Market brief 24/03/2022

VIETNAM STOCK MARKET

1,498.26

1D -0.27%

YTD 0.00%

1,497.44

1D -0.54%

YTD -2.49%

462.80

1D 0.15%

YTD -2.36%

117.27

1D 0.59%

YTD 4.07%

-130.78

1D 0.00%

YTD 0.00%

30,460.48

1D -9.88%

YTD -1.97%

Foreign investors net sold again 131 billion dong in the session 24/3, DXG and VNM were the focus. DGC was still the stock that was bought the most by foreign investors on HoSE with 359 billion dong, far behind VHC with more than 50 billion dong. Meanwhile, DXG was sold the most on this floor with 170 billion dong. VNM and HPG were net sold 129 billion dong and 70 billion dong respectively.

ETF & DERIVATIVES

25,150

1D -0.47%

YTD -2.63%

17,580

1D -0.90%

YTD -2.82%

18,510

1D 3.93%

YTD -2.58%

22,210

1D 0.05%

YTD -3.01%

22,100

1D -0.85%

YTD -1.69%

28,650

1D 3.43%

YTD 2.14%

19,900

1D -0.25%

YTD -7.36%

1,485

1D -0.32%

YTD 0.00%

1,490

1D -0.26%

YTD 0.00%

1,472

1D 0.00%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

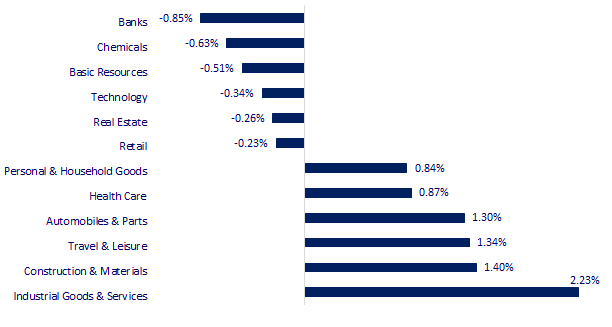

CHANGE IN PRICE BY SECTOR

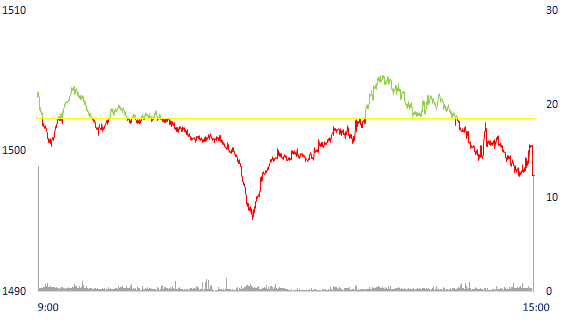

INTRADAY VNINDEX

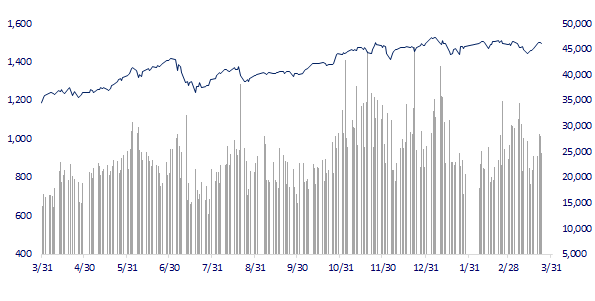

VNINDEX (12M)

GLOBAL MARKET

28,110.39

1D 1.55%

YTD -2.37%

3,250.26

1D -0.63%

YTD -10.70%

2,729.66

1D -0.20%

YTD -8.33%

21,945.95

1D 0.16%

YTD -6.20%

3,399.70

1D 1.05%

YTD 8.84%

1,680.89

1D 0.18%

YTD 1.40%

114.92

1D -1.02%

YTD 50.22%

1,944.90

1D 0.09%

YTD 6.82%

Asian stocks mixed, oil prices rose. In Japan, the Nikkei 225 gained 1.55%. The Chinese market fell with Shanghai Composite down 0.63%, Shenzhen Component down 0.831%. Hong Kong's Hang Seng rose 0.16%. Shares of Chinese tech giant Tencent, listed in Hong Kong, fell 5.91% after the company on March 23 recorded slow revenue growth on record.

