consider joining the United States in the Russian oil embargo.

VINGROUP

82,200

1D 1.48%

5D 4.98%

Buy Vol. 5,370,300

Sell Vol. 7,602,700

78,000

1D 0.65%

5D 4.70%

Buy Vol. 6,741,100

Sell Vol. 8,043,100

33,200

1D 0.00%

5D 4.57%

Buy Vol. 6,081,700

Sell Vol. 8,572,300

VIC: postpone the 2022 Annual General Meeting of Shareholders by up to 2 months from April 30, 2022.

FOOD & BEVERAGE

76,900

1D -0.90%

5D -0.39%

Buy Vol. 3,633,700

Sell Vol. 4,321,900

148,500

1D 2.41%

5D 5.24%

Buy Vol. 1,721,200

Sell Vol. 1,554,400

154,000

1D 1.18%

5D 1.78%

Buy Vol. 240,500

Sell Vol. 160,100

VNM: After reaching a record revenue of over 61,000 billion dong in 2021, VNM continues to expect revenue to grow to over 64,000 billion dong in 2022., profit before tax of 12,000 billion dong.

OTHERS

140,800

1D -1.74%

5D -4.86%

Buy Vol. 990,500

Sell Vol. 1,208,900

140,800

1D -1.74%

5D -4.86%

Buy Vol. 990,500

Sell Vol. 1,208,900

96,400

1D 1.15%

5D 5.93%

Buy Vol. 3,368,200

Sell Vol. 4,576,400

135,200

1D 0.22%

5D 2.89%

Buy Vol. 1,502,600

Sell Vol. 2,142,300

107,000

1D 1.33%

5D 3.98%

Buy Vol. 1,471,400

Sell Vol. 2,020,000

34,650

1D 0.14%

5D 2.36%

Buy Vol. 2,725,000

Sell Vol. 3,541,200

44,350

1D 0.11%

5D 2.42%

Buy Vol. 9,928,500

Sell Vol. 12,824,900

46,900

1D 0.11%

5D 1.63%

Buy Vol. 37,684,200

Sell Vol. 37,599,900

PNJ: just announced the business situation in February 2022, recorded net revenue of 3,589 billion dong, up 26.5% and EAT at 252 billion dong, up nearly 18% over the same period in 2021. Thus, if compared with the results of January 2022, net revenue increased by 3.5% and profit after tax decreased by 7%. In the first 2 months of the year, PNJ's net revenue reached VND 7,066 billion and profit after tax of VND 522 billion, up 41% and 37% respectively over the same period in 2021.

Market by numbers

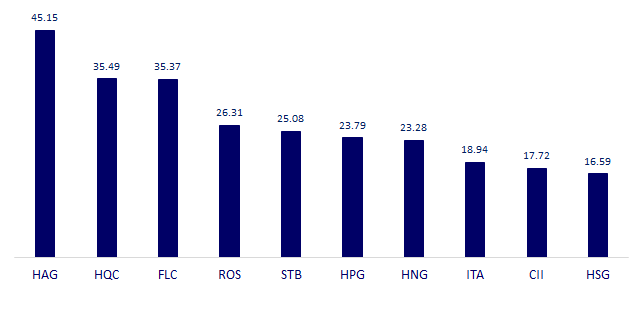

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

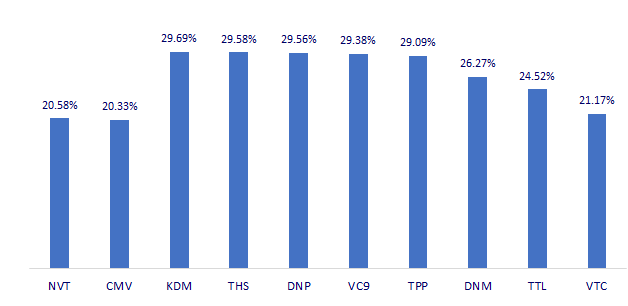

TOP INCREASES 3 CONSECUTIVE SESSIONS

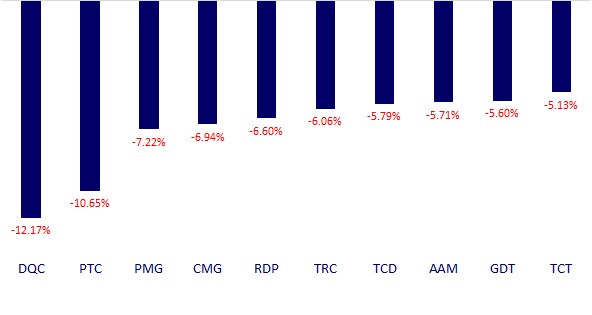

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.