VIETNAM ECONOMY

2.19%

1D (bps) 1

YTD (bps) 138

5.60%

1.87%

1D (bps) -1

YTD (bps) 86

2.41%

YTD (bps) 41

23,090

1D (%) -0.02%

YTD (%) 0.65%

25,576

1D (%) -0.12%

YTD (%) -3.37%

3,660

1D (%) 0.00%

YTD (%) 0.05%

The Government's specific target and plan is that by 2025, the outstanding debt in the bond market can reach at least 47% of GDP. In which, outstanding loans in the corporate bond market reach at least 20% of GDP. By 2030, outstanding debt in the bond market will reach at least 58% of GDP. In which, outstanding loans in the corporate bond market reach at least 25% of GDP.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The bond market sets a target of at least 58% of GDP

- The Government requires the management of gasoline prices to follow the world market

- Vietnam and Belarus create conditions for businesses to find new opportunities

- The global bond market faces unprecedented selling pressure

- EC proposes measures to ensure energy supply

- China quietly buys cheap oil from Russia

VN30

BANK

83,500

1D -1.65%

5D 0.60%

Buy Vol. 723,100

Sell Vol. 1,066,600

43,100

1D -0.69%

5D -0.92%

Buy Vol. 2,293,100

Sell Vol. 2,281,800

32,550

1D -0.91%

5D -0.46%

Buy Vol. 7,516,800

Sell Vol. 10,449,800

49,300

1D -0.60%

5D 0.61%

Buy Vol. 5,173,700

Sell Vol. 6,446,800

36,350

1D -0.82%

5D -0.27%

Buy Vol. 17,479,500

Sell Vol. 20,839,700

32,050

1D -0.31%

5D -0.62%

Buy Vol. 15,351,600

Sell Vol. 15,215,800

28,100

1D 0.36%

5D 2.18%

Buy Vol. 5,322,900

Sell Vol. 7,046,500

40,100

1D 0.12%

5D 1.26%

Buy Vol. 4,352,200

Sell Vol. 5,003,500

33,650

1D -1.03%

5D 2.59%

Buy Vol. 19,906,500

Sell Vol. 21,410,600

32,900

1D -0.90%

5D -0.30%

Buy Vol. 4,292,300

Sell Vol. 5,570,100

VCB: Vietcombank, OeanBank, PVCombank filed a lawsuit with the People's Court of Quang Ngai city for related to overdue loans and debt recovery measures for the construction loan of the Dung Quat ethanol biofuel plant, a project of BSR - BF) with a total value of principal and interest of about VND1,371.9 billion. The residual value of all tangible fixed assets used as collateral for the above loans is VND 1,217.7 billion.

REAL ESTATE

82,800

1D -1.19%

5D 8.09%

Buy Vol. 9,494,400

Sell Vol. 8,724,900

53,100

1D 0.19%

5D 3.31%

Buy Vol. 1,309,300

Sell Vol. 1,541,700

93,900

1D 3.99%

5D 8.68%

Buy Vol. 8,176,400

Sell Vol. 6,862,100

PDR: mobilized 300 billion dong of bonds for real estate projects. The bond's term is 2 years from the date of issue, with an interest rate of 11.2%/year at a selling price of VND 100 million/bond.

OIL & GAS

112,300

1D 0.00%

5D 5.94%

Buy Vol. 981,500

Sell Vol. 1,219,700

16,800

1D -0.59%

5D 3.07%

Buy Vol. 24,251,900

Sell Vol. 34,463,600

56,000

1D 0.00%

5D 0.36%

Buy Vol. 2,357,700

Sell Vol. 3,032,300

Oil prices rose 5% on Wednesday (March 23) as disruptions to Russia and Kazakhstan's crude exports via the CPC pipeline raised concerns about tight global supplies.

VINGROUP

81,000

1D -0.49%

5D 3.58%

Buy Vol. 2,850,900

Sell Vol. 4,182,300

75,700

1D -1.94%

5D 2.30%

Buy Vol. 6,871,300

Sell Vol. 7,658,000

32,800

1D -0.15%

5D 1.71%

Buy Vol. 4,940,100

Sell Vol. 6,594,400

VIC: VIC recorded a put-through transaction with a value of more than 1,260 billion dong in the session of March 23, at the same time, foreign investors also made a large volume trade.

FOOD & BEVERAGE

75,600

1D -0.66%

5D -2.07%

Buy Vol. 6,394,000

Sell Vol. 5,305,500

146,600

1D -0.27%

5D 6.23%

Buy Vol. 1,303,400

Sell Vol. 1,674,200

157,800

1D 0.19%

5D 2.47%

Buy Vol. 211,100

Sell Vol. 196,100

MSN: profit of nearly 5,700b dong from the sale of MNS Feed. The transfer of MSN Feed caused Masan's profit after tax to increase by more than 6 times and Masan MeatLife by 1.5 times.

OTHERS

144,000

1D 2.13%

5D -0.69%

Buy Vol. 1,419,700

Sell Vol. 1,349,800

144,000

1D 2.13%

5D -0.69%

Buy Vol. 1,419,700

Sell Vol. 1,349,800

96,000

1D -0.52%

5D 4.35%

Buy Vol. 2,854,300

Sell Vol. 3,431,000

134,000

1D -0.74%

5D 2.45%

Buy Vol. 1,218,200

Sell Vol. 1,978,200

107,000

1D 1.81%

5D 4.29%

Buy Vol. 972,900

Sell Vol. 1,868,400

34,900

1D -1.41%

5D 3.25%

Buy Vol. 3,192,300

Sell Vol. 3,912,000

43,800

1D -0.90%

5D 0.00%

Buy Vol. 12,167,500

Sell Vol. 13,623,900

46,400

1D -0.85%

5D 0.98%

Buy Vol. 24,625,900

Sell Vol. 29,708,500

HPG: Hoa Phat is the company that holds the first position in the race to hold money with more than 40,700 billion VND including cash, cash equivalents and term deposits according to the financial statements of 2021.

Market by numbers

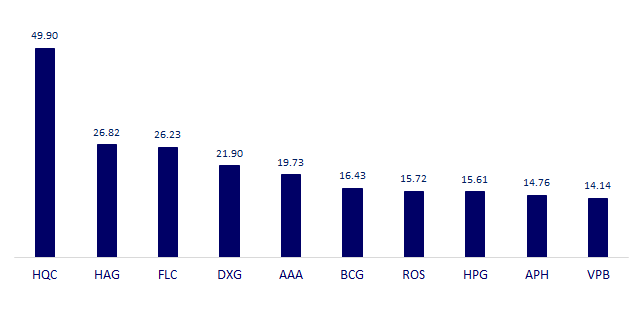

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

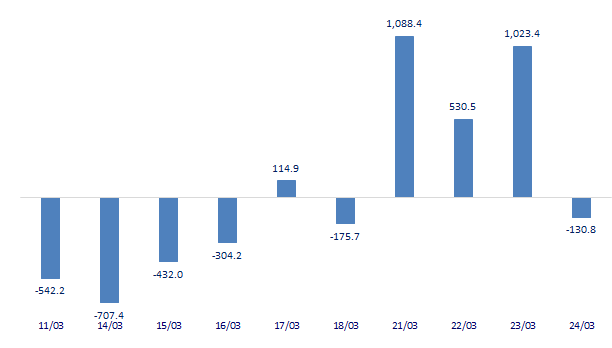

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

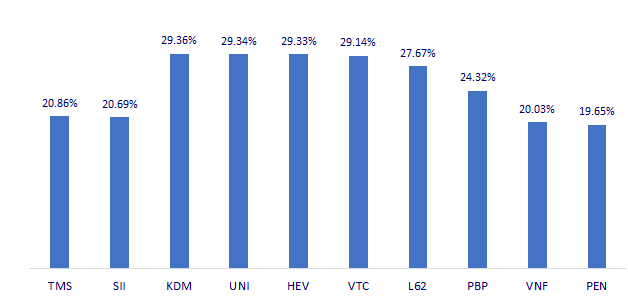

TOP INCREASES 3 CONSECUTIVE SESSIONS

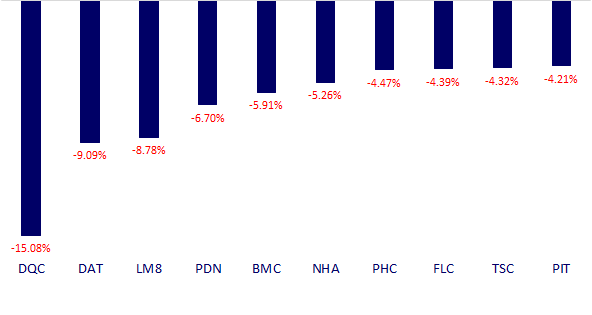

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